VSA Pulse System

- Indicatori

- Paul Edunyu Carissimo

- Versione: 1.0

- Attivazioni: 5

VSA Pulse System

Stop trading shapes. Start trading Energy. The advanced VSA + Price Action logic engine.

Description:

Most indicators show you history (lag). The VSA Pulse System shows you reality (physics).

This indicator decodes the "Energy" behind every candle. It moves beyond simple "Bullish" or "Bearish" labels and identifies the intent of the Smart Money.

It answers the three most critical questions in trading:

-

Is this move real? (Power Impulse)

-

Is this a trap? (Fakeout/Churn)

-

Are we gliding? (Ease of Movement)

Key Features:

-

Zero Lag: Analyses the current bar's physics (Range, Volume, Close Location).

-

Fakeout Detection: Identifies "Slate Blue" bars where price is moving but volume is missing (Traps).

-

Churn Warning: Identifies "Gold" bars where Volume is high but Price is stuck (Reversal/Absorption).

-

Flow Logic: Distinguishes between aggressive "Power Moves" and low-volume "Trend Gliding."

-

Full Customization: All colors and thresholds are adjustable.

-

Alerts: Push notifications and Pop-ups for Power, Rejection, and Churn signals.

How it Works (The Logic):

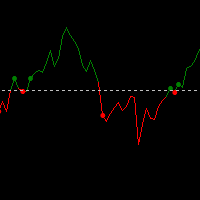

The indicator uses Volume, Range, and Price Location to categorize every bar into one of 10 states:

-

Power Impulse (Lime/Red): High Volume + Wide Range. Institutional aggression. Action: ENTER.

-

Flow/Trend (SeaGreen/IndianRed): Low Volume + Breakout. Price gliding with no resistance. Action: HOLD.

-

Churn (Gold): High Volume + Indecision. A battle is raging. Action: EXIT.

-

Rejection (Aqua/Pink): High Volume + Pinbar. Immediate reversal. Action: REVERSE.

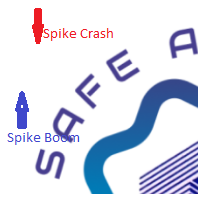

-

Fakeout (SlateBlue): Low Volume + Range (Inside Noise). A trap for retail traders. Action: IGNORE.

How to Use (Interpretation Guide)

1. The Entry Signal (Power & Rejection)

Look for Bright Lime or Bright Red bars breaking out of a consolidation. This confirms Smart Money is driving the move. Alternatively, look for Aqua (Hammer) or Pink (Shooting Star) bars at key support/resistance levels.

2. The "Hold" Signal (Flow)

If you are in a trade and see Pale Green/Pale Red bars, DO NOT CLOSE. This indicates "Ease of Movement." The price is drifting in your direction because there is no opposing pressure. Sit tight.

3. The "Danger" Signal (Churn)

If you see a Gold bar, pay attention. It means "High Effort, No Result." Someone is absorbing orders. If you are in profit, tighten your stop or take partials.

4. The "Trap" Signal (Fakeout)

If you see Slate Blue bars, do not be fooled by the range. The volume is not there to support the move. It is likely a stop-hunt or a vacuum that will be filled.