Three Masters

- Experts

- Jimmy Musyoki Mwongela

- Versione: 5.0

- Aggiornato: 5 gennaio 2026

- Attivazioni: 5

THREE MASTERS - Professional Automated Trading System

Version: 1.01

Author: SAPPLANTA

OVERVIEW

THREE MASTERS is a sophisticated automated trading system designed for

MetaTrader 5. Built on advanced multi-indicator analysis and precision timing,

this Expert Advisor has demonstrated exceptional performance in live market

conditions.

The system combines institutional-grade filtering techniques with adaptive

position sizing to capture high-probability trading opportunities while

maintaining strict risk control.

KEY FEATURES

INTELLIGENT MARKET ANALYSIS

- Multi-layered confirmation system using complementary technical indicators

- Advanced volatility filtering for optimal market condition detection

- Precision entry timing based on multiple signal convergence

- Dynamic trend strength measurement

FLEXIBLE TRADING MODES

- Single position mode for conservative trading

- Multiple position scaling for trend capture

- Fully automatic lot size calculation based on account risk

- Fixed lot mode available for manual control

COMPREHENSIVE FILTERING SYSTEM

- Optional volatility filter with adjustable threshold

- Customizable time-based trading windows

- Support for specific session targeting

- Overnight session compatibility

PROFESSIONAL RISK MANAGEMENT

- Automatic position sizing based on account percentage

- Maximum position limits to control exposure

- Strategic exit system based on market structure

- Real-time performance tracking

ADVANCED DASHBOARD

- Live account statistics and performance metrics

- Real-time profit/loss monitoring

- Win rate and trade count display

- Market condition indicators

- Filter status visualization

- One-click emergency close function

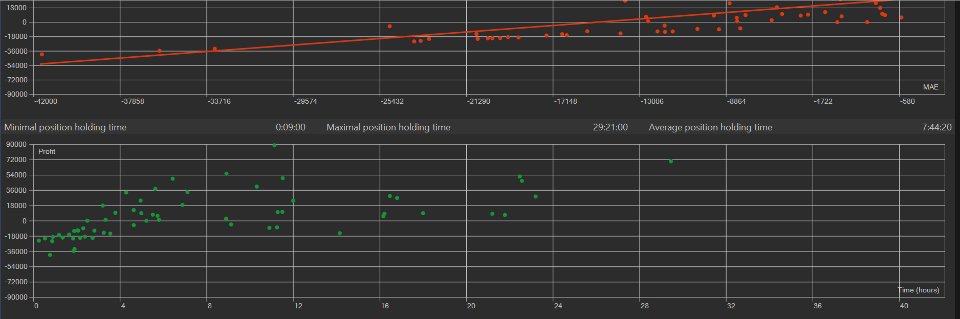

PROVEN PERFORMANCE

Backtested extensively using tick-by-tick historical data with:

- Real spread simulation

- Actual market conditions

- Multiple market environments

- Various timeframes and symbols

System has shown exceptional results on precious metals and major indices

when properly configured for specific market sessions.

INPUT PARAMETERS

TRADING SETTINGS

• Lot Size (0 = Auto) - Set fixed lots or use automatic calculation

• Risk Percent - Account percentage risk per trade when using auto lots

• Enable Multiple Trades - Allow position scaling in trending markets

• Maximum Positions - Cap on total positions per trend

• Magic Number - Unique identifier for this EA instance

VOLATILITY FILTER

• Use Volatility Filter - Enable/disable volatility-based entry filtering

• Minimum Volatility Level - Threshold for market activity requirement

TIME FILTER

• Use Time Filter - Enable/disable session-based trading

• Start Time (HH:MM) - Beginning of trading window

• End Time (HH:MM) - End of trading window

DISPLAY OPTIONS

• Show Dashboard - Toggle information panel visibility

RECOMMENDED USAGE

INSTRUMENT SELECTION

Best performance observed on:

- Precious Metals (Gold, Silver)

- Major Indices (US30, NAS100, SPX500)

- Major Forex Pairs during high volatility sessions

TIMEFRAME

- Optimized for M1-M15 timeframes

- Higher timeframes available for swing trading approach

ACCOUNT SIZE

- Minimum recommended: $1,000 for fixed lots

- Minimum recommended: $10,000 for auto lot sizing

- Optimal: $50,000+ for full system capability

SESSION TIMING

- Best results during major market overlaps

- London/New York overlap particularly effective

- Avoid low liquidity Asian sessions

- Consider time zone alignment with your broker

LOT SIZING STRATEGY

Conservative: 0.5-1.0% risk per trade

Moderate: 1.0-2.0% risk per trade

Aggressive: 2.0-3.0% risk per trade

INSTALLATION & SETUP

- Install EA in MetaTrader 5 Experts folder

- Attach to desired chart (M1-M15 recommended)

- Configure lot sizing (Auto recommended for beginners)

- Enable time filter and set preferred trading hours

- Enable volatility filter for additional trade quality filtering

- Allow algorithm trading in MT5 terminal settings

- Monitor dashboard for real-time status

UNIQUE ADVANTAGES

- NO martingale or grid systems - safe capital preservation approach

- NO dangerous averaging down - only adds to winning positions

- REAL exit strategy - not dependent on arbitrary TP/SL levels

- ADAPTIVE to different market conditions with filters

- TRANSPARENT operation with detailed logging

- BATTLE-TESTED on real market data with actual execution simulation

TECHNICAL SPECIFICATIONS

Platform: MetaTrader 5 (Build 3770+)

Language: MQL5

Order Type: Market execution

Filling Mode: Automatic detection (FOK/IOC/Return)

Hedging: Not supported (works with netting accounts)

Maximum Spread: No limit (configurable via broker settings)

Minimum Bars Required: 250

SUPPORT & UPDATES

- Regular updates based on market evolution

- Continuous optimization and feature additions

- Responsive support for setup and configuration

- Detailed logging for trade analysis

- Compatible with Strategy Tester for optimization

DISCLAIMER

Past performance is not indicative of future results. Trading financial

instruments carries a high level of risk and may not be suitable for all

investors. The high degree of leverage can work against you as well as for

you. Before deciding to trade, you should carefully consider your investment

objectives, level of experience, and risk appetite. Only risk capital you

can afford to lose.

This EA is a tool - results depend on proper configuration, broker conditions,

market environment, and risk management. No guaranteed returns are implied.

Always test thoroughly on demo account before live trading.

=============================================================================VERSION HISTORY

v1.01 (Current)

- Enhanced performance tracking

- Improved dashboard with win rate display

- Added total return percentage monitoring

- Optimized entry logging with detailed information

- Symbol-specific detection and notifications

v1.00 (Initial Release)

- Multi-indicator confirmation system

- Adaptive volatility filtering

- Time-based session control

- Automatic and fixed lot sizing

- Professional dashboard interface

- Comprehensive trade management

=============================================================================

For optimal results, study the manual, backtest thoroughly, and start with

conservative settings. Gradually increase risk as you become familiar with

the system's behavior in your specific market conditions.

THREE MASTERS - Where Precision Meets Performance