All-In-One Breakout EA – Settings Explained and Setfiles

Setfiles

Download the setfiles pack from here for version 2.000 and above:

Before backtesting with your broker account, it is important to change the daylight saving timezone in Section 14 of the EA settings.

Optimisation

Download the optimisation .ini pack from here:

Important Links

Download Demo Trial and Buy

About Breakout Strategy

Settings

1. Money Management

These settings control how the EA manages position sizing and risk.

Money Management Type (MMType)

Fixed Lot Size (MMByFixed)

Uses a fixed lot size for all trades.

Example: MMFixed = 0.20 → every trade uses 0.20 lots.

Equity Ratio (MMByEquityRatio)

Calculates lot size based on a ratio of equity (0.01 lot per $100 equity).

Example: MMEquityRatio = 100 , Equity = $1,000 → (1000 / 100) × 0.01 = 0.10 lots.

Balance Ratio (MMByBalanceRatio)

Calculates lot size based on account balance (0.01 lot per $100 balance).

Example: MMBalanceRatio = 200 , Balance = $5,000 → (5000 / 200) × 0.01 = 0.25 lots.

Risk Percentage (MMByRiskPC)

Calculates lot size based on the percentage of equity risked per trade.

Example: MMRiskPC = 2 , Equity = $10,000, SL = 50 points → risk = $200 = 2%, lot size = 4.00 lots.

Fixed Dollar Loss (MMByFixedDollar)

Risks a fixed max dollar amount per trade. Ideal for controlling maximum loss.

Example: MMFixedDollar = 125 , Account = $25,000 → each trade risks 0.5%.

Risks a total max daily DD% (Daily DD) based on initial deposit shared by number of Number of AIOBO assest/Symbol. Initial deposit can be AutoDetect or Manual Entry.

Example: Money Management Type = Prop Firm Initial Deposit % Risk, Initial Deposit = 200,000, Daily DD=1.0% and Number of AIOBO assest/Symbol* = 8, then each assset has max risk of $250 for each pair of pending orders, totally $2000 max for each. New

* Means a MT5 terminal is loaded with 8 different setfiles.

Note: If Cancel Order Order (COO) is disabled, means opposit pending order will not be cancelled when one side is triggered, in Section 8, all money management mode lot size will be halved except Fixed Lot Size New

Minimal Lot size as specified by broker will be used if the calculated lot size (depending on range size and other factors) is smaller then the mininal lot size, if this is set to true.

If set to false, and the calculated lot size is smaller then minimal lot size, there won't be trade.

2. Box Time

This section defines the time window used to form the breakout range. The EA measures the high/low (or close/close) within this window and sets breakout levels accordingly.

Box Timeframe (TimeframeRange)

Specifies which timeframe is used to build the box.

Example: PERIOD_M5 → box based on 5-minute candles.

Box Type (BoxType)

- High/Low (HighLow): uses highest high & lowest low.

- Support/Resistance (HighLowClosed): uses highest close & lowest close.

Box Anchor (BoxAnchor)

Defines how the EA interprets your time range:

- RangeStart: box starts at the given time, ends after the duration.

- RangeEnd: box ends at the given time, starts by subtracting the duration.

Box Start / End Time

- RangeStartHour, RangeStartMinute, RangeStartSecond → defines start time.

- RangeEndHour, RangeEndMinute, RangeEndSecond → defines end time or duration, depending on anchor.

Examples:

Start = 02:00, Duration = 5h30m → Box = 02:00–07:30

End = 07:30, Duration = 4h00m → Box = 03:30–07:30

Randomised Box Time

- Enable Randomisation (RandomRange): randomises start and end times.

- Random Range Delta (RangeSecondDelta): maximum ±seconds shift.

Example: RangeSecondDelta = 180 → up to ±3-minute variation.

2.1 Box Method

Defines volatility-based calculation for box metrics.

