You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.10.28 10:06

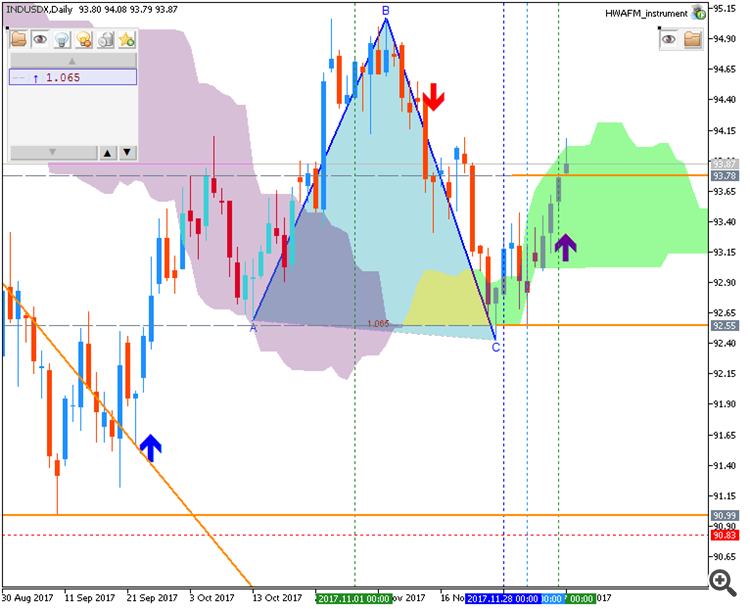

Dollar Index - daily bullish breakout (based on the article)

Daily price broke Ichimoku cloud to above for the bullish reversal: price broke 94.61 daily resistance level to above for the bullish breakout to be continuing with 99.76 nearest bullish target.

==========

The chart was made on MT5 with Brainwashing system/AscTrend system (MT5) from this thread (free to download) together with following indicators:

Same system for MT4:

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.10.28 12:24

Weekly Outlook: 2017, October 29 - November 05 (based on the article)

The US dollar had an excellent week, mostly thanks to speculation about the next Chair of the Fed. What’s next? The upcoming week opens a new month and packs both a Fed decision and the Non-Farm Payrolls. Here are the highlights for the upcoming week.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.10.28 11:20

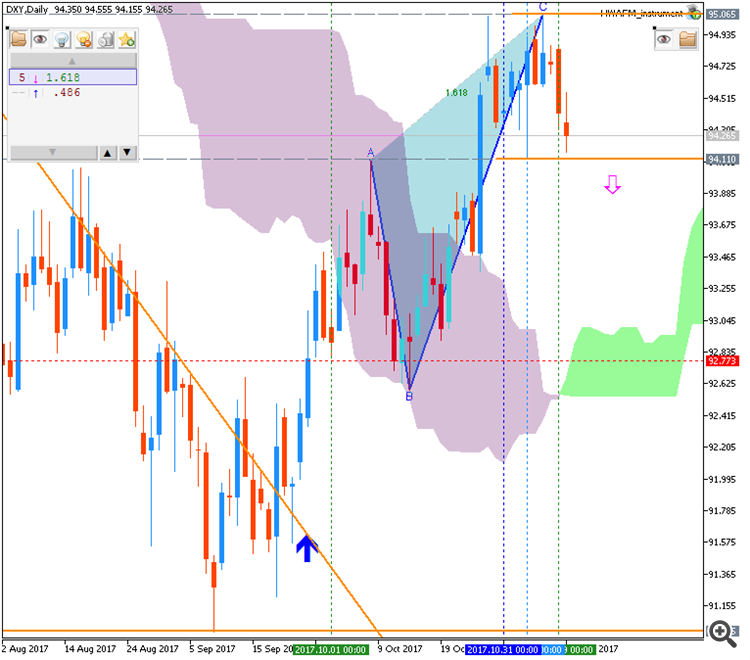

Weekly Fundamental Forecast for Dollar Index (based on the article)

Dollar Index - "The week ahead brings a hefty dose of fresh fodder to inform this narrative. The FOMC will convene for a policy meeting and marquee data releases including October’s employment numbers as well as the closely watched ISM and PMI activity surveys are set to cross the wires. Both components seem likely to complement the greenback’s latest upward push. Recent comments from Fed Chair Yellen have not-so-subtly signaled that the US central bank is on track for a rate hike in December. That makes the release of November’s policy statement a familiar pre-game exercise unambiguously setting the stage for what’s to follow. Meanwhile, a steady outperformance on US data outcomes since mid-June opens the door for another round of upbeat releases on the horizon."

-----------

Chart was made on MT4 using iFibonacci indicator and MaksiGen_Range_Move indicator from CodeBase (free to download).

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.11.03 14:04

Intra-Day Fundamentals - EUR/USD, NZD/USD and Dollar Index: Non-Farm Payrolls

2017-11-03 12:30 GMT | [USD - Non-Farm Employment Change]

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Non-Farm Employment Change] = Change in the number of employed people during the previous month, excluding the farming industry.

==========

From official report :

==========

EUR/USD M5: range price movement by Non-Farm Employment Change news events

==========

NZD/USD M5: range price movement by Non-Farm Employment Change news events

==========

Dollar Index M5: range price movement by Non-Farm Employment Change news events

============

Chart was made on MT5 with BrainTrading system (MT5) from this thread (free to download) as well as the following indicators from CodeBase:

All about BrainTrading system for MT5:

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.11.05 08:07

Weekly Outlook: 2017, November 05 - November 12 (based on the article)

The US dollar was mixed across the board despite big events in markets. Will this continue? The upcoming week features events from all over the world. Here are the highlights for the upcoming week.

