Kbar Energy

- Uzman Danışmanlar

- Chih Wen Huang

- Sürüm: 3.9

- Güncellendi: 18 Eylül 2025

- Etkinleştirmeler: 10

Kbar-Energy: An Advanced Tool for Momentum and Trend Tracking

Kbar-Energy is an advanced tool for high-speed trading, perfect for traders who focus on momentum and trend tracking. It provides a unique and powerful perspective on the core principles of momentum, enabling you to explore trading in a way that is both detail-oriented and disruptive to conventional methods. It empowers you to navigate market conditions with both patience and aggressive trading.

As a high-speed, powerful tool that triggers trades based on short-term momentum, it is ideal for multi-indicator combination strategies. You can choose to focus on a single direction with greater momentum, selecting to trigger only on buy, sell, or both signals.

It's also designed for high-frequency trading during strong momentum surges, allowing for short stop-loss and tight trailing take-profit settings. This makes it suitable for activation before major news releases. With the ability to place an order based on how many points the price moves within a few seconds, it offers rapid execution and combines multiple concepts into one strategy.

-

Precision Momentum Capture: Features a unique built-in momentum detection engine—your dedicated radar for trading momentum. It's set in seconds to precisely detect explosive price changes, allowing for decisive entry based on your parameter settings.

-

Momentum Trigger Points: Gives you the flexibility to choose whether momentum conditions trigger buy orders, sell orders, or both.

-

Integrated Technical Analysis: Can be activated with multiple indicator filters (RSI, MACD, ADX, Vegas Tunnel). In addition to the EA's active timeframe, you can select another timeframe for a combined market trend and momentum analysis.

-

Dynamic Risk Control and Profit Locking: The innovative trailing stop-loss feature automatically follows profitable trades and can be set to gradually reduce the distance to the current price.

-

Smart Money Management: Allows you to automatically calculate lot size based on account equity. When your equity reaches a set level, it automatically scales up or down your trading size.

-

Strict Loss Protection: Each trade can be set with a fixed stop-loss, and the EA includes two consecutive loss pause mechanisms, plus an additional daily maximum drawdown percentage to protect your capital.

-

Beginner-Friendly: This EA is also highly suitable for beginners practicing trading with a demo account or backtesting, as it helps them understand trading logic, the application of key features, and the art of parameter optimization.

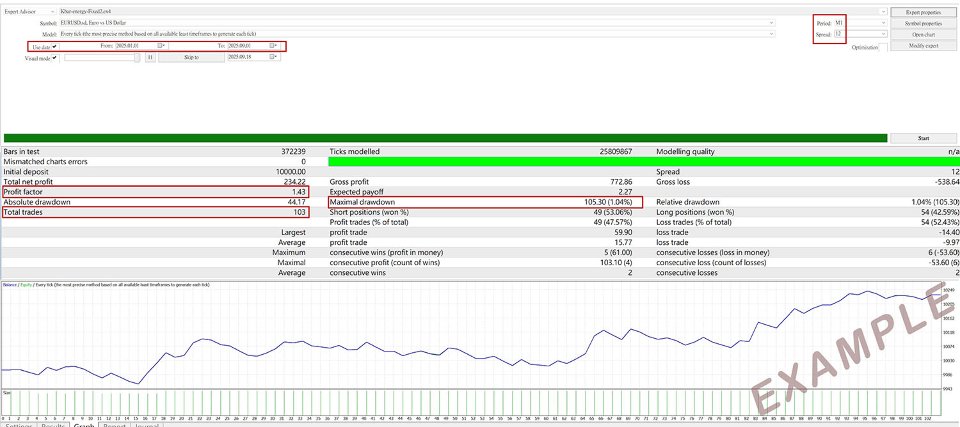

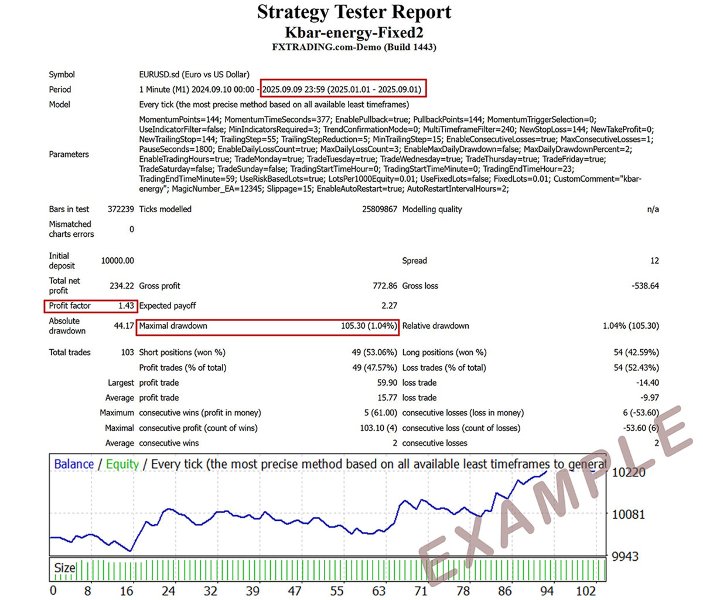

Backtest Results

The displayed backtest results are designed to attract people to download and test the EA. The data is compelling: Period (M1) Visual mode ☑

-

Highlights Core Profitability: The Profit Factor is a key metric for professional traders, indicating the efficiency of the strategy.