- ATR Timeframe (ATRTF): timeframe used to calculate ATR.

- ATR Period (ATRPeriod): number of candles (e.g., 14).

- ADR Period (ADRPeriod): number of days for average daily range.

Example: ADRPeriod = 20 → average of last 20 daily ranges.

2.2 Box Offset

Offsets are applied to box boundaries to adjust entry levels.

Box Offset Type (OffsetType)

- OffsetOff: no adjustment.

- Fixed Point: adds/subtracts fixed points.

Example: +20 → entry 20 pts above; –13 → 13 pts below. - Fixed Percentage: percentage of box size.

Example: 10% of 100 pts box → ±10 pts. - ATR: percentage of ATR value.

- ADR: percentage of ADR.

- Price: percentage of current price.

Random Offset Type (RandomOffset)

- Off: none.

- By Point: random shift by fixed points.

- By Percentage: random shift by % of box size.

Example: RandomOffsetPC = 10 → ±10 pts randomisation.

2.3 Box Range Filter

Restricts trading to boxes within a desired volatility range.

Range Filter Type (RangeType)

- Off: no filter.

- Fixed Point: minimum & maximum in points.

- ATR: range as % of ATR.

- ADR: range as % of ADR.

- Price: range as % of current price.

Example:

MinRangePoint = 40 , MaxRangePoint = 100 → trade only when box = 40–100 pts.

3. Cancel Orders

Defines when untriggered pending orders will be cancelled.

Cancel Duration

CancelOrdersHour, CancelOrdersMinute, CancelOrdersSecond

Time added to box end before pending orders are cancelled.

Randomisation

- Enable (RandomCancelOrder): true/false.

- Variation (CancelOrderSecondDelta): ±seconds adjustment.

Example:

Box ends 07:30 → Cancel + 6 h = 13:30

CancelOrderSecondDelta = 180 → cancel between 13:27–13:33.

4. Close Positions

Defines when open positions are force-closed after the cancel period or known as Stop Type.

Close Type (CloseType)

- CloseByTime: force close at exact time.

- CloseByTP: close only on Take Profit.

- CloseByTP_Time: close by TP or time, whichever comes first.

Duration

ClosePositionsHour, ClosePositionsMinute, ClosePositionsSecond

Duration after cancel time.

Randomisation

- Enable (RandomClosePosition): true/false.

- Variation (ClosePositionSecondDelta): ±seconds variation.

Example:

Cancel = 13:30 → Close + 2 h = 15:30 ± 3 min → 15:27–15:33.

5. Stop Loss

Defines how stop loss is calculated.

Stop Loss Type (SLType)

- Box Factor: multiple of box size.

- Fixed Point: exact points.

- ATR-Based: Factor of ATR.

- ADR-Based: Factor of ADR.

- Price Factor: % of current price.

- Off: no stop loss (highly risky).

Random Stop Loss (RandomSL)

- Off: none.

- By Point: ±points around base SL.

- By Percentage: ±% around base SL.

Example: base 100 pts, ±10% → SL = 90–110 pts.

6. Take Profit

Defines how take profit is calculated.

Take Profit Type (TPType)

- Stop-Loss Factor: multiple of SL (risk-reward ratio).

- Fixed Point: exact distance.

- ATR-Based: Factor of ATR.

- ADR-Based: Factor of ADR.

- Price Factor: % of price.

- Off: no take profit.

Random Take Profit (RandomTP)

- Off: none.

- By Point: ±points randomisation.

- By Percentage: ±% randomisation.

Example: base 100 pts, ±10% → TP = 90–110 pts.

7. Trailing Stop

Adjusts stop loss dynamically as price moves favourably.

Trailing Stop Switch

Enables/disables trailing stop.

Trailing Stop Type (TSType)

- By Stop-Loss Factor: Factor of initial SL.

- Fixed Point: fixed points.

- ATR/ADR-Based: Factor of ATR/ADR.