Forum on trading, automated trading systems and testing trading strategies

Press review

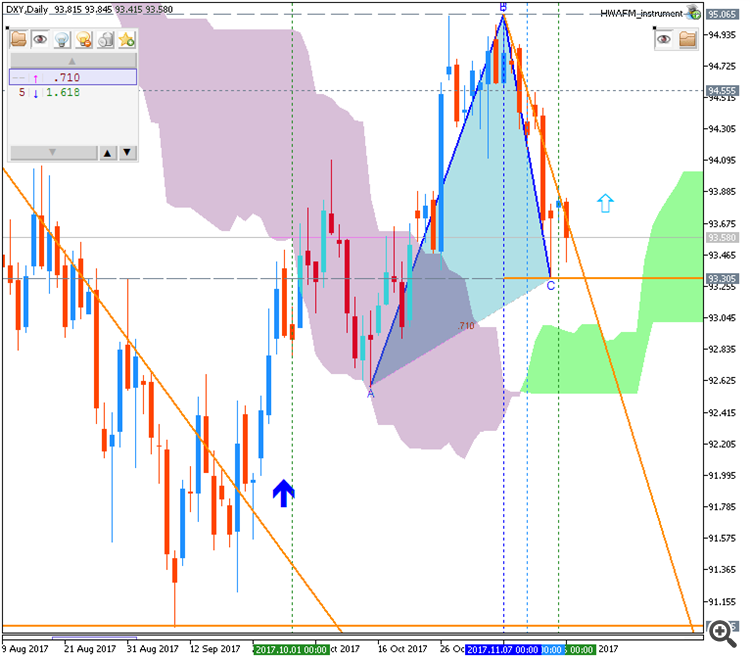

Sergey Golubev, 2017.11.11 08:24

Weekly Outlook: 2017, November 12 - November 19 (based on the article)

The US dollar was somewhat on the backfoot in a relatively slow week. Will it continue sliding? The upcoming week features the all-important inflation and retail sales figures from the US as well as housing data and more. Here are the highlights for the upcoming week.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.11.19 10:55

Weekly Outlook: 2017, November 19 - November 26 (based on the article)The US dollar had a mixed week amid all-important inflation numbers. The upcoming week features US durable goods orders, housing data, speeches from Yellen and Draghi, and the FOMC minutes as we head into Thanksgiving. Here are the highlights for the upcoming week.

Forum on trading, automated trading systems and testing trading strategies

Press review

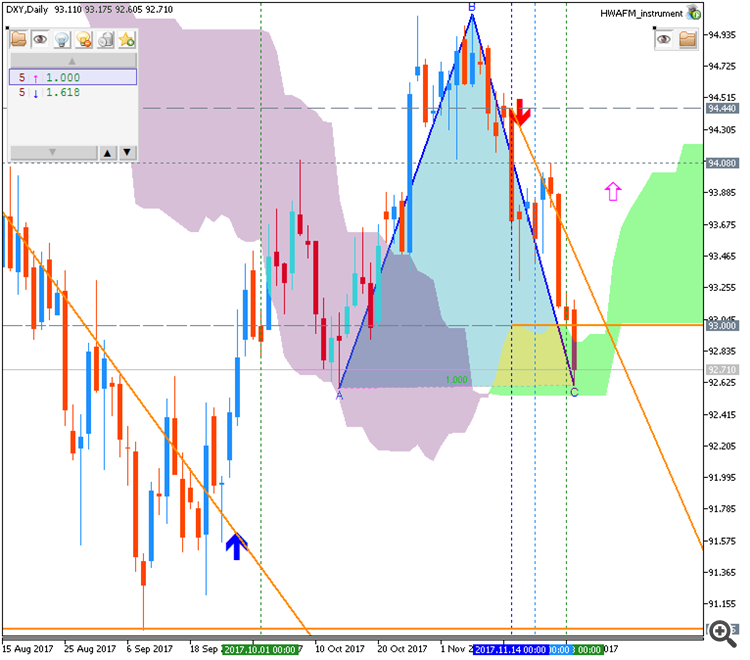

Sergey Golubev, 2017.11.26 17:43

Weekly Outlook: 2017, November 26 - December 03 (based on the article)

The US dollar was on the back foot in the week of Thanksgiving and now we are back to business with a busy week. A mix of housing data, inflation figures, and an update on GDP stand out Here are the highlights for the upcoming week.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.12.02 11:05

Weekly Outlook: 2017, December 03 - December 10 (based on the article)

The US dollar managed to recover in the week after Thanksgiving on positive data, upbeat Fed statements, imminent tax cuts, and despite a major development in Trump’s troubles. The Non-Farm Payrolls is the key event and we also have rate decisions from Australia and Canada Here are the highlights for the upcoming week.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.12.10 07:58

Weekly Outlook: 2017, December 10 - December 17 (based on the article)

The US dollar continued enjoying the optimism from the tax cuts and was not hit hard by the data. Can it continue higher? Four rate decisions await us: the SNB, ECB, BOE, and the FED, with Yellen’s last post-rate decision press conference. Can the dollar continue higher? Here are the highlights for the upcoming week.