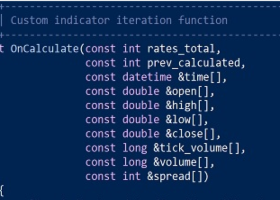

Research shows that beginner traders usually stay active for about 8.5 months. Only around one-third continue trading for more than one year. Those who receive proper training in the first 90 days normally stay active for about 14 months.

Studies from the United States and the United Kingdom say that up to 80% of retail traders stop trading during their first year. Brokers also report that an average trading account lasts only 6–10 months. The main reasons are lack of knowledge and high emotional stress in the beginning.

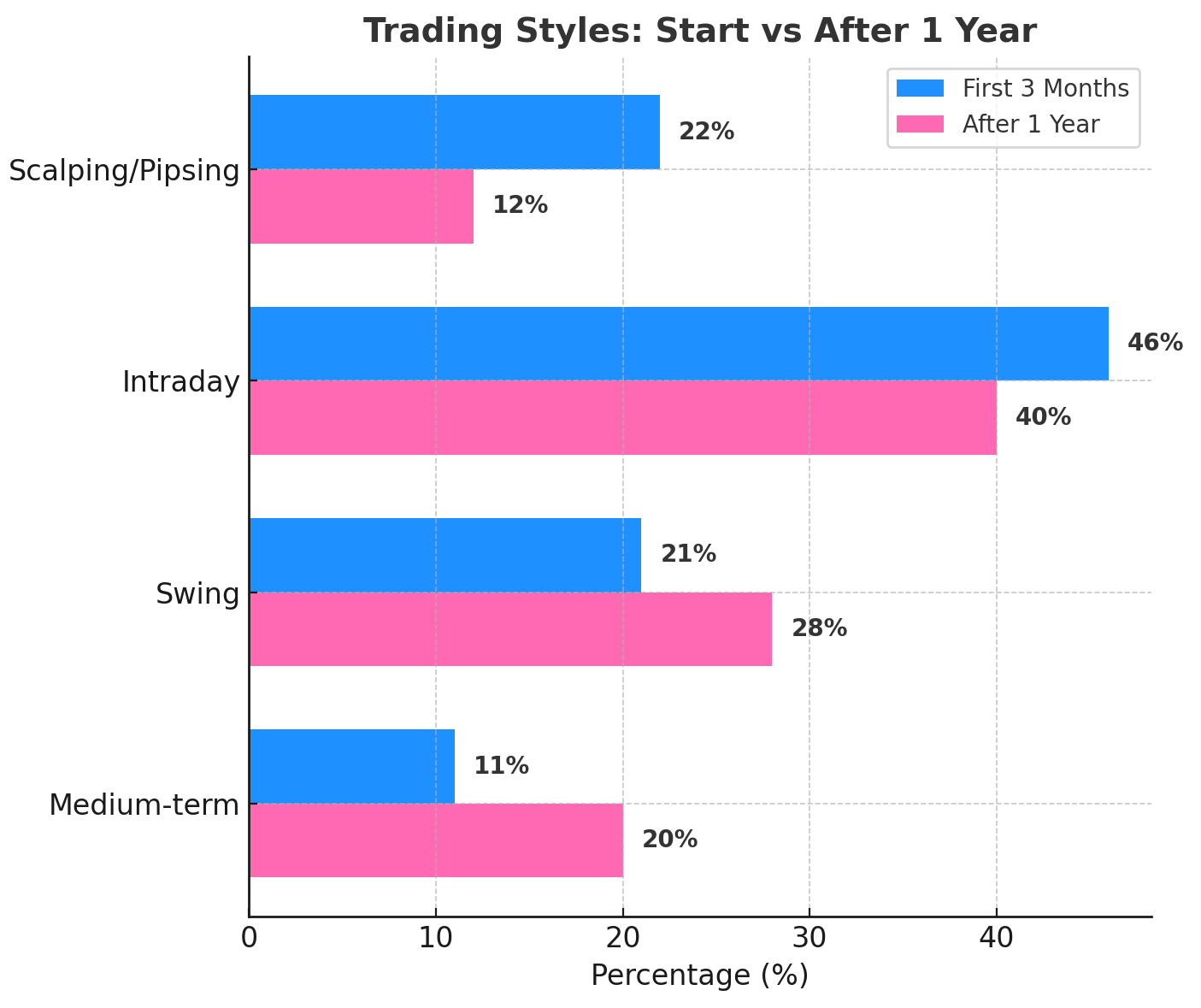

At the start, 22% of new traders choose scalping, 46% trade inside the same day, 21% use swing trading – meaning they hold trades for a few days to one week, – and only 11% follow longer-term strategies. After one year, only 12% continue scalping, while 48% become swing or medium-term traders. This shows that people move towards calmer and less stressful ways of trading.

Broker reports say that an average day trader opens up to 70 trades per month, and their total trading volume can be 20–30 times bigger than their deposit. Swing traders usually trade only 5–6 times their deposit, which means lower costs and less emotional pressure.

Scalping requires many fast decisions within seconds or minutes. This increases stress and reduces focus. A study by the University of California found that traders making more than 50 trades per day are twice as likely to burn out emotionally within six months. Swing trading is different — it allows more time for analysis, news reading and planning, which makes it easier and more stable for many traders.

Technology also affects the market. According to JPMorgan, more than 65% of forex trades are automated. This makes entry easier but increases competition.

Financial psychologist Brett Steenbarger says trading is not a fight against the market – it is a fight against your own impatience. Over time, successful traders move to longer-term styles, learn better risk control and develop analytical thinking. These traders have a chance to become part of the 20% who remain in the market for many years.

When the scalper sees ticks, the swing trader sees dreams.