MQL5 Cookbook: Development of a Multi-Symbol Indicator to Analyze Price Divergence

Introduction

In this article, we will consider the development of a multi-symbol indicator to analyze price divergence in a specified period of time. The core topics have been already discussed in the previous article on the programming of multi-currency indicators MQL5 Cookbook: Developing a Multi-Symbol Volatility Indicator in MQL5. So this time we will dwell only on those new features and functions that have been changed dramatically. If you are new to the programming of multi-currency indicators, I recommend you to first read the previous article.

In this article we'll consider the following questions:

- Changing the chart properties.

- Handling of the CHARTEVENT_OBJECT_DRAG (dragging a chart object) and CHARTEVENT_CHART_CHANGE (resizing the chart or modifying the chart properties using the properties dialog window) events.

- Rendering indicator buffers using more than one color.

- Defining highs and lows in indicator buffers within the visibility area to set a chart high/low.

- Inversion of a series.

The resulting amount of code for our indicator is quite large, about 1500 lines. Therefore, we will distribute all the functions in separate files and will link them to the main project file. There will be three categories of functions for external files:

- Checks.mqh - Functions to perform various checks and to download available data.

- Objects.mqh - Functions for managing graphical objects.

- Chart.mqh - Functions for managing chart properties.

All the functions that do not belong to the categories above will be left in the main file.

Development of the Indicator

Next proceed to the programming of indicator. First we need to create a new project. To do this, in the Metatrader 5\MQL5\Indicators directory create folder named as our indicator, and in it the Include folder to which we will place the include files. Next, create the main file in the indicator folder. This can be done manually by creating a text file with the *.mq5 extension or using the MQL5 Wizard by template. In addition to the core functions of the program OnInit(), OnDeinit() and OnCalculate(), we will also use OnChartEvent() and OnTimer().

Just like in the previous article, in addition to the current symbol we will display data for 5 symbols specified in external parameters. But this time, instead of values calculated by some formula, we will output raw price data on the chart. User is free to choose the type of data representation in the external parameters from the drop-down list: Line, Bars or Candlesticks.

If we would only have to display data as one-colored lines, then it will be enough to specify the number of buffers equal to the number of symbols in the indicator properties (#property). But since there are two modes for drawing series as bars and candles, we need more buffers for the two-color mode: four buffers to render each series and one buffer to set the color (depending on condition) for each element in a graphic series.

For each series it is required to specify colors in the program properties section. To do this, simply list them separated by commas. First comes the color used in one-color mode. In two-color mode, it is used for the up bars/candlesticks. The second color will be used only in the two-color mode for the down bars/candlesticks.

The codes of all these parameters are provided below:

#property indicator_chart_window // Indicator is in the main window #property indicator_buffers 25 // Number of buffers for indicator calculation #property indicator_plots 5 // Number of plotting series //--- Indicator buffers colors #property indicator_color1 clrDodgerBlue,C'0,50,100' #property indicator_color2 clrLimeGreen,C'20,80,20' #property indicator_color3 clrGold,C'160,140,0' #property indicator_color4 clrAqua,C'0,140,140' #property indicator_color5 clrMagenta,C'130,0,130'

With the #define directive let's declare constants and using the #include command line let's include files with functions that have already been described above, and the class from Standard library to work with the canvas:

//--- Constants #define RESET 0 // Returning the indicator recalculation command to the terminal #define SYMBOLS_COUNT 5 // Number of symbols //--- Include the class for working with the canvas #include <Canvas\Canvas.mqh> //--- Include the class for working with the canvas #include "Include/Checks.mqh" #include "Include/Chart.mqh" #include "Include/Objects.mqh"

Add the ENUM_DRAWTYPE and ENUM_START_POINT enumerations to create drop-down lists that allow to select drawing type of the price data and mode of the price divergence starting point in external parameters:

//--- Drawing type of the price data enum ENUM_DRAWTYPE { LINE =0, // Line BARS =1, // Bars CANDLES=2 // Candlesticks }; //--- Mode of the price divergence starting point enum ENUM_START_POINT { VERTICAL_LINE=0, // Vertical line MONTH =1, // Month WEEK =2, // Week DAY =3, // Day HOUR =4 // Hour };

The types of data rendering is already described above, now let's talk a bit more about what the price divergence starting point means.

Altogether there will be five modes: Vertical line, Month, Week, Day and Hour. For the Vertical line mode, a vertical line will be added when loading indicator on the chart. By dragging this line you specify the bar where prices of all symbols will meet in a single point. The open price of specified bar for the current symbol will be considered as a reference point of this meeting. Any other mode will tell the program that each time prices should meet at the beginning of specified period. I.e. at the beginning of each month, at the beginning of each week, at the beginning of each day or at the beginning of each hour.

Below you can find the list of the input parameters of the indicator:

//--- External parameters input ENUM_DRAWTYPE DrawType =CANDLES; // Drawing type input ENUM_START_POINT StartPriceDivergence =VERTICAL_LINE; // Start of price divergence input bool TwoColor =false; // Two-color bars/candlesticks sinput string dlm01=""; //- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - input string Symbol02 ="GBPUSD"; // Symbol 2 input bool Inverse02 =false; // Inverse symbol 2 input string Symbol03 ="AUDUSD"; // Symbol 3 input bool Inverse03 =false; // Inverse symbol 3 input string Symbol04 ="NZDUSD"; // Symbol 4 input bool Inverse04 =false; // Inverse symbol 4 input string Symbol05 ="USDCAD"; // Symbol 5 input bool Inverse05 =false; // Inverse symbol 5 input string Symbol06 ="USDCHF"; // Symbol 6 input bool Inverse06 =false; // Inverse symbol 6

Symbols are numbered starting from 2, since 1 is the current symbol on chart.

