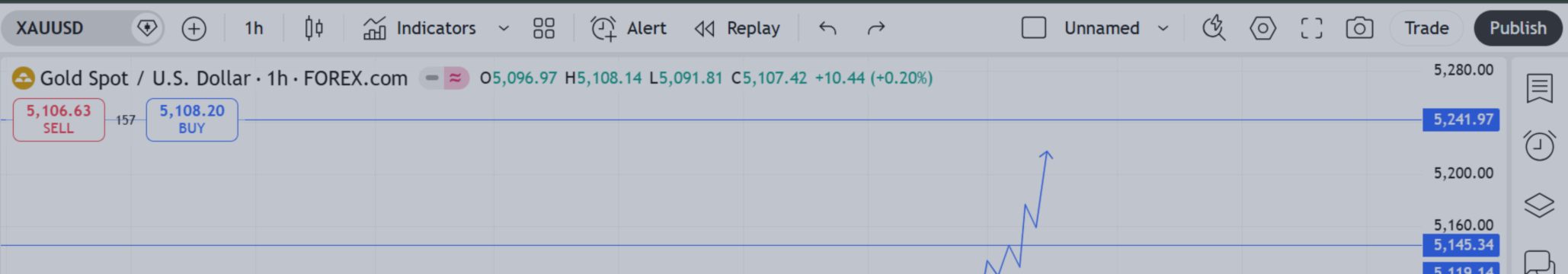

Gold (XAU/USD) 1H Outlook for Monday (23 February 2026) – Expansion Phase Under Watch

As we head into Monday’s session, Gold remains in a strong intraday bullish structure on the 1-hour timeframe.

Chart: https://www.mql5.com/en/channels/learning-forex-gold

After consolidating around the 5,000 region, price has broken into expansion mode and is now trading near 5,107–5,120 resistance.

This is not random volatility — this is structured momentum.

🔎 Current Market Structure (1H)

-

Clear sequence of higher highs and higher lows

-

Strong impulsive leg from 5,020 region

-

Clean breakout above prior consolidation

-

No confirmed bearish structural shift

The market has transitioned from accumulation to expansion.

🔑 Key Levels for Monday

🔹 Resistance: 5,119

This level has already been tested.

If Monday opens above 5,110 and holds:

→ Expect continuation toward 5,145.

🔹 Major Target: 5,145

If price breaks and sustains above 5,145:

→ Next projected expansion: 5,180–5,200.

🔹 Critical Support: 5,090

This is the “line in the sand.”

As long as hourly candles close above 5,090:

→ Bias remains bullish.

A strong close below 5,090:

→ Opens corrective move toward 5,060 liquidity zone.

🔥 Monday Scenarios

🟢 Bullish Continuation

-

Hold above 5,100

-

Strong hourly close above 5,119

-

Momentum candles without heavy wicks

Targets:

5,145 → 5,180

🔴 Controlled Pullback

-

Failure to hold 5,100

-

Break below 5,090

Targets:

5,060 → 5,030

This would be a healthy retracement, not a full trend reversal.

📊 Professional Insight

There is no confirmed distribution yet.

No lower highs.

No structural breakdown.

No heavy rejection.

Trend is strong but slightly extended.

Monday will likely start with:

• Liquidity sweep → continuation

or

• Direct breakout continuation

Avoid chasing impulsive candles.

📊 Detailed chart explanation is shared in my channel.

Follow the channel for daily professional analysis and structured market updates.