- Price %: % of price.

Trail Activation

- Trail % (Trail): portion of distance used to trigger trail.

- Above Break-Even Switch (Trail_Above_Switch): enable trailing only beyond BE.

- Above Factor (Trail_Above): how far beyond BE before trail activates.

Random Trailing Stop (RandomTS)

- Off: none.

- By Point / %: random variation to trailing stop.

8. Trades

Controls general trade behavior.

Cancel Opposite Orders (COO_Switch)

When enabled, opposite pending orders are cancelled once one side is triggered.

Trade Direction (BorS)

- Buy and Sell: both directions.

- Buy Only / Sell Only: restrict to one side.

- Off: disable trading.

Maximum Trades

- Max Long Trades: maximum daily buy orders.

- Max Short Trades: maximum daily sell orders.

- Max Total Trades: total daily limit.

Minimum Time Between Trades (NextOpenTradeAfterSeconds)

Defines the cooldown time (in seconds) after a position is closed before a new one can be opened.

Prevents rapid re-entries and helps manage trading frequency.

Examples:

0 = no wait.

600 = 10 minutes.

3600 = 1 hour.

9. Day to Trade

Choose which weekdays the EA may trade.

Each input ( TradeMonday , TradeTuesday , …) = true/false.

Example: TradeMonday = true, TradeFriday = false → trades Monday to Thursday only.

10. Confluence

Adds trend and volatility confirmations.

3 Moving Averages Filter

- Enable (CMASwitch)

- Timeframe (MAATF)

- Method (MAMethod)

- Fast/Medium/Slow Periods (CMA1Period, CMA2Period, CMA3Period)

Entry only if MAs align in the same direction (e.g., 21 > 50 > 200 for uptrend).

ADI Filter

- Enable (CADISwitch)

- Timeframe / Period (CADITF / CADIPeriod)

- ADX Threshold (CADIMainLevel)

- DI Levels & Difference (CADILevel / CADIDiff)

Ensures DI+ vs DI− and ADX confirm directional strength (DI+ for uptrend and DI− for downtrend).

ADR Filter

- Enable (CADRSwitch)

- Timeframe (CADRTF)

- Period (CADRPeriod)

- Min/Max ADR Levels (CADRLevelMin / CADRLevelMax)

Trades only when daily volatility is within a defined range.

Bollinger Bands Filter

- Enable (CBBSwitch)

- Timeframe (CBBRTF)

- Period / Deviation / Min Max Width (CBBPeriod / CBBDev / CBBLevelMin / CBBLevelMax)

Allows trades only when Bollinger band width is within a healthy volatility range.

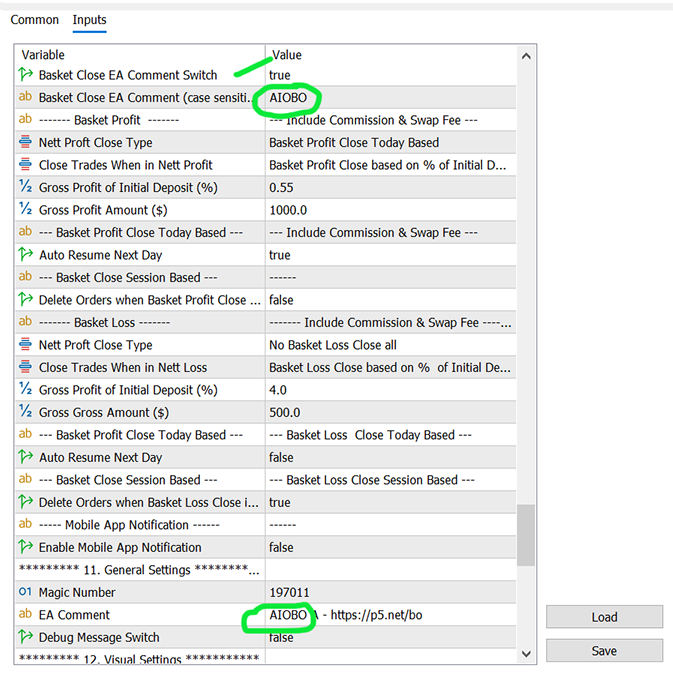

15. Session Management (Basket Profit & Loss Control)

This section manages "Global Exit" rules for the entire account or specific sessions. It is designed to lock in profits or cap losses across all active trades managed by the EA, including Commission and Swap fees.