Inversion can be applied for each included symbol. Inversion means that the symbol data will be rendered upside down. This can be useful, when the list of the symbols analyzed includes currency pairs in which the same currency (for example, US dollar) can be both the base one and the counter one. For example, in the EURUSD currency pair, US dollar is the counter currency, and in the USDCHF currency pair it is the base one. If the current symbol on the chart is EURUSD, then you can turn on the inversion for USDCHF, what will make the representation of the prices more convenient for the analysis.

Below is the list of the global variables and arrays:

//--- Structure of the indicator buffers arrays struct buffers { double open[]; // Open prices buffer double high[]; // High prices buffer double low[]; // Low prices buffer double close[]; // Close prices buffer double icolor[]; // Buffer to determine the color of element }; buffers buffer_data[SYMBOLS_COUNT]; //--- Load the class CCanvas canvas; //--- Variables/arrays for copying data from OnCalculate() int OC_rates_total =0; // Size of input time series int OC_prev_calculated =0; // Bars processed at the previous call datetime OC_time[]; // Opening time double OC_open[]; // Open prices double OC_high[]; // High prices double OC_low[]; // Low prices double OC_close[]; // Close prices long OC_tick_volume[]; // Tick volumes long OC_volume[]; // Real volumes int OC_spread[]; // Spread //--- For the purpose of storing and checking the time of the first bar in the terminal datetime series_first_date[SYMBOLS_COUNT]; datetime series_first_date_last[SYMBOLS_COUNT]; //--- Time array of the bar from which we will start drawing datetime limit_time[SYMBOLS_COUNT]; //--- Symbol names array string symbol_names[SYMBOLS_COUNT]; //--- Array of symbol inverse flags bool inverse[SYMBOLS_COUNT]; //--- Colors of indicator lines color line_colors[SYMBOLS_COUNT]={clrDodgerBlue,clrLimeGreen,clrGold,clrAqua,clrMagenta}; //--- String representing the lack of the symbol string empty_symbol="EMPTY"; //--- Chart properties int window_number =WRONG_VALUE; // Indicator window number int chart_width =0; // Chart width int chart_height =0; // Chart height int last_chart_width =0; // Last saved chart width int last_chart_height =0; // Last saved chart height int chart_center_x =0; // Horizontal center of chart int chart_center_y =0; // Vertical center of chart color color_bar_up =clrRed; // Up bar color color color_bar_down =C'100,0,0'; // Down bar color string indicator_shortname ="MS_PriceDivergence"; // Short name of the indicator string prefix =indicator_shortname+"_"; // Prefix for objects //--- Name of vertical line of the price divergence starting point string start_price_divergence=prefix+"start_price_divergence"; //--- Canvas properties string canvas_name =prefix+"canvas"; // Canvas name color canvas_background =clrBlack; // Canvas background color uchar canvas_opacity =190; // Opacity int font_size =16; // Font size string font_name ="Calibri"; // Font ENUM_COLOR_FORMAT clr_format =COLOR_FORMAT_ARGB_RAW; // Color components should be correctly set by the user //--- Canvas messages string msg_prepare_data ="Preparing data! Please wait..."; string msg_not_synchronized ="Unsynchronized data! Please wait..."; string msg_load_data =""; string msg_sync_update =""; string msg_last =""; //--- ENUM_TIMEFRAMES timeframe_start_point =Period(); // Timeframe for the price divergence starting point datetime first_period_time =NULL; // Time of the first specified period on chart double divergence_price =0.0; // Price of the price divergence starting point datetime divergence_time =NULL; // Time of the price divergence starting point double symbol_difference[SYMBOLS_COUNT]; // Difference in price relative to the current symbol double inverse_difference[SYMBOLS_COUNT]; // Difference that is formed when calculating inversion

Next, we will consider functions that are used during the indicator initialization. In general, there are no major changes compared with the OnInit() function from the previous article.

Let's add the check on where the indicator is used. The point is that currently the terminal developers have not implemented all the features of controlling the chart properties in Strategy Tester, so we restrict our indicator to be used only out of Strategy Tester. To implement this, we will write a simple function - CheckTesterMode(). It will be located in the Checks.mqh file:

//+------------------------------------------------------------------+ //| Checks if indicator is used in Strategy Tester | //+------------------------------------------------------------------+ bool CheckTesterMode() { //--- Report that indicator is not intended to be used in Strategy Tester if(MQLInfoInteger(MQL_TESTER) || MQLInfoInteger(MQL_VISUAL_MODE) || MQLInfoInteger(MQL_OPTIMIZATION)) { Comment("Currently, the <- "+MQLInfoString(MQL_PROGRAM_NAME)+" -> indicator is not intended to be used in Strategy Tester!"); return(false); } //--- return(true); }

Another new function SetBarsColors() is intended to set colors for bars/candlesticks of current symbol. It is located in the Chart.mqh file.

