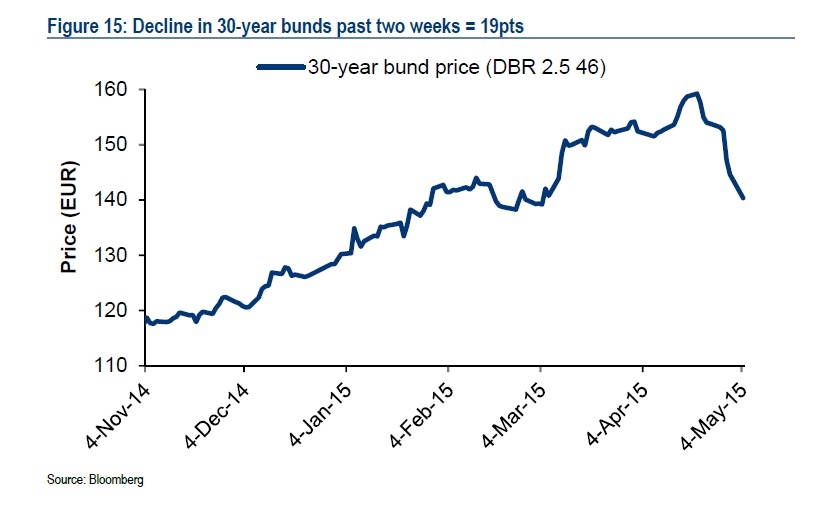

Over the past fourteen days, investors in German government bonds have received a crash course in "duration" (sensitivity of a bond’s price to changes in its yield) - a weird concept that is nevertheless a driving force in fixed income.

It has been a popular strategy for those investors seeking higher return in the times of low interest rates to buy longer-dated bonds with longer duration. It can bear risk, given that such debt is extremely sensitive to changes

in interest rates and yields.

When they rise, the price of bonds with a greater duration will fall a lot more than that of shorter-dated debt.

The painful unison of duration, bond prices, and yield has become impressively vivid in recent days, as investors have been in a hurry to sell longer-dated German government bonds.

Credit strategist at Bank of America Merrill Lynch Hans Mikkelsen has crunched the numbers on the outsize moves in bunds and has come up with some ugly math for investors:

For the typical high yield bond with a duration of 4.4, a 53bps increase in yield would imply roughly a 2.3% decline in bond price – or the equivalent of about a third of a year’s worth of yield. However, at their peak two weeks ago 30-year bunds had duration of 23.7. Hence 30-year bund prices have declined approximately 12% over the last two weeks, or roughly 25 years worth of yield!

The yield on the 30-year bund has already jumped from an April low of

0.465 percent to 1.19 percent in the sell-off.

Yields on 30-year U.S. Treasuries have risen to a near five-month high, prompting some high-profile investors to call the end of the historic bull market in bonds.

You've had plenty of warning about the susceptibility of the market to duration risk. In March Bloomberg News said that if 30-year German bund yields were to rise by 50 basis points, investors would stand to lose about 10 percent, so investors received much of warning about the market vulnerability, and this is more or less what has happened.