Quantum Edge H2

- Uzman Danışmanlar

- Sergio Tiscar Ortega

- Sürüm: 1.0

- Etkinleştirmeler: 20

EURUSD Quantum Edge - Institutional H2 Core

System Philosophy

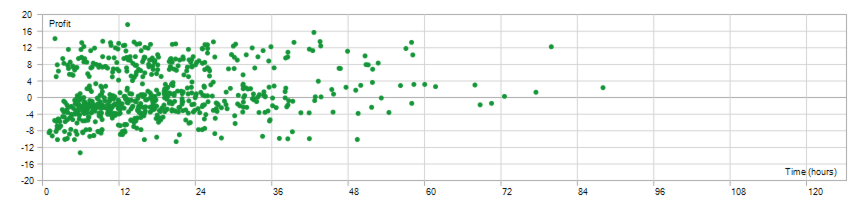

EURUSD Quantum Edge is a quantitative trading algorithm engineered specifically for the EURUSD pair on the 2-hour (H2) timeframe. The system specializes in capturing intraday market inefficiencies using a low-latency execution engine that balances entry precision with dynamic exit management. Unlike other systems, this EA has been validated over a 7-year horizon (2018-2026), demonstrating exceptional adaptability to various economic cycles.

Operational Methodology

The algorithm utilizes a hybrid approach, combining volume and volatility analysis to confirm every trade:

-

Advanced Liquidity Filtering: It integrates VWAP and Volume Average readings to ensure entries occur only during periods of high institutional participation, avoiding flat or low-volume markets.

-

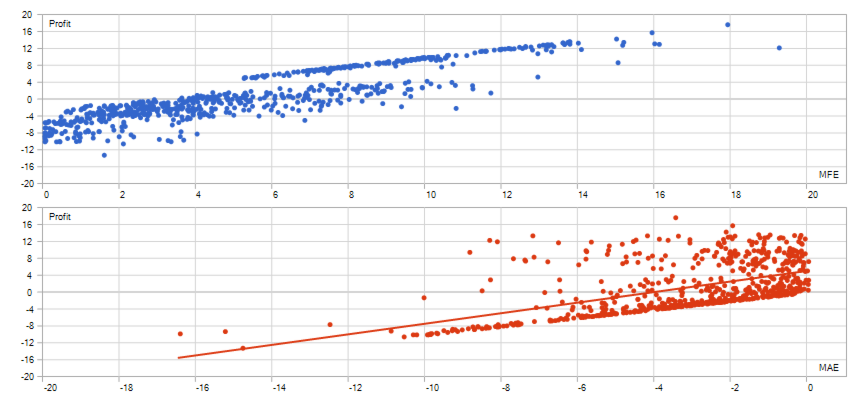

Dynamic Exit Management: The system implements dual-layer Profit Targets and an adaptive Trailing Stop based on volatility coefficients, allowing it to maximize gains in extended trends while quickly securing capital.

-

Session Control: The EA is optimized to operate within specific time windows (01:30 - 23:30), filtering out periods of excessive spreads or erratic volatility during market rollovers.

Quantitative Rigor & Protection

-

Superior Stability: Boasting a Sharpe Ratio of 2.69 and a Profit Factor of 1.47, the system offers one of the best risk-reward profiles in its class.

-

Capital Protection: Utilizing compound interest or fixed lot management, the system maintains a historically low maximum Drawdown (3.70%), making it ideal for accounts seeking sustained growth with minimal exposure.

-

Data Validation: Tested with 99% modeling quality, ensuring that the results are a reliable reflection of actual market behavior.

Specifications

-

Symbol: EURUSD.

-

Timeframe: H2.

-

Style: Intraday / Short-term Swing.

-

Suggested Capital: $1,500.