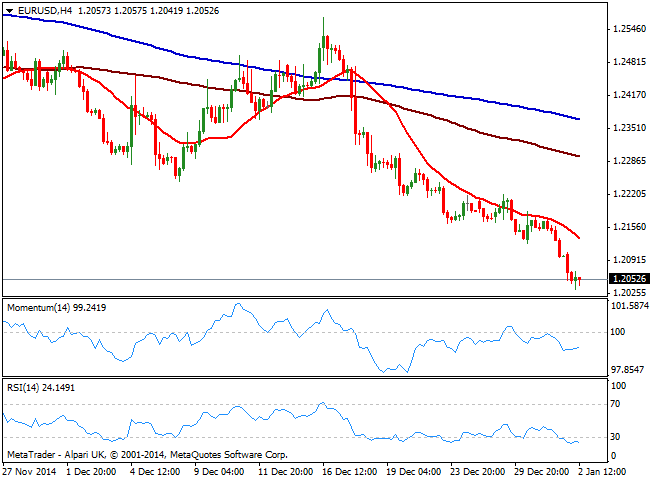

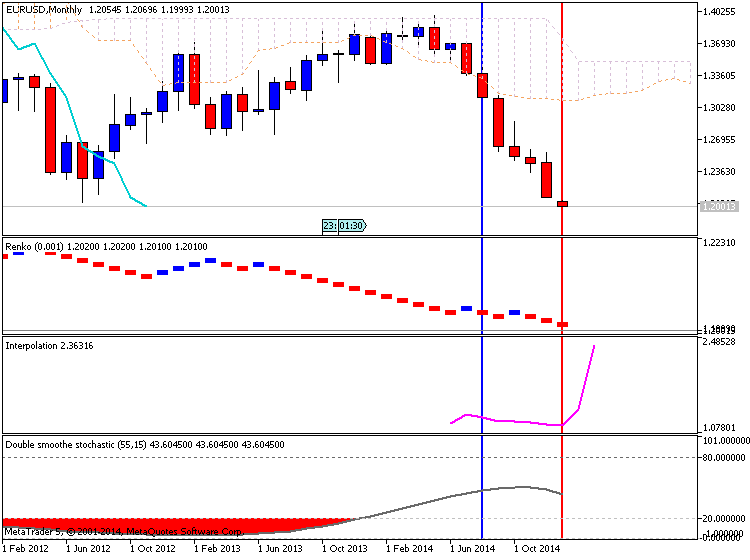

Euro forecast

Euro continues to remain under pressure as ECB (European Central Bank) is quite determined to pump more cash in the Eurozone.

Current Euro exchange rate –

- 1 EUR = 0.7837 GBP and 1 GBP = 1.2770 EUR

- 1 EUR = 1.2516 USD

- 1 EUR = 1.4443 AUD

A forecast for Eurozone and US economies suggests that EUR/USD will decline to 1.25 by the end of 2015. It also predicts that there will be a consistent fall, but at slow rate than what is seen recently. The pattern in EUR/USD monthly candlestick chart connects 2005, 2010 & 2012 lowers at 1.1643, 1.1880 and 1.2046 respectively. At the moment, it intersects at almost 1.21 increasing little by little every month. HSBC Holdings have covered a bullish USD outline, and predicted that by the end of 2015 EUR/USD will be 1.19. Moreover, if US authorities ignore push backs to increase USD value the downside may be larger.

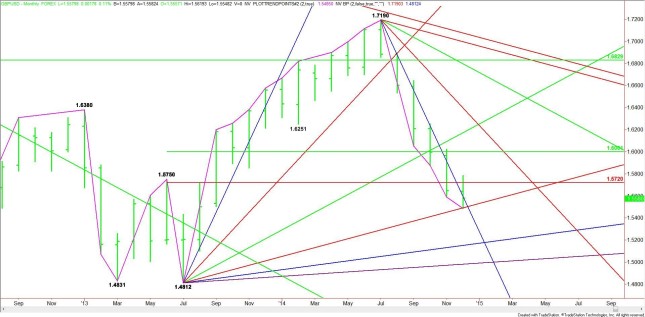

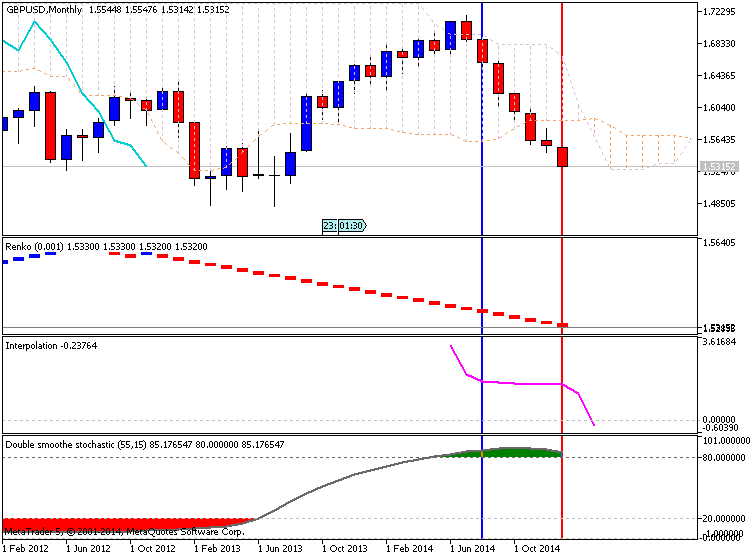

Pound prediction

Lately,

the pound to dollar trading seems to be on the back-foot. Majority of

forecast suggests that more falls are possible with momentum depending

on USD bulls. Currently, GBP/USD exchange rate is below 1.6000 levels,

and can possibly decline to 1.550.

