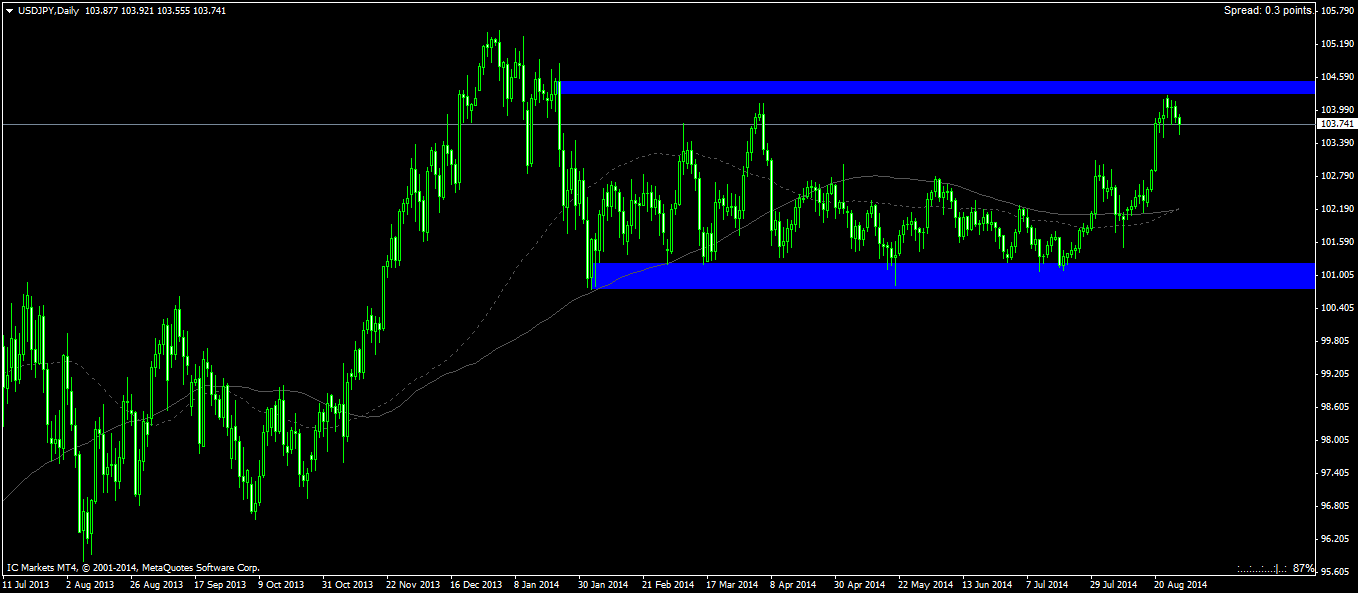

USDJPY is making January highs as it hit 104.273 just three days earlier. It looks like the selling has begun with two days of selling after the doji. Take a look below.

As mentioned before, the doji is considered an indecision candle because the volumes posted by buyers are equally matched with the volumes posted by the sellers. Because of this, they "cancel out" each other's orders. However, it is still uncertain as to whether is pair will be ranging or is this just a correction. Keep in mind this pair is exhausted from the massive buying on the 19th and 20th followed by a gap up. We may just be experiencing a period of buyers closing out their longs causing the price fall.

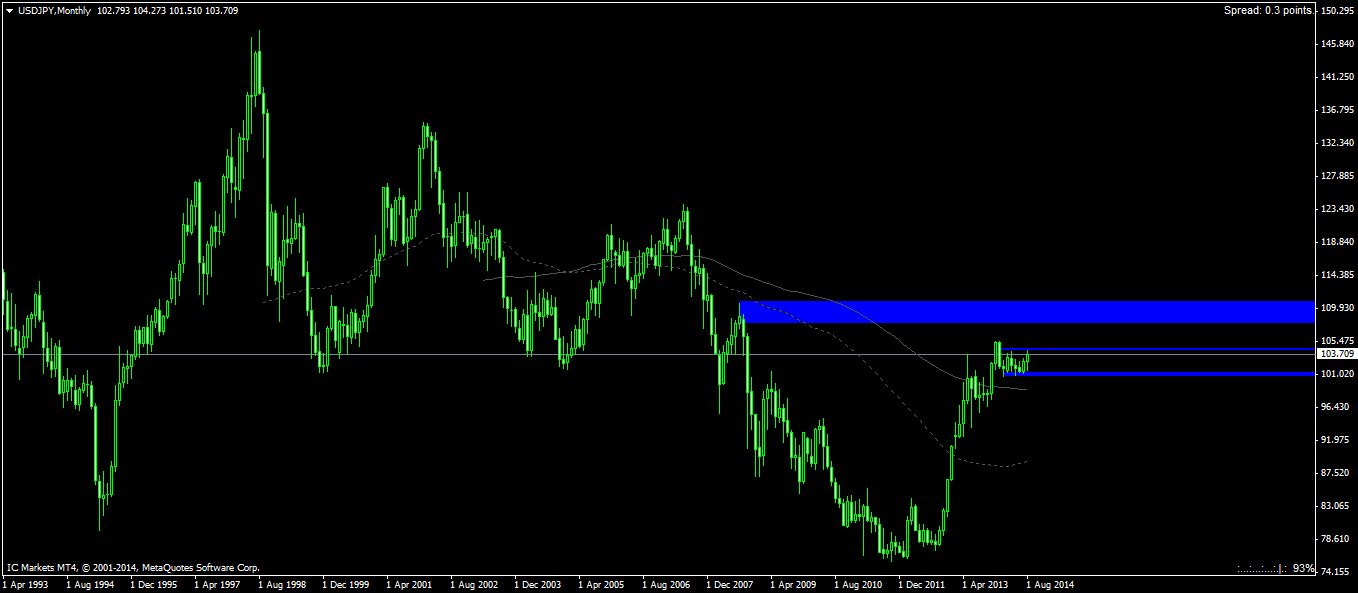

Meanwhile, looking at the monthly time frame, USDJPY has no reason to fall now. The last supply demand imbalance was on September 1, 2008 producing a massive sell-off from 107.835. There is just no visible supply zone or selling pressure at the current price level.

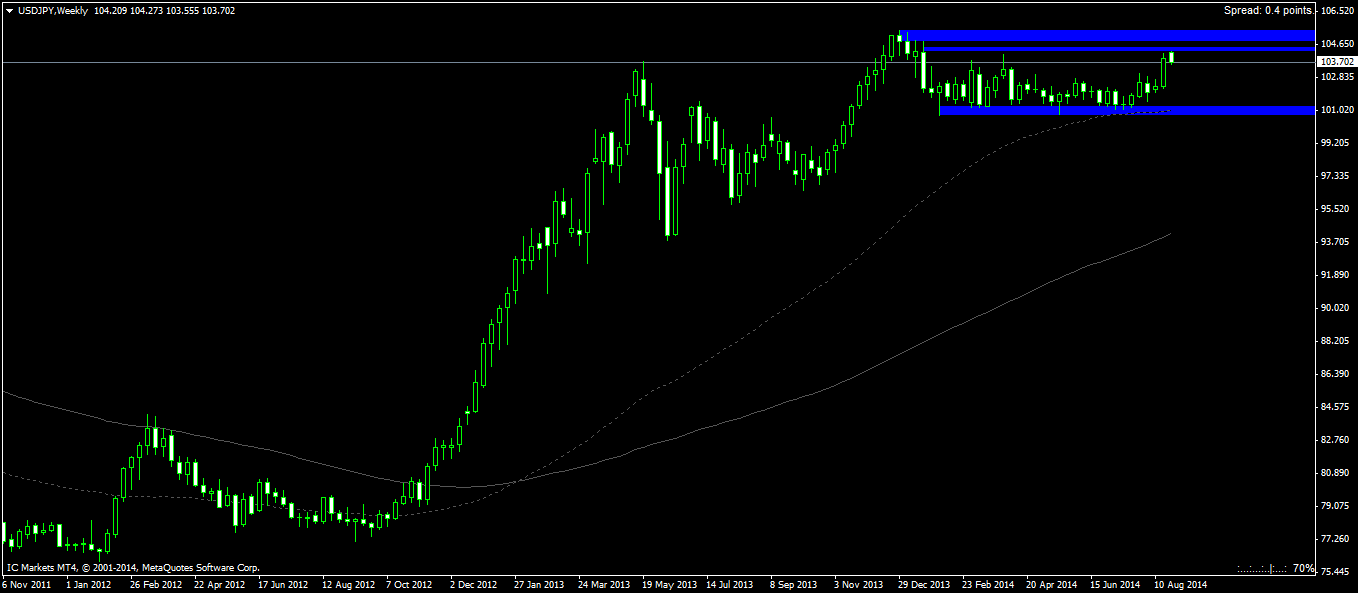

Even looking at the weekly time frame, price still has a short way to go before hitting the 104.814 selling pressure. As of the moment, the selling over the last four days has weakened the bullish outlook for this pair. The selling pressure is not expected to come until much later. If it is this early, we can expect to see this pair entering a range. Looking at all other major pairs, the U.S. Dollar has been experiencing moderate selling.