Reversal Detection Ea

- Experts

- Nguyen Van Kien

- Versione: 1.23

- Attivazioni: 5

REVERSAL DETECTION EA v1.2 - PROFESSIONAL MARKET REVERSAL TRADING SYSTEM

CAPTURE MARKET TURNING POINTS WITH PRECISION AND CONFIDENCE

In the dynamic world of financial markets, identifying reversal points before they fully develop can be the difference between consistent profitability and missed opportunities. The Reversal Detection EA v1.2 represents a sophisticated algorithmic trading solution engineered to detect, confirm, and execute trades at critical market reversal zones with institutional-grade precision.

Built on advanced ZigZag reversal detection methodology combined with multi-timeframe EMA trend confirmation, this Expert Advisor delivers a complete automated trading framework that adapts to varying market conditions while maintaining strict risk management protocols. Whether you trade Forex pairs, cryptocurrencies, indices, or commodities, the Reversal Detection EA provides the intelligent automation needed to capitalize on market swings with calculated precision.

CORE TRADING METHODOLOGY - THE SCIENCE BEHIND THE SIGNALS

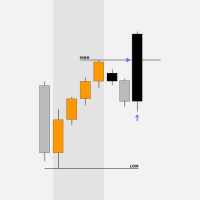

The Reversal Detection EA employs a sophisticated multi-layered signal generation system that combines classical technical analysis with modern algorithmic refinement. At its foundation lies an advanced ZigZag reversal detection engine that identifies genuine market pivots while filtering out insignificant price noise.

The system operates through a dual-pivot tracking mechanism that monitors both actual price extremes and smoothed reversal points. This sophisticated approach ensures that detected reversals represent meaningful market structure changes rather than temporary fluctuations. The algorithm continuously evaluates price action using configurable calculation methods - either Average-based smoothing or High/Low extremes - allowing traders to optimize the detection mechanism for their specific trading instruments and market environments.

Signal confirmation occurs through a rigorous multi-factor validation process. First, the system identifies a potential reversal using percentage-based, absolute value, or ATR-multiplier thresholds. These adaptive thresholds automatically adjust to current market volatility, ensuring consistent performance across different trading conditions. Once a preliminary reversal is detected, the EA applies an optional confirmation bar requirement, demanding that the reversal structure persists for a specified number of candles before signal generation.

The triple EMA trend filter adds an additional layer of robustness to the trading logic. The system employs three exponential moving averages with periods of 9, 14, and 21 bars by default. Buy signals are only generated when all three EMAs align in bullish formation with EMA9 above EMA14 and EMA14 above EMA21, indicating strong upward momentum. Conversely, sell signals require bearish EMA alignment. This trend confirmation mechanism significantly reduces false signals during choppy or ranging market conditions.

One of the most powerful features of this EA is its real-time signal detection capability. Unlike many trading systems that only evaluate conditions at bar close, the Reversal Detection EA can process signals as they develop within the current candle when the Real-time Signal Detection parameter is enabled. This feature provides traders with earlier entry opportunities and improved risk-reward ratios by capturing reversals closer to their actual turning points.

ADAPTIVE SENSITIVITY SYSTEM - TAILORED TO YOUR TRADING STYLE

Market conditions vary dramatically across different instruments and timeframes. A sensitivity level appropriate for scalping EUR/USD on M5 may generate excessive signals when applied to daily Bitcoin charts. The Reversal Detection EA addresses this challenge through its comprehensive sensitivity preset system.

The EA offers five predefined sensitivity levels plus a custom configuration option. Very High sensitivity employs an ATR multiplier of 0.8 and a percentage threshold of 0.02, making it ideal for active traders seeking frequent signals on liquid instruments with tight spreads. This setting excels in range-bound markets where smaller reversals present profitable opportunities.

High sensitivity increases the ATR multiplier to 1.2 and percentage threshold to 0.03, striking a balance between signal frequency and quality. This preset works well for intraday trading on major currency pairs and popular cryptocurrencies, providing regular trading opportunities while maintaining reasonable signal accuracy.

Medium sensitivity represents the default balanced configuration with an ATR multiplier of 2.0 and percentage threshold of 0.05. This setting suits most traders and market conditions, offering a solid foundation for swing trading strategies on 4-hour and daily timeframes. The medium preset filters out minor fluctuations while capturing significant trend reversals.

