You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.09.23 17:36

EUR/USD - bullish ranging near intra-day bearish ranging reversal (based on the article)

Intra-day H4 price is above 200 SMA and near above 100 SMA in the primary bullish area of the chart. The price is testing 1.1935 support level to below for the ranging market condition with 1.1890 bearish reversal level as a nearest taregt in this case.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.09.23 08:25

Weekly EUR/USD Outlook: 2017, September 24 - October 01 (based on the article)

EUR/USD dropped to lower ground, but gradually recovered, holding onto known ranges. The German elections provide a strong start to the week, which continues with inflation figures and other data. Here is an outlook for the highlights of this week.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.09.25 17:18

EUR/USD Intra-Day Fundamentals: ECB President Draghi Speech and range price movement

2017-09-25 14:00 GMT | [EUR - ECB President Draghi Speech]

if actual > forecast (or previous one) = good for currency (for EUR in our case)

[EUR - ECB President Draghi Speech] = Speech about the economy and monetary policy before the European Parliament Economic and Monetary Affairs Committee, in Brussels.

==========

From rttnews article :

==========

EUR/USD M5: range price movement by ECB President Draghi Speech news event

-----------

Chart was made on MT5 with BrainTrading system (MT5) from this thread (free to download) as well as the following indicators from CodeBase:

All about BrainTrading system for MT5:

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.09.26 16:53

Intra-Day Fundamentals - EUR/USD: The Conference Board Consumer Confidence

2017-09-26 15:00 GMT | [USD - CB Consumer Confidence]

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - CB Consumer Confidence] = Level of a composite index based on surveyed households.

==========

From official report :

==========

EUR/USD M15: range price movement by The Conference Board Consumer Confidence news events

============

Chart was made on MT5 with BrainTrading system (MT5) from this thread (free to download) as well as the following indicators from CodeBase:

All about BrainTrading system for MT5:

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.09.28 14:48

Intra-Day Fundamentals - EUR/USD and GBP/USD: U.S. Gross Domestic Product

2017-09-28 13:30 GMT | [USD - Final GDP]

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Final GDP] = Annualized change in the inflation-adjusted value of all goods and services produced by the economy.

==========

From official report :

==========

EUR/USD M15: range price movement by U.S. Final GDP news events

==========

GBP/USD M5: range price movement by U.S. Final GDP news events

============

Chart was made on MT5 with BrainTrading system (MT5) from this thread (free to download) as well as the following indicators from CodeBase:

All about BrainTrading system for MT5:

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.09.30 08:19

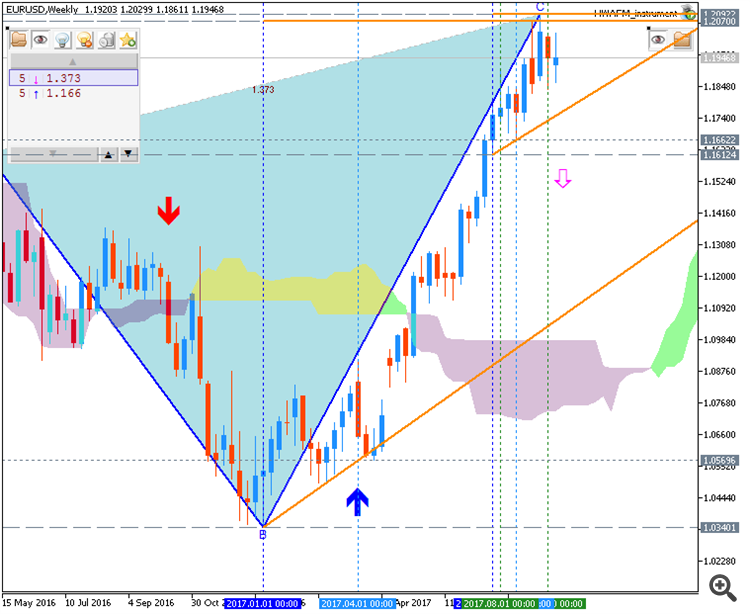

EURUSD Weekly - daily ranging near bearish ranging reversal (based on the article)

The price on the daily chart is located near and above Senkou Span line this is the virtual border between the primary bearish and the primary bullish trend. If the price breaks 1.1730/1.1661 resistance levels so the daily bearish reversal will be started, otherwise - ranging within the levels.

==========

The chart was made on D1 timeframe with Ichimoku market condition setup (MT5) from this post (free to download for indicators and template) as well as the following indicator from CodeBase:

As we can see on the chart:

already three-week candles go from the maximum all the lower and lower. But usually on Mondays there is a correction. Therefore, on Monday there will be a correction, and then from Tuesday the price will be lower and lower.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.10.02 16:06

Intra-Day Fundamentals - EUR/USD: ISM Manufacturing PMI

2017-10-02 13:30 GMT | [USD - ISM Manufacturing PMI]

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - ISM Manufacturing PMI] = Level of a diffusion index based on surveyed purchasing managers in the manufacturing industry.

==========

From official report :

==========

EUR/USD M5: range price movement by ISM Manufacturing PMI news events

============

Chart was made on MT5 with BrainTrading system (MT5) from this thread (free to download) as well as the following indicators from CodeBase:

All about BrainTrading system for MT5:

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.10.06 14:53

Intra-Day Fundamentals - EUR/USD and USD/CNH: Non-Farm Payrolls

2017-10-06 13:30 GMT | [USD - Non-Farm Employment Change]

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Non-Farm Employment Change] = Change in the number of employed people during the previous month, excluding the farming industry.

==========

From official report :

==========

EUR/USD M5: range price movement by Non-Farm Payrolls news events

==========

USD/CNH M5: range price movement by Non-Farm Payrolls news events

==========

Chart was made on MT5 with MA Channel Stochastic system uploaded on this post, and using standard indicators from Metatrader 5 together with following indicators:

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.10.07 08:25

Weekly EUR/USD Outlook: 2017, October 08 - October 15 (based on the article)

EUR/USD was under pressure once again, dropping for the second week in a row. The upcoming week’s highlight is a speech by Mario Draghi. Here is an outlook for the highlights of this week.

==========

The chart was made on H4 timeframe with standard indicators of Metatrader 4 except the following indicators (free to download):