Best Order Block Detector

- Göstergeler

- Manh Toan Do

- Sürüm: 1.0

### Best Order Block Detector Indicator for MT5

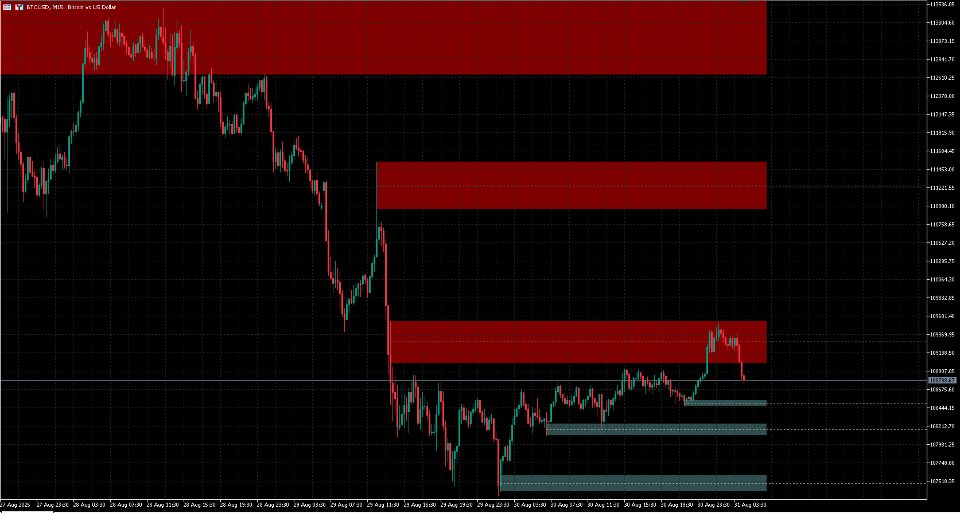

The Order Block Detector is a technical analysis indicator designed for MetaTrader 5 (MT5). It identifies potential order blocks (OBs) in the market, which are key price levels where significant buying or selling activity has occurred, often acting as support or resistance zones. These blocks are detected based on volume pivots and market structure swings, helping traders spot areas of institutional interest for potential reversals or continuations.

#### Key Features:

- Detection Mechanism:

- Uses a user-defined Volume Pivot Length (default: 5) to identify pivot highs in volume, combined with overbought/oversold (OS) states based on price highs and lows.

- Bullish Order Blocks (green) are formed during oversold conditions (OS = 1) at volume pivots, representing potential accumulation zones.

- Bearish Order Blocks (red) are formed during overbought conditions (OS = 0) at volume pivots, representing potential distribution zones.

- Visualization:

- Displays order blocks as semi-transparent rectangles extending to the right of the chart.

- Includes an average line (midpoint of the block) with customizable style (solid, dashed, or dotted) and width.

- Limits display to the last N blocks (configurable via "Bullish OB" and "Bearish OB" inputs, default: 3 each) to avoid chart clutter.

- Customizable colors for backgrounds, borders, and average lines for both bullish and bearish blocks.

- Mitigation:

- Supports two mitigation methods: Wick (based on highs/lows) or Close (based on closing prices).

- Automatically removes (mitigates) order blocks when price breaches them, simulating absorption or invalidation.

- Alerts:

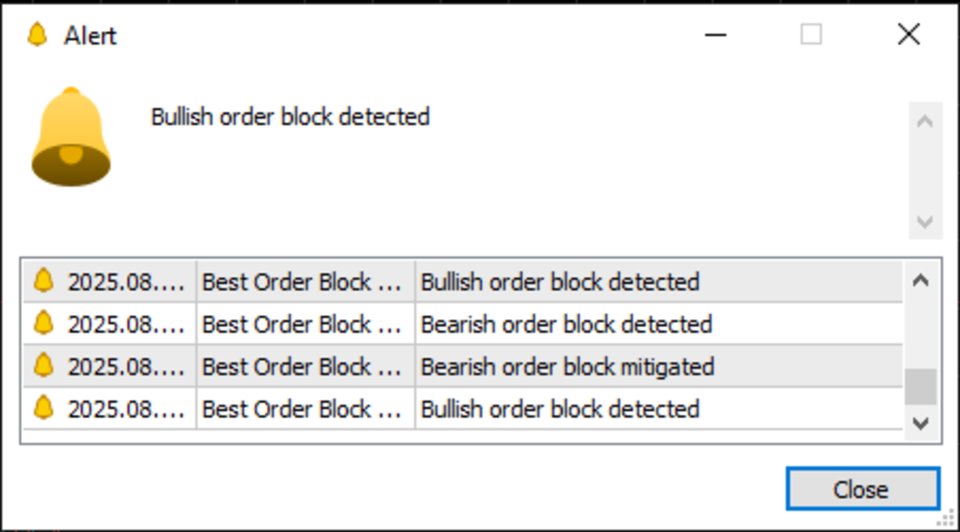

- Optional alerts (enabled/disabled via input) for:

- Bullish/Bearish OB formation.

- Bullish/Bearish OB mitigation.

- Alerts are triggered in real-time as conditions are met.

- Performance and Limits:

- Processes up to 500 order blocks internally to prevent overload.

- Efficient for historical and real-time data, updating on each new bar.

- No indicator buffers or plots are used; visualization relies on chart objects (rectangles and trend lines).

#### Usage:

- Apply the indicator to any chart timeframe and symbol.

- Adjust inputs to fine-tune sensitivity (e.g., longer pivot length for higher timeframes).

- Ideal for supply/demand trading strategies, where traders enter positions at unmitigated OBs or use mitigated ones as confirmation of trend changes.

The Order Block Detector is a technical analysis indicator designed for MetaTrader 5 (MT5). It identifies potential order blocks (OBs) in the market, which are key price levels where significant buying or selling activity has occurred, often acting as support or resistance zones. These blocks are detected based on volume pivots and market structure swings, helping traders spot areas of institutional interest for potential reversals or continuations.

#### Key Features:

- Detection Mechanism:

- Uses a user-defined Volume Pivot Length (default: 5) to identify pivot highs in volume, combined with overbought/oversold (OS) states based on price highs and lows.

- Bullish Order Blocks (green) are formed during oversold conditions (OS = 1) at volume pivots, representing potential accumulation zones.

- Bearish Order Blocks (red) are formed during overbought conditions (OS = 0) at volume pivots, representing potential distribution zones.

- Visualization:

- Displays order blocks as semi-transparent rectangles extending to the right of the chart.

- Includes an average line (midpoint of the block) with customizable style (solid, dashed, or dotted) and width.

- Limits display to the last N blocks (configurable via "Bullish OB" and "Bearish OB" inputs, default: 3 each) to avoid chart clutter.

- Customizable colors for backgrounds, borders, and average lines for both bullish and bearish blocks.

- Mitigation:

- Supports two mitigation methods: Wick (based on highs/lows) or Close (based on closing prices).

- Automatically removes (mitigates) order blocks when price breaches them, simulating absorption or invalidation.

- Alerts:

- Optional alerts (enabled/disabled via input) for:

- Bullish/Bearish OB formation.

- Bullish/Bearish OB mitigation.

- Alerts are triggered in real-time as conditions are met.

- Performance and Limits:

- Processes up to 500 order blocks internally to prevent overload.

- Efficient for historical and real-time data, updating on each new bar.

- No indicator buffers or plots are used; visualization relies on chart objects (rectangles and trend lines).

#### Usage:

- Apply the indicator to any chart timeframe and symbol.

- Adjust inputs to fine-tune sensitivity (e.g., longer pivot length for higher timeframes).

- Ideal for supply/demand trading strategies, where traders enter positions at unmitigated OBs or use mitigated ones as confirmation of trend changes.

Ein sehr guter Indikator, der sich auf das Wesentliche konzentriert. Vielen Dank!