Low sensitivity raises the bar with an ATR multiplier of 2.8 and percentage threshold of 0.06, reducing signal frequency in favor of higher-quality setups. This configuration performs optimally on daily and weekly charts where major trend reversals occur less frequently but offer substantial profit potential.

Very Low sensitivity implements the most conservative parameters with an ATR multiplier of 3.5 and percentage threshold of 0.08. This setting is purpose-built for long-term position trading and volatile instruments where only the most significant reversals warrant attention.

For advanced users who require precise control over detection parameters, the Custom sensitivity option unlocks manual configuration of all threshold values. This flexibility enables sophisticated optimization workflows using historical backtesting data and forward testing validation.

INSTITUTIONAL-GRADE MONEY MANAGEMENT - PROTECT YOUR CAPITAL

Risk management separates consistently profitable traders from those who eventually face account depletion. The Reversal Detection EA incorporates multiple position sizing methodologies that align with professional risk management principles.

Fixed Lot Mode provides the simplest approach, opening every trade with a predetermined lot size specified by the user. While straightforward, this method is best suited for experienced traders with stable account balances who understand their maximum acceptable risk per trade.

Risk Percentage Mode represents the gold standard of position sizing used by professional traders worldwide. This method calculates lot size based on a fixed percentage of account equity risked per trade. For example, with a 2 percent risk setting and a 50-pip stop loss, the EA automatically calculates the precise lot size that ensures maximum loss from the trade equals exactly 2 percent of current account balance. As the account grows, position sizes scale proportionally, creating a compounding growth effect.

Balance Percentage Mode allocates a fixed percentage of account balance to each trade's notional value. This approach differs from risk percentage by focusing on position size relative to total capital rather than potential loss. A 5 percent balance allocation means the trade's face value equals 5 percent of account equity.

Fixed Risk Amount Mode enables traders to specify an absolute dollar amount they are willing to risk per trade regardless of account size. This approach provides psychological comfort for traders who prefer concrete risk figures over percentage-based calculations. The EA automatically adjusts lot size to ensure the stop loss distance corresponds to the specified monetary risk.

For cryptocurrency trading and brokers with specific minimum lot requirements, the EA includes a Min Lot Multiplier parameter. When the calculated lot size falls below the broker's minimum, the system can automatically apply a multiplier to meet minimum requirements while keeping the trader informed of the adjusted risk level.

DYNAMIC RISK CONTROL - ATR-BASED STOP LOSS AND TAKE PROFIT

Static pip-based stop losses fail to account for changing market volatility. A 50-pip stop that provides adequate protection during calm trading hours may prove insufficient during high-volatility news releases. The Reversal Detection EA solves this problem through ATR-based dynamic stop loss placement.

The Average True Range indicator measures current market volatility by analyzing the range of recent price bars. By applying a configurable multiplier to the ATR value, the EA sets stop losses that adapt to prevailing market conditions. During low volatility periods, stops tighten to protect against small adverse moves. When volatility expands, stops widen proportionally to avoid premature exit from valid setups.

The default stop loss ATR multiplier of 1.5 provides balanced protection for most trading scenarios. Conservative traders may increase this value to 2.0 or 2.5 to reduce the likelihood of stop-out during temporary price spikes. Aggressive traders might reduce it to 1.0 or 1.2 to tighten risk control and improve risk-reward ratios on highly confident setups.

For traders who prefer traditional fixed pip stops or trade instruments where ATR-based calculation proves suboptimal, the EA offers a Fixed SL Pips parameter that becomes active when ATR-based stop loss is disabled.

Take profit calculation employs a risk-reward ratio approach that ensures winning trades deliver returns proportional to risked capital. The default 2.0 take profit ratio means that for every dollar risked via the stop loss, the EA targets two dollars in profit. This 1:2 risk-reward structure ensures profitability even with a win rate below 50 percent.

BREAKEVEN AND TRAILING STOP - LOCK IN PROFITS AUTOMATICALLY

Open trades represent unrealized potential until closed. Market conditions change rapidly, and profitable positions can quickly reverse into losses. The Reversal Detection EA features intelligent position management tools that progressively reduce risk and lock in gains as trades move favorably.

The breakeven function automatically moves the stop loss to the entry price plus a small buffer once the trade reaches a specified profit level. By default, this occurs when the trade achieves a 1.0 risk-reward ratio - meaning the profit equals the initial risk amount. At this point, the EA adjusts the stop loss to entry price plus the configured Breakeven Plus pips value. This ensures that even if the market reverses, the trade closes at worst with a small profit or minimal loss rather than the full stop loss amount.

