Orderflow Scalp Pro

- インディケータ

- TitanScalper

- バージョン: 2.42

- アップデート済み: 29 12月 2025

- アクティベーション: 5

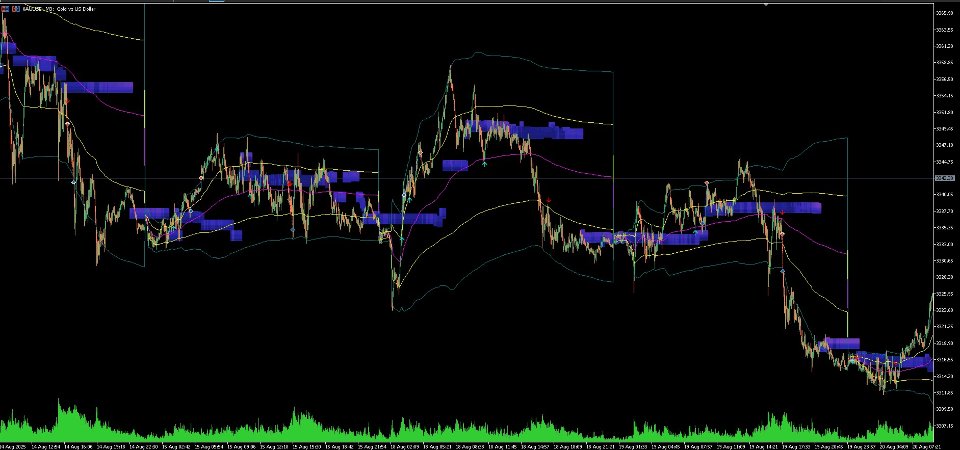

Orderflow Scalp Pro v2.4 delivers institutional-grade trading intelligence through advanced volume analysis, dynamic VWAP calculations, real-time aggressive score monitoring, and precision arrow signals. This complete trading system transforms complex market data into clear, actionable signals for consistent profitability on 3-4 minute timeframes.

📖 Full Documentation: [Download PDF]

Four Powerful Components in One System

Volume Profile HeatMap with POC/VAH/VAL

Transform your charts into institutional-grade order flow analysis. The 20-level color-coded heatmap reveals where smart money is positioned, showing support and resistance zones before they become obvious to other traders.

Key Features:

- Point of Control (POC): Automatic identification of maximum volume price levels

- Value Area High (VAH) and Low (VAL): 70% volume concentration zones marked in real-time

- High Volume Nodes (HVN): Color-coded volume clusters for key support/resistance

- Volume gap analysis for breakout opportunities

- Real-time institutional order flow tracking

- Dynamic histogram updates on candle close for optimal performance

Advanced VWAP System

Professional volume-weighted average price calculations with triple standard deviation bands. VWAP serves as the institutional benchmark - price above indicates bullish sentiment, below signals bearish momentum.

VWAP Bands:

- Band 1: Immediate support/resistance levels

- Band 2: Strong institutional levels

- Band 3: Extreme reversal zones

- Session-based automatic resets

- Optimized calculation engine: Updates on candle close for 10-50x faster backtesting

Aggressive Score System (NEW in v2.4)

Revolutionary buyer/seller pressure analysis displayed in real-time on your chart. This advanced orderflow metric reveals institutional aggression before major price moves.

Live Metrics:

- Aggressive Score: Net buyer/seller pressure indicator

- Buyer Score: Real-time buying aggression measurement

- Seller Score: Real-time selling pressure analysis

- Color-coded visualization (Green for bullish, Red for bearish)

- Configurable lookback periods and corner placement

- Updates every tick for instant market sentiment feedback

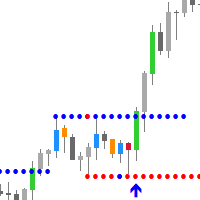

Precision Arrow Signals

Intelligent signal generation combining volume confirmation, VWAP interaction, aggressive score analysis, and momentum validation. Two distinct signal types provide clear entry opportunities.

Signal Types:

- Rejection Arrows: High-probability reversals at key levels with volume confirmation

- Breakout Arrows: Momentum continuation signals aligned with aggressive score

- ATR-based positioning for optimal entry timing

- Multi-bar confirmation reduces false signals

- VWAP band integration for enhanced accuracy

Optimized for High-Frequency Trading

Perfect Timeframes

Primary: 3-4 minute charts for precise entries

Confirmation: 15-minute for trend bias

Context: 1-hour for major levels

Best Markets

Gold (XAUUSD): Ideal for volatile precious metals trading

Major Forex Pairs: EUR/USD, GBP/USD, USD/JPY, AUD/USD

Stock Indices: US100, US30, US500

High-Volume Sessions: London-New York overlap periods

Multi-Confirmation Trading Framework

Tier 1 Setups (70%+ Win Rate)

All elements must align:

- Volume confirmation at POC/VAH/VAL levels

- Clear VWAP position

- Arrow signal present

- Aggressive score alignment (buyer score for longs, seller score for shorts)

- Trend alignment on higher timeframe

Tier 2 Setups (60%+ Win Rate)

Four of five elements align for moderate probability trades

Signal Quality Control

Advanced filtering prevents overtrading and improves signal accuracy through volume validation, aggressive score confirmation, and trend analysis

Professional Entry Strategies

VWAP + Aggressive Score Strategy

Combine VWAP band interaction with aggressive score divergence for high-probability entries when buyer/seller pressure aligns with price action.

