Fundamental Weekly Forecasts for US Dollar, USDJPY, GBPUSD, AUDUSD and GOLD: Friday’s NFPs - volatility in different capital markets look dangerous

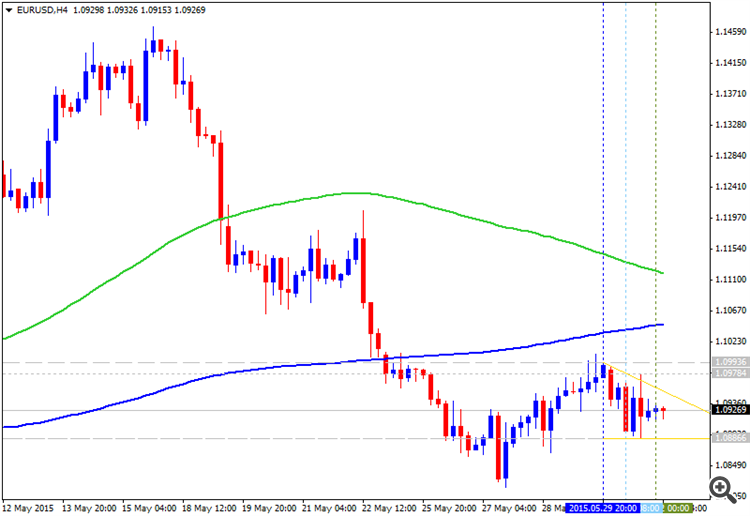

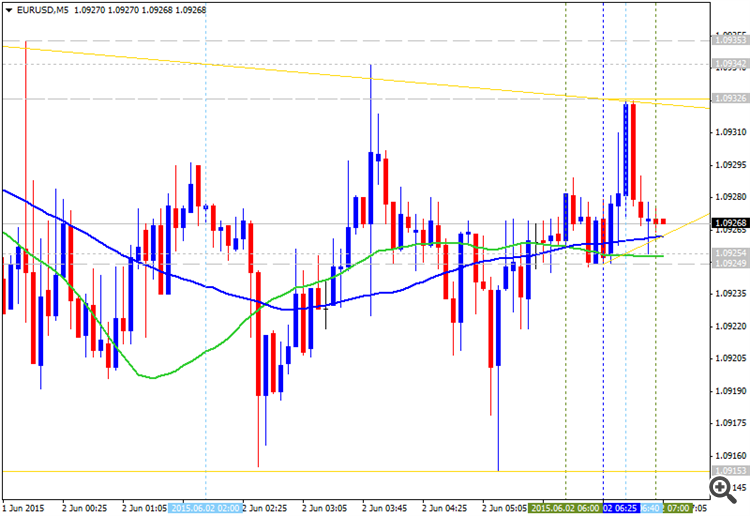

US Dollar - "Interest rate forecasting has proven the most tangible motivator for fundamental traders these past months, but it is not the only game in town for price and volatility. Risk trends should not be underestimated for its heavy influence over the market. Volatility measures in different capital markets look dangerous, but not as dangerous as equity indexes like the S&P 500 and Shanghai Composite. Meanwhile, the ‘relative’ factor to exchange rates should have us also looking at Greece, the RBA rate decision and other event risk that can buoy or crush the Dollar’s most liquid counterparts.".