-

Highlights Excellent Risk Control: The Maximum Drawdown is exceptionally low, demonstrating the strategy's stability and safety.

-

Highlights Profit/Loss Ratio: The average profit per trade is greater than the average loss per trade.

-

Highlights Long-Term Stability: The large number of trades proves that the results are not a coincidence but a testament to the strategy's stability.

The strategy test report data looks very positive! However, before using it in a live account, it's highly recommended to run it on a demo account to verify its performance in real-time market conditions. The backtest screenshot is for conceptual understanding only; further parameter optimization and testing are required.

Important Notice

While this backtest result looks promising, please note the following:

-

Past Performance is Not Indicative of Future Results: Historical data does not guarantee similar performance in the future.

-

Slippage and Commission: Real-time trading involves additional costs like slippage and commissions.

-

Over-Optimization: Sometimes, a strategy's parameters may be over-optimized for historical data, leading to poor performance in live trading.

-

Data Quality: The quality of the historical data model affects the accuracy of the backtest. Overall, this is a promising trading strategy that warrants further research and analysis.

Demo Account Testing Recommendations

For effective testing, it's recommended to:

-

Use high-quality third-party historical data for backtesting.

-

Run the EA on a VPS to maximize trading speed.

-

Choose a broker with low spreads, high network speed, and no high-frequency trading restrictions.

-

Note that results can vary between brokers, even with the same parameters. Live accounts may also have slightly more latency and spread than demo accounts, which is crucial for high-frequency trading with short-duration settings.

If you wish to test the effectiveness of this EA, please open a demo account and start testing.

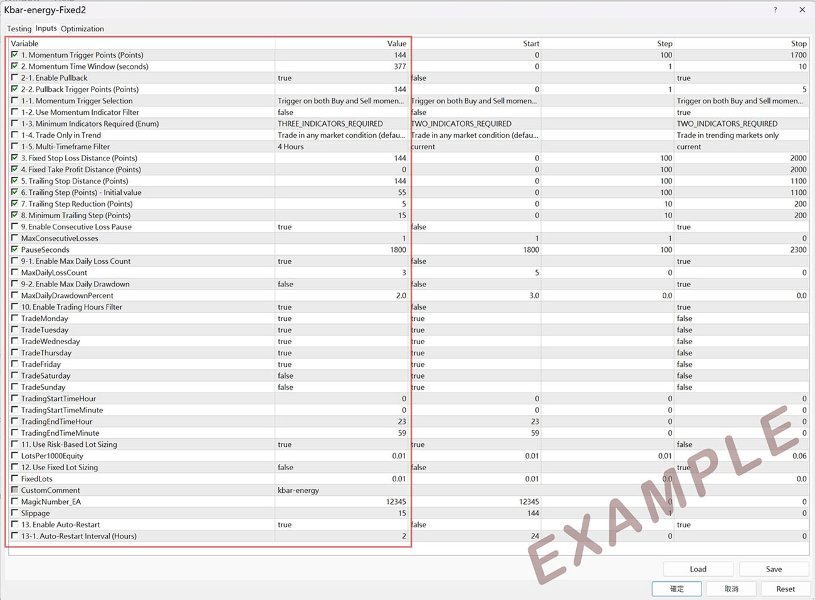

Kbar-energy EA Feature and Parameter Descriptions

1. Momentum Trigger Points (Points)

Description: This is the threshold to determine if there is enough market momentum. The EA will only consider a trading signal valid when the price moves in a single direction by more than this number of points within the specified time window.

-

1-1. Momentum Trigger Selection Description: Allows you to select the momentum direction for the EA to trade.

-

TRIGGER_BOTH: Trades on both buy and sell momentum signals.

-

TRIGGER_BUY_ONLY: Only trades on buy momentum signals.

-

TRIGGER_SELL_ONLY: Only trades on sell momentum signals.

-

-

1-2. Use Momentum Indicator Filter Description: A switch to enable or disable the indicator filter. When enabled, the EA uses multiple technical indicators (RSI, MACD, etc.) to confirm the trend, effectively filtering out false signals.

-

1-3. Minimum Indicators Required Description: When the filter is enabled, this parameter determines how many technical indicators (RSI, MACD, ADX, Vegas Tunnel) must give a signal in the same direction for the EA to consider the trend valid. This allows you to control the strictness of the trading signals.

