Gold Long-Only Grid EA About 2 Months of Forward Results on XAUUSD

Hello,

In this post I’d like to share the forward-test results of my gold long-only grid Expert Advisor,

Symbol: XAUUSD (GOLDmicro) – demo account

-

Timeframe: M15

-

Direction: Long only

-

Period: around 20 October 2025 – mid-December 2025 (about 2 months)

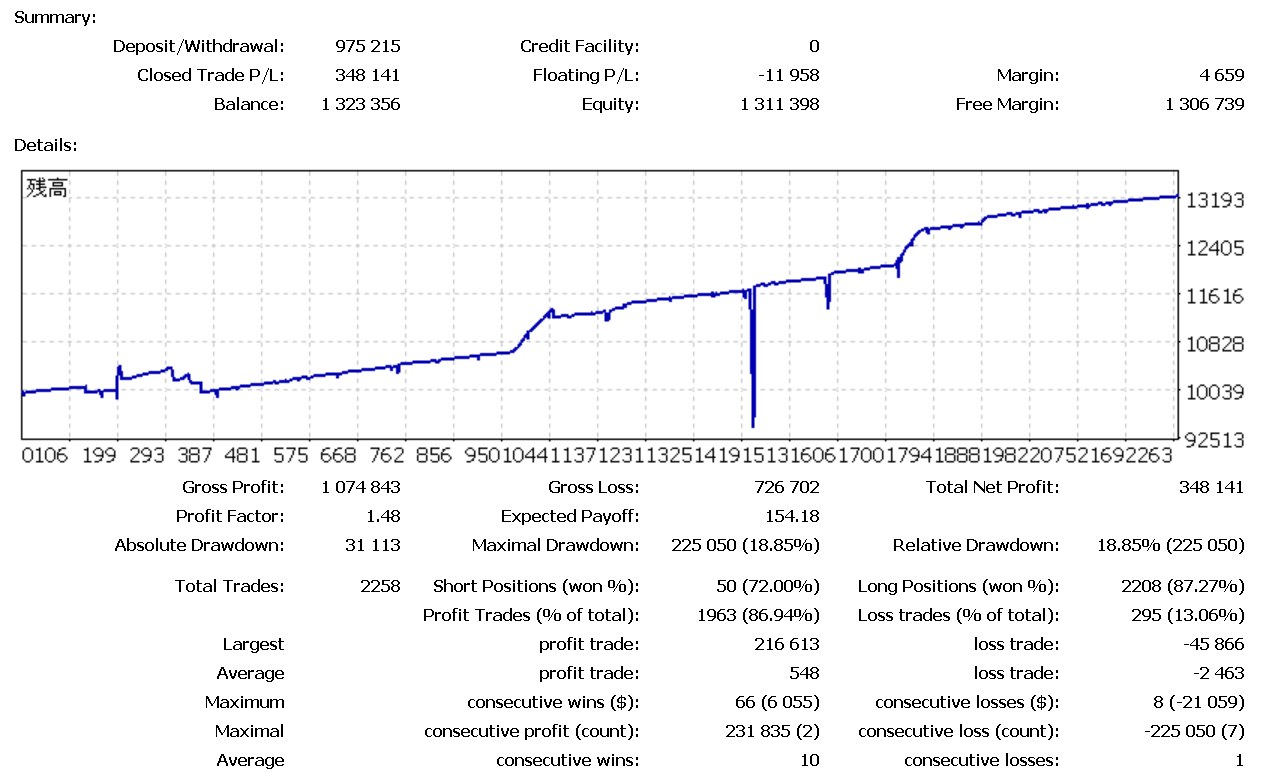

Below you will see two equity curves:

