About:

Turtles EA on MT5: https://www.mql5.com/en/market/product/153372

The Turtles EA revives the legendary Turtle Trading experiment from the 1980s—Richard Dennis's proof that anyone can be taught to trade like a pro using simple, rule-based trend following.

The method is presented in Michael Covel's book: "The Complete TurtleTrader: How 23 Novice Investors Became Overnight Millionaires". Listening a lot to Jerry Parker podcasts i found that the turtles never used pyramiding but the confusion comes from the usage of 2 systems (S1 20/10 - short term and S2 55/20 - long term). Listen here starting with 13:34 where the most famous turtle trader says it clear.

The turtles never skipped a trade because you never know if the trade will be successful or not and since the outlier trades make the method profitable you don't want to miss one such a trade.

Since the markets usually don't have such strong trends as in the 1980's it is recommended to use larger stop losses like 3-4 ATR multiples and longer periods of time for breakouts and trail stops.

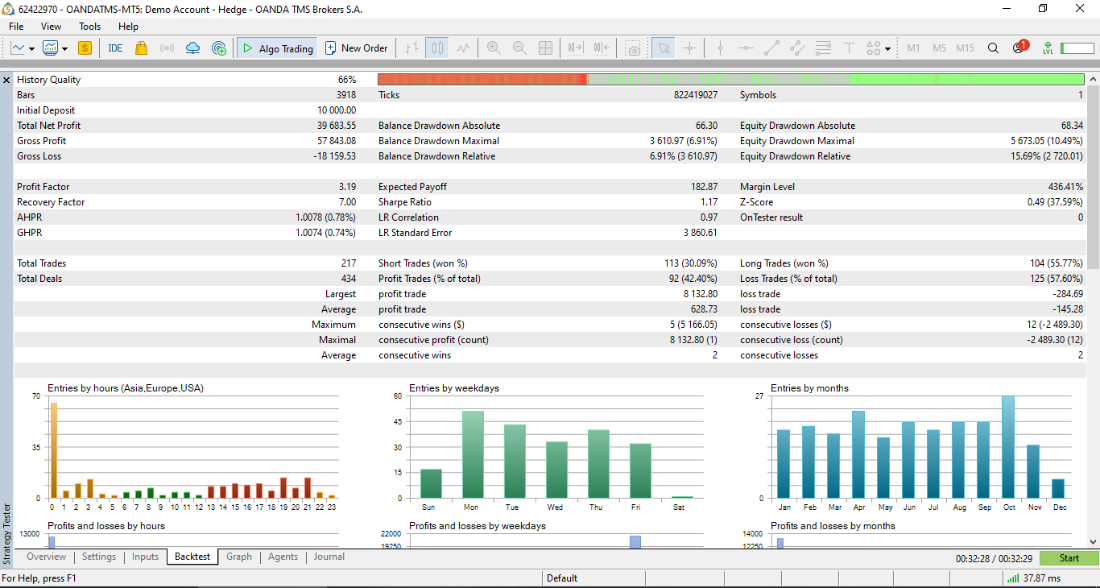

In the following backtest i used S1 = 40/20, S2 = 100/50, SL = 2ATR, 1% risk per trade, daily time frame. Period tested 2014 - 2025.

Turtles EA - Dual-System Breakout Trader - Hedging accounts only key features:

Persistent file storage for risk settings (auto-backup & recovery).

If you close MT5, in case of power failure when you open the trading platform(MT5), the max balance, the number of the reduction steps and the percentage risked per trade will be there and will be loaded.

Best For: Trendy markets like forex, crypto, metals, indices, or commodities. Backtest on D1 charts. Start with a demo account. It's designed for steady, low-risk growth, not scalping.

FAQ

Q: Why would i choose this EA instead of others or even free versions?

A: This EA implements the turtles method of trading such as it is described in the Michael Covel's book "The Complete TurtleTrader: How 23 Novice Investors Became Overnight Millionaires" plus it implements the precious remarks of the most successful turtle trader Jerry Parker. In addition the mechanism of protection in case of drawdown actually works in real conditions when it is inevitable to close MT5 for update or you encounter electricity interruptions.