Technical Analysis for US Dollar, S&P 500, Gold and Crude Oil - Waiting for Direction Cues Within Familiar Range for S&P 500

US DOLLAR TECHNICAL ANALYSIS

Prices transitioned into digestion

mode after bouncing to retest a recently broken rising trend. A daily

close above the 23.6% Fibonacci expansion at 12027 exposes the trend

line support-turned-resistance at 12058.

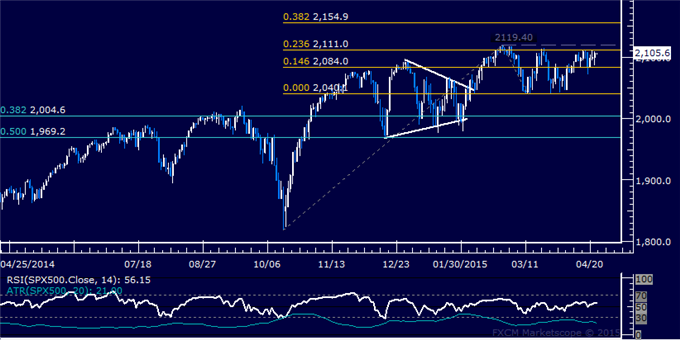

S&P 500 TECHNICAL ANALYSIS

Prices continue to hover below

resistance in the 2111.00-19.40 area (23.6% Fibonacci expansion,

February 25 high). A break above that on a daily closing basis exposing

the 38.2% level at 2154.90.

GOLD TECHNICAL ANALYSIS

Prices may be carving out a bearish

Head and Shoulders top chart pattern. Confirmation is required on a

daily close below 1185.23, the 23.6% Fibonacci expansion, with the first

downside target thereafter coming in the 38.2% level (1161.16).

Near-term resistance is at 1224.15, the April 6 high.

CRUDE OIL TECHNICAL ANALYSIS

Prices transitioned back into

consolidation mode after recoiling lower from resistance near the

$65/barrel figure. A break below the 50% Fibonacci expansion at 61.46

exposes the 38.2% level at 59.35. Alternatively, a move above the

63.56-73 area (61.8% Fib, April 16 close) targets the 76.4% expansion at

66.16.