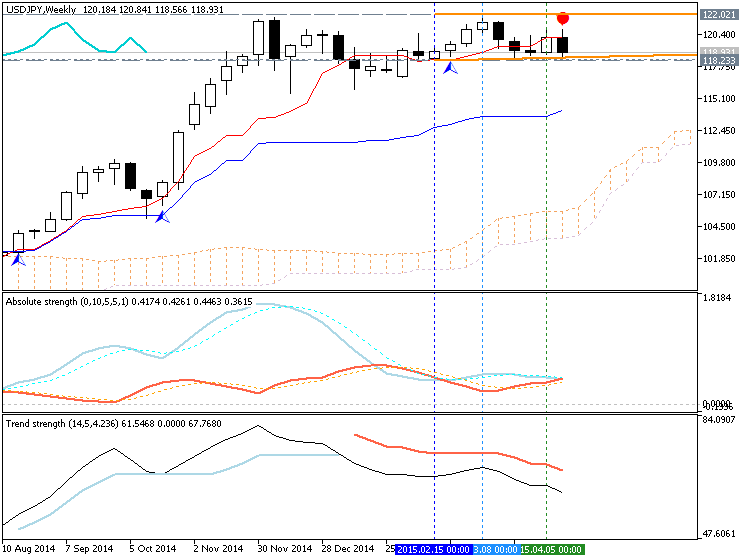

Technical Analysis for USDJPY - secondary correction within the primary bullish for weekly timeframe; breakdown on daily

- Tenkan-sen line is located above Kijun-sen line of Ichimoku

indicator with 122.02 resistance and 118.23 support on W1 timeframe with good signal for

the secondary correction to be started within the primary bullish on open weekly bar.

- AbsoluteStrength indicator and TrendStrength indicators are showing the downtrend for the correction to be started on W1 timeframe.

- “Continue to favor a broad range as 119.80-120.70 as resistance and 116.40-117.10 as support. A move through either one of these zones would define target zones of 124-128 and 110-114.”

- "Near term, watch for resistance now near 120.08. The next support on a break would be the median line just above 117."

- D1 price is breaking 118.78 support on open bar with good potential for breakdown.

Trend:

- H4 - ranging bearish

- D1 - bearish breakdown

- W1 - correction (bullish breakdown on open bar)

- MN1 - correction is started within primary bullish