Range Lover

- Experts

- Sio Kei Wong

- Versão: 2.0

- Atualizado: 19 janeiro 2026

- Ativações: 10

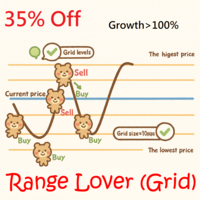

Range Lover - A Two-Way Hedging System Designed for Sideways Markets

📊 Why do 80% of traders fail in range-bound markets?

Because they try to find trends when there are none.Market statistics show that 70% of the time, markets are in a range state, while only 30% experience unidirectional trends. Most trend-following EAs frequently hit stop-losses during sideways movements, causing capital to be eroded repeatedly.

Range Lover doesn't predict the future; it capitalizes on the present. It's engineered to capture market noise, transforming frustrating volatility into profit. This is an advanced grid system based on Bidirectional Hedging and Dynamic Pullback Tracking.

💎 Core Strategy & Code Advantages

Based on its underlying code logic, this system possesses unique advantages distinct from ordinary grid systems on the market:

Exclusive Close-By Technology (Cost Optimization):

The code incorporates a PositionCloseBy function. When both long and short positions exist simultaneously, the system utilizes hedging positions to close them off against each other. This not only saves one spread but also reduces commission costs. This represents a core advantage of professional high-frequency trading.

Intelligent Pullback Mechanism (PB/RB Ratio):

Unlike rigid position-adding strategies, this system incorporates PB_Ratio (Pullback) and RB_Ratio (Rebound) parameters. The system calculates the percentage retracement from price highs/lows and executes trades only when specific pullback ratios are met, preventing premature entry during one-sided market movements.

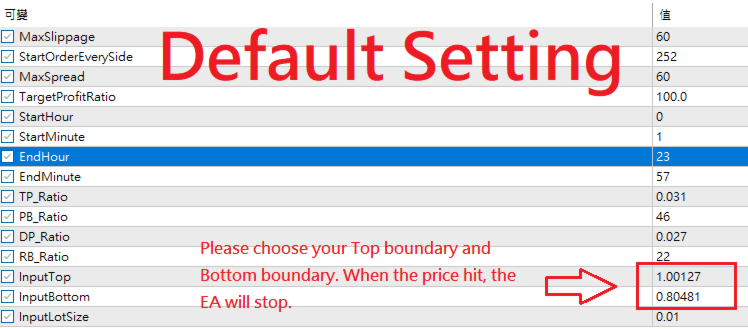

Hard Boundary Protection:

Set InputTop (upper price limit) and InputBottom (lower price limit). If prices breach this range, the system triggers ordercloseby_all_trades risk control to prevent unlimited stop-loss orders.

Time and Profit Locking:

Built-in Check_TimeSession function avoids high-risk news release periods.

Features TargetProfitRatio: When account equity reaches the target (e.g., 120% of principal), positions are automatically closed and the system stops running, ensuring profits are locked in.

⚙️ Parameter Settings Guide

StartOrderEverySide: Initial number of layers/lots for opening positions on both sides.

InputTop / InputBottom: Upper and lower price limits for the range (0 indicates automatic calculation).

TP_Ratio / DP_Ratio: Ratio coefficients for take-profit and dynamic stop-loss spacing. (0.1 represents 10%)

PB_Ratio / RB_Ratio: Trigger ratios for pullback and rebound (core filter; 10 represents 10%).

CloseGuaranteedProfit: Minimum guaranteed profit when conditions are met.

MagicNumber: Order identifier.

StartHour/EndHour: Trading time filter.

✅Recommended Operating Environment

Account Type: Must be a Hedge account.

Trading Instruments: Suitable for currency pairs in prolonged sideways movement (e.g., EURGBP, AUDCAD) or indices in consolidation phases.

Timeframe: M15 or H1 (recommended to backtest first for optimization based on current volatility).

VPS: Low-latency VPS recommended to ensure efficient OrderCloseBy execution.

⚠️Risk Disclosure

Past performance does not guarantee future results. This EA employs hedging and grid strategies. Thoroughly test your settings on a Demo account and adjust LotSize according to your capital size. Swap-free accounts are recommended to minimize holding costs.