Comment Filtering

- Basket Comment Switch (PartialCommentSwitch): When enabled, the EA only includes trades that contain the specified PartialComment in its calculation.

- Partial Comment (PartialComment): The specific text string the EA looks for in trade comments (case-sensitive). Example: If set to https://t.me/AIOBOEA , the basket logic ignores any manual trades or other EAs running on the same account that don't share this comment.

Basket Profit Settings (Locking in Gains)

- Nett Profit Close Type (GrossProfitCloseType):

- NettProfitOff : Feature disabled.

- NettProfitSessionBased : Closes all based on the current active trades (floating P/L).

- NettProfitTodayBased : Closes all based on total performance (Closed trades today + Floating P/L).

- Profit Calculation Mode (CloseDeleteAllTradesWhenProfitType):

- Percentage : Calculates target based on % of Initial Deposit.

- Amount : Calculates target based on a fixed Dollar ($) value.

- Profit Targets:

- Gross Profit % (GrossProfitPercentage) : e.g., 0.55 means 0.55% of account.

- Gross Profit Amount (GrossProfit) : e.g., $1000.

- Session Controls:

- Auto Resume Next Day (HaltProfitResume) : If true, the EA resets and resumes trading automatically the next day after a profit hit.

- Cancel Order on Profit (CancelOrderWhenProfit) : If true, all pending orders are deleted the moment the profit target is met.

Basket Loss Settings (Capital Protection)

- Nett Loss Close Type (GrossLossCloseType):

- NettLossOff : Feature disabled.

- NettLossSessionBased : Triggered by current floating drawdown.

- NettLossTodayBased : Triggered by total daily loss (Realized loss today + Floating drawdown).

- Loss Calculation Mode (CloseDeleteAllTradesWhenLossType):

- Percentage : Target based on % of Initial Deposit.

- Amount : Target based on a fixed Dollar ($) value.

- Loss Thresholds:

- Gross Loss % (GrossLossPercentage) : e.g., 4.0 means 4% of account.

- Gross Loss Amount (GrossLoss) : e.g., $500 (Enter as a positive number).

- Session Controls:

- Auto Resume Next Day (HaltLossResume) : If true, the EA resets the next day. If false, the EA stays halted until manual intervention.

- Cancel Order on Loss (CancelOrderWhenLoss) : If true, all pending orders are deleted immediately if the loss threshold is hit to prevent further exposure.

Notifications

- Mobile Notification (NotificationSwitch): If enabled, the EA will send a push notification to your MetaTrader mobile app the moment a Basket Profit or Basket Loss event triggers a global close-out.

11. General Settings

Magic Number (MagicNumber)

Unique identifier for the EA’s trades. If you chart more the 1 symbol in a MT5 terminal, make sure you change the magic number to something unique.

EA Comment (EaOrderComment)

Custom text tag added to each order. You may want to change this.

Chart Comment (ChartComment)

Show/hide dynamic on-chart status.

Debug Messages (DebugSwitch)

Enable or disable detailed log messages.

12. Visual Settings

Controls how the EA draws boxes, labels, and statistics.

- RangeColor: main box color.

- StopColor / CancelColor: colors for stop/cancel lines.

- DayOpenColor: color for daily open line.

- UpperBoxColor / LowerBoxColor: colors for box edges.

- ShowInfo: toggle on-chart info.

- TextSize / TextColor / BoxColor: font size, color, and info box background.

