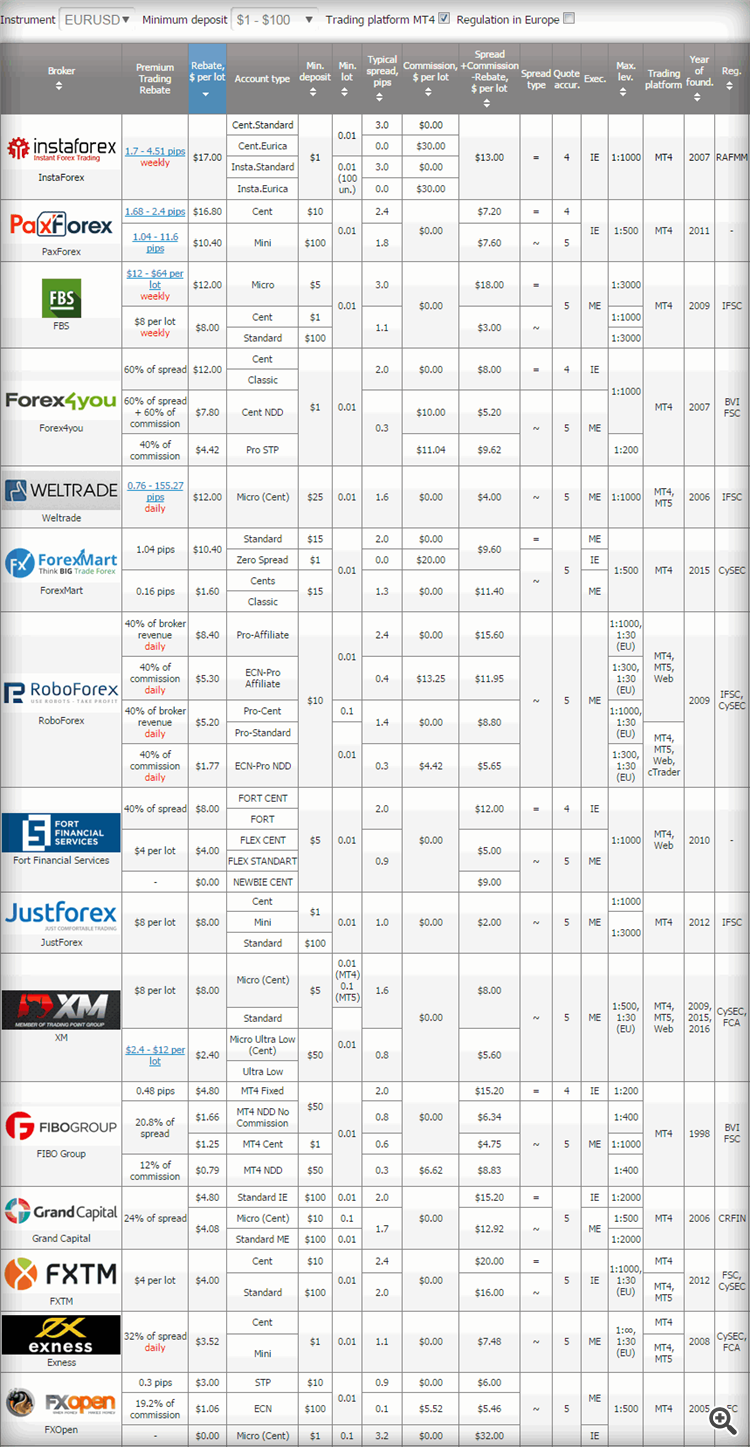

Choosing the best broker for Forex trading is always important as that of beginners and experienced traders.

I present to you a selection of brokers for beginners, and comparison of trading conditions, taking into account rebates (return spreads

or commissions from Premium Trading).

Compare the best trading conditions Forex brokers from Premium Trading

In comparison table Forex (forex) brokers from Premium Trading You can compare not only the trading conditions of different brokers, but also different types of accounts within a single broker. The following table shows the main parameters that are sure to draw the attention of experienced traders in choosing the best broker.

More:

- Award from Premium Trading - remuneration paid by Premium Trading for each transaction. Indicated in paragraphs, a percentage of the spread or the percentage of the commission.

- Premium, $ per lot - fee in USD (USD cents for cent accounts) paid by Premium Trading for transactions amounting to 1 lot (100,000 reference currency units) on selected trading instrument.

- Account type - the name type of account. The main types of accounts: Cent - accounts with the balance in US cents, Micro - having minimum lot from 0.01 (1,000 reference currency units), Standard - the classic account, as a rule, with the most comprehensive functionality, Pro - account for professional traders as usually having reduced spread, ECN (electronic Communications Network) - accounts with access to one of electronic stock exchange systems, NDD (no Dealing Desk) - accounts with execution without dealer intervention, STP (Sraight through processing) - accounts with a continuous transaction processing.

- Min. deposit - the minimum deposit required to open this type of account.

- Min. Lot - the minimum position amount where 1 lot = 100,000 units of base currency.

- Typical spread - the difference between the bid and ask prices for the selected instrument. For account types with fixed spread constant value is specified. For account types with floating spread is indicated, as a rule, the average spread over the day. If the broker does not specify this value, the typical spread is calculated by Premium Trading as average daily value of the terminal time.

- Commission, $ per lot - Commission in USD (USD cents for cent accounts), charged by the broker for full transaction (including opening and closing) amounting to 1 lot (100,000 reference currency units) on selected trading instrument.

- Spread + Commission - Premium, $ per lot - Pure costs in USD (USD cents for cent accounts) to the full transaction (including opening and closing) amounting to 1 lot (100,000 reference currency units) on selected trading instrument including premiums from Premium Trading.

- Spread type - "=" - fixed spread, "~" - floating spread.

- Acc. listed. - the number of decimal places in the value of the stock.

- Met. App. - method of execution of trading positions: IE - Instant Execution - instant execution - market order is either executed at the requested price, or if the price changed, confirmation of order execution at a new price (requote - «re-quotes"). ME - Market Execution - market execution - the order is executed at affordable price with possible positive or negative gapping (without requote).

- Max. shoulder - the maximum amount of leverage.

- Bargain. platf. - trading platform.

- Year founded. - the year of foundation of the company.

- Reg. - regulatory organization.

- Regulation in Europe - Brokers registered and regulated in the European Union.