Fundamental Weekly Forecasts for US Dollar, USDJPY, GBPUSD, AUDUSD and GOLD - traders will be closely eyeing with CPI, Durable Goods Orders and GDP

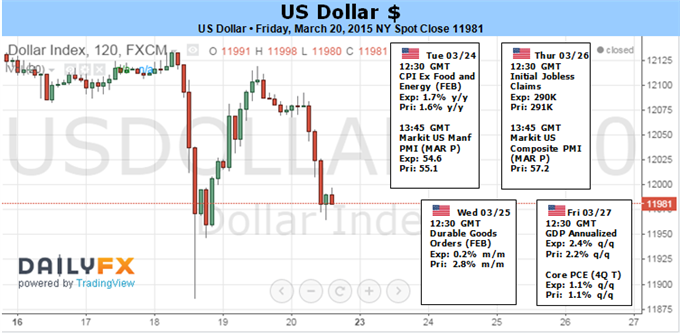

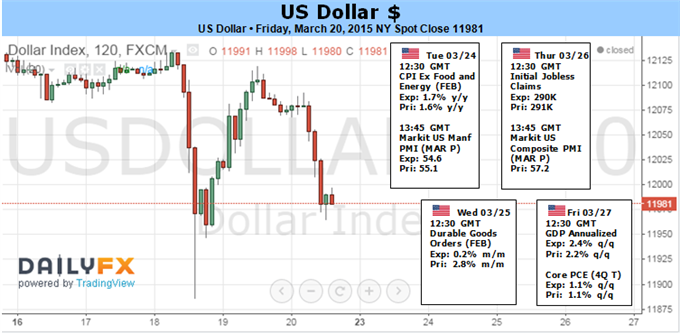

US Dollar - "What is perhaps even more remarkable from this past week, was the swell in risk appetite following the Fed decision. Even a delay to the start of a tightening regime still clarifies the central bank’s ability and intention to raise rates. That reverses a course of years of increasing accommodation to draw risk out of the market and encourage investing. Yet, to a market with an increasingly shorter time frame for positioning, it offers a quick opportunity. The trouble is, what will the mentality be after that speculative swing is over? For milestones to gauge policy and risk trends moving forward; watch event risk such as the CPI data, the laundry list of Fed Speeches (including Yellen’s address on Friday) as well as international topics – like Greece’s financial problems."

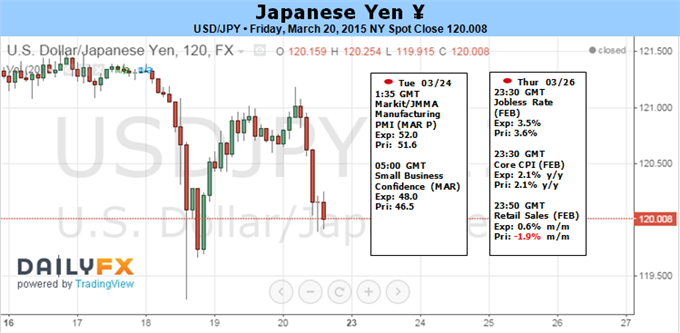

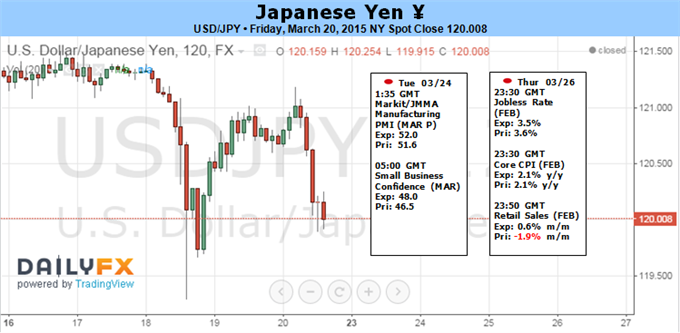

USDJPY - "As a result, the near-term topping process around the 122.00 handle may pave the way for a further decline in USD/JPY, and the pair may continue to give back the advance from earlier this year as the Relative Strength Index (RSI) fails to retain the bullish trend carried over from back in January. The downside break in the oscillator favors the approach to ‘sell bounces’ in the dollar-yen, but the pair may face choppy price action going into the key event risks as market participants continue to digest the latest developments coming out of the U.S."

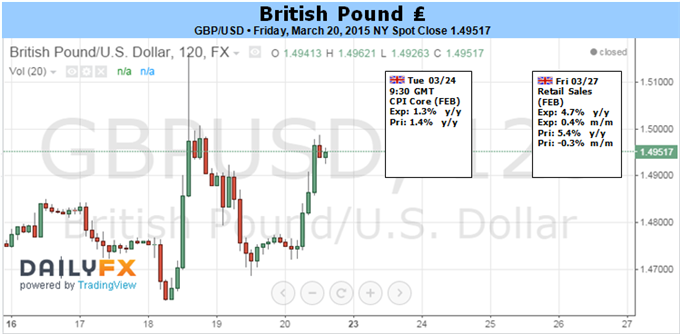

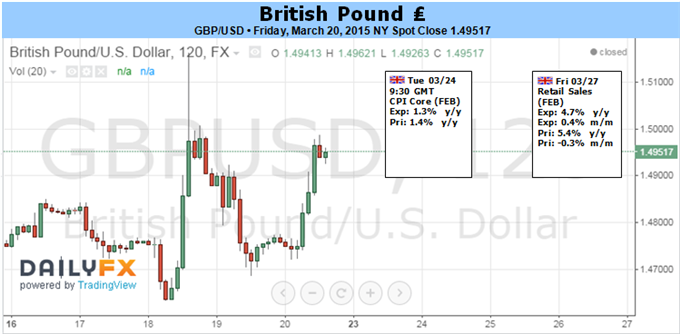

GBPUSD - "At the risk of coming off as hyperbolic and repetitive, we believe it is shaping up to be yet another pivotal week for the British Pound. The GBP/USD finished modestly higher this past week only because the US currency saw a much larger correction in yield expectations. Major reactions to surprises in CPI inflation and Retail Sales figures could ultimately determine broader direction in the UK currency."

