In the world of forex trading, every transaction comes with a spread, a small but crucial factor that can significantly affect your profitability. Whether you're a day trader or a long-term investor, understanding how spreads work and how to use them effectively in your trading strategy is key.

| What is Spread in Forex Trading? |

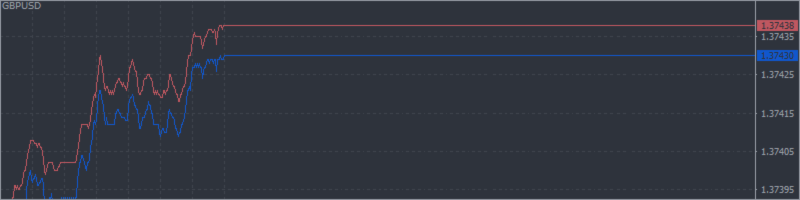

Spread refers to the difference between the bid price (the price at which you can sell) and the ask price (the price at which you can buy) of a currency pair. The spread represents the cost of trading, and traders often measure it in pips - the smallest price movement unit in forex. And there is a point » refer to Addendum to know more about the difference. The Current Price indicator is a useful tool showing the magnified Bid and Ask price for the chart symbol along with the spread.

For instance, if the EUR/USD bid price is 1.1050 and the ask price is 1.1052, the spread is 2 pips.

Types of Forex Spreads

- Fixed Spread: The spread remains constant regardless of market volatility. Often offered by brokers using a dealing desk model. Because of electronic trading, the number of forex dealers at a desk has declined significantly since the mid-2000s.

- Variable Spread: The spread fluctuates depending on market conditions, liquidity, and volatility. Found with brokers using ECN (Electronic Communication Network) or STP (Straight Through Processing) models.

| Spread indicates Market Volatility |

The spread difference can provide valuable insights into market volatility. Here’s how:

- Wider Spreads During High Volatility: When there is uncertainty, such as during major economic announcements or geopolitical events, spreads widen as liquidity providers factor in additional risk. A sudden increase in spread often shows market instability.

- Narrow Spreads in Stable Conditions: If the market is calm and trading volume is high, spreads remain tight. This is common during peak trading sessions, when liquidity is abundant.

- Impact of Low Liquidity on Spreads: Outside of major trading hours (such as during late Asian sessions), lower liquidity can cause spreads to widen, even in the absence of volatility.

| Spread impacts your Trading |

- Higher spreads increase trading costs: If the spread is wider, it requires a larger price movement to break even.

- Lower spreads are beneficial for traders: Especially for scalpers and day traders, lower spreads mean lower costs per trade.

- Volatility affects spread: During major news events, spreads can widen dramatically, signaling potential market turbulence.

| Using Spread to your Advantage |

- Choose the Right Broker: Some brokers offer raw spreads with lower costs but charge commissions, while others provide zero-commission trading with slightly higher spreads.

- Trade During High Liquidity: Major currency pairs like EUR/USD or GBP/USD typically have lower spreads, especially during peak market hours (London and New York sessions).

- Consider Spread When Setting Stop-Loss and Take-Profit: If you're scalping, a large spread could eat into profits. Make sure to account for spread when determining your trade exit points.

- Use Spread-Based Trading Strategies: Some traders adopt spread trading, where they hedge positions by taking opposing trades with different spreads to capitalize on price inefficiencies.

- Example » Trading EUR/USD (with a tight spread) and hedging it with GBP/USD (which may have a wider spread).

Understanding spread and its relationship to market volatility is an essential skill for forex traders. By monitoring spread differences, traders can gauge liquidity conditions and potential turbulence in the market. Being mindful of spread fluctuations, selecting the right broker, and timing your trades effectively can minimize costs and improve efficiency.

| Addendum |

In forex trading, pips and points are both units of measurement used to quantify price movements, but they differ in precision and application.

Pips (Percentage in Points)

- A pip is the standard unit of price movement in forex, typically referring to the fourth decimal place in a currency quote (except for JPY pairs, which use the second decimal place).

- Example: If EUR/USD moves from 1.1050 to 1.1051, it has moved 1 pip.

- Pips are widely used by traders to measure profit, loss, and spread.

Points (Fractional Pips)

- A point represents a smaller price movement than a pip, often referring to the fifth decimal place (or third for JPY pairs).

- Example: If EUR/USD moves from 1.10500 to 1.10501, it has moved 1 point (which is one-tenth of a pip).

- Points are used in high-frequency trading, where precise price movements matter.

Understanding these differences helps traders analyze price movements more accurately and refine their strategies based on the level of precision they need.

Disclaimer: The content, including the indicator guide, is provided for reference and use only and should not be considered financial advice. Forex trading involves risk, and past performance does not guarantee future results. Users should conduct their own research and seek professional guidance before making trading decisions. The provider is not responsible for any losses incurred.