Time Trigger EA MT5

- Experts

- Mariusz Piotr Rodacki

- 버전: 1.0

Overview

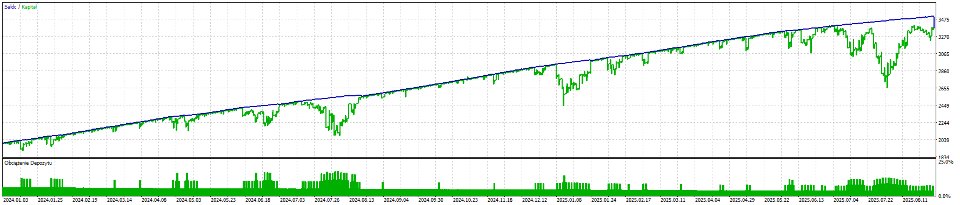

TimeTriggerEA is a sophisticated automated trading system that executes trades based on precise time triggers combined with technical analysis. Unlike traditional EAs that monitor markets continuously, TimeTriggerEA operates on a strict schedule, opening only one carefully analyzed position per day at your specified time.

⚠️ Important Notice

The EA has not been tested on the market, but you can now find the right time and direction using the strategy tester on any currency pair.

I created it to see if a time-based strategy could work.

Please note that this EA does not account for spread variations, which can be significantly higher during off-trading hours, weekends, or market openings. The execution time you select should consider typical spread conditions for your broker and instrument.

Optimization Recommended: Use MT5 Strategy Tester to find optimal parameters for your trading style and market conditions.

Key Features

⏰ Precision Timing

-

Executes trades at exact user-defined time (e.g., 10:00 AM daily)

-

One trade per day discipline prevents overtrading

-

Perfect for traders who want scheduled, predictable trading activity

📊 Multiple Trading Strategies

-

Buy Only Mode: Always enters long positions

-

Sell Only Mode: Always enters short positions

-

Trend Following: Trades with MA trend (buy above MA, sell below MA)

-

Counter-Trend: Trades against MA for reversals (buy below MA, sell above MA)

🛡️ Advanced Risk Management

-

Adjustable Stop Loss and Take Profit levels

-

Built-in Trailing Stop functionality

-

Option to disable SL/TP for advanced users

-

Fixed lot size with recovery system

⚙️ Technical Specifications

-

Moving Average period customization (50 default)

-

Multiple MA methods (SMA, EMA, SMMA, LWMA)

-

Various price inputs (Close, Open, High, Low, etc.)

-

Magic number identification for order management

How It Works

-

Time Activation: EA wakes up at your specified trading hour

-

Strategy Selection: Chooses direction based on your preferred mode

-

MA Analysis: When using MA strategies, calculates optimal entry point

-

Trade Execution: Opens precisely calculated position

-

Risk Management: Applies protective stops and trailing features

Spread Considerations

-

⚠️ Does not monitor or adjust for spread conditions

-

📊 Spread can significantly impact profitability during low-liquidity hours

-

🕒 Recommended to trade during high-liquidity sessions

-

💡 Test with your broker's typical spread patterns

Ideal For

-

Busy professionals who want scheduled trading during optimal hours

-

Disciplined traders seeking one-position-per-day strategy

-

Risk-averse investors preferring controlled exposure

-

Algorithmic traders wanting time-based entry systems

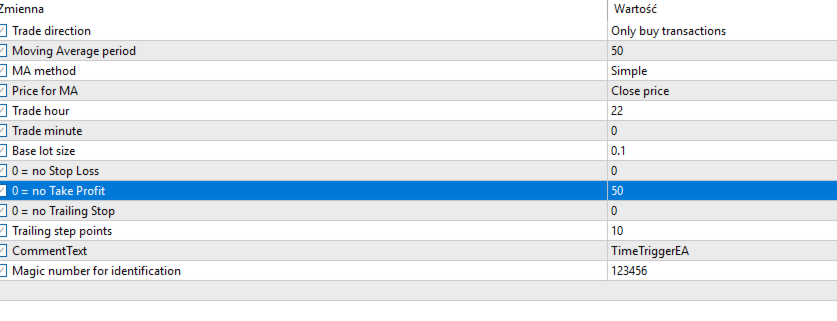

Input Parameters

-

Trade Hour/Minute: Exact execution time (24h format) - choose wisely considering spread

-

Trade Direction: Choose from 4 trading approaches

-

MA Settings: Customize period, method, and price source

-

Risk Management: SL, TP, Trailing Stop, and step settings

-

Lot Size: Fixed position sizing