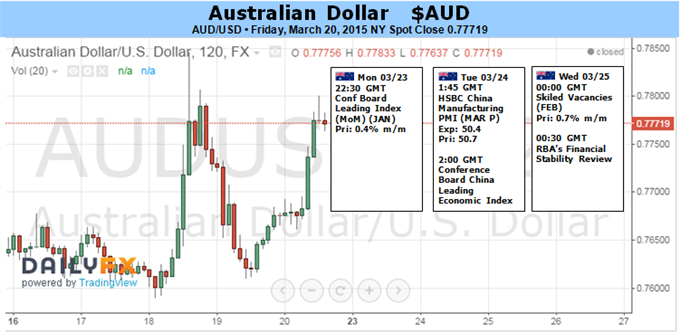

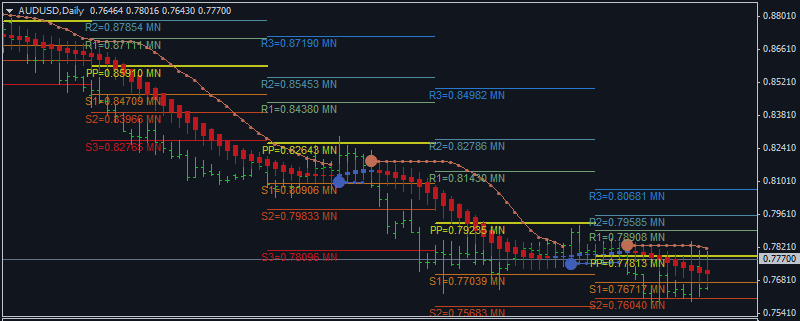

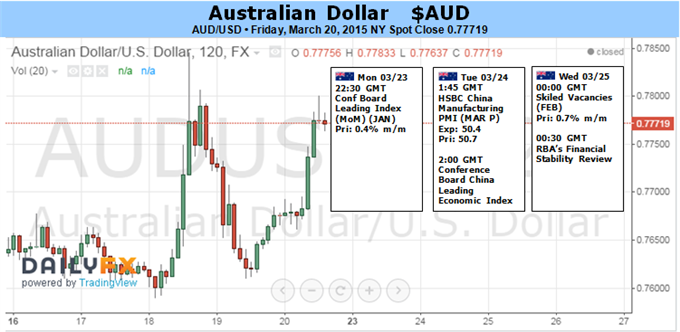

AUDUSD - "HSBC’s Chinese Manufacturing PMI print is a wild card. The release is expected to show factory-sector activity slowed in March, hitting a two-month low. The Aussie has tracked eroding 2015-16 Chinese GDP forecasts downward since mid-2013. This warns that signs of sluggishness in the Oceanic country’s top export market may push the RBA policy outlook deeper into dovish territory and weigh on the exchange rate. Markets now price in 50bps in easing over the coming 12 months."

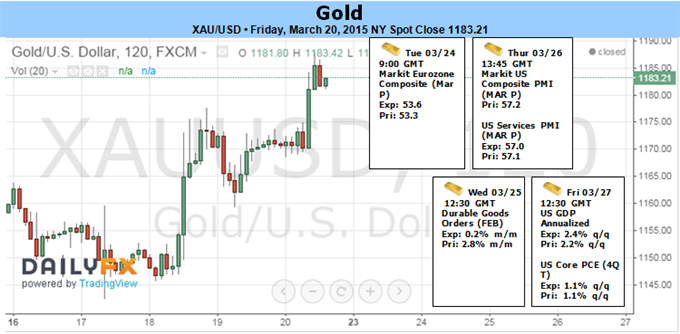

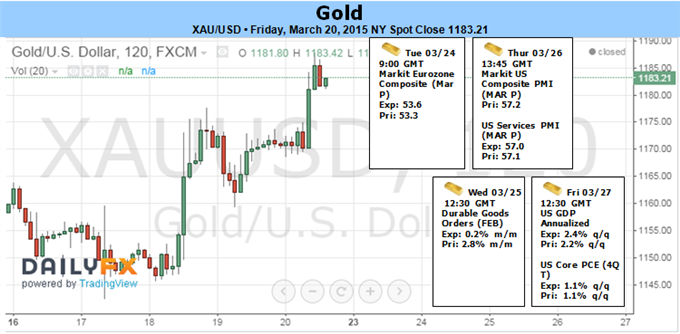

GOLD - "From a technical standpoint, gold has now rebounded off the key support region we’ve been noting over the past few weeks at 1150/51. Price action this week completes a sizeable key outside reversal candle off of a critical support region with the rally taking prices briefly through the 23.6% retracement of the decline off the January highs at 1181 before settling just below. Look for near-term support at 1167/68 which is defined by the March 18th reversal-day close & the January stretch low."