Trailing stop functionality takes profit protection a step further by progressively moving the stop loss as the trade continues in the profitable direction. The system activates trailing once the position reaches the specified Start Trailing at R:R parameter, defaulting to 1.5. From this point forward, the EA monitors price movement and advances the stop loss in increments defined by the Trailing Step parameter.

For buy positions, the trailing stop follows price upward while maintaining the configured distance. If price retraces, the stop loss remains at its highest achieved level rather than moving back down. This mechanism locks in progressively larger profits while allowing the trend to continue developing.

INTELLIGENT SPREAD FILTERING - OPTIMIZE EXECUTION COSTS

Transaction costs directly impact trading profitability. Wide spreads erode potential profits and can transform winning strategies into marginal or losing systems. The Reversal Detection EA incorporates sophisticated spread filtering to ensure trades only execute under favorable cost conditions.

The Auto Spread Filter represents the recommended approach for most trading scenarios. This intelligent system calculates maximum acceptable spread as a percentage of current ask price. The default 0.5 percent threshold adapts automatically to different instruments and their typical price levels. For a currency pair trading at 1.10000, the system permits a spread up to 55 pips. For Bitcoin at 50000, the acceptable spread scales to 250 price units. This percentage-based approach ensures consistent cost control across diverse instruments without requiring manual adjustment.

When spread exceeds the threshold, the EA delays trade execution until conditions improve. This patience prevents costly entries during illiquid periods or market volatility spikes. The system logs spread violations in debug mode, enabling traders to identify problematic trading times and potentially adjust their time filter settings.

PRECISION TIME FILTERING - TRADE YOUR OPTIMAL SESSIONS

Market behavior varies significantly across trading sessions. The Asian session often exhibits lower volatility and tighter ranges compared to the explosive price action during London-New York overlap. News releases, economic announcements, and institutional trading flows create distinct characteristics for different time periods.

The Reversal Detection EA includes comprehensive time filtering that enables traders to restrict trading activity to specific hours. This functionality serves multiple strategic purposes. Traders employing session-specific strategies can limit operations to their targeted timeframes. Those wishing to avoid news volatility can exclude trading during scheduled announcement times. Traders concerned about overnight exposure can prevent new positions from opening during sleeping hours.

Time filter configuration accepts start and end times specified in hours and minutes based on the broker server time. The system handles overnight periods correctly, supporting scenarios like 22:00 to 06:00 for traders wanting to avoid Asian session activity.

COMPREHENSIVE POSITION MANAGEMENT - MAINTAIN TRADING DISCIPLINE

Successful trading requires consistent adherence to predefined rules. Emotional decision-making and rule violations destroy more accounts than flawed strategies. The Reversal Detection EA enforces disciplined position management through multiple configurable controls.

The One Trade Per Signal parameter prevents duplicate entries from the same reversal pattern. Without this protection, real-time signal detection could potentially trigger multiple orders as price oscillates around a reversal zone. Enabling this setting ensures each distinct reversal generates a maximum of one trade in each direction.

Close Opposite Trades functionality automatically exits positions in one direction when a reversal signal triggers in the opposite direction. For example, if the EA holds an active buy position and generates a sell signal, the system closes the long position before opening the new short position. This prevents hedging and ensures capital is always allocated in alignment with current market analysis.

Max Concurrent Positions limits the total number of simultaneous trades the EA can maintain. Conservative traders may set this to 1, ensuring focused exposure and simplified risk management. More aggressive approaches might allow 3 to 5 concurrent positions. This control prevents overexposure and maintains portfolio risk within acceptable bounds.

MULTI-ASSET COMPATIBILITY - FROM FOREX TO CRYPTOCURRENCIES

Financial markets span diverse instrument classes with vastly different price structures and trading mechanics. The Reversal Detection EA was engineered from the ground up for true multi-asset compatibility.

The system automatically detects symbol type and adjusts its calculations accordingly. For cryptocurrency pairs like BTCUSD where prices range in thousands and lot sizes may use unusual decimal precision, the EA's flexible lot calculation engine accommodates broker-specific requirements. The percentage-based spread filter adapts to wildly different price levels, ensuring consistent cost control whether trading EUR/USD at 1.10 or Bitcoin at 50000.

Symbol point value detection ensures accurate pip calculation across three-digit, five-digit, and non-standard quotation instruments. ATR-based calculations scale correctly regardless of price magnitude or decimal places, delivering consistent volatility-adjusted risk management.

