Raptor Bot

- Experts

- Casey Nkalubo

- Versione: 1.0

- Attivazioni: 6

Product Description

Raptor EA is an algorithmic trading solution designed for scalping in financial markets. The system combines technical indicators with optional machine learning components to identify trading opportunities while implementing risk management controls.

This Expert Advisor has been developed for ECN accounts and is suitable for traders seeking automated execution with structured risk management. The system provides tools and safeguards for both experienced traders and those learning automated trading strategies.

Key Features

Multi-Asset Compatibility: Functions across forex pairs including EURUSD, GBPUSD and commodities including XAUUSD, BTCUSD Scalping Design: Structured for short-term trades on lower timeframes Risk Management: Includes daily limits, circuit breakers, and position sizing controls

ML Component: Optional filtering for signal validation Testing Status: Completed MT5 Marketplace automated testing across multiple symbols and timeframes User Setup: Parameter configuration with documentation and support

System Overview

Testing Background

Raptor EA has completed the MT5 Marketplace validation process. This process involves automated testing across multiple symbols, timeframes, and market conditions. The validation process tests whether the EA can function in various market scenarios.

Risk Management Features

The system includes several risk management components designed to protect trading capital:

- Circuit breaker system that pauses trading after consecutive losses

- Daily loss limits that halt trading when reached

- Position sizing based on account equity

- Breakeven and trailing stop mechanisms

- Spread and news filters to avoid certain market conditions

System Transparency

The EA provides information about its methodology. Users can review how trading decisions are made, adjust parameters based on their preferences, and observe the system's approach to market analysis.

Trading Methodology

Core Approach

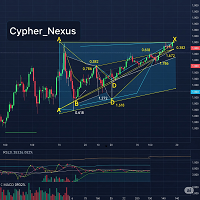

Raptor EA uses a methodology that combines momentum analysis with volatility assessment to identify entry signals. The system adapts to current market conditions using:

- Real-time momentum analysis through RSI indicators

- Volatility measurement using Average True Range (ATR)

- Optional machine learning validation for signal confirmation

- Risk adjustment based on current market conditions

Operation Process

The EA monitors the chosen timeframe and enters positions when confirmation criteria are met. The process includes:

- Market Scanning: Analyzes price action and volatility

- Signal Generation: Identifies potential entry opportunities using technical indicators

- ML Validation: Optional layer validates signals

- Risk Assessment: Calculates position size and stop levels

- Trade Execution: Places orders when criteria are satisfied

- Trade Management: Manages exits through targets, trailing stops, or protective measures

System Design Features

The EA addresses common trading challenges through:

- Entry criteria that filter trading opportunities

- Risk management where position sizes and stops adjust to current volatility

- Multiple protection layers

- Market condition assessment that affects trading decisions

Parameter Configuration

Understanding these parameters is important for configuring Raptor EA for specific trading requirements. Each parameter has been selected based on testing and market experience.

Trading Strategy Parameters

RiskPerTrade (Default: 0.3) Controls what percentage of account equity is risked on each trade. Conservative setting of 0.3% can be adjusted based on user preferences and account size.

RSIPeriod (Default: 14) Period for momentum calculation. The default 14 functions with most currency pairs and timeframes. Shorter periods (10-12) increase system sensitivity, while longer periods (16-20) make it more conservative.

ATRPeriod (Default: 14) Used for volatility measurement. Recommended to align with RSIPeriod for consistency. This value affects how the EA adapts to changing market volatility.

RSIOverbought / RSIOversold (Default: 75/25) Define momentum thresholds for trade entries. Higher overbought levels (70-80) and lower oversold levels (20-30) create more selective trading.

ATR Multipliers These parameters control trade management:

- ATRSlMultiplier (2.5): Controls stop-loss distance

- ATRTpMultiplier (4.0): Sets take-profit targets

- ATRBreakevenMultiplier (1.5): Triggers breakeven protection after favorable moves

- ATRTrailingMultiplier (1.0): Distance for trailing stops

- ATRTrailingTriggerMultiplier (2.0): Profit threshold to activate trailing

Machine Learning Settings

MLConfidenceThreshold (Default: 0.501) Minimum confidence level required for trade validation. Higher values (0.6-0.7) create more selective trading. The embedded model has been optimized for XAUUSD patterns.

UseMlFilter (Default: true) Enables machine learning signal confirmation. Recommended for XAUUSD trading. Can be tested with other symbols.

Risk Management Parameters

MaxDailyLossPct (Default: 5.0) The EA stops trading for the day if losses reach this percentage. Can be set between 2-5% based on account size preferences.

DailyProfitTargetPct (Default: 3.0) When daily profits reach this level, the EA stops trading. This helps prevent giving back profits due to overtrading.

CooldownAfterLossMinutes (Default: 60) Pause period after losing trades. This increases with consecutive losses.

Circuit Breaker Settings

- UseCircuitBreaker: Recommended to keep enabled

- MaxConsecutiveLosses (3): Stops trading after consecutive losses

- CooldownIncreaseMinutes (60): Additional cooldown time per loss

Trading Time Controls

AvoidOvernight (Default: true) Prevents holding positions overnight. Recommended for scalping strategies.

TradingStartHour / TradingEndHour (Default: 8/21) Defines active trading hours in broker time. Can be aligned with major session overlaps.

WeekendTrading (Default: false) Controls weekend trading when spreads may be wider and liquidity lower.

News and Market Filters

UseNewsFilter (Default: true) Avoids trading around high-impact news events.

NewsBufferMinutes (Default: 30) Creates a trading pause before and after news events.

MaxSpreadPips (Default: 150.0) Prevents trading when spreads exceed this threshold. Can be adjusted based on broker spreads.

Asset Configuration Recommendations

Gold (XAUUSD)

The embedded ML model has been trained on gold patterns:

- Timeframe: M1 to M5

- RiskPerTrade: 0.3-0.5%

- UseMlFilter: Recommended

- Sessions: London and New York overlap periods

- ATR Multipliers: Default settings or adjusted for volatility

Forex Majors (EURUSD, GBPUSD, USDJPY)

These pairs can work with standard settings:

- Timeframe: M1 to M5

- RiskPerTrade: 0.3-0.7%

- UseMlFilter: Can be tested enabled and disabled

- Focus on major session overlaps

Cryptocurrencies (BTCUSD)

Crypto trading requires consideration of volatility:

- Timeframe: M1 recommended

- RiskPerTrade: 0.2-0.4% (adjusted for volatility)

- UseMlFilter: Often disabled

- Monitor spreads regularly

Installation and Setup

Prerequisites

Before installing Raptor EA, ensure the following requirements:

- MT5 Platform: Download from a reputable broker

- Account Type: ECN or low-spread account recommended for scalping

- Minimum Capital: $500 for cent accounts, $5000 for standard accounts

- Internet Connection: Stable connection for consistent execution

- VPS: Recommended for continuous operation

Installation Steps

Download and Install

- Purchase Raptor EA from the MT5 Marketplace

- File downloads automatically to Experts folder

- Restart MT5 to ensure proper loading

Initial Configuration

- Open chart for chosen symbol

- Right-click and select Expert Advisors

- Find Raptor EA and attach to chart

- Enable AutoTrading

- Allow DLL imports if using news filter

Parameter Setup

- Start with default parameters

- Adjust RiskPerTrade based on account size

- Configure trading hours for timezone

- Set appropriate daily limits

Demo Testing Phase

- Run on demo account for at least one week

- Monitor dashboard for statistics

- Verify trades align with expectations

- Document performance metrics

Setup Checklist

- MT5 platform updated to latest version

- AutoTrading enabled in platform settings

- Raptor EA properly installed and visible

- Demo account with adequate virtual balance

- Parameters configured according to recommendations

- Trading hours set correctly for timezone

- News filter enabled and tested

- Dashboard displaying correctly

Performance Configuration

Configuration Approaches

Conservative Approach

- RiskPerTrade: 0.2%

- MaxConsecutiveLosses: 2

- DailyProfitTargetPct: 2.0%

- Higher ATR multipliers for wider stops

Balanced Approach

- Use default settings

- Monitor for 2-3 weeks

- Make gradual adjustments based on performance

Active Approach (Experienced Users)

