How Smart Traders Use MT4 Indicators to Gain an Edge

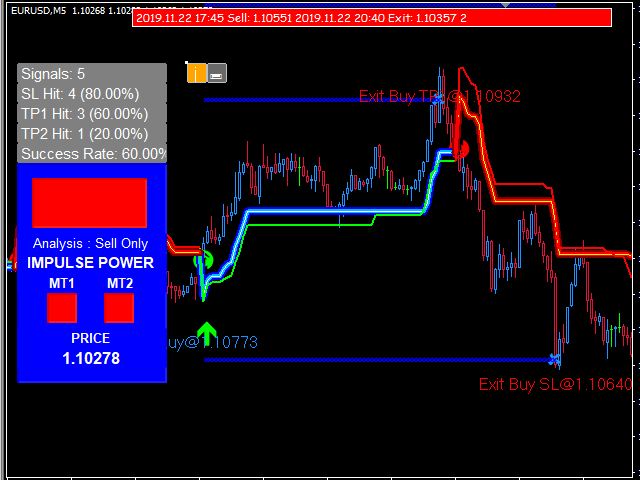

MT4 indicators play a crucial role in the trading world, providing traders with valuable insights into market trends, price movements, and potential entry and exit points. These indicators are essential tools for technical analysis, helping traders make informed decisions based on historical price data and market behavior. By understanding the role of MT4 indicators, traders can gain a competitive edge and improve their overall trading performance.

MT4 indicators are mathematical calculations based on historical price data, volume, or other market variables. They help traders analyze market conditions and identify potential trading opportunities. These indicators can be used to confirm trends, predict price movements, and generate buy or sell signals.

By incorporating MT4 indicators into their trading strategies, traders can enhance their decision-making process and increase the probability of successful trades.

Key Takeaways

- MT4 indicators can provide traders with a competitive edge in the market.

- Understanding the role of MT4 indicators is crucial for successful trading.

- Choosing the right MT4 indicators is essential for aligning with your trading strategy.

- MT4 indicators can be used to identify market trends and make informed trading decisions.

- Combining multiple MT4 indicators can enhance trading signals and improve decision-making.

Choosing the Right MT4 Indicators for Your Trading Strategy

Selecting the right MT4 indicators is crucial for developing a successful trading strategy. With a wide range of indicators available, traders must carefully consider their trading style, risk tolerance, and market conditions when choosing which indicators to use. It's essential to understand the strengths and limitations of each indicator and how they align with your specific trading goals.

For trend-following strategies, traders may opt for indicators such as moving averages or the Average Directional Index (ADX) to identify and confirm market trends. On the other hand, oscillators like the Relative Strength Index (RSI) or the Stochastic Oscillator are popular choices for momentum-based strategies, helping traders identify overbought or oversold conditions in the market. By selecting indicators that complement their trading approach, traders can effectively analyze market dynamics and make well-informed trading decisions.

Using MT4 Indicators to Identify Market Trends

MT4 indicators are invaluable tools for identifying market trends, which are essential for making informed trading decisions. Trend-following indicators such as moving averages, Bollinger Bands, and the Parabolic SAR can help traders recognize the direction of the market and potential reversal points. By analyzing price movements and trend patterns, traders can use these indicators to confirm the strength of a trend and determine optimal entry and exit points.

For example, a trader using the Moving Average Convergence Divergence (MACD) indicator may look for crossovers between the MACD line and the signal line to identify potential trend changes. Similarly, the use of Bollinger Bands can help traders visualize price volatility and potential trend reversals based on the bands' width and position relative to price movements. By leveraging these indicators, traders can gain valuable insights into market trends and adjust their trading strategies accordingly.

For more MT4 indicators, visit this link.

Leveraging MT4 Indicators for Entry and Exit Points

| Indicator | Type | Entry Point | Exit Point |

|---|---|---|---|

| Simple Moving Average (SMA) | Trend-following | When price crosses above SMA | When price crosses below SMA |

| Relative Strength Index (RSI) | Oscillator | When RSI crosses above 30 | When RSI crosses below 70 |

| Bollinger Bands | Volatility | When price touches lower band | When price touches upper band |

MT4 indicators are instrumental in helping traders identify optimal entry and exit points in the market. By using indicators such as the Moving Average, Fibonacci Retracement, or Pivot Points, traders can pinpoint potential support and resistance levels, which are crucial for determining entry and exit points. These indicators provide traders with objective criteria for making trading decisions, reducing emotional bias and improving overall trade accuracy.