This universal compatibility eliminates the need for separate EA versions for different asset classes. A single installation serves the complete trading portfolio from major currency pairs to exotic crosses, from gold to oil, from indices to cryptocurrencies.

ALERT SYSTEM - STAY INFORMED WITHOUT CONSTANT MONITORING

Automated trading offers freedom from screen time, but traders still want awareness of trading activity. The Reversal Detection EA includes a comprehensive alert system that keeps users informed of important events.

Push notifications deliver instant alerts to the MetaTrader mobile app when signals trigger and trades execute. This real-time connectivity enables traders to monitor EA activity from anywhere without maintaining open platform access. Whether in meetings, commuting, or enjoying leisure time, traders receive immediate notification of new positions.

Sound alerts provide audio feedback for traders who keep the platform running but may not actively watch charts. Configurable sound files enable customization of alert tones to suit personal preferences.

DEBUG MODE AND PERFORMANCE TRACKING - TRANSPARENCY AND OPTIMIZATION

Understanding EA behavior is essential for strategy validation and performance optimization. The Reversal Detection EA features extensive debug logging that provides unprecedented transparency into decision-making processes.

When debug mode is enabled, the system generates detailed log entries documenting signal detection, filter application, position sizing calculations, and execution results. Traders can review exactly why specific signals were accepted or rejected, trace the logic behind lot size determination, and verify that all risk management rules applied correctly.

The built-in statistics tracking system maintains running totals of trades executed, wins, losses, and win rate. This real-time performance monitoring enables quick assessment of strategy effectiveness under current market conditions.

INSTALLATION AND GETTING STARTED

Deploying the Reversal Detection EA requires only a few simple steps. Copy the EA file to your MetaTrader 5 platform's Experts directory, typically located at MQL5/Experts within your data folder. Restart the platform or refresh the Navigator window to load the EA.

Attach the EA to your desired chart by dragging from the Navigator window onto the chart. The input parameters dialog appears automatically. For initial testing, maintain default settings with the following adjustments: set InpDebugMode to true for detailed logging, reduce InpRiskPercent to 0.5 or 1.0 for conservative testing, and verify InpMagicNumber is unique if running multiple EAs.

Monitor the first several signals closely through debug logs and chart visualization. Verify that entry prices align with detected reversal zones, stop losses place at logical distances, and take profits target reasonable objectives. After confirming proper operation on demo account with satisfactory results over at least 50 trades, consider transitioning to live trading with minimal risk settings.

RISK DISCLOSURE AND TRADING CONSIDERATIONS

Automated trading systems including the Reversal Detection EA do not guarantee profits and involve substantial risk of loss. Past performance in backtesting or forward testing does not ensure future results. Market conditions change continuously and strategies that performed well historically may underperform in current environments.

Users must thoroughly understand all EA parameters and their implications before deploying in live trading. Start with conservative risk settings on demo accounts and only transition to live trading after verified positive results over statistically significant sample sizes.

Leverage amplifies both gains and losses. Ensure position sizing aligns with personal risk tolerance and never risk capital you cannot afford to lose. Maintain adequate account capitalization to withstand normal drawdown periods without emotional decision-making.

CONCLUSION - INTELLIGENT AUTOMATION FOR MODERN TRADERS

The Reversal Detection EA v1.2 represents a sophisticated fusion of proven technical analysis principles and modern algorithmic execution. By combining ZigZag reversal detection with EMA trend confirmation and ATR-based risk management, the system identifies high-probability trading opportunities while maintaining strict capital protection protocols.

Real-time signal processing, adaptive sensitivity presets, and flexible money management modes provide the customization needed to match diverse trading styles and instrument characteristics. Comprehensive position management rules enforce disciplined trade execution without requiring constant manual oversight.

Whether you trade Forex pairs, cryptocurrencies, or indices, the Reversal Detection EA delivers institutional-grade automation accessible to retail traders. The combination of powerful features and intuitive configuration creates a professional trading tool suitable for both experienced algorithmic traders and those new to automated systems.

Success in trading requires the right combination of robust strategy, disciplined execution, and appropriate risk management. The Reversal Detection EA provides all three elements in a single, comprehensive package. Combined with proper testing, realistic expectations, and ongoing performance monitoring, this Expert Advisor can become a valuable component of a diversified trading approach.

Download the Reversal Detection EA today and experience the power of intelligent, automated reversal trading.