- RiskPerTrade: 0.5-0.7%

- Lower ML confidence threshold

- Extended trading hours

- Higher daily profit targets

Configuration Notes

- Avoid over-optimization based on limited data

- Keep safety features enabled

- Test parameters that worked in backtests in live conditions

- Make changes gradually

- Consider spread and slippage in backtests

Troubleshooting

No Trades Being Placed

Possible Causes:

- Spreads exceed MaxSpreadPips setting

- News filter active during events

- ML filter confidence threshold too high

- Trading outside configured hours

Solutions:

- Monitor spread conditions during trading hours

- Temporarily disable news filter to test

- Lower ML confidence threshold

- Verify trading hours match broker time

Frequent Stop-Outs

Possible Causes:

- ATR multipliers too tight for current volatility

- Broker execution issues

- High slippage environment

Solutions:

- Increase stop-loss multipliers

- Test with different broker if execution is poor

- Use ECN account for better pricing

ML Filter Blocking Trades

Possible Causes:

- Model not optimized for chosen symbol

- Confidence threshold too high

- Market conditions outside training data

Solutions:

- Test with UseMlFilter disabled

- Consider XAUUSD for ML performance

Performance Issues

Possible Causes:

- Suboptimal symbol/timeframe combination

- Market conditions

- Parameter settings

- Broker execution issues

Solutions:

- Test multiple symbols and timeframes

- Review market conditions and volatility

- Return to default parameters and adjust gradually

- Consider different brokers

Risk Management

Risk Factors

Trading with automated systems involves risks that users should understand:

Market Risk: Volatility spikes can cause larger losses than expected, even with stops in place.

Technical Risk: Platform failures, internet disconnections, or broker issues can affect trade execution.

Model Risk: The machine learning component may perform differently during various market conditions.

Execution Risk: Slippage and requotes can impact actual versus expected results.

Safety Features

Raptor EA includes multiple protection layers:

- Daily Loss Limits: Stops trading when daily losses reach threshold

- Circuit Breakers: Pauses trading after consecutive losses

- Position Size Controls: Limits risk per trade based on account equity

- Spread Filters: Avoids trading during poor market conditions

- News Avoidance: Prevents trading around high-impact events

- Time Filters: Restricts trading to configured market hours

Trading Practices

Risk Management: Trade only with money you can afford to lose. Automated trading does not provide income certainty.

Gradual Scaling: Begin with minimum position sizes and increase only after observing consistent performance.

Regular Monitoring: Automated systems require supervision. Check performance daily and be ready to intervene if needed.

Safety Features: Keep circuit breakers, daily limits, and other protective features enabled.

Diversification: Avoid putting all trading capital on one EA or strategy. Diversification helps manage overall risk.

Market Awareness: Stay informed about market news and economic events that might affect trading instruments.

Getting Started

Week 1: Demo Testing

- Install Raptor EA on demo account

- Use default parameters with preferred symbol

- Monitor performance and familiarize with dashboard

- Document all trades and outcomes

Week 2: Parameter Adjustment

- Analyze demo results from week 1

- Make conservative adjustments to parameters

- Focus on risk settings and trading hours

- Continue demo trading with new settings

Week 3: Live Preparation

- If demo results are satisfactory, prepare for live trading

- Start with minimum account size ($500 cent account)