POC Rejection Strategy

Trade reversals at Point of Control when price is rejected with strong aggressive score confirmation and volume support.

VAH/VAL Breakout Strategy

Enter breakouts through Value Area High or Low when aggressive score shows strong momentum and volume confirms the move.

Volume Profile Gap Fill

Trade low-volume areas in the heatmap when price moves to fill gaps with strong momentum and favorable aggressive score.

Multi-Timeframe Confluence

Combine 15-minute bias with 3-4 minute precision entries and aggressive score alignment for optimal risk-reward ratios.

Risk Management Excellence

Built-in Stop Loss Logic

- Automatic calculation based on recent swing points

- VWAP-based stop levels

- VAL/VAH dynamic stops

- Maximum 2% account risk per trade

Profit Targeting System

- Target 1: VWAP Band 1 or POC

- Target 2: VAH/VAL or VWAP Band 2

- Target 3: VWAP Band 3 with trailing stops

Position Sizing

Smart position calculation: Account Risk ÷ (Entry - Stop Loss)

Advanced Trading Techniques

Aggressive Score Divergence

Identify early reversals when aggressive score diverges from price action at key VWAP or volume profile levels.

POC Magnetism Trading

Trade mean reversion to Point of Control when price extends with weakening aggressive score.

Institutional Order Flow Reading

Identify smart money activity through volume analysis, aggressive score spikes, and VWAP interaction patterns.

Session-Based Trading Plan

Pre-Market Preparation

- Setup multi-timeframe analysis

- Mark previous session POC/VAH/VAL levels

- Check aggressive score baseline

- Check economic calendar

- Determine market bias

Main Trading Sessions

Morning (High Volatility): Focus on breakout strategies with aggressive score confirmation

Afternoon (Lower Volatility): Emphasize VWAP pullback trades and POC reactions

Closing Hour: Watch for institutional positioning via aggressive score changes

Performance Optimization (v2.4 Upgrade)

Blazing Fast Performance

- 10-50x faster backtesting compared to previous versions

- Optimized VWAP calculation engine

- Efficient volume profile rendering

- Smart caching for aggressive score calculations

- Reduced CPU usage for smooth live trading

- Enhanced memory management for large datasets

Expected Results

Conservative Approach: 8-15% monthly returns with <10% drawdown

Aggressive Approach: 15-25% monthly returns with <15% drawdown

Key Performance Metrics

- Minimum 1:1.5 risk-reward ratio

- Target 65%+ overall win rate

- Monthly performance review and optimization

Technical Specifications

Supported Instruments

- XAUUSD (Gold) - Primary focus

- XAGUSD (Silver)

- EUR/USD, GBP/USD, USD/JPY

- AUD/USD, USD/CHF, NZD/USD

- Stock Indices (US100, US30, US500, DAX, FTSE)

- Any high-volume forex pairs

Alert System

- Popup notifications with trade details

- Sound alerts for different signal types

- Email notifications with analysis

- Push notifications for mobile trading

- Configurable alert cooldown periods

Installation and Setup

Quick Start

- Auto-detection of symbol type (Forex, Gold, Silver, Indices)

- Pre-configured BinRange parameters for optimal performance

- Professional chart templates included

- Complete user manual with video tutorials

- Instant aggressive score display on startup

Customization Options

- Adjustable color schemes for volume profile and heatmap

- Flexible alert preferences

- Custom risk parameters

- Visual element customization

- Aggressive score display position and styling

- Volume profile histogram width and levels

Educational Support

Complete Learning Package

- Professional trading strategy guide

- Aggressive score interpretation manual

- Volume profile analysis techniques

- Risk management course

- Psychology and discipline training

Ongoing Support

- Direct developer contact

- Regular updates and improvements

- Community access

- Performance optimization assistance

Professional Disclaimer

This indicator is designed for educational and analytical purposes. Trading involves substantial risk of loss. The system provides technical analysis tools and signals but does not guarantee profits. Always practice proper risk management and never risk more than you can afford to lose. Thorough backtesting and demo practice are recommended before live trading.

What's New in Version 2.4:

✅ Real-time Aggressive Score System with buyer/seller pressure metrics

✅ Full Volume Profile integration (POC, VAH, VAL, HVN detection)

✅ 10-50x faster backtesting performance

✅ Optimized VWAP calculation engine

✅ Enhanced memory efficiency and CPU usage

✅ Smart caching for all calculation modules

Optimized For: XAUUSD, XAGUSD, Major Forex Pairs, Stock Indices

Best Timeframes: 3-4 Minutes (Primary), 15 Minutes (Confirmation)

Trading Style: High-Frequency Scalping with Institutional Flow Analysis

Win Rate Target: 65%+ Overall

Risk-Reward: 1:1.5 to 1:3

Platform: MetaTrader 5

Version: 2.4 (Performance & Feature Enhanced)

Transform your trading with institutional-grade order flow analysis. Experience the power of professional volume profile technology, advanced VWAP calculations, real-time aggressive score monitoring, and precision arrow signals in one complete system.