Adaptive RSI Signals

- Indicatori

- Alberto Boada

- Versione: 1.0

Powered by SVX Strategies Quant Team

This is the full implementation of our "Self-Adaptive Trading Rules." It combines Market Structure (Dynamic Support & Resistance) with Adaptive RSI intelligence to generate high-probability buy and sell signals.

Want this strategy fully automated?

Manual execution requires constant screen time. If you prefer to have our team manage the execution for you, copy our official algorithms:

THE STRATEGY LOGIC

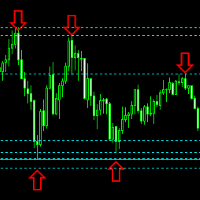

The indicator hunts for specific extreme scenarios: Price breaks a key support/resistance level from previous days, BUT the RSI simultaneously hits a dynamically calculated extreme deviation.

This confluence signals a high probability of a "False Breakout" or Mean Reversion, offering entries with excellent Risk/Reward ratios.

Key Features:

- Visual Signals: Clear Blue (Buy) and Red (Sell) arrows.

- Double Confirmation: Requires both a price structure breakout AND volatility confirmation.

- Total Adaptability: RSI levels are calculated in real-time based on market volatility, not fixed 70/30 levels.

- Multi-Timeframe Structure: Analyzes higher timeframe levels (e.g., Daily) while trading lower frames (e.g., M15).

Ideal For:

- Mean Reversion Traders.

- False Breakout Operators.

- Traders seeking precise, filtered entries.

SVX Strategies | Chief Investment Officer: Alberto Boada

Disclaimer: Educational tool. Past performance does not guarantee future results.