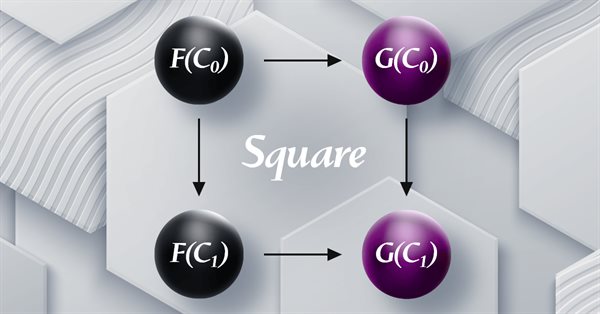

Category Theory in MQL5 (Part 19): Naturality Square Induction

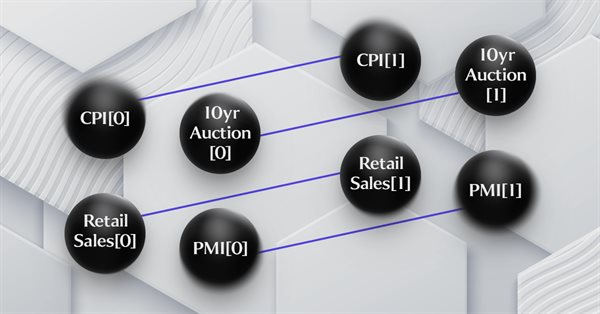

We continue our look at natural transformations by considering naturality square induction. Slight restraints on multicurrency implementation for experts assembled with the MQL5 wizard mean we are showcasing our data classification abilities with a script. Principle applications considered are price change classification and thus its forecasting.

How to create a simple Multi-Currency Expert Advisor using MQL5 (Part 1): Indicator Signals based on ADX in combination with Parabolic SAR

The Multi-Currency Expert Advisor in this article is Expert Advisor or trading robot that can trade (open orders, close orders and manage orders an more) for more than 1 symbol pair only from one symbol chart.

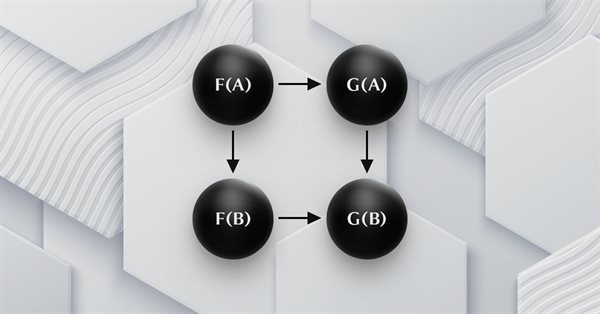

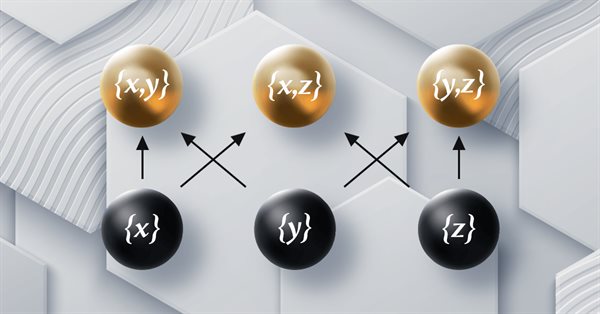

Category Theory in MQL5 (Part 18): Naturality Square

This article continues our series into category theory by introducing natural transformations, a key pillar within the subject. We look at the seemingly complex definition, then delve into examples and applications with this series’ ‘bread and butter’; volatility forecasting.

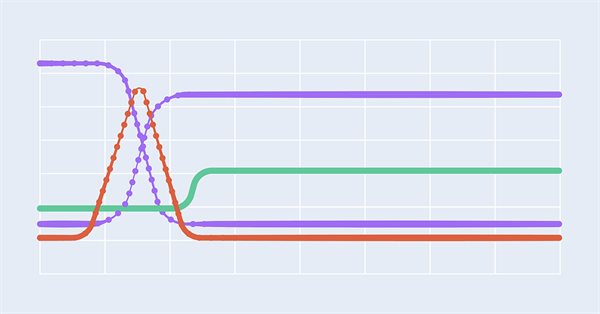

Testing different Moving Average types to see how insightful they are

We all know the importance of the Moving Average indicator for a lot of traders. There are other Moving average types that can be useful in trading, we will identify these types in this article and make a simple comparison between each one of them and the most popular simple Moving average type to see which one can show the best results.