//+------------------------------------------------------------------+ //| Sets colors for the current symbol bars | //+------------------------------------------------------------------+ void SetBarsColors() { //--- Color for the up bar, shadows and body borders of bull candlesticks ChartSetInteger(0,CHART_COLOR_CHART_UP,color_bar_up); //--- Body color of a bull candlestick ChartSetInteger(0,CHART_COLOR_CANDLE_BULL,color_bar_up); //--- Line chart color and color of "Doji" Japanese candlesticks ChartSetInteger(0,CHART_COLOR_CHART_LINE,color_bar_up); //--- For two-color mode if(TwoColor) { //--- Color for the down bar, shadows and body borders of bear candlesticks ChartSetInteger(0,CHART_COLOR_CHART_DOWN,color_bar_down); //--- Body color of a bear candlestick ChartSetInteger(0,CHART_COLOR_CANDLE_BEAR,color_bar_down); } //--- If two-color mode is turned off else { //--- Color for the down bar, shadows and body borders of bear candlesticks ChartSetInteger(0,CHART_COLOR_CHART_DOWN,color_bar_up); //--- Body color of a bear candlestick ChartSetInteger(0,CHART_COLOR_CANDLE_BEAR,color_bar_up); } }

During the initialization, we need to determine which mode is selected in the StartPriceDivergence external parameter. If the Vertical line is selected, then the timeframe_start_point global variable will be assigned with default value, i.e. current timeframe. Otherwise selected timeframe will be applied. For this purpose, let's write the InitStartPointTF() function:

//+------------------------------------------------------------------+ //| Identifies timeframe for the price starting point mode | //+------------------------------------------------------------------+ void InitStartPointTF() { //--- Exit if vertical line mode is selected if(StartPriceDivergence==VERTICAL_LINE) return; //--- Otherwise define the timeframe switch(StartPriceDivergence) { case MONTH : timeframe_start_point=PERIOD_MN1; break; case WEEK : timeframe_start_point=PERIOD_W1; break; case DAY : timeframe_start_point=PERIOD_D1; break; case HOUR : timeframe_start_point=PERIOD_H1; break; } }

The CheckInputParameters() function unlike the one from the previous article now looks like this:

//+------------------------------------------------------------------+ //| Checks input parameters for correctness | //+------------------------------------------------------------------+ bool CheckInputParameters() { //--- For all other modes except the 'Vertical Line' if(StartPriceDivergence!=VERTICAL_LINE) { //--- If the current period is greater than or equal to the specified period of the price divergence starting point, report of it and exit if(PeriodSeconds()>=PeriodSeconds(timeframe_start_point)) { Print("Current timeframe should be less than one specified in the Start Price Divergence parameter!"); Comment("Current timeframe should be less than one specified in the Start Price Divergence parameter!"); return(false); } } //--- return(true); }

Arrays are initialized just like in the previous article. Only the names and the number of arrays have been changed.

//+------------------------------------------------------------------+ //| First initialization of arrays | //+------------------------------------------------------------------+ void InitArrays() { ArrayInitialize(limit_time,NULL); ArrayInitialize(symbol_difference,0.0); ArrayInitialize(inverse_difference,0.0); ArrayInitialize(series_first_date,NULL); ArrayInitialize(series_first_date_last,NULL); //--- for(int s=0; s<SYMBOLS_COUNT; s++) { ArrayInitialize(buffer_data[s].open,EMPTY_VALUE); ArrayInitialize(buffer_data[s].high,EMPTY_VALUE); ArrayInitialize(buffer_data[s].low,EMPTY_VALUE); ArrayInitialize(buffer_data[s].close,EMPTY_VALUE); ArrayInitialize(buffer_data[s].icolor,EMPTY_VALUE); } } //+------------------------------------------------------------------+ //| Initializes array of symbols | //+------------------------------------------------------------------+ void InitSymbolNames() { symbol_names[0]=AddSymbolToMarketWatch(Symbol02); symbol_names[1]=AddSymbolToMarketWatch(Symbol03); symbol_names[2]=AddSymbolToMarketWatch(Symbol04); symbol_names[3]=AddSymbolToMarketWatch(Symbol05); symbol_names[4]=AddSymbolToMarketWatch(Symbol06); } //+------------------------------------------------------------------+ //| Initializes array of inversions | //+------------------------------------------------------------------+ void InitInverse() { inverse[0]=Inverse02; inverse[1]=Inverse03; inverse[2]=Inverse04; inverse[3]=Inverse05; inverse[4]=Inverse06; }

Significant changes were made to the SetIndicatorProperties() function. In fact, this is completely new function. Now, depending on which mode of data rendering is selected, the corresponding properties are set during initialization.