For instance, a trader utilizing the Fibonacci Retracement tool may look for price retracements to key Fibonacci levels as potential entry points, while also using these levels as targets for profit-taking or exit points. Similarly, Pivot Points can help traders identify significant price levels based on the previous day's high, low, and close, serving as reference points for potential entry and exit decisions. By incorporating these indicators into their trading strategies, traders can enhance their precision in timing their trades and managing risk effectively.

Combining Multiple MT4 Indicators for Better Trading Signals

While individual MT4 indicators provide valuable insights into market dynamics, combining multiple indicators can offer more robust trading signals. By using a combination of trend-following, momentum, and volatility-based indicators, traders can gain a comprehensive understanding of market conditions and improve the accuracy of their trading decisions. However, it's essential to avoid overloading charts with too many indicators, which can lead to conflicting signals and confusion.

For example, a trader may combine the use of the Moving Average crossover with the RSI indicator to confirm potential trend reversals. When the Moving Average crossover signals a change in trend direction, the RSI can be used to validate whether the market is overbought or oversold, providing additional confirmation for trade entries or exits. By carefully selecting and combining complementary indicators, traders can strengthen their trading signals and make more informed decisions in various market scenarios.

Avoiding Common Pitfalls When Using MT4 Indicators

While MT4 indicators offer valuable insights into market dynamics, traders must be cautious of common pitfalls when using these tools. One common mistake is relying solely on indicators without considering other fundamental or macroeconomic factors that may impact market movements. Additionally, using too many indicators or misinterpreting signals can lead to analysis paralysis and poor decision-making.

Traders should also be mindful of indicator lag, which occurs when an indicator's signals are delayed compared to actual price movements. This lag can result in late entries or exits from trades, impacting overall trade performance. Furthermore, it's essential to regularly review and update indicator settings to ensure they remain relevant in evolving market conditions.

By being aware of these pitfalls and exercising prudence when using MT4 indicators, traders can maximize the effectiveness of these tools in their trading strategies.

Customizing MT4 Indicators to Fit Your Trading Style

Customizing MT4 indicators to align with your specific trading style can enhance their effectiveness in analyzing market conditions. Many MT4 indicators offer customizable settings such as period lengths, smoothing methods, or signal thresholds that can be adjusted to better suit individual trading preferences. By tailoring these settings to match your trading approach and risk tolerance, you can optimize the performance of these indicators in your trading strategy.

For instance, a trader employing a short-term trading strategy may adjust the period length of a moving average indicator to capture more immediate price movements, while a long-term investor may prefer longer period lengths for smoother trend identification. Similarly, adjusting the sensitivity of oscillators like the RSI or Stochastic Oscillator can help align these indicators with different trading timeframes and market conditions. By customizing MT4 indicators to fit your trading style, you can fine-tune their functionality and improve their relevance to your specific trading approach.

Backtesting MT4 Indicators to Validate Their Effectiveness

Before integrating MT4 indicators into live trading, it's essential to backtest these indicators using historical price data to validate their effectiveness. Backtesting allows traders to assess how well an indicator would have performed in past market conditions and identify its strengths and weaknesses. This process helps traders gain confidence in their chosen indicators and refine their trading strategies based on historical performance.

For example, a trader may backtest a moving average crossover strategy using historical price data to evaluate its profitability and drawdowns in different market environments. Similarly, backtesting an RSI-based strategy can provide insights into its effectiveness in identifying overbought or oversold conditions across various timeframes. By rigorously backtesting MT4 indicators, traders can make informed decisions about their inclusion in their trading arsenal and gain a deeper understanding of how these indicators perform under different market scenarios.

Incorporating MT4 Indicators into Automated Trading Systems

MT4 indicators can be seamlessly integrated into automated trading systems or Expert Advisors (EAs), allowing traders to automate their trading strategies based on predefined indicator signals. By programming specific rules and conditions based on indicator signals, EAs can execute trades automatically without requiring manual intervention. This automation can help traders capitalize on trading opportunities around the clock while removing emotional biases from decision-making.

