GBPUSD Next Week Outlook - ranging bearish with 38.2% Fibo support level crossing

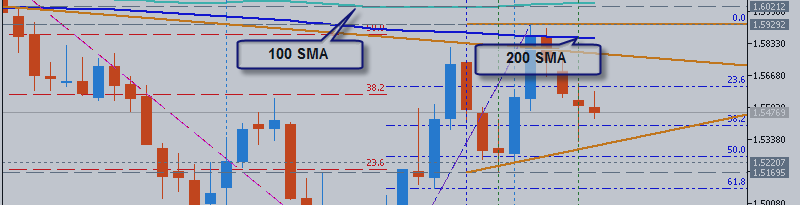

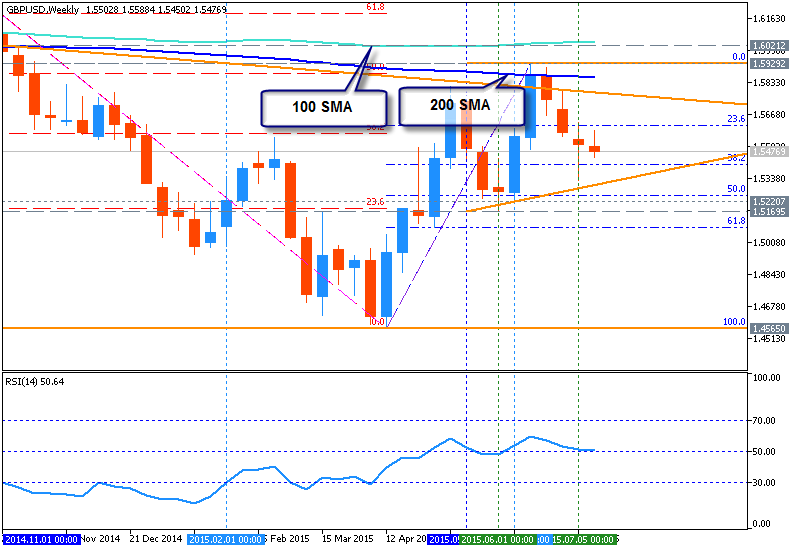

W1 price is located below 200 period SMA and below 100 period SMA for the primary bearish ranging between Fibo resistance level at 1.5929 and 61.8% Fibo support level at 1.5086:

- 38.2% Fibo support level at 1.5410 is going to be crossed by the price from above to below for the bearish condition to be continuing;

- 200 SMA

and 100 SMA are moved in almost horizantal way for ranging market condition;

- there is expectation for the ranging bearish condition with first target as 38.2% Fibo support level at 1.5410 and second target as 50.0% Fibo support level at 1.5247;

- if the price breaks 61.8% Fibo support level at 1.5086 so the next target will be Fibo level at 1.4564 which may be expected by the end of this year for example.

- RSI indicator is located at 50 level for the price to be waiting for direction.

If the price will break 61.8% Fibo support level at 1.5086 so the bearish market condition will be continuing.

If the price will break Fibo resistance level at 1.5929 from below to above - we may see the reversal of the price movement from the primary bearish to primary bullish market condition.

If not so the price will be ranging between between support level at 1.5086 and resistance level at 1.5929.

Trend: