Rebound from channel boundaries or trading on flat sections

It is obvious that when the market enters the consolidation phase (flat), it is preferable to use modified methods of opening trades. The classic strategy for such an entry is to open a position from the channel borders. You can use limit orders or bars with large shadows crossing the channel border. But modern markets have a lot of noise in their structure, so a breakout with confirmation looks preferable.

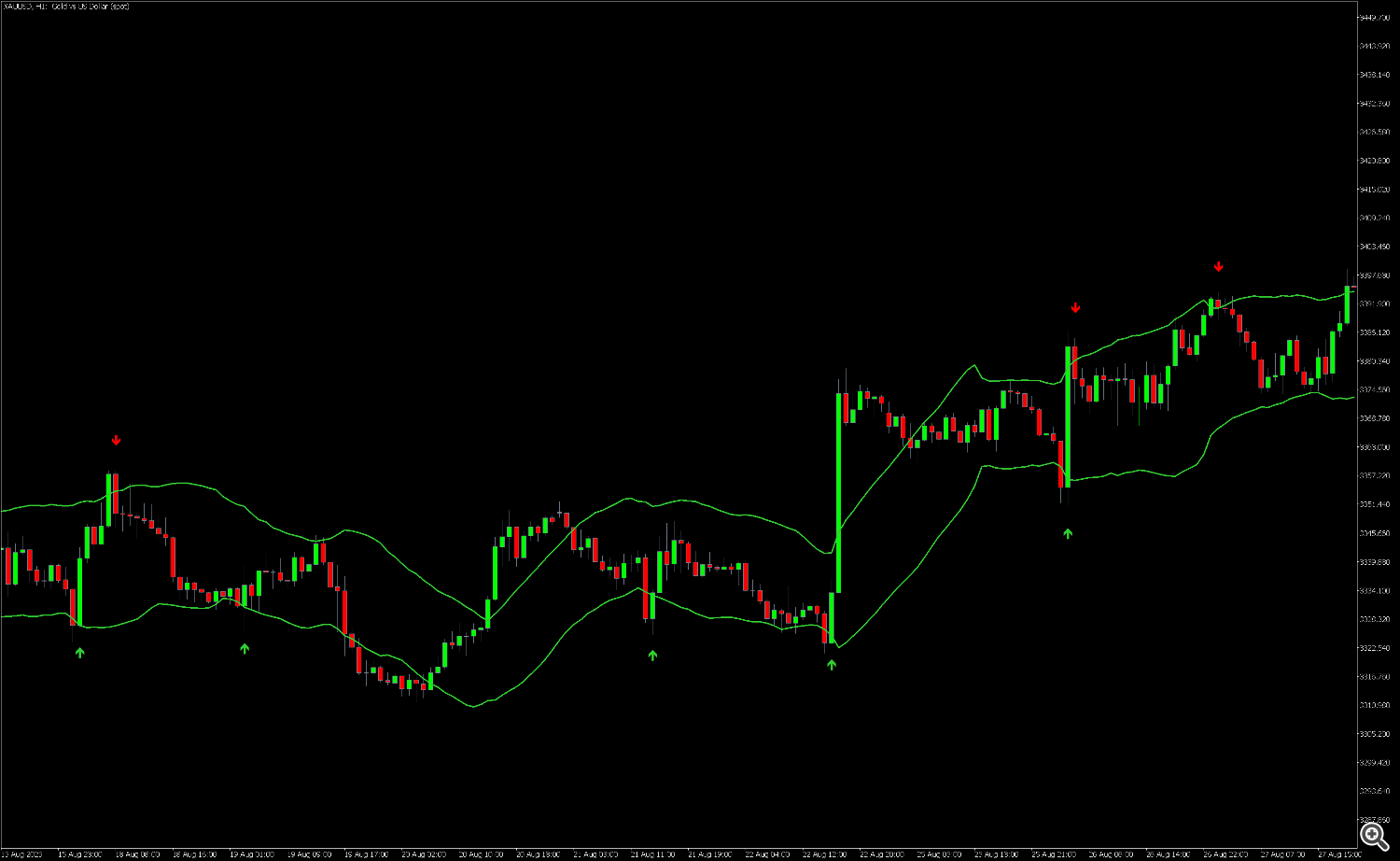

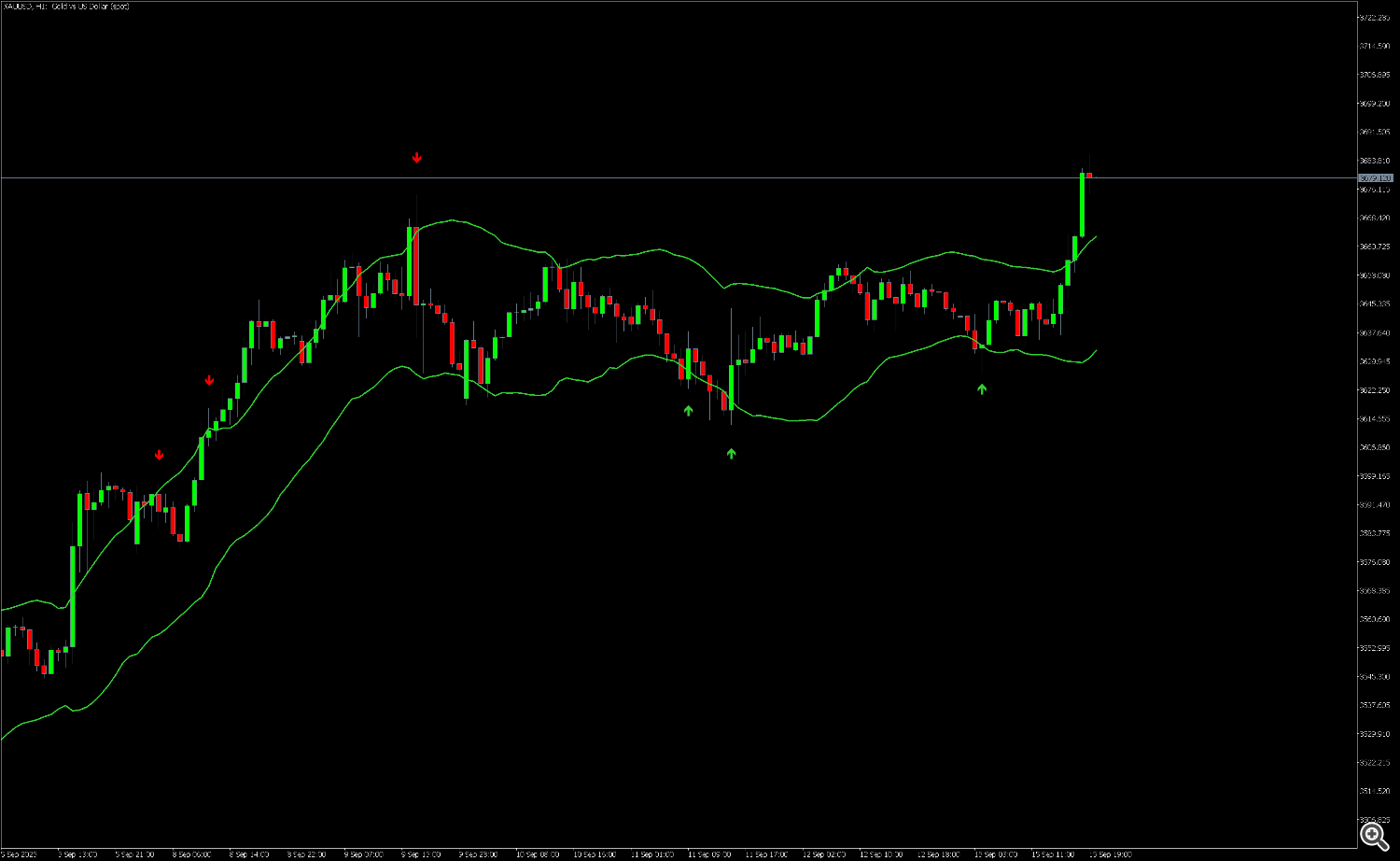

One of my clients suggested adding an interesting variation of the market entry strategy. Let's consider it in more detail: we have a channel built on average highs and lows and expanded several times from its original width. To buy, we want to see a bar crossing the lower line with its body from bottom to top and then a reversal with a reverse intersection. It is important that the close is above the channel line.

The psychology of this pattern is as follows: The price breaks through the support level sharply, knocking out small players. At this stage, large players get the opportunity to increase the desired position without much influence on the price. After this, the market turns around and goes in the right direction.

Of course, when there is a strong trend on the market, such an entry method begins to make mistakes. In this situation, you can improve your chances by simply waiting for the maximum of the bar that formed the signal to be broken.

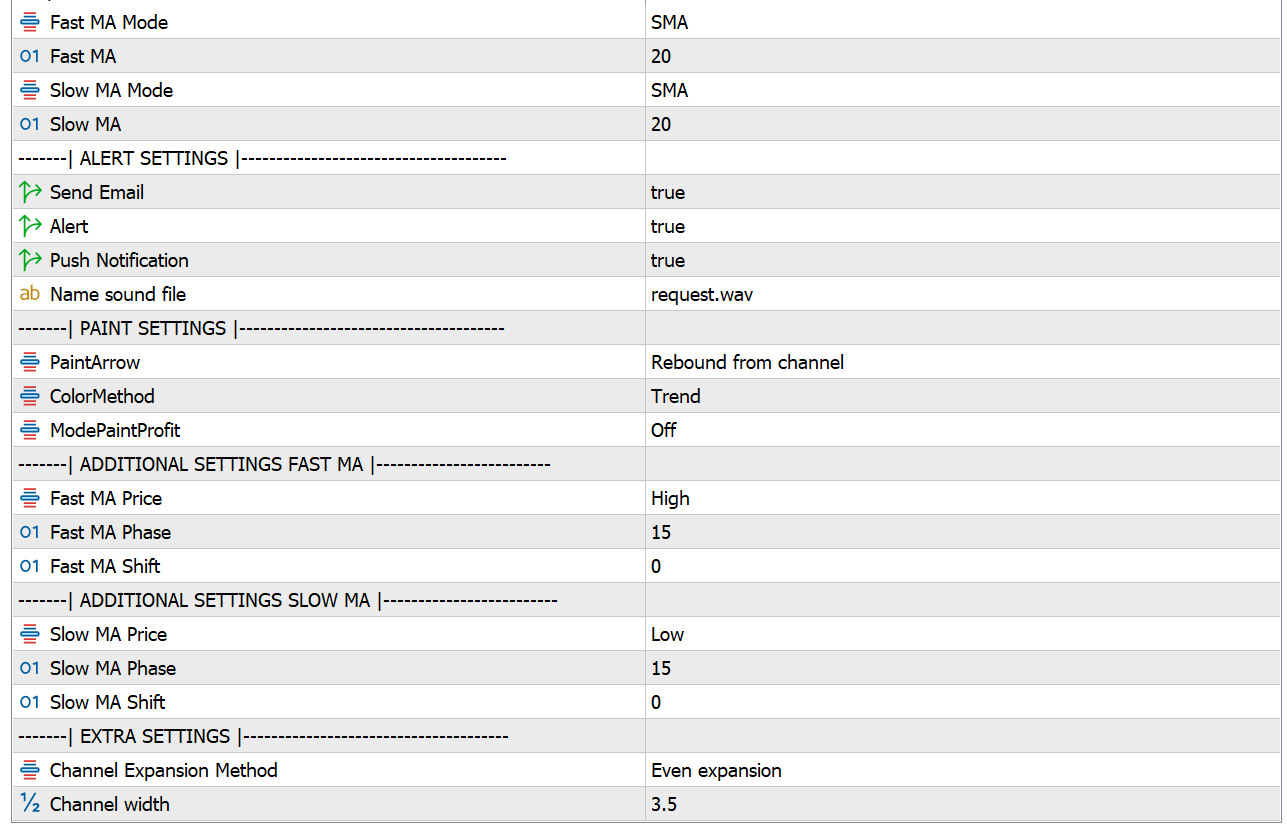

For convenience, we have added this entry strategy to our free Moving Average Cross Signal indicator: https://www.mql5.com/en/market/product/148478

And here are the parameters we used in the first two screenshots:

In conclusion, I would like to say that channel strategies can have completely different variations and even application conditions. For example, this is what an expanding channel of two different moving averages looks like. Here, the cyclical narrowing-expansion of volatility begins to work. A breakout beyond the channel is a strong signal to continue the movement. Scalping strategies also look good outside the channel.