For instance, an automated trading system may use a combination of moving average crossovers and RSI signals to trigger buy or sell orders based on predefined criteria. By incorporating MT4 indicators into automated systems, traders can streamline their trading process and execute trades with precision based on objective indicator signals. However, it's crucial to regularly monitor automated systems to ensure they adapt to changing market conditions and remain aligned with evolving trading strategies.

Staying Updated on New MT4 Indicators and Their Potential Impact on Trading

The world of MT4 indicators is constantly evolving, with new indicators being developed to address specific market dynamics or trading strategies. Traders should stay updated on new MT4 indicators and assess their potential impact on trading performance. By exploring new indicator offerings and understanding their underlying principles, traders can expand their toolkit and adapt to changing market conditions more effectively.

For example, advancements in machine learning algorithms have led to the development of predictive indicators that leverage artificial intelligence to forecast future price movements with greater accuracy. Traders who stay abreast of such developments can explore how these new indicators may complement their existing strategies or provide alternative perspectives on market analysis. By remaining informed about new MT4 indicators, traders can continuously refine their trading approach and leverage innovative tools to gain a competitive edge in the dynamic world of financial markets.

In conclusion, MT4 indicators are indispensable tools for traders seeking to gain an edge in the financial markets. By understanding their role in technical analysis, selecting the right indicators for specific trading strategies, leveraging them to identify market trends and entry/exit points, combining multiple indicators for robust signals, avoiding common pitfalls, customizing them to fit individual trading styles, backtesting their effectiveness, incorporating them into automated systems, and staying updated on new developments – traders can harness the power of MT4 indicators to enhance their decision-making process and improve overall trading performance.

FAQs

What are MT4 Indicators and Their Role in Trading?

MT4 indicators are technical analysis tools used by traders to analyze market trends, identify entry and exit points, and make informed trading decisions. They are designed to help traders gain insights into market behavior and make more accurate predictions about future price movements.

How Do Smart Traders Use MT4 Indicators to Gain an Edge?

Smart traders use MT4 indicators to gain an edge by combining multiple indicators to confirm trading signals, identifying market trends, and using indicators to validate their trading strategies. They also customize indicators to fit their trading style and incorporate them into automated trading systems for more efficient trading.

How Can Traders Choose the Right MT4 Indicators for Their Trading Strategy?

Traders can choose the right MT4 indicators for their trading strategy by considering their trading goals, risk tolerance, and preferred trading style. They should also test different indicators to see which ones work best for their specific trading approach.

How Do Traders Use MT4 Indicators to Identify Market Trends?

Traders use MT4 indicators to identify market trends by looking for patterns and signals that indicate the direction of the market. They may use trend-following indicators like moving averages or momentum indicators to confirm the strength of a trend.

How Can Traders Leverage MT4 Indicators for Entry and Exit Points?

Traders can leverage MT4 indicators for entry and exit points by using them to identify potential reversal points, overbought or oversold conditions, and other signals that indicate a good time to enter or exit a trade.

What Are Some Common Pitfalls to Avoid When Using MT4 Indicators?

Common pitfalls to avoid when using MT4 indicators include relying too heavily on one indicator, using indicators in isolation without confirmation, and not considering the limitations of certain indicators. Traders should also be cautious of over-optimizing indicators based on historical data.

How Can Traders Customize MT4 Indicators to Fit Their Trading Style?

Traders can customize MT4 indicators to fit their trading style by adjusting the settings, parameters, and inputs of the indicators to align with their specific trading preferences and strategies.

Why is Backtesting MT4 Indicators Important to Validate Their Effectiveness?

Backtesting MT4 indicators is important to validate their effectiveness because it allows traders to see how the indicators would have performed in past market conditions. This helps traders assess the reliability and accuracy of the indicators before using them in live trading.

How Can Traders Stay Updated on New MT4 Indicators and Their Potential Impact on Trading?

Traders can stay updated on new MT4 indicators and their potential impact on trading by following reputable trading websites, forums, and social media channels dedicated to trading. They can also participate in webinars, workshops, and training sessions offered by trading experts and developers of MT4 indicators.