- Use conservative risk settings

- Set up proper monitoring and alerts

Week 4 and Beyond: Live Trading

- Begin live trading with caution

- Monitor every trade closely for the first week

- Compare live results to demo performance

- Make gradual adjustments based on real market conditions

User Checklist

- Open demo account with recommended broker

- Install and configure Raptor EA

- Set RiskPerTrade to 0.2% for initial testing

- Enable all safety features

- Run for one full week without changes

- Document and analyze results

- Make conservative adjustments if needed

- Consider live trading only after consistent demo performance

Support and Resources

Getting Help

Support is available for Raptor EA users:

Direct Support: Email kuntahkays@gmail.com for technical issues, parameter questions, or general guidance. Response time is typically within 24-48 hours.

WhatsApp Support: Contact +256_727337989 for immediate assistance.

Documentation: This guide covers most scenarios, but additional questions are welcome.

Updates: Updates are provided through the MT5 Marketplace. Users are notified when updates become available.

Community: Connect with other Raptor EA users through MT5 forums and trading communities.

Additional Resources

- MT5 User Guide for platform-specific questions

- MQL5 documentation for users wanting to understand the code

- Economic calendars for news awareness

- Broker comparison guides for execution quality

What Is Included

- Complete Raptor EA system

- This comprehensive documentation

- Updates through MT5 Marketplace

- Email and WhatsApp support

- Access to optimization guides

- Parameter recommendation updates

System Features

Transparency

Raptor EA provides information about its methodology. Users can review how trades are selected, managed, and closed. This transparency allows users to:

- Make informed decisions about parameters

- Understand why certain trades were taken

- Learn from the EA's approach to market analysis

- Modify settings based on risk tolerance

Educational Component

Raptor EA functions as both a trading tool and learning platform. By observing its decision-making process, users can gain insights into:

- Risk management techniques

- Market timing and entry selection

- The importance of multiple confirmation signals

- Professional approaches to scalping

Quality Focus

The EA prioritizes quality trades that meet specific criteria. This approach can lead to:

- Better risk-reward ratios

- More consistent performance

- Lower transaction costs

- Reduced trading stress

Continuous Development

The Raptor EA system continues to develop based on:

- User feedback and suggestions

- Market condition changes

- Performance analysis

- Technological advances

Updates ensure users have access to improvements without additional cost.

Considerations for Users

System Evaluation

Users considering Raptor EA should evaluate:

- Interest in transparent, educational approach to automated trading

- Value placed on risk management versus pure profit potential

- Willingness to start conservatively and optimize gradually

- Understanding that no trading system provides performance certainty

- Preparedness to monitor and learn from EA performance

Implementation Steps

- Education: Read documentation thoroughly and understand all parameters

- Demo Testing: Complete demo testing phase regardless of experience level

- Conservative Start: Begin with low risk settings and gradually increase as confidence grows

- Monitoring and Learning: Use Raptor EA as learning tool alongside trading

- Realistic Expectations: Maintain reasonable expectations and focus on consistent, long-term performance

Summary

Raptor EA represents a structured approach to automated scalping. The system has been tested and refined to provide users with tools for trading success. Combined with proper education, realistic expectations, and disciplined risk management, Raptor EA can serve as a useful tool in a trading approach.

Successful trading requires patience and discipline. Raptor EA is designed for users who understand this principle and are committed to consistent, disciplined trading approaches.

Users are encouraged to try the system on demo first, learn from its approach, and evaluate if it aligns with their trading objectives. Following the guidelines in this documentation while maintaining proper risk management can help users find Raptor EA to be a valuable trading tool.

Trading involves risk. Users should begin with demo testing, continue with careful live implementation, and see if Raptor EA meets their requirements for automated trading assistance.

Disclaimer: Trading forex, commodities, and cryptocurrencies involves substantial risk of loss and is not suitable for all investors. Past performance does not indicate future results. This EA is provided as a tool to assist in trading decisions, but all trading carries risk. Trade only with money you can afford to lose.

Contact Information: Email: kuntahkays@gmail.com WhatsApp: +256_727337989