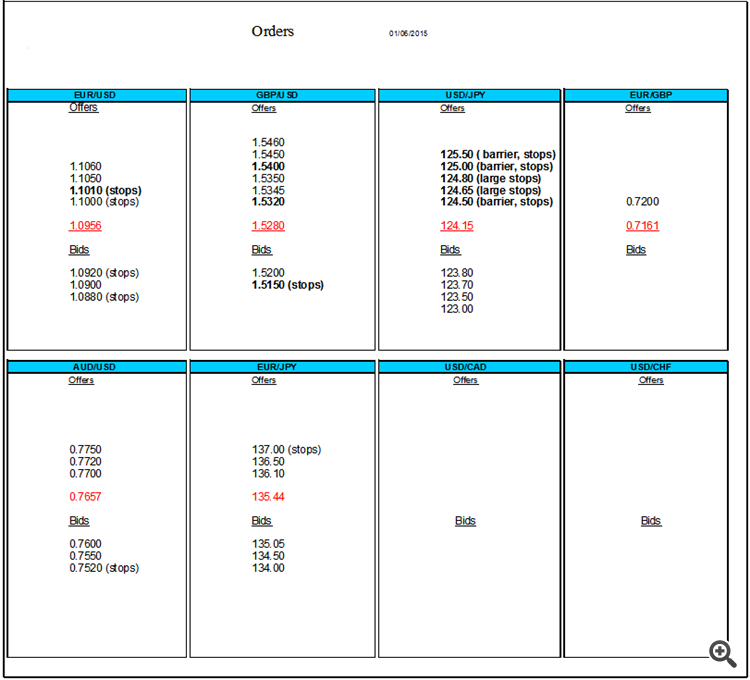

GBPUSD - "The recent string of lower highs & lows in GBP/USD raises the risk for a further decline in the exchange rate, and the pair may continue to give back the rebound from 1.4564 (April low) as it fails to retain the bullish formations carried over from the previous month".

USDJPY - "Upcoming US Nonfarm Payrolls data is likely to force important volatility in the USDJPY, while traders should also watch an upcoming speech by Bank of Japan Governor Kuroda on Thursday for any surrpises. Whether or not Kuroda makes reference to recent JPY weakness will be of special interest as traders gauge officials’ apptetite for further Yen depreciation. It’s shaping up to be a big week for the JPY—whether or not the Dollar sustains a rally above ¥124 could determine momentum for some time to come".

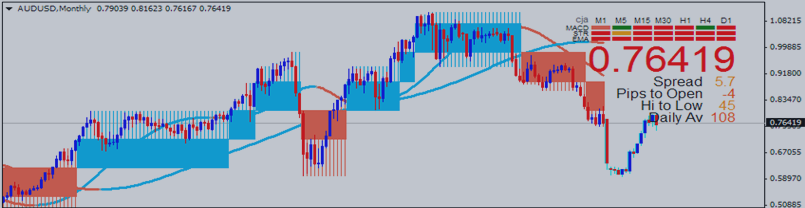

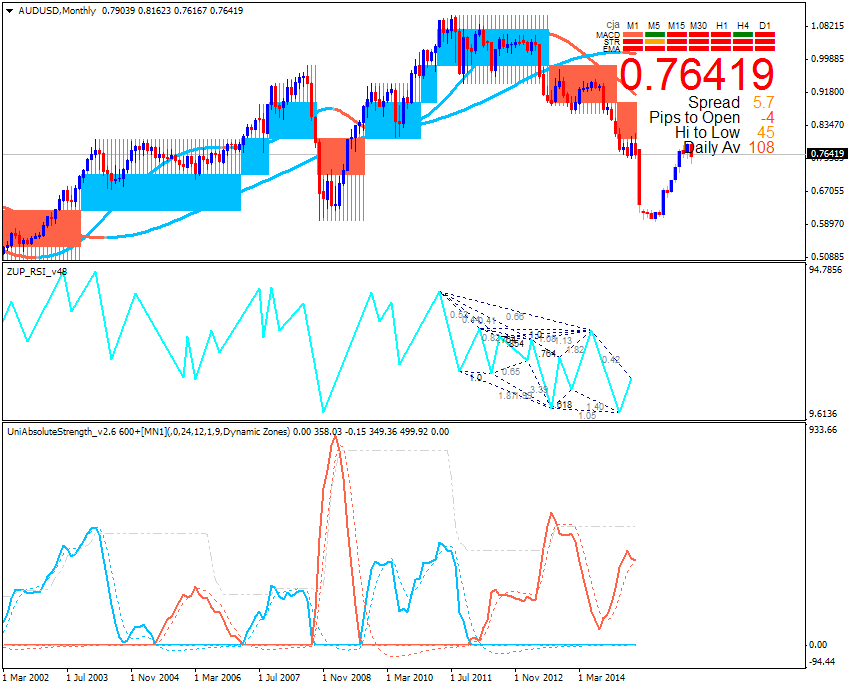

AUDUSD - "The Aussie may decline as an up-shift in the markets’ expected timeline for the onset of Federal Reserve interest rate hikes weighs on risk appetite and punishes the sentiment-linked unit. It ought to be noted however that COT positioning data suggests the USD recovery from mid-May has played out against a backdrop of falling speculative net-long exposure. Furthermore, Fed Funds futures have not materially budged from placing a hike no sooner than October even as the greenback soared to a monthly high. This casts doubt on the ability of US news to generate lasting follow-through, at least for now".

GOLD - "We’ll take a neutral stance heading into the monthly open with a break lower targeting 1176 backed by the 1.618% extension at 1164. A breach above channel resistance risks a rally back into the near-term bearish invalidation level at the 1200. Keep an eye on the RSI resistance trigger extending off the May high- breach would be bullish".