MTF Levels And Moving Averages

- Индикаторы

- Arinze Michael Ejike

- Версия: 1.0

- Активации: 5

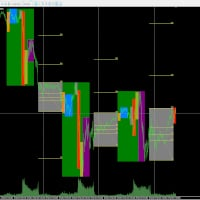

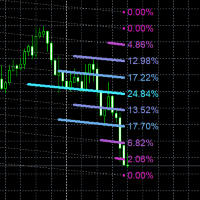

MTF Levels And Moving Averages is a professional indicator designed to identify key support and resistance levels across multiple timeframes. The tool helps traders locate precise entry and exit points by analyzing market structure and price action patterns.

Key Features

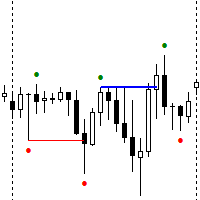

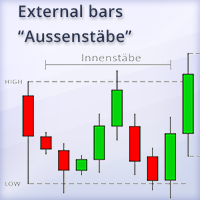

The indicator provides multi-timeframe analysis covering H1, H4, D1, and W1 periods simultaneously. It identifies supply and demand zones where price typically reacts, using color-coded visualization to distinguish between different timeframes and level types. The built-in Heikin Ashi integration enhances trend visualization, while the alert system notifies you when price interacts with important levels.

Technical Approach

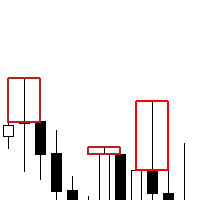

MTF Levels And Moving Averages uses market structure algorithms to identify genuine support and resistance levels. The indicator analyzes historical price action to determine significant highs and lows, creating a comprehensive view of potential reaction zones. This approach focuses on price pattern recognition, peak-and-trough identification, and supply-demand zone mapping across multiple timeframes.

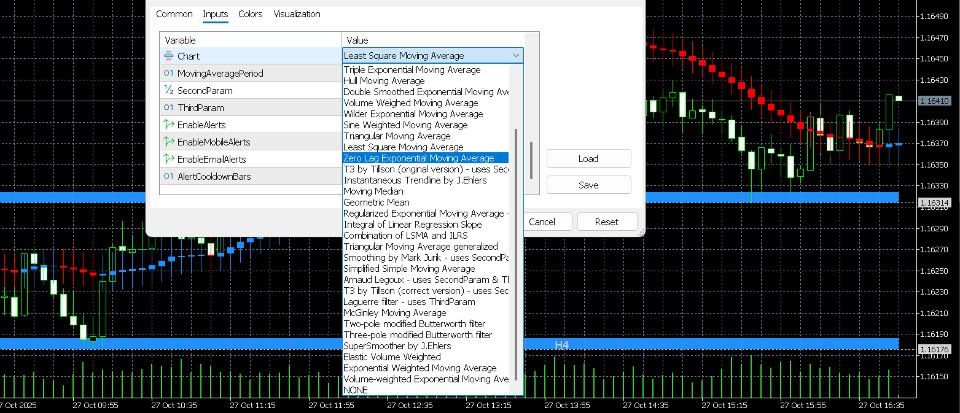

The indicator operates with three primary parameters that control how the moving averages behave:

MovingAveragePeriod (Default: 21) This parameter determines the lookback period for calculating the moving averages. A period of 21 means the indicator considers the previous 21 bars when computing each moving average value. Smaller periods (like 10-14) create more responsive charts that react quickly to price changes, while larger periods (30-50) produce smoother charts that emphasize longer-term trends. Traders can adjust this value based on their trading timeframe and strategy requirements.

SecondParam (Default: 0.5) Several moving average types require additional mathematical parameters to fine-tune their calculations. The SecondParam serves this purpose for specific algorithms including T3, T3_basic, REMA (Regularized EMA), JSmooth (Jurik Smoothing), and ALMA (Arnaud Legoux Moving Average). For T3 variants, this value controls the volume factor in the calculation, affecting how aggressively the average smooths price data. For REMA, it represents the lambda coefficient that regulates the smoothing behavior. For ALMA, it determines the offset parameter that influences where the average focuses within the lookback window. Values typically range between 0.5 and 1.0, with higher values generally producing smoother results.

ThirdParam (Default: 5) This parameter provides additional control for moving averages that require a third input value. Currently, it affects ALMA and Laguerre filter calculations. For ALMA, ThirdParam sets the sigma value, which controls the width of the Gaussian distribution used in the calculation. For the Laguerre filter, it determines the order of the filter, essentially deciding how many stages of filtering are applied to the price data. Higher orders produce smoother outputs but may introduce more lag.

Trading Applications

The indicator serves technical traders who rely on support and resistance analysis. It benefits multi-timeframe traders needing consolidated analysis, price action traders seeking key market levels, and swing traders identifying optimal entry and exit points.

For entry strategies, look for price approaching identified levels with Heikin Ashi confirmation. Enter when price reacts at these levels with proper risk management. For exits, take profits at the next identified level in your trade direction, or when price breaks through the supporting level.

Practical Benefits

The tool provides clearer entry and exit points, reduces analysis time through automated level identification, and enhances trading confidence. It improves risk management by offering precise stop-loss placement opportunities and better understanding of market structure across timeframes.

MTF Levels And Moving Averages transforms your technical analysis by providing professional-grade support and resistance identification. The indicator works on all major currency pairs and timeframes, making it suitable for various trading styles and market conditions.