//+------------------------------------------------------------------+ //| Sets indicator properties | //+------------------------------------------------------------------+ void SetIndicatorProperties() { //--- Set the short name IndicatorSetString(INDICATOR_SHORTNAME,indicator_shortname); //--- Set the number of decimal digits IndicatorSetInteger(INDICATOR_DIGITS,_Digits); //--- In the 'Line' mode we need only one buffers that displays the open price if(DrawType==LINE) { for(int s=0; s<SYMBOLS_COUNT; s++) SetIndexBuffer(s,buffer_data[s].close,INDICATOR_DATA); } //--- In other modes we use all prices for drawing // bars/candlesticks and additional buffer for the two-color mode else if(DrawType==BARS || DrawType==CANDLES) { for(int s=0; s<SYMBOLS_COUNT; s++) { static int buffer_number=0; SetIndexBuffer(buffer_number,buffer_data[s].open,INDICATOR_DATA); buffer_number++; SetIndexBuffer(buffer_number,buffer_data[s].high,INDICATOR_DATA); buffer_number++; SetIndexBuffer(buffer_number,buffer_data[s].low,INDICATOR_DATA); buffer_number++; SetIndexBuffer(buffer_number,buffer_data[s].close,INDICATOR_DATA); buffer_number++; SetIndexBuffer(buffer_number,buffer_data[s].icolor,INDICATOR_COLOR_INDEX); buffer_number++; } } //--- Set labels for the current timeframe // In the 'Line' mode only opening price is used if(DrawType==LINE) { for(int s=0; s<SYMBOLS_COUNT; s++) PlotIndexSetString(s,PLOT_LABEL,symbol_names[s]+",Close"); } //--- In other modes all prices of bars/candlesticks // ";" is used as a separator else if(DrawType==BARS || DrawType==CANDLES) { for(int s=0; s<SYMBOLS_COUNT; s++) { PlotIndexSetString(s,PLOT_LABEL, symbol_names[s]+",Open;"+ symbol_names[s]+",High;"+ symbol_names[s]+",Low;"+ symbol_names[s]+",Close"); } } //--- Set the type of lines for indicator buffers //--- Line if(DrawType==LINE) for(int s=0; s<SYMBOLS_COUNT; s++) PlotIndexSetInteger(s,PLOT_DRAW_TYPE,DRAW_LINE); //--- Bars if(DrawType==BARS) for(int s=0; s<SYMBOLS_COUNT; s++) PlotIndexSetInteger(s,PLOT_DRAW_TYPE,DRAW_COLOR_BARS); //--- Candlesticks if(DrawType==CANDLES) for(int s=0; s<SYMBOLS_COUNT; s++) PlotIndexSetInteger(s,PLOT_DRAW_TYPE,DRAW_COLOR_CANDLES); //--- Set the type of lines for data of current symbol //--- Line if(DrawType==LINE) ChartSetInteger(0,CHART_MODE,CHART_LINE); //--- Bars if(DrawType==BARS) ChartSetInteger(0,CHART_MODE,CHART_BARS); //--- Candlesticks if(DrawType==CANDLES) ChartSetInteger(0,CHART_MODE,CHART_CANDLES); //--- Set the line width for(int s=0; s<SYMBOLS_COUNT; s++) PlotIndexSetInteger(s,PLOT_LINE_WIDTH,1); //--- Set the line color for the 'Line' mode if(DrawType==LINE) for(int s=0; s<SYMBOLS_COUNT; s++) PlotIndexSetInteger(s,PLOT_LINE_COLOR,line_colors[s]); //--- Display data in Data Window only for existing symbols for(int s=0; s<SYMBOLS_COUNT; s++) { if(symbol_names[s]!=empty_symbol) PlotIndexSetInteger(s,PLOT_SHOW_DATA,true); else PlotIndexSetInteger(s,PLOT_SHOW_DATA,false); } //--- Empty value for plotting where nothing will be drawn for(int s=0; s<SYMBOLS_COUNT; s++) PlotIndexSetDouble(s,PLOT_EMPTY_VALUE,EMPTY_VALUE); }

And finally, another new function SetDivergenceLine() to be used in OnInit(). It sets the vertical green line to manipulate the price divergence start point in the Vertical line mode.

//+------------------------------------------------------------------+ //| Sets vertical line for price divergence starting point | //+------------------------------------------------------------------+ void SetDivergenceLine() { //--- If there is no vertical line yet, set it if(StartPriceDivergence==VERTICAL_LINE && ObjectFind(0,start_price_divergence)<0) //--- Place a vertical line on the true bar CreateVerticalLine(0,0,TimeCurrent()+PeriodSeconds(),start_price_divergence, 2,STYLE_SOLID,clrGreenYellow,true,true,false,"","\n"); //--- For all other modes except the 'Vertical Line' if(StartPriceDivergence!=VERTICAL_LINE) DeleteObjectByName(start_price_divergence); }

Below is the representation of everything described above inside the OnInit() function. When everything is split into separate functions and files, it becomes very convenient to read the program code.

//+------------------------------------------------------------------+ //| Custom indicator initialization function | //+------------------------------------------------------------------+ int OnInit() { //--- Check if indicator is currently being used in Strategy Tester if(!CheckTesterMode()) return(INIT_FAILED); //--- Set the color for bars/candlesticks SetBarsColors(); //--- Define the timeframe for the price divergence starting point InitStartPointTF(); //--- Check input parameters for correctness if(!CheckInputParameters()) return(INIT_PARAMETERS_INCORRECT); //--- Set the timer at 1-second intervals EventSetMillisecondTimer(1000); //--- Set the font to be displayed on the canvas canvas.FontSet(font_name,font_size,FW_NORMAL); //--- Initialization of arrays InitArrays(); //--- Initialize the array of symbols InitSymbolNames(); //--- Initialize the array of inversions InitInverse(); //--- Set indicator properties SetIndicatorProperties(); //--- Set vertical line of the price divergence start SetDivergenceLine(); //--- Clear the comment Comment(""); //--- Refresh the chart ChartRedraw(); //--- Initialization completed successfully return(INIT_SUCCEEDED); }

In the OnCalculate() function, the program code remained virtually unchanged. In the previous article, after all the checks on the availability of data have been made, the program first filled auxiliary arrays and only then filled indicator buffers with prepared data. This time we will try to arrange everything in a single loop.

I made functions of validating and loading data more strict. Now each value you want to get passes through specified number of attempts. If value is obtained, the loop is stopped. And since now we have modes where we need to determine the start of a period (month, week, day, hour), then we will get the period start time via the higher timeframe. Therefore, I created an additional function similar to LoadAndFormData() which has a similar name of LoadAndFormDataHighTF(). Its code is very similar to the original one, so I will not post it here.