Category Theory in MQL5 (Part 17): Functors and Monoids

This article, the final in our series to tackle functors as a subject, revisits monoids as a category. Monoids which we have already introduced in these series are used here to aid in position sizing, together with multi-layer perceptrons.

Category Theory in MQL5 (Part 16): Functors with Multi-Layer Perceptrons

This article, the 16th in our series, continues with a look at Functors and how they can be implemented using artificial neural networks. We depart from our approach so far in the series, that has involved forecasting volatility and try to implement a custom signal class for setting position entry and exit signals.

Improve Your Trading Charts With Interactive GUI's in MQL5 (Part III): Simple Movable Trading GUI

Join us in Part III of the "Improve Your Trading Charts With Interactive GUIs in MQL5" series as we explore the integration of interactive GUIs into movable trading dashboards in MQL5. This article builds on the foundations set in Parts I and II, guiding readers to transform static trading dashboards into dynamic, movable ones.

The RSI Deep Three Move Trading Technique

Presenting the RSI Deep Three Move Trading Technique in MetaTrader 5. This article is based on a new series of studies that showcase a few trading techniques based on the RSI, a technical analysis indicator used to measure the strength and momentum of a security, such as a stock, currency, or commodity.

Developing a Replay System — Market simulation (Part 04): adjusting the settings (II)

Let's continue creating the system and controls. Without the ability to control the service, it is difficult to move forward and improve the system.

Everything you need to learn about the MQL5 program structure

Any Program in any programming language has a specific structure. In this article, you will learn essential parts of the MQL5 program structure by understanding the programming basics of every part of the MQL5 program structure that can be very helpful when creating our MQL5 trading system or trading tool that can be executable in the MetaTrader 5.

Trading strategy based on the improved Doji candlestick pattern recognition indicator

The metabar-based indicator detected more candles than the conventional one. Let's check if this provides real benefit in the automated trading.

Understanding functions in MQL5 with applications

Functions are critical things in any programming language, it helps developers apply the concept of (DRY) which means do not repeat yourself, and many other benefits. In this article, you will find much more information about functions and how we can create our own functions in MQL5 with simple applications that can be used or called in any system you have to enrich your trading system without complicating things.

Developing a Replay System — Market simulation (Part 02): First experiments (II)

This time, let's try a different approach to achieve the 1 minute goal. However, this task is not as simple as one might think.

Developing a Replay System — Market simulation (Part 01): First experiments (I)

How about creating a system that would allow us to study the market when it is closed or even to simulate market situations? Here we are going to start a new series of articles in which we will deal with this topic.

Revisiting an Old Trend Trading Strategy: Two Stochastic oscillators, a MA and Fibonacci

Old trading strategies. This article presents one of the strategies used to follow the trend in a purely technical way. The strategy is purely technical and uses a few technical indicators and tools to deliver signals and targets. The components of the strategy are as follows: A 14-period stochastic oscillator. A 5-period stochastic oscillator. A 200-period moving average. A Fibonacci projection tool (for target setting).

Creating Graphical Panels Became Easy in MQL5

In this article, we will provide a simple and easy guide to anyone who needs to create one of the most valuable and helpful tools in trading which is the graphical panel to simplify and ease doing tasks around trading which helps to save time and focus more on your trading process itself without any distractions.

Can Heiken-Ashi Combined With Moving Averages Provide Good Signals Together?

Combinations of strategies may offer better opportunities. We can combine indicators or patterns together, or even better, indicators with patterns, so that we get an extra confirmation factor. Moving averages help us confirm and ride the trend. They are the most known technical indicators and this is because of their simplicity and their proven track record of adding value to analyses.

