Even with interest rates in the EU at record lows, companies have been cautious to finance their future goals with bank loans. After all, we've just overcome a debt crisis. However, that may be changing, says ECB data.

The European Union needs investment because spending money now to drive

productive capacity later might help turn a cyclical rebound into a

more lasting one, if other conditions like structural reforms are in

place.

The ECB is doing what it has to by providing liquidity at a record low interest rate.

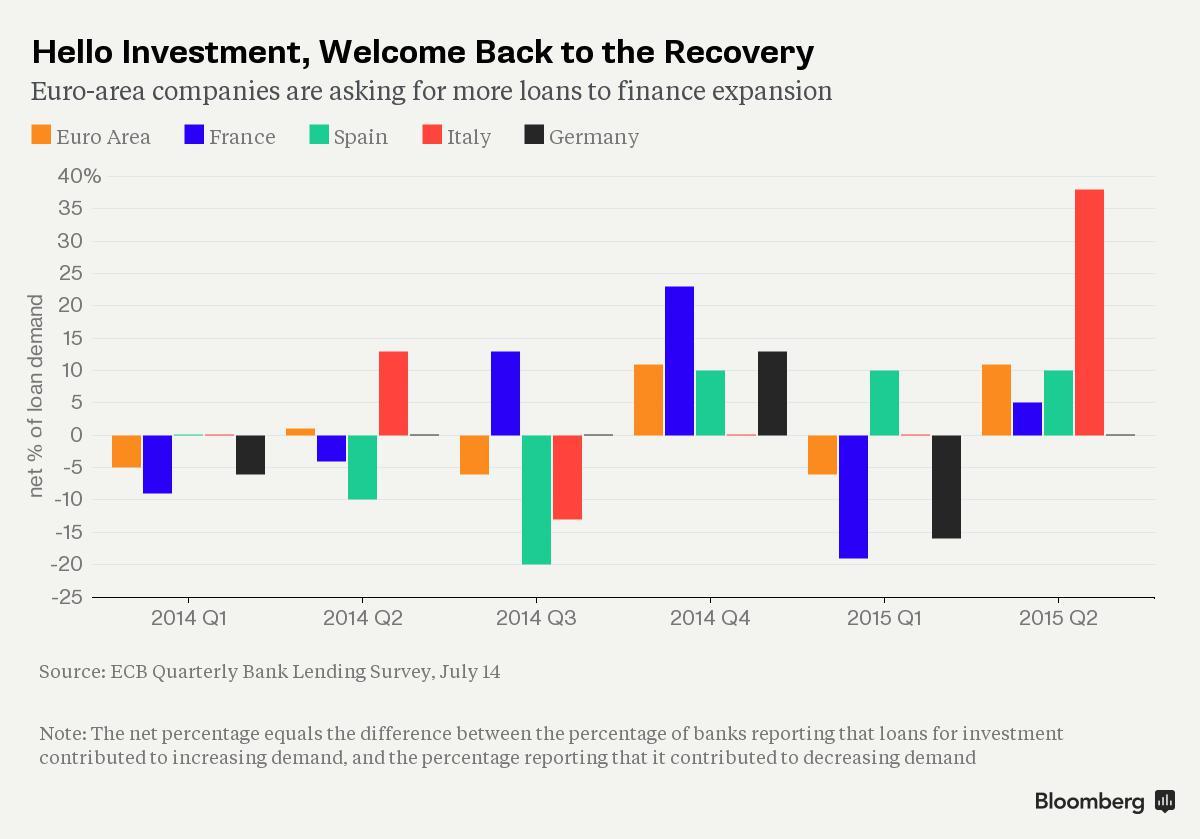

And, according to its recent data, represented by the bank's quarterly bank-lending survey, there is a tentative recovery in demand for loans for fixed investment.

So far, borrowing to pay for such things as equipment or, say, new factories, has remained behind the general recovery in credit. The graph below shows the net percentage of lenders reporting investment loans as a contributing factor to overall demand in each period:

Italy, Spain and France contributed

the most to driving loan demand for investment in the euro area in the second quarter of 2015.

In

Germany, where the Mittelstand companies often prefer to finance expansion themselves, demand is lower.

In the euro area, investment by firms has dipped as a percentage of GDP from 13 percent before the financial crisis ago to less than 12 percent now.

''We now see encouraging signs that also private investment

is picking up,'' ECB President Mario Draghi commented in June, adding that it is a sign the economy is gaining momentum.