Hedging Gridder

- Experts

- Alex Amuyunzu Raymond

- Versione: 2.0

- Aggiornato: 26 gennaio 2026

- Attivazioni: 5

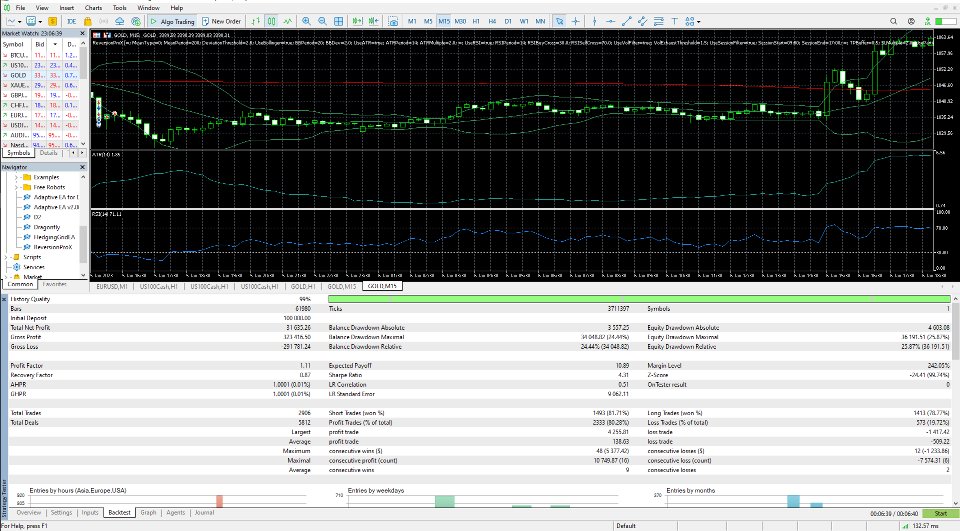

Hedging Grid EA – Adaptive Multi-Strategy Trading System

Hedging Grid EA is a fully automated Expert Advisor designed for traders who want robust grid trading with dynamic hedging, adaptive lot sizing, and multiple protection mechanisms.

Built with flexibility and precision, it can be optimized for both aggressive growth and conservative risk-managed performance, making it suitable for a wide range of trading styles.

Key Features

Order Management

-

Buy & Sell Modes – enable/disable Buy or Sell trades independently.

-

Custom Magic Number – separates trades from other EAs.

-

Max Orders Control – limit the maximum Buy and Sell orders open at once.

-

Market or Pending Entry – choose how the initial trade is executed.

-

Slippage Protection – prevents poor fills during volatile conditions.

Smart Lot Sizing

-

Initial Lot Selection – start small or large depending on account size.

-

Martingale Mode (Optional) – increase lots with each