Verification of the data availability for the current and higher timeframes was implemented in one function CheckAvailableData():

//+------------------------------------------------------------------+ //| Checks the amount of available data for all symbols | //+------------------------------------------------------------------+ bool CheckAvailableData() { int attempts=100; //--- for(int s=0; s<SYMBOLS_COUNT; s++) { //--- If this symbol is available if(symbol_names[s]!=empty_symbol) { datetime time[]; // Array for checking the number of bars int total_period_bars =0; // Number of bars of the current period datetime terminal_first_date =NULL; // First date of the current time frame data available in the terminal //--- Get the first date of the current time frame data in the terminal terminal_first_date=(datetime)SeriesInfoInteger(symbol_names[s],Period(),SERIES_TERMINAL_FIRSTDATE); //--- Get the number of available bars from the date specified total_period_bars=Bars(symbol_names[s],Period(),terminal_first_date,TimeCurrent()); //--- Check the readiness of bar data for(int i=0; i<attempts; i++) { //--- Copy the specified amount of data if(CopyTime(symbol_names[s],Period(),0,total_period_bars,time)) { //--- If the required amount has been copied, terminate the loop if(ArraySize(time)>=total_period_bars) break; } } //--- If the amount of data copied is not sufficient, one more attempt is required if(ArraySize(time)==0 || ArraySize(time)<total_period_bars) { msg_last=msg_prepare_data; ShowCanvasMessage(msg_prepare_data); OC_prev_calculated=0; return(false); } } } //--- Exit if current mode is vertical line of the price divergence starting point if(StartPriceDivergence==VERTICAL_LINE) return(true); else { datetime time[]; // Array for checking the number of bars int total_period_bars =0; // Number of bars of the current period datetime terminal_first_date =NULL; // First date of the current time frame data available in the terminal //--- Get the first date of the current time frame data in the terminal for(int i=0; i<attempts; i++) if((terminal_first_date=(datetime)SeriesInfoInteger(Symbol(),Period(),SERIES_FIRSTDATE))>0) break; //--- Get the number of available bars from the date specified for(int i=0; i<attempts; i++) if((total_period_bars=(int)SeriesInfoInteger(Symbol(),timeframe_start_point,SERIES_BARS_COUNT))>0) break; //--- Check the readiness of bar data for(int i=0; i<attempts; i++) //--- Copy the specified amount of data if(CopyTime(Symbol(),timeframe_start_point, terminal_first_date+PeriodSeconds(timeframe_start_point),TimeCurrent(),time)>0) break; //--- If the amount of data copied is not sufficient, one more attempt is required if(ArraySize(time)<=0 || total_period_bars<=0) { msg_last=msg_prepare_data; ShowCanvasMessage(msg_prepare_data); OC_prev_calculated=0; return(false); } } //--- return(true); }

The FillIndicatorBuffers() function has been significantly complicated for the current task. This is due to the fact that now there are several modes, and each one of them requires its own actions. In fact, everything can be divided into four steps.

- Getting data for specified symbol.

- Getting data for higher timeframe, and determining the time and the price level, where the prices of all the symbols are meeting.

- Calculating values and filling the indicator buffer.

- Verification of the calculated values.

The function code is provided with detailed comments for your consideration:

//+------------------------------------------------------------------+ //| Fills indicator buffers | //+------------------------------------------------------------------+ void FillIndicatorBuffers(int i,int s,datetime const &time[]) { MqlRates rates[]; // Data structure double period_open[]; // Opening price for bar at the price divergence starting point datetime period_time[]; // Time of the price divergence starting point int attempts=100; // Number of copying attempts datetime high_tf_time=NULL; // Time of higher timeframe's bar //--- Exit if we are out of "true" bars zone if(time[i]<limit_time[s]) return; //--- Reset the last error ResetLastError(); //--- Get data of current bar for the specified symbol for(int j=0; j<attempts; j++) if(CopyRates(symbol_names[s],Period(),time[i],1,rates)==1) { ResetLastError(); break; } //--- Exit if failed to get data if(ArraySize(rates)<1 || GetLastError()!=0) return; //--- If the current time is before the first timeframe's time or // bar time is not equal to the bar time of the current symbol or // empty values are fetched if(rates[0].time==NULL || time[i]!=rates[0].time || time[i]<first_period_time || rates[0].low==EMPTY_VALUE || rates[0].open==EMPTY_VALUE || rates[0].high==EMPTY_VALUE || rates[0].close==EMPTY_VALUE) { //--- Write empty value if(DrawType!=LINE) { buffer_data[s].low[i] =EMPTY_VALUE; buffer_data[s].open[i] =EMPTY_VALUE; buffer_data[s].high[i] =EMPTY_VALUE; } buffer_data[s].close[i]=EMPTY_VALUE; return; } //--- If current mode is vertical line of the price divergence starting point if(StartPriceDivergence==VERTICAL_LINE) { //--- Get the time of the line divergence_time=(datetime)ObjectGetInteger(0,start_price_divergence,OBJPROP_TIME); //--- Get the time of the first bar first_period_time=time[0]; } //--- For all other modes, we will keep track the beginning of period else { //--- If we are here for the first time, store data of the first bar of higher timeframe if(divergence_time==NULL) { ResetLastError(); //--- Get opening time of the first bar of higher timeframe for(int j=0; j<attempts; j++) if(CopyTime(Symbol(),timeframe_start_point,time[0]+PeriodSeconds(timeframe_start_point),1,period_time)==1) { ResetLastError(); break; } //--- Exit if failed to get price/time if(ArraySize(period_time)<1 || GetLastError()!=0) return; //--- Otherwise store time of the first bar of higher timeframe else first_period_time=period_time[0]; } //--- If current bar's time on the current timeframe is before the first bar's time on higher timeframe if(time[i]<first_period_time) high_tf_time=first_period_time; //--- Otherwise we will receive data of the last bar of the higher timeframe with respect to the current bar on the current timeframe else high_tf_time=time[i]; //--- Reset the last error ResetLastError(); //--- Get the opening price of the first bar of the higher timeframe for(int j=0; j<attempts; j++) if(CopyOpen(Symbol(),timeframe_start_point,high_tf_time,1,period_open)==1) { ResetLastError(); break; } //--- Get opening time of the first bar of higher timeframe for(int j=0; j<attempts; j++) if(CopyTime(Symbol(),timeframe_start_point,high_tf_time,1,period_time)==1) { ResetLastError(); break; } //--- Exit if failed to get price/time if(ArraySize(period_open)<1 || ArraySize(period_time)<1 || GetLastError()!=0) return; //--- If the current timeframe's time is before the first period's time or // time of specified period is not equal to the one in memory if(time[i]<first_period_time || divergence_time!=period_time[0]) { symbol_difference[s] =0.0; // Zero out difference in symbol prices inverse_difference[s] =0.0; // Zero our difference of inversion //--- Store time of the price divergence starting point divergence_time=period_time[0]; //--- Store price of the price divergence starting point divergence_price=period_open[0]; //--- Set vertical line in the beginning of the price divergence start CreateVerticalLine(0,0,period_time[0],start_price_divergence+"_"+TimeToString(divergence_time), 2,STYLE_SOLID,clrWhite,false,false,true,TimeToString(divergence_time),"\n"); } } //--- If current mode is 'Vertical Line' and bar's time is less than line's time if(StartPriceDivergence==VERTICAL_LINE && time[i]<divergence_time) { //--- Keep zero values of difference symbol_difference[s] =0.0; inverse_difference[s] =0.0; //--- For the 'Line' drawing mode only opening price is used if(DrawType==LINE) buffer_data[s].close[i]=rates[0].close-symbol_difference[s]; //--- For all other modes all prices are used else { buffer_data[s].low[i] =rates[0].low-symbol_difference[s]; buffer_data[s].open[i] =rates[0].open-symbol_difference[s]; buffer_data[s].high[i] =rates[0].high-symbol_difference[s]; buffer_data[s].close[i] =rates[0].close-symbol_difference[s]; //--- Set color for the current element of indicator buffer SetBufferColorIndex(i,s,rates[0].close,rates[0].open); } } //--- For all other modes else { //--- If inversion of symbol data is required if(inverse[s]) { //--- If new period has started, recalculate variables if(symbol_difference[s]==0.0) { //--- For the 'Vertical Line' mode if(StartPriceDivergence==VERTICAL_LINE) { //--- Calculate the difference symbol_difference[s] =rates[0].open-OC_open[i]; inverse_difference[s] =OC_open[i]-(-OC_open[i]); } //--- For all other modes else { //--- Calculate the difference symbol_difference[s] =rates[0].open-divergence_price; inverse_difference[s] =divergence_price-(-divergence_price); } } //--- In the 'Line' mode only opening price is used if(DrawType==LINE) buffer_data[s].close[i]=-(rates[0].close-symbol_difference[s])+inverse_difference[s]; //--- For all other modes all prices are used else { buffer_data[s].low[i] =-(rates[0].low-symbol_difference[s])+inverse_difference[s]; buffer_data[s].open[i] =-(rates[0].open-symbol_difference[s])+inverse_difference[s]; buffer_data[s].high[i] =-(rates[0].high-symbol_difference[s])+inverse_difference[s]; buffer_data[s].close[i] =-(rates[0].close-symbol_difference[s])+inverse_difference[s]; //--- Set color for the current element of indicator buffer SetBufferColorIndex(i,s,rates[0].close,rates[0].open); } } //--- If inversion is not used, then we need to calculate only the difference between symbol prices at the beginning of period else { //--- If new period has started if(symbol_difference[s]==0.0) { //--- For the 'Vertical Line' mode if(StartPriceDivergence==VERTICAL_LINE) symbol_difference[s]=rates[0].open-OC_open[i]; //--- For all other modes else symbol_difference[s]=rates[0].open-divergence_price; } //--- For the 'Line' drawing mode only opening price is used if(DrawType==LINE) buffer_data[s].close[i]=rates[0].close-symbol_difference[s]; //--- For all other modes all prices are used else { buffer_data[s].low[i] =rates[0].low-symbol_difference[s]; buffer_data[s].open[i] =rates[0].open-symbol_difference[s]; buffer_data[s].high[i] =rates[0].high-symbol_difference[s]; buffer_data[s].close[i] =rates[0].close-symbol_difference[s]; //--- Set color for the current element of indicator buffer SetBufferColorIndex(i,s,rates[0].close,rates[0].open); } } } //--- Verification of the calculated values // In the 'Line' mode only opening price is used if(DrawType==LINE) { //--- If the current time is before the first timeframe's time or // bar time is not equal to the bar time, write empty value if(time[i]!=rates[0].time || time[i]<first_period_time) buffer_data[s].close[i]=EMPTY_VALUE; } //--- For all other modes all prices are used else { //--- If the current time is before the first timeframe's time or // bar time is not equal to the bar time of the current symbol or // empty values are fetched if(rates[0].time==NULL || time[i]!=rates[0].time || time[i]<first_period_time || rates[0].low==EMPTY_VALUE || rates[0].open==EMPTY_VALUE || rates[0].high==EMPTY_VALUE || rates[0].close==EMPTY_VALUE) { //--- Write empty value buffer_data[s].low[i] =EMPTY_VALUE; buffer_data[s].open[i] =EMPTY_VALUE; buffer_data[s].high[i] =EMPTY_VALUE; buffer_data[s].close[i] =EMPTY_VALUE; } } }

When studying the function above you should notice another custom function SetBufferColorIndex(). This function sets the color in the indicator color buffer.