-

The full history from 20 October until now

-

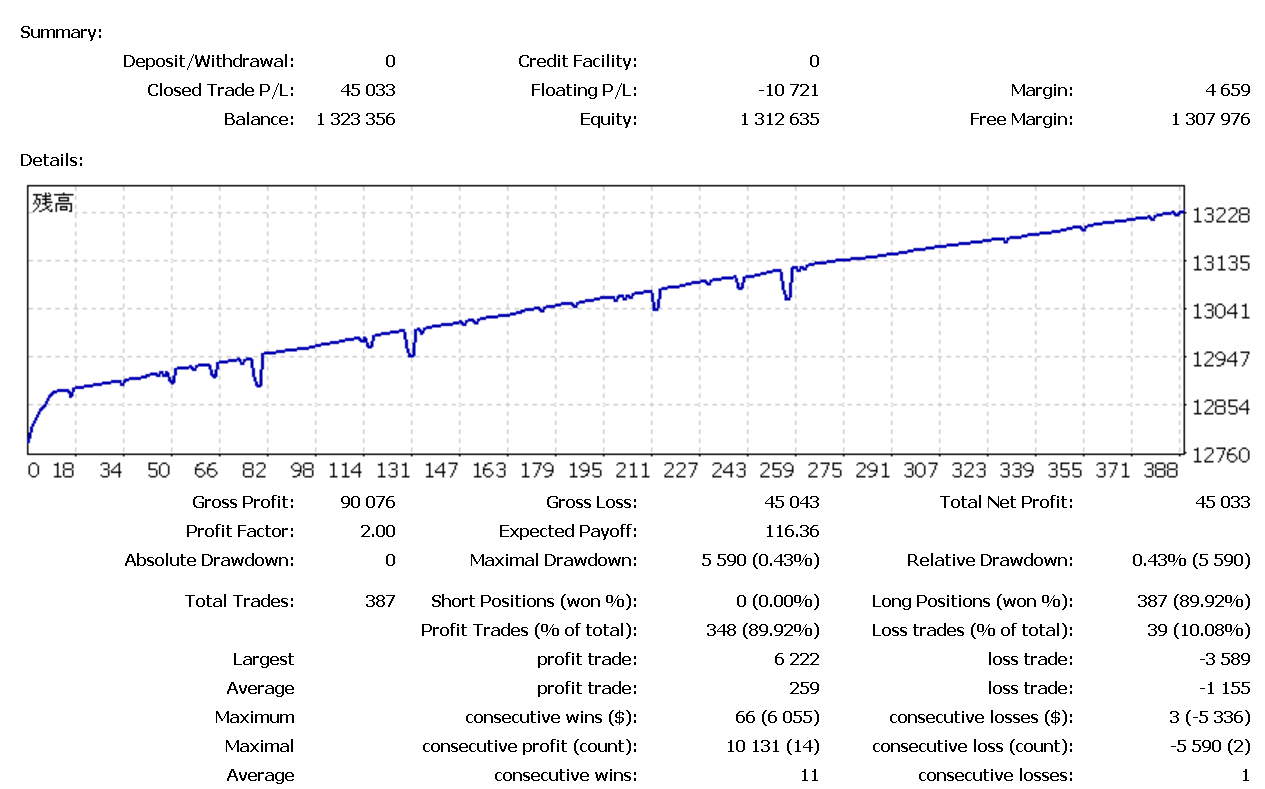

The equity curve for this month only

Both tests are pure forward trading, not backtests.

EA concept

This EA is not designed as a “get rich quick” scalper.

The main idea is:

-

Buy dips on GOLD using a long-only grid

-

On bullish days, let the basket grow and take profit in steps

-

On heavy down days, focus on surviving and waiting for a bounce, rather than forcing trades

Version 1.5 focuses on three risk-management tools:

-

Time-of-day filter – trading is allowed only between 00:00 and 15:00 (server time)

-

No new trades / no martingale outside trading hours

-

Smart martingale skip logic – if conditions look bad, the EA simply does not place the next averaging order

This combination makes the EA behave like:

-

“Exploit strong bullish sessions”, and

-

“Stay small and patient when the market looks dangerous”.

About 2 months of forward results

Looking at the full equity curve from 20 October, you can clearly see one deep dip:

this was during a ~300 USD one-way drop in GOLD.

Apart from that event, the curve is quite smooth and stair-like:

-

equity climbs in steps on bullish days

-

small temporary drawdowns appear when the market pulls back

-

then the grid closes in profit and the balance makes a new high

-

From the report for the recent period, the key stats are approximately:

-

Profit Factor: 2.00

-

Win rate: about 90% (348 winning trades out of 387)

-

Maximal drawdown: 0.43% (about 5,590 in account currency)

So far I’m happy with how ver1.5 behaves:

it “accepts” the occasional deep dip when GOLD trends one-way,

but otherwise keeps drawdown relatively calm while pushing the balance upward.

This month’s performance

If you zoom in on this month only, the equity curve becomes even cleaner:

-

gentle, almost linear uptrend in balance

-

a few small pullbacks where the grid had to sit through drawdown

-

quick recoveries followed by new equity highs

In my opinion, the biggest contributors are:

-

restricting trading to 0–15h only, avoiding the most chaotic late-US / rollover hours

-

disabling new grid and martingale entries outside those hours

-

letting the skip logic prevent “over-averaging” when volatility or structure looks dangerous

It won’t win every single day, but the overall behavior fits the EA’s concept well:

“make money on good long days, survive the bad ones”.

Risk considerations

Of course, this is still a grid + averaging EA on XAUUSD.

There is always a risk that:

-

GOLD trends hard against the long direction, or

-

the market stays in a deep downtrend longer than expected

For that reason, I strongly recommend:

-

using conservative starting lot sizes

-

keeping enough free margin for extended drawdowns

-

understanding the maximum basket size / total lot before using it on a live account

Even with time filters and skip logic, risk can never be completely removed.

Closing thoughts

“Gold Only Win World” has gradually become an EA that:

-

captures profits on strong bullish sessions

-

avoids unnecessary exposure in dangerous hours

-

and prioritizes survival over over-aggression

I will continue to monitor the forward results and adjust risk settings if needed,

but for now I’m quite satisfied with how ver1.5 performs under real-time conditions.

If you have any questions about the setup, risk parameters or the logic behind this EA,

feel free to leave a comment or send me a message.

https://www.mql5.com/en/market/product/157834