The recent economic data has

caused this weakness, which gives an impression that UK will soon join

EMU (Economic & Monetary Union). Another reason to expect from the

selling of pound is that currently BoE (Bank of England) sounded a

little bit dovish as well as supported GBP/USD downward view.

HSBC Holdings analysts forecasted that GBP/USD rate will drift lower from 1.60 (2014) to 1.55 by 2015.

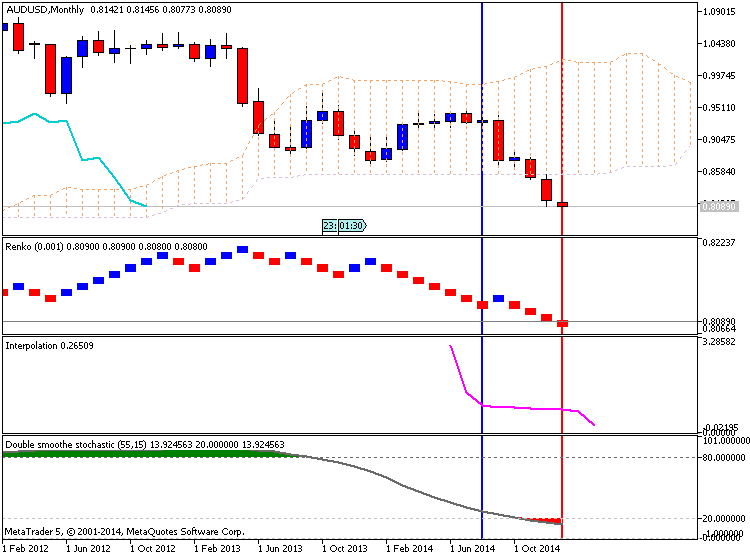

Australia dollar forecast

Forecast suggests that the year 2015 is not positive for traders hoping for strong Australian currency. However there can be sharp rebounds possible like -

- At this moment, GBP/AUD exchange rate is trading 0.43% low at 1.8460

- EUR/AUD is 0.40% low at 1.4474

- AUD/USD is 0.49& high at 0.8884

Economists expect Australian GDP to plummet by 2% in 2015. Technical forecast points out that AUD/USD is fast approaching the main support level – 8850, which was this year’s low.

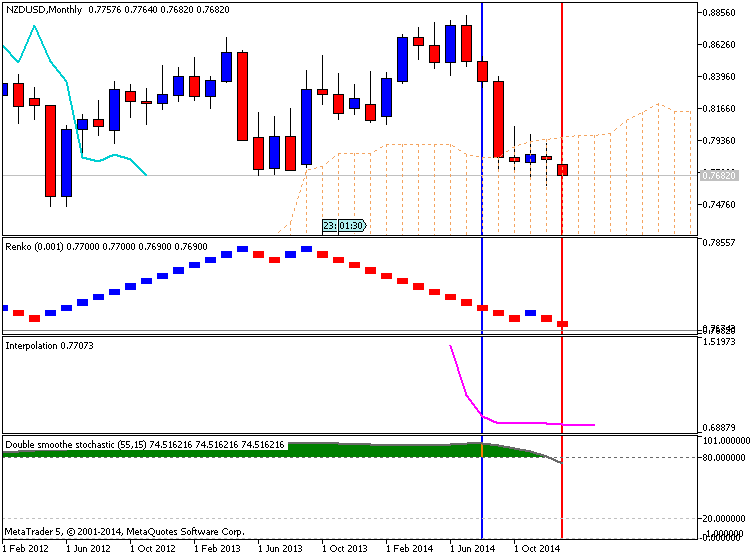

New Zealand dollar projections

NZD is experiencing a substantial pressure in the global financial market. At the moment –

- NZD to USD is 0.27% low (0.7787 NZD)

- Pound to NZD is 0.22% high (2.0813 NZD)

The RBNZ intervened and pushed ‘Kiwi’s’ low by highlighting that its rate is unfair. Analysts feel that the NZD currency is behind time, which can bounce back sharply. However, traders are urged to be careful, when they trade this currency.

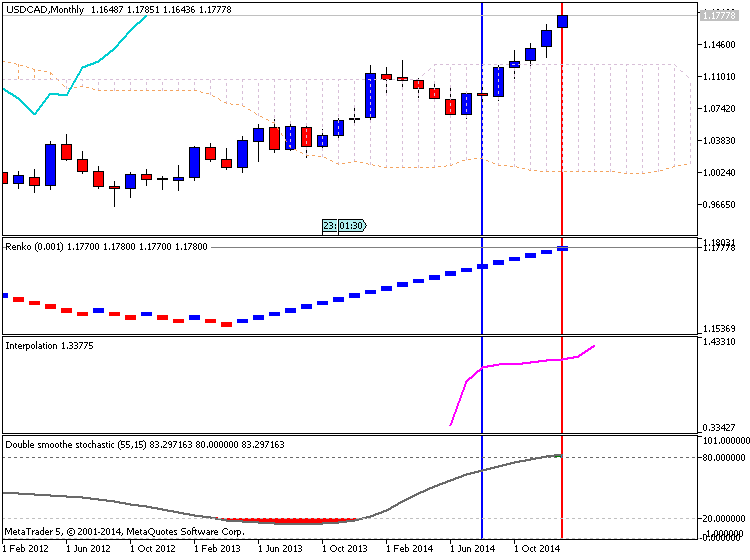

Canadian dollar presumption

The USD bullish run is keeping Canadian dollar buying interest suppressed.

Current CAD status –

- 1GBP = 1.8124 CAD (0.18% low)

- 1EUR = 1.4095 CAD (0.35% low)

- 1USD = 1.1183 CAD (0.13% low)