Improve Your Trading Charts With Interactive GUI's in MQL5 (Part II): Movable GUI (II)

Unlock the potential of dynamic data representation in your trading strategies and utilities with our in-depth guide to creating movable GUIs in MQL5. Delve into the fundamental principles of object-oriented programming and discover how to design and implement single or multiple movable GUIs on the same chart with ease and efficiency.

Category Theory in MQL5 (Part 12): Orders

This article which is part of a series that follows Category Theory implementation of Graphs in MQL5, delves in Orders. We examine how concepts of Order-Theory can support monoid sets in informing trade decisions by considering two major ordering types.

Rebuy algorithm: Multicurrency trading simulation

In this article, we will create a mathematical model for simulating multicurrency pricing and complete the study of the diversification principle as part of the search for mechanisms to increase the trading efficiency, which I started in the previous article with theoretical calculations.

Understanding MQL5 Object-Oriented Programming (OOP)

As developers, we need to learn how to create and develop software that can be reusable and flexible without duplicated code especially if we have different objects with different behaviors. This can be smoothly done by using object-oriented programming techniques and principles. In this article, we will present the basics of MQL5 Object-Oriented programming to understand how we can use principles and practices of this critical topic in our software.

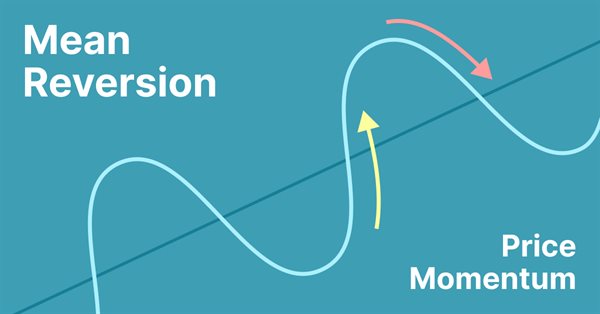

Simple Mean Reversion Trading Strategy

Mean reversion is a type of contrarian trading where the trader expects the price to return to some form of equilibrium which is generally measured by a mean or another central tendency statistic.

Category Theory in MQL5 (Part 11): Graphs

This article is a continuation in a series that look at Category Theory implementation in MQL5. In here we examine how Graph-Theory could be integrated with monoids and other data structures when developing a close-out strategy to a trading system.

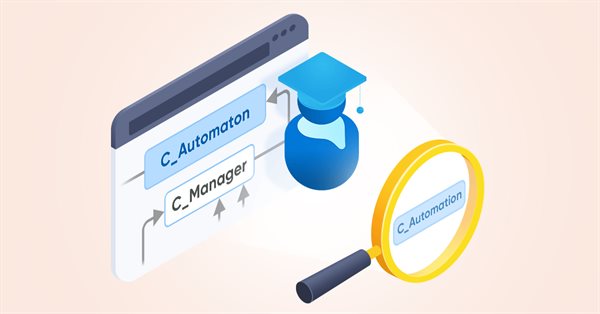

Creating an EA that works automatically (Part 15): Automation (VII)

To complete this series of articles on automation, we will continue discussing the topic of the previous article. We will see how everything will fit together, making the EA run like clockwork.

Forecasting with ARIMA models in MQL5

In this article we continue the development of the CArima class for building ARIMA models by adding intuitive methods that enable forecasting.

Creating an EA that works automatically (Part 14): Automation (VI)

In this article, we will put into practice all the knowledge from this series. We will finally build a 100% automated and functional system. But before that, we still have to learn one last detail.

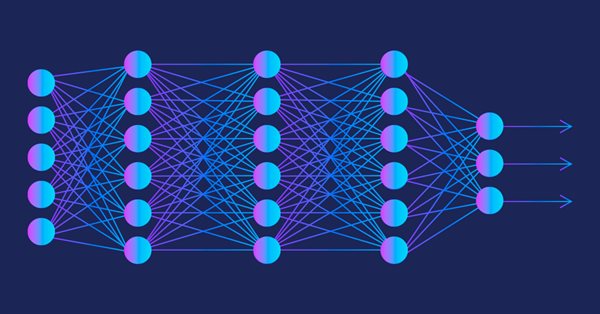

Multilayer perceptron and backpropagation algorithm (Part 3): Integration with the Strategy Tester - Overview (I).

