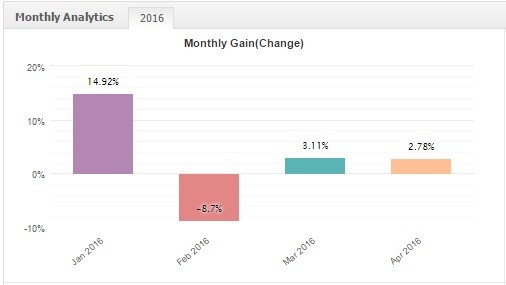

Money talks and bs takes the bus. For Algonell, the Scientific FX Trading innovator, January was one of the best months to trade for the past two years. February just kicked us right in the face. March was positive and spiky. Eventually we ended Q1 with 8000 pips.

We have been trading using Machine Learning algorithms since the beginning of the year, and not surprisingly, there are patterns in the data. Economists tend to shout about ARIMA, equilibrium and efficient markets. Quants silently analyse the data and get the insights come true. So portfolio managers, hedge funds and other market participants, you can shout or you can join the Quantitative Investment revolution because it is retail more than ever.

You can enter a trade by analyzing the current M5, M15, H1, H4, D1, monthly, weekly, quarterly or annually time frames, but you’re better take a look on the entire data available simultaneously. Well as a matter of fact, you better let Artificial Intelligence solve your problem and save you time. We are humans, we tend to make mistakes and we cannot handle massive amounts of data available in the FX market.

Machine Learning is a sub-field of Artificial Intelligence dealing with the concrete algorithms to solve generalized problems. Think about your trading strategy: it is probably an algorithm of “if then else” rules. You found your golden system and it works, but can it suite the market infinity? Probably it is not, whereas Machine Learning lets you build generalized trading models to be good in the unseen future, and you can verify your models’ quality scientifically. Machine Learning applications are anywhere. From driving cars, trend classification and spam filtering down to insurance companies providing loans and managing risks.

So how do you join the crowd? Unfortunately, there is no crowd yet. Retail traders stick to their golden rules, or golden rules of some super-friend-gordon-master-of-the-universe. Retail traders afraid of black boxes while most of them incorporate trading strategies originally created by someone else. So actually they use black box with holes.

What can you do to apply Machine Learning in your trading? Start by reading and exploring tools like Inovance, check out trading signals by Algonell and take some Coursera Data Science knowledge. Finally feel free to ask the community about anything. MQL community is the first place to look for implementations, discussions and quality answers.