13. Trade Sessions Indicator

Displays the start of key market sessions on the chart.

- Enable (TradeSessionsIndicatorSwitch)

- Tokyo Start (JP_Start_Hour)

- London Start (LD_Start_Hour)

- New York Start (NY_Start_Hour)

- Spacing: vertical distance between session labels.

Thick line = session start, thin line = session end.

Typical broker server (GMT+2 / 3):

Tokyo = 2 London = 10 New York = 15

Adjust these if your broker server uses a different timezone.

14. Backtest & Optimisation

Fast Backtest Mode (FastBacktest)

Choose optimisation shortcut:

- T-Type: skips redundant ticks for speed.

- S-Type: simplified candle-based logic.

- Off: full tick simulation.

Test Interval (TInt)

Defines spacing between test steps for T-Type mode.

Broker Time Offsets

For correct backtest, these 2 parameters must be changed if your broker server is different from GMT+2. Defines your broker’s server-to-GMT offset:

- WinterOffset: normal season offset.

- SummerOffset: daylight-saving offset.

Examples:

ICMarkets: Winter = 2.0, Summer = 3.0

Exness: Winter = 0, Summer = 1

This ensures your box and session times remain accurate when moved across brokers or seasons.

Trailing Step Validation

- MinTrailingStepCheck: enable or disable optimisation safety check.

- MinTrailingStep: minimum logical step size in points.

Prevents unrealistic trailing configurations (e.g., trailing smaller than spread).

Recommended: enable check and set MinTrailingStep ≈ 1.5 – 3× typical spread.

Prop Fim Money Management

AIOBO EA has a way to split the risk (daily DD) and close in profit each day to accumulte profit to reach the target. This method can be used in broker account and account of any type, as it limit the risk and grow the account processively and steadily.Suggested setting as follow:

At Section 1. Money Management

Money Management Type: Prop Firm Initial Deposit % Risk

This is the max risk you want to afford in 1 day

Auto Detect Initial Deposit: Auto

This will auto detect the account size of your challenges. If personal broker account, you may want to use set it to Manual and enter the amount of deposition at the next parameter (Manual Entry of Initial Deposit).

Max Daily DD you want to risk (%): 2

This setting means the total and MAXIMUM amount of DD in a day you can expect. Prop firm daily drawdown is 5%, you definately want to set this lower then 5%, else you may loss your account once the drawdown is reached.

Number if AIOBO: 8

This is number of chart of different symbol and different setfiles are used, the actual number of chart you are using

Set the above in ALL the charts.

The following is to close daily small profit.

At Section 15. Session Management.

Nett Profit Close Type: Nett Profit Close Today Based

Close all trades once the profit of today is reached.

Close Trades When in Nett Proft: Nett Profit Close based on % Initial Deposit

This is where you set how much to close trades when in profit based in your initial deposit (or Account Size)

Gross Profit of Initial Deposit (%): 0.55

This is the amount of nett profit you want to take per day, with commission and swap deducted.

Auto Resume Next Day: true

When Gross Profit is hit, there would not be any more trade for today. Set this to true, so it can resume trading next working day.

For the above setup, all trades will be closed with 0.55% profit per day, it will resume next trading day. For worst case, it will hit 2% (Combined Max) drawdown.

Note:

- This is no 100% gurannttee to pass a prop firm, however, if you use smaller risk and smaller Nett Profit setting, you will have better chance

- You can use the same method in funded account or personal broker account.

- Make your own setfile to prevent being flag as copy trades for prop firms, especially funded account

- If there is a trading which hit the max risk you have set, I suggest you to stop the EA for 3 working days.

- Strongly suggest you to setup a broker demo account to test this concept with the same account size, same brokers server timezone and same setting before trying to pass a prop firm or use in funded account

If you have question regarding this EA, you can contact me at:

https://www.mql5.com/en/users/rodeong