MarketReact EA

- Experten

- Mohd Hakim Johari

- Version: 3.6

- Aktualisiert: 7 Oktober 2025

- Aktivierungen: 5

MarketReact EA: Die Multi-Strategy Trading Engine

Warum sollten Sie sich mit einem starren, eindimensionalen EA zufrieden geben? Die meisten automatisierten Systeme legen Sie auf eine einzige, starre Strategie fest. In einem Markt, der sich ständig verändert, brauchen Sie ein Tool, das sich mit ihm anpasst.

MarketReact EA ist ein professionelles Handelssystem, das für ultimative Flexibilität entwickelt wurde. Es ermöglicht Ihnen, Ihr eigenes, individuelles Handelssignal zu erstellen, indem es drei der zuverlässigsten technischen Indikatoren kombiniert. Egal, ob Sie ein aggressiver Grid-Trader oder ein disziplinierter Single-Entry-Trader sind, MarketReact bietet eine solide Grundlage, die durch eine Reihe von Sicherheitsfunktionen auf institutionellem Niveau verstärkt wird.

Bauen Sie Ihr Arsenal auf: Drei EAs in einem

Dies ist der neue Kern der Leistungsfähigkeit von MarketReact EA. Sie erhalten nicht nur eine Strategie, sondern eine modulare Engine, mit der Sie Ihre eigene erstellen können. Aktivieren, deaktivieren und kombinieren Sie die folgenden Indikatoren, um Ihr eigenes Einstiegssignal zu generieren:

-

Ichimoku Kinko Hyo: Ein umfassender All-in-One-Indikator zur Bestimmung von Trend, Momentum und wichtigen Unterstützungs-/Widerstandszonen.

-

-

Stochastischer Oszillator: Ein klassischer Momentum-Indikator, der sich perfekt zur Identifizierung von überkauften und überverkauften Bedingungen eignet, um präzise Einstiegssignale zu generieren.

-

Awesome Oscillator (AO): Ein leistungsstarkes Tool, das die Marktdynamik misst und die einem Trend zugrunde liegende Kraft bestätigt.

Sie haben die vollständige Kontrolle. Verwenden Sie einen Indikator für ein reines Signal, kombinieren Sie zwei für eine aussagekräftige Bestätigung, oder aktivieren Sie alle drei für die wahrscheinlichsten Handelsmöglichkeiten.

Wählen Sie Ihren Handelsstil: Zwei Betriebsmodi

Sobald Sie Ihr Signal erstellt haben, wählen Sie Ihren Ausführungsstil.

-

Modus 1: Strategisches Rastersystem (MaxOpenTrades > 1)

Für Händler, die schwankende Märkte dominieren möchten. In diesem Modus werden strategisch neue Positionen eröffnet, wenn sich der Markt gegen den ursprünglichen Handel bewegt, mit dem Ziel, den gesamten Korb mit Gewinn zu schließen. Sie behalten die volle manuelle Kontrolle über denPipstep, so dass Sie die Aggressivität des Rasters anpassen können. -

Modus 2: Precision Single Entry (MaxOpenTrades = 1)

Für den disziplinierten Trader, der einen klassischen, risikodefinierten Ansatz bevorzugt. Dieser Modus nimmt einen qualitativ hochwertigen Trade pro Signal und verwaltet ihn professionell mit einem Stop Loss, Take Profit und einem gewinnsichernden Trailing Stop.

Ihre Festung: Die integrierte Kapitalschutz-Suite

Beim automatisierten Handel ist das Überleben das Wichtigste. Die Rentabilität folgt. Aus diesem Grund wurde MarketReact EA mit einem mehrschichtigen Verteidigungssystem ausgestattet, das Ihr Kapital um jeden Preis schützen soll. Dies ist Ihr automatischer Risikomanager, der 24/5 arbeitet.

Die automatisierten Kill Switches (Equity Protection)

Dies ist Ihr ultimatives Sicherheitsnetz. Wenn sich die Marktbedingungen gegen Sie wenden, werden diese reaktiven Kontrollen aktiviert, um Ihr Konto zu schützen.

✅ Max Daily Loss Percent: Legt fest , wie viel Sie an einem einzigen Tag verlieren können.

✅ Max Drawdown Percent: Der wichtigste Kill Switch. Er überwacht ständig Ihren Floating Drawdown, um katastrophale Verluste zu verhindern.

✅ Min Equity Percent: Eine letzte Verteidigungslinie, um Ihr Kernkapital zu schützen.

Die proaktiven Filter (Smart Trade Prevention)

Der beste Weg zum Risikomanagement besteht darin, schlechte Trades von Anfang an zu vermeiden.

✅ Max Spread Protection: Vermeidet das Eingehen von Geschäften während kostspieliger, volatiler Phasen.

✅ Market Hours Time Filter: Sie legen die genauen Handelszeiten fest, zu denen der EA arbeiten darf.

✅ Freitags-Exit-Strategie: Schützt Ihre Rasterpositionen vor gefährlichen Wochenend-Gaps.