//+------------------------------------------------------------------+ //| Sets the color for buffer element by condition | //+------------------------------------------------------------------+ void SetBufferColorIndex(int i,int symbol_number,double close,double open) { //--- For two-color mode, check condition if(TwoColor) { //--- If the closing price is more than the opening price, this is up bar, so we use the first color if(close>open) buffer_data[symbol_number].icolor[i]=0; //--- otherwise it is down bar, so we use the second color else buffer_data[symbol_number].icolor[i]=1; } //--- For one-color mode we use the first color for all bars/candlesticks else buffer_data[symbol_number].icolor[i]=0; }

Once the indicator buffers are filled, we need to determine the maximum and minimum from all the values that are currently visible in the chart window. MQL5 allows to get the first visible bar in a chart window and the number of visible bars. We will benefit from these features in another custom function CorrectChartMaxMin(). The code flow in the function can be divided into several steps:

- Determining the numbers of the first and the last visible bars.

- Determining the maximum and minimum of visible bars for current symbol.

- Determining the maximum and minimum among all arrays of symbols.

- Setting the maximum and minimum in chart properties.

Below is the code of the CorrectChartMaxMin() function located in the Chart.mqh file.

//+------------------------------------------------------------------+ //| Corrects chart's high/low with respect to all buffers | //+------------------------------------------------------------------+ void CorrectChartMaxMin() { double low[]; // Array of lows double high[]; // Array of highs int attempts =10; // Number of attempts int array_size =0; // Array size for drawing int visible_bars =0; // Number of visible bars int first_visible_bar =0; // Number of the first visible bar int last_visible_bar =0; // Number of the last visible bar double max_price =0.0; // Highest price double min_price =0.0; // Lowest price double offset_max_min =0.0; // Offset from chart's high/low //--- Reset the last error ResetLastError(); //--- Number of visible bars visible_bars=(int)ChartGetInteger(0,CHART_VISIBLE_BARS); //--- Number of the first visible bar first_visible_bar=(int)ChartGetInteger(0,CHART_FIRST_VISIBLE_BAR); //--- Number of the last visible bar last_visible_bar=first_visible_bar-visible_bars; //--- Exit in case of error if(GetLastError()!=0) return; //--- Fix incorrect value if(last_visible_bar<0) last_visible_bar=0; //--- Get the current symbol high/low in visible area of chart for(int i=0; i<attempts; i++) if(CopyHigh(Symbol(),Period(),last_visible_bar,visible_bars,high)==visible_bars) break; for(int i=0; i<attempts; i++) if(CopyLow(Symbol(),Period(),last_visible_bar,visible_bars,low)==visible_bars) break; //--- Exit if failed to get data if(ArraySize(high)<=0 || ArraySize(low)<=0) return; //--- If succeeded to get data, identify high and low in the current symbol arrays else { min_price=low[ArrayMinimum(low)]; max_price=high[ArrayMaximum(high)]; } //--- Get high and low prices in all price arrays for(int s=0; s<SYMBOLS_COUNT; s++) { //--- If current symbol is not present, go to the next one if(symbol_names[s]==empty_symbol) continue; //--- datetime time[]; // Time array int bars_count=0; // Number of bars for calculation //--- Set zero size for arrays ArrayResize(high,0); ArrayResize(low,0); //--- Get the time of the first bar visible on chart for(int i=0; i<attempts; i++) if(CopyTime(Symbol(),Period(),last_visible_bar,visible_bars,time)==visible_bars) break; //--- Exit if the amount of data is less than number of visible bars on chart if(ArraySize(time)<visible_bars) return; //--- If time of the first "true" bar is greater than // time of the first visible bar on the chart, then // get available number of bars of the current symbol in loop if(limit_time[s]>time[0]) { //--- Get the array size array_size=ArraySize(time); //--- Get the number of bars from the first "true" one if((bars_count=Bars(Symbol(),Period(),limit_time[s],time[array_size-1]))<=0) return; } //--- Else get number of visible bars on chart else bars_count=visible_bars; //--- Index elements in indicator buffers as timeseries ArraySetAsSeries(low,true); ArraySetAsSeries(high,true); //--- Copy data from the indicator buffer // All modes except 'Line' if(DrawType!=LINE) { ArrayCopy(low,buffer_data[s].low); ArrayCopy(high,buffer_data[s].high); } //--- For the 'Line' mode else { ArrayCopy(low,buffer_data[s].close); ArrayCopy(high,buffer_data[s].close); } //--- Get the array size array_size=ArraySize(high); //--- Fill empty values, // so they are not considered when calculating high/low for(int i=0; i<array_size; i++) { if(high[i]==EMPTY_VALUE) high[i]=max_price; if(low[i]==EMPTY_VALUE) low[i]=min_price; } //--- Get high/low with respect to inversion if(inverse[s]) { //--- If no errors occur, store values if(ArrayMaximum(high,last_visible_bar,bars_count)>=0 && ArrayMinimum(low,last_visible_bar,bars_count)>=0) { max_price=fmax(max_price,low[ArrayMaximum(low,last_visible_bar,bars_count)]); min_price=fmin(min_price,high[ArrayMinimum(high,last_visible_bar,bars_count)]); } } else { //--- If no errors occur, store values if(ArrayMinimum(low,last_visible_bar,bars_count)>=0 && ArrayMaximum(high,last_visible_bar,bars_count)>=0) { min_price=fmin(min_price,low[ArrayMinimum(low,last_visible_bar,bars_count)]); max_price=fmax(max_price,high[ArrayMaximum(high,last_visible_bar,bars_count)]); } } } //--- Calculate offset (3%) form chart's top and bottom offset_max_min=((max_price-min_price)*3)/100; //--- Turn on the fixed chart scale mode. ChartSetInteger(0,CHART_SCALEFIX,true); //--- Set high/low ChartSetDouble(0,CHART_FIXED_MAX,max_price+offset_max_min); ChartSetDouble(0,CHART_FIXED_MIN,min_price-offset_max_min); //--- Refresh the chart ChartRedraw(); }