Indicator Filter Parameters

| Indicator Name | Parameter | Type | Current Value | Description |

| RSI | RSILength | Period | 14 | RSI period |

| RSI | RSISMALength | Period | 55 | Moving average period for RSI |

| MACD | MACDFastMA | Period | 13 | Fast line period |

| MACD | MACDSlowMA | Period | 21 | Slow line period |

| MACD | MACDTrigger | Period | 9 | Signal line period |

| ADX | ADX_DI_Length | Period | 13 | ADX (+-DI) period |

| ADX | ADX_Smoothing | Period | 13 | ADX line smoothing period |

| ADX | ADX_Threshold | Value | 13 | ADX strength threshold to judge trend strength |

| Vegas Tunnel | VEGAS_TUNNEL_FAST_MA | Period | 12 | Fast moving average period |

| Vegas Tunnel | VEGAS_TUNNEL_SLOW_MA_1 | Period | 144 | Slow moving average 1 period |

| Vegas Tunnel | VEGAS_TUNNEL_SLOW_MA_2 | Period | 169 | Slow moving average 2 period |

-

1-4. Trade Only in Trend Description: An advanced filter option. When enabled, the EA will additionally check the ADX indicator to ensure the market is in a strong trend before entering a trade, helping to avoid trading in ranging markets.

-

1-5. Multi-Timeframe Filter Description: Allows you to set a higher timeframe as an additional filter. The EA will only place an order when the trend analysis from both the current chart timeframe and the specified higher timeframe is in agreement, effectively preventing counter-trend trading.

2. Momentum Time Window (seconds)

Description: This parameter defines the time window, in seconds, over which the EA calculates price momentum.

-

2-1. Enable Pullback Description: When enabled, the EA will wait for the price to retrace by a specified number of points before entering a trade, instead of chasing the price immediately after a momentum signal appears. This helps in getting a better entry price.

-

2-2. Pullback Trigger Points (Points) Description: When "Enable Pullback" is active, this parameter sets the distance the price needs to retrace from the momentum trigger point.

3. Fixed Stop Loss Distance (Points)

Description: Sets a fixed stop-loss distance in points for every trade.

4. Fixed Take Profit Distance (Points)

Description: Sets a fixed take-profit distance in points for every trade. If set to 0, fixed take-profit is not used, and the trade will be managed by trailing stop or manual closure.

5. Trailing Stop Distance (Points)

Description: Once the trailing stop is activated, this parameter determines the fixed distance in points between the stop-loss level and the current price.

6. Trailing Step (Points)

Description: The trailing stop feature will only activate after the trade's profit reaches this number of points.

7. Trailing Step Reduction (Points)

Description: After each successful trailing stop trigger, the EA will reduce the points for the next Trailing Step, making the stop-loss follow the price more closely.

8. Minimum Trailing Step (Points)

Description: Sets a lower limit for the "Trailing Step Reduction" to prevent it from becoming too small.

9. Enable Consecutive Loss Pause

Description: When enabled, the EA will automatically pause trading for a specified duration in seconds after a certain number of consecutive losses.

-

9-1. Enable Max Daily Loss Count Description: When enabled, the EA will automatically pause trading for the rest of the day after the number of losing trades reaches the specified count. Trading resumes the next day.

-

9-2. Enable Max Daily Drawdown Description: When enabled, an additional capital protection feature. The EA tracks the total realized losses for the day. When this sum reaches the set percentage of the account equity, trading is automatically paused.

10. Enable Trading Hours Filter

Description: Allows you to set specific hours and days for the EA to trade, avoiding order placement during quiet market periods.

11. Use Risk-Based Lot Sizing

Description: How it works: When you set this option to true and input a value for LotsPer1000Equity , the EA will:

-

Read your current account equity in real-time.

-

Automatically calculate the lot size: Lot Size = (Account Equity / 1000) * LotsPer1000Equity . Example:

-

Your account equity is $5,000 .

-

You set LotsPer1000Equity to 0.01 .

-

The EA will automatically calculate: (5000 / 1000) * 0.01 = 0.05 lots.

-

Therefore, the EA will use 0.05 lots for each trade.

12. Use Fixed Lot Sizing

Description: When enabled, the EA will use the fixed lot size you set for all trades.

13. Enable Auto-Restart

Description: Strongly recommended to enable. This prevents unexpected pauses during backtesting or on demo accounts. If the EA does not place any trades for a specified period, it will automatically restart, ensuring its state returns to its clean initial state, especially after any accumulated calculations or trading pauses.

-

13-1. Auto-Restart Interval (Hours) Description: Sets the waiting time, in hours, for the EA to automatically restart after a period of no trading.

Disclaimer:

The Kbar Energy (EA Name) is an automated trading tool. Trading with this program involves high risk, and you may lose some or all of your capital. Past performance is not indicative of future results. You are solely responsible for all trading risks and outcomes. This product is provided "as is," and the author makes no express or implied warranties. This program does not constitute financial or investment advice.