Erste Schritte: Von $100 bis zum professionellen Maßstab

Der MarketReact EA ist für alle Ambitionsstufen geeignet. Sie haben die Flexibilität, mit dem Kapital zu beginnen, mit dem Sie sich wohl fühlen.

-

Der Micro Account Pfad (Start mit ~$100):

Perfekt für diejenigen, die den EA mit echtem Geld testen möchten, ohne ein großes Kapital zu investieren. Wenn Sie ein Cent- oder Micro-Konto verwenden, können Sie mit einem Startguthaben von 100 $ arbeiten. Dieser Ansatz ermöglicht es Ihnen, das Verhalten des EA zu lernen und Ihre Einstellungen in einer Live-Umgebung mit kontrolliertem Risiko fein abzustimmen. -

Der Standardpfad (Start mit ~$1000):

Dies ist der empfohlene Weg für ein stetiges und professionelles Wachstum. Ein Startguthaben von $1000 auf einem Standardkonto bietet einen sicheren Puffer, um mit Marktrückgängen umzugehen, und ermöglicht es der automatischen Kompensationsfunktion LotsPer1000Balance, optimal zu arbeiten.

Professionelle Anleitung: Die Kunst, Ihren Pipstep zu optimieren

Bei uns haben Sie die volle Kontrolle. Wir glauben nicht an "Einheitseinstellungen", da jedes Währungspaar ein einzigartiges Volatilitätsprofil aufweist. Der Schlüssel zum Erfolg beim Grid-Trading liegt darin, den Pipstep auf das von Ihnen gewählte Paar und Ihre persönliche Risikobereitschaft abzustimmen.

Hier ist der professionelle Prozess:

-

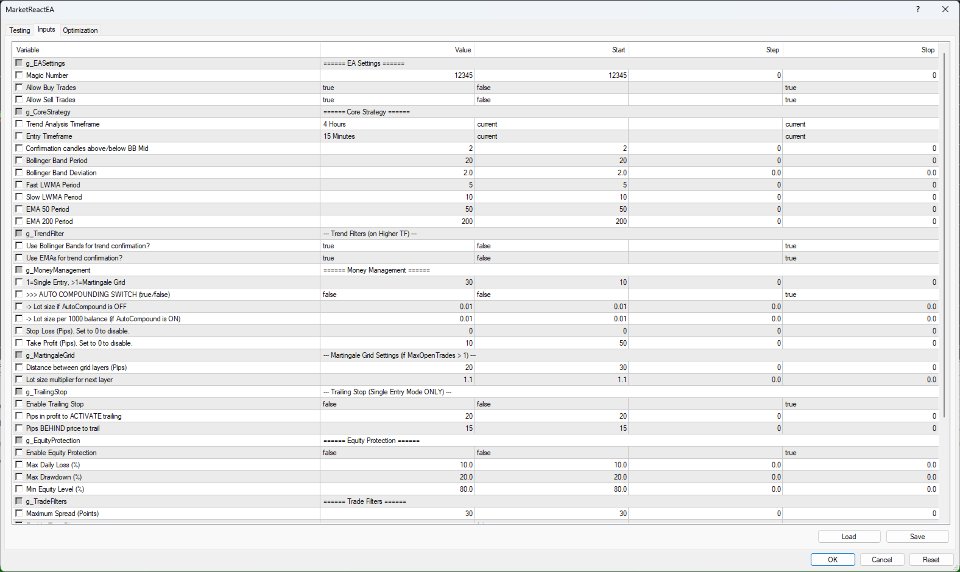

Sammeln Sie Daten: Verwenden Sie den MT4 Strategy Tester, um den EA mit dem von Ihnen gewählten Paar zu testen. Beobachten Sie, wie verschiedene Pipstep-Werte die Performance und den Drawdown beeinflussen. Dies ist die Phase des Datensammelns.

-

Definieren Sie Ihr Risiko:Entscheiden Sie auf der Grundlage der Daten, mit welchem Risikoniveau Sie einverstanden sind. Ein engerer Pipstep kann mehr Trades bieten, aber möglicherweise einen höheren Drawdown. Ein breiterer Pipstep ist sicherer, kann aber weniger häufig gehandelt werden. Sie haben die Kontrolle.

-

Verwenden Sie unsere Empfehlungen als Ausgangspunkt: Die folgende Tabelle enthält gut recherchierte Grundeinstellungen. Verwenden Sie diese als Ausgangspunkt für Ihre eigenen Tests und Optimierungen.

Professionelle Anleitung: Manuelle Pipstep-Konfiguration

| PAIR | VOLATILITÄTSPROFIL | EMPFOHLENER MANUELLER PIPSTEP |

| EURUSD | MITTEL | 20-35 PIPS |

| AUDCAD | NIEDRIG-MITTEL | 25-40 PIPS |

| AUDNZD | NIEDRIG (RANGING) | 20-35 PIPS |

(Hinweis: Dies sind Ausgangspunkte. Führen Sie immer Backtests durch, um Ihre optimalen Einstellungen zu finden).