The function described above will be used when processing event of dragging the vertical line (and when calculating the indicator values in OnCalculate, of course):

//+------------------------------------------------------------------+ //| ChartEvent function | //+------------------------------------------------------------------+ void OnChartEvent(const int id, const long &lparam, const double &dparam, const string &sparam) { //--- Event of dragging a graphical object if(id==CHARTEVENT_OBJECT_DRAG) { //--- If current mode is vertical line for the price divergence starting point, then update indicator buffers if(StartPriceDivergence==VERTICAL_LINE) OnCalculate(OC_rates_total, 0, OC_time, OC_open, OC_high, OC_low, OC_close, OC_tick_volume, OC_volume, OC_spread); } //--- Event of resizing the chart or modifying the chart properties using the properties dialog window. if(id==CHARTEVENT_CHART_CHANGE) //--- Correct the maximum and minimum of chart with respect to the indicator buffers' values CorrectChartMaxMin(); }

All the functions are ready. You can study the fully commented code attached to this article.

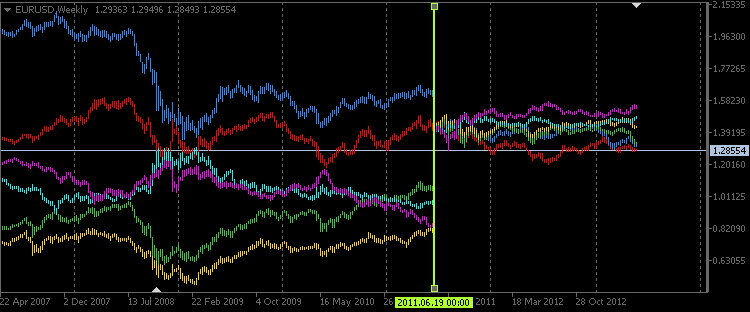

Let's demonstrate what we have eventually got. The default the GBPUSD, AUDUSD, NZDUSD, USDCAD, USDCHF symbols are specified in external parameters. On the screenshot below you can see the weekly chart for EURUSD in the Vertical line mode with disabled inversion:

Fig. 1 - Weekly timeframe in the "Vertical line" mode

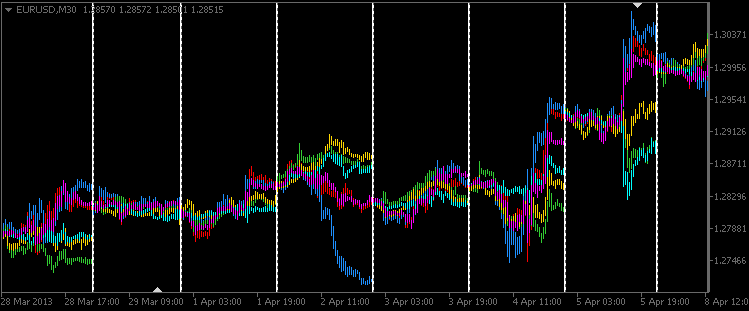

On the screenshot below you can see the M30 timeframe in the Day mode, but this time inversion is enabled for symbols with USD as a base currency. In our case these are USDCAD (light blue candles) and USDCHF (purple candles).

Fig. 2 - M30 timeframe in the "Day" mode

Conclusion

I think we have created a pretty interesting and informative tool for multi-currency analysis of price divergence. This indicator can be infinitely improved.

Thank you for your time!

Translated from Russian by MetaQuotes Ltd.

Original article: https://www.mql5.com/ru/articles/754

Warning: All rights to these materials are reserved by MetaQuotes Ltd. Copying or reprinting of these materials in whole or in part is prohibited.

This article was written by a user of the site and reflects their personal views. MetaQuotes Ltd is not responsible for the accuracy of the information presented, nor for any consequences resulting from the use of the solutions, strategies or recommendations described.

Why Is It Important to Update MetaTrader 4 to the Latest Build by August 1?

Why Is It Important to Update MetaTrader 4 to the Latest Build by August 1?

Tales of Trading Robots: Is Less More?

Tales of Trading Robots: Is Less More?

Continuous futures contracts in MetaTrader 5

Continuous futures contracts in MetaTrader 5

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

This article was a continuation of the topic. Please also see the previous one: MQL5 Recipes - Developing a Multicurrency Volatility Indicator in MQL5.

Thank you. Now it's clear.

The most interesting thing is that the article under discussion says it right away

In this article we will consider the development of a multicurrency indicator to analyse the price divergence for the specified period of time. Many basic points have already been discussed in the previous article on programming multicurrency indicators MQL5 Recipes - Developing a Multicurrency Volatility Indicator in MQL5. Therefore, this time we will dwell only on the new features and those features that have undergone strong changes. If you are considering the topic of programming multicurrency indicators for the first time, it is recommended to read the previous article first.

Interesting article, thank you. But some time has passed and maybe something has changed in mql. Now the indicator gives such an error in the Checks.mqh file and hangs. Can you tell me what is the reason?

The article is written very engagingly and the screenshots are beautiful. But the attached indicator does not work.

It compiles successfully, but it gives an error when installed on a chart:

@Anatoli Kazharski, please tell me what could be the matter?