Analysis USD/JPY - FXStreet

USD/JPY Current price: 110.16

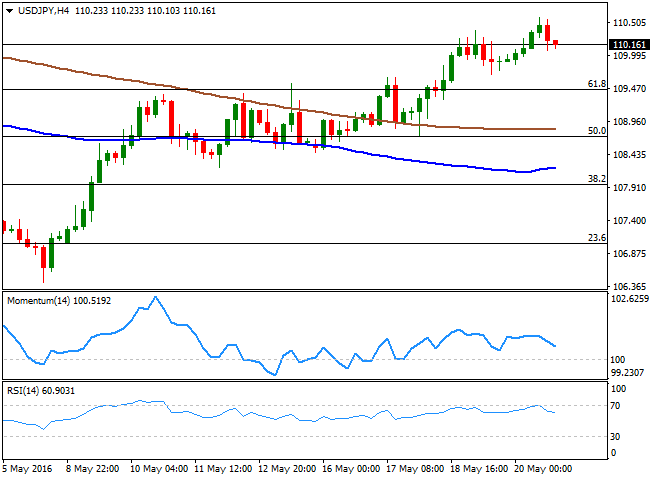

The USD/JPY pair closed the week above the 110.00 level for the first time since the BOJ's April meeting disappointment, when the Central Bank decided to maintain its economic policy on hold. Dollar's gains should have been more impressive against the yen after FOMC's hawkish stance, but the upside in the pair remained limited by the sour tone in worldwide stocks during these last few days. Over the weekend, a G7 meeting took place in Japan, but as usual, no relevant decisions have been made, and it will probably mean nothing in terms of price action at the weekly opening. The pair maintains a strong bullish tone daily basis, but it met selling interest around 110.60, a major static resistance level that the pair needs to break to be able to keep rallying. Technical readings in the daily chart support such advance, up to 112.00, where a strongly bearish 100 DMA should cap the advance. Shorter term and according to the 4 hours chart, the pair is poised to continue correcting lower, as the RSI indicator retreats from overbought readings and the Momentum indicator turned lower above its mid-line, with scope to test 109.50 in the short term, the 61.8% retracement of the latest daily slide.

Support levels: 109.90 109.50 109.10

Resistance levels: 110.60 111.00 111.45