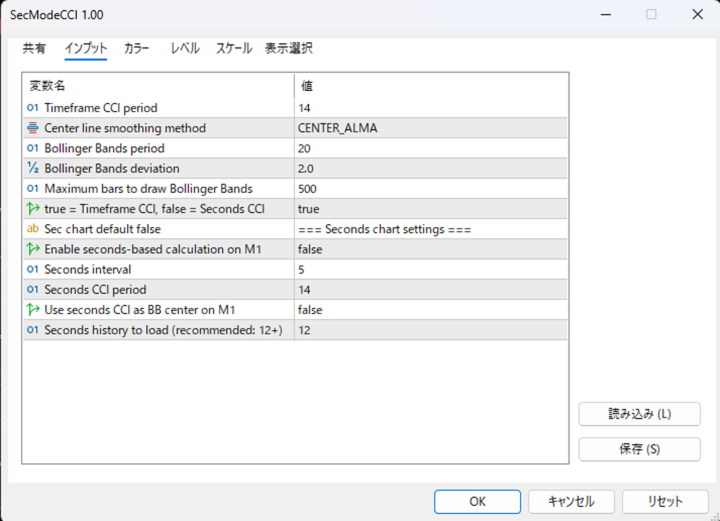

SecModeCCI

- Göstergeler

- Kazutaka Okuno

- Sürüm: 1.0

🌍 【SecMode Series】SecModeCCI – High‑Resolution Tick‑Based CCI Indicator

📌 Overview

SecModeCCI is part of the SecMode Series, a next‑generation suite of indicators designed to reveal the micro‑structure of price action at the tick/second level—a level of detail that traditional 1‑minute indicators cannot capture.

While standard indicators refresh only once per minute, SecModeCCI uses a proprietary second‑level engine to:

- Update up to 60 times per minute (or at user‑defined intervals)

- Visualize momentum, pressure, and turning points in real time

- Highlight divergences between standard timeframe (TF) and second‑level (Sec) signals

- Operate without custom symbols, ensuring a clean and lightweight setup

This provides a high‑resolution market perspective that conventional tools are fundamentally unable to deliver.

🎯 Key Features

① Tick‑Based Engine (No Custom Symbols Required)

Most second‑level indicators rely on:

- Custom symbol creation

- Saving and maintaining second‑level data

- Regenerating data when files become corrupted

- Heavy MT5 resource consumption

SecModeCCI avoids all of these issues.

It generates second‑level data internally from tick streams, offering:

- Fast and simple setup

- Clean chart integration

- Lightweight MT5 performance

- Stable operation even on VPS environments

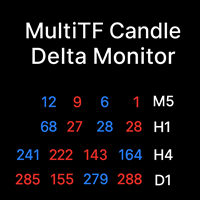

② Dual‑Line Structure (TF × Sec)

By plotting both TF (standard timeframe) and Sec (second‑level) CCI lines:

- The Sec line tends to react first

- The TF line follows afterward

This makes early momentum shifts visually obvious, giving traders a timing advantage for entries and exits.

③ Bollinger Band Visualization of Momentum Extremes

Includes:

- CenterLine (switchable: ALMA / TMA / SMA)

- Upper / Lower Bands for overheat and reversal zones

When the Sec CCI line breaks through the Bollinger Bands, it reveals explosive pressure points that standard indicators fail to detect.

④ No Color Logic (CCI Uses Waveform Information Only)

Unlike ADX and CMO, which use directional color logic,

CCI conveys information through waveform structure alone.

This keeps the display clean and focused on:

- Overbought/oversold behavior

- Momentum compression

- Sec‑level divergence

- Waveform symmetry and breakouts

⑤ No Repainting (Final Values Stay Final)

SecModeCCI draws second‑level values directly from tick data:

- Closed bars never change (no repainting)

- Open bars update rapidly in real time

This mirrors natural candlestick behavior and ensures transparent, trustworthy signals.

⑥ Unified UI Across the Entire Series

All SecMode indicators share the same interface and design philosophy:

- CCI (Sec)

- RSI (Sec)

- Stochastic (Sec)

- ADX (Sec, with color logic)

- CMO (Sec, with color logic)

This consistency makes multi‑indicator setups intuitive and seamless.

⑦ Three Selectable CenterLine Engines (Bollinger Band Core)

Switch among three engines depending on market conditions and trading style:

1. ALMA – Sniper Mode

- Ultra‑low latency with smoothness

- Fastest response of the three

- Ideal for scalpers targeting second‑level reversals

2. TMA – Cycle Mode

- Smoothest curve via double averaging

- Highlights market cycles and overextensions

- Excellent for rhythm recognition and counter‑trend setups

- Note: TMA naturally “follows” price until bar close—ideal for environment analysis

3. SMA – Benchmark Mode

- Most widely recognized moving average

- Reflects what the majority of traders watch

- Best for standard Bollinger Band behavior with second‑level refinement

🎁 About the Free Version

This free edition provides full access to the core second‑level engine and high‑resolution market visualization.

To keep the design streamlined, the following features are intentionally excluded:

- Signal generation

- Alert notifications

- Auto‑drawing tools

- Advanced filters

All essential functions—tick engine, TF/Sec divergence, Bollinger Band behavior—are fully available.

Use this streamlined core edition to experience how dramatically different the second‑level market truly is.

🧠 Usage Examples

- Sec CCI reacts first → early signal detection

- Sec CCI pierces Bollinger Bands → momentum spike

- TF/Sec divergence → reversal anticipation

- CenterLine break → trend transition

🚀 Summary

- Tick‑based second‑level engine (no custom symbols)

- TF/Sec divergence becomes actionable entry logic

- Bollinger Bands reveal overheat and reversal zones

- CCI uses waveform‑only logic (no color changes)

- No repainting (TMA naturally follows price until close)

- Unified UI across the SecMode Series

- Free access to a radically different market perspective

Experience a level of market detail that traditional indicators are fundamentally unable to deliver.