The multilayer perceptron is an evolution of the simple perceptron which can solve non-linear separable problems. Together with the backpropagation algorithm, this neural network can be effectively trained. In Part 3 of the Multilayer Perceptron and Backpropagation series, we'll see how to integrate this technique into the Strategy Tester. This integration will allow the use of complex data analysis aimed at making better decisions to optimize your trading strategies. In this article, we will discuss the advantages and problems of this technique.

Automated exchange grid trading using stop pending orders on Moscow Exchange (MOEX)

The article considers the grid trading approach based on stop pending orders and implemented in an MQL5 Expert Advisor on the Moscow Exchange (MOEX). When trading in the market, one of the simplest strategies is a grid of orders designed to "catch" the market price.

Creating an EA that works automatically (Part 13): Automation (V)

Do you know what a flowchart is? Can you use it? Do you think flowcharts are for beginners? I suggest that we proceed to this new article and learn how to work with flowcharts.

Rebuy algorithm: Math model for increasing efficiency

In this article, we will use the rebuy algorithm for a deeper understanding of the efficiency of trading systems and start working on the general principles of improving trading efficiency using mathematics and logic, as well as apply the most non-standard methods of increasing efficiency in terms of using absolutely any trading system.

How to create a custom Donchian Channel indicator using MQL5

There are many technical tools that can be used to visualize a channel surrounding prices, One of these tools is the Donchian Channel indicator. In this article, we will learn how to create the Donchian Channel indicator and how we can trade it as a custom indicator using EA.

Experiments with neural networks (Part 6): Perceptron as a self-sufficient tool for price forecast

The article provides an example of using a perceptron as a self-sufficient price prediction tool by showcasing general concepts and the simplest ready-made Expert Advisor followed by the results of its optimization.

Category Theory in MQL5 (Part 8): Monoids

This article continues the series on category theory implementation in MQL5. Here we introduce monoids as domain (set) that sets category theory apart from other data classification methods by including rules and an identity element.

Experiments with neural networks (Part 5): Normalizing inputs for passing to a neural network

Neural networks are an ultimate tool in traders' toolkit. Let's check if this assumption is true. MetaTrader 5 is approached as a self-sufficient medium for using neural networks in trading. A simple explanation is provided.

Creating an EA that works automatically (Part 12): Automation (IV)

If you think automated systems are simple, then you probably don't fully understand what it takes to create them. In this article, we will talk about the problem that kills a lot of Expert Advisors. The indiscriminate triggering of orders is a possible solution to this problem.

How to create a custom True Strength Index indicator using MQL5

Here is a new article about how to create a custom indicator. This time we will work with the True Strength Index (TSI) and will create an Expert Advisor based on it.

Creating an EA that works automatically (Part 11): Automation (III)

An automated system will not be successful without proper security. However, security will not be ensured without a good understanding of certain things. In this article, we will explore why achieving maximum security in automated systems is such a challenge.

Creating an EA that works automatically (Part 10): Automation (II)

Automation means nothing if you cannot control its schedule. No worker can be efficient working 24 hours a day. However, many believe that an automated system should operate 24 hours a day. But it is always good to have means to set a working time range for the EA. In this article, we will consider how to properly set such a time range.

Creating an EA that works automatically (Part 09): Automation (I)

Although the creation of an automated EA is not a very difficult task, however, many mistakes can be made without the necessary knowledge. In this article, we will look at how to build the first level of automation, which consists in creating a trigger to activate breakeven and a trailing stop level.

Experiments with neural networks (Part 4): Templates

In this article, I will use experimentation and non-standard approaches to develop a profitable trading system and check whether neural networks can be of any help for traders. MetaTrader 5 as a self-sufficient tool for using neural networks in trading. Simple explanation.