HOW TO CORRECTLY SETUP YOUR EXPERT ADVISOR FOR PROP TRADING CHALLENGES ? - PART 1

In this post, I will explain the dynamics of successfully managing a prop trading challenge with a correct setup of Meta Trader Expert Advisors. So let’s start:

1- There are of course many prop companies out there with different trading conditions. In this post, I will explain setting up your EA for the prop trading companies that use Meta Trader and allow swing trades. That is, trading conditions are relaxed and as long as you trade in line with Drawdown limits, your account will be live.

2- We start with and example of a 100K prop trading challenge. Prop companies usually allow 5% daily Drawdown limit. It does not matter if it is 3% or 5% or 7%, the logic will always be the same.

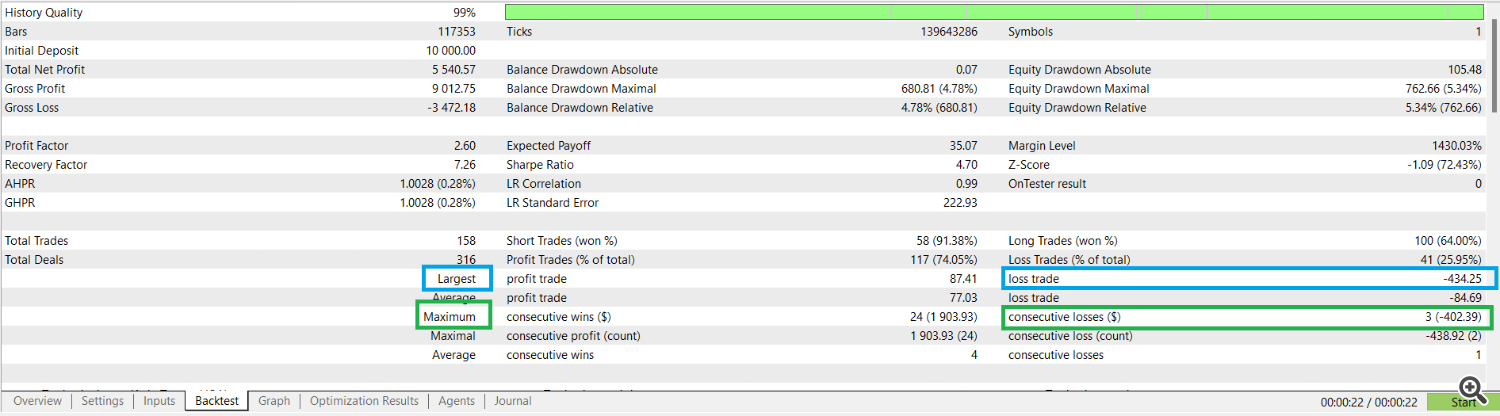

In this case, we have a 5k daily drawdown limit. If our drawdown exceeds that amount in a day at any time, we are knocked-out.

3- We have three critic information with our EA that we must focus on::

-

Largest Loss Trade,

-

Consecutive Losses,

-

Default lot size,

4- Let’s consider the backtest results of an EA that uses no martingale and no grid. So we have only a single position for every trade.

-

Largest Loss Trade is : -$434.25

-

Maximum Consecutive Losses is :-$402

-

Default lot size is : 1 (That is 1 point move equals $1)

5 - Maximum Consecutive Losses is important because even if the EA closes several positions with a loss, the maximum amount of consecutive losses are $402 for this EA.

In some cases, Largest Loss Trade can be -$434, but it can close several positions in loss below it such as -$330, -$240 etc. These losses are seen in Maximum Consecutive Loss and will increase the overall Drawdown significantly.

In our EA, the Largest Loss Trade is -$434 and Maximum Consecutive Losses is -$402. So we have around $450 risk.

6- Now, we must tailor our risk with the daily drawdown limit of our prop trading account.

We have $450 risk for every 1 lot of position. Because our daily drawdown limit is $5k, we need to divide $5000/$450 and the result is roughly 11.

7 - That means we can use as much as 11 lot size in the 100K prop trading account. Being on the safe limits, we can select 8 lot or 9 lot size for this prop trading account.

When we use 9 lots, our maximum risk will be around 3.9k which is well below the 5k daily drawdown limit. So we can safely cruise in prop trading challenge.

8 - Looking at the expected profit, raising lot size will also increase the expected profits. In our example, the expected profit rises from $5.5k to $49.5k.

This also implies that looking at the statistics, we see that the average profit trade is $77 for 1 lot and $693 for 9 lots.

If profit target is 8% to pass the challenge, we need only 12 win trades to pass this challenge in our best scenario where the EA doesn't SL.

In this article, I have explained the basics of utilizing the Meta Trader expert advisors for prop trading challenges. The series will continue with more advanced concepts. You can PM me anytime if you have further questions.

Speak soon,

Evren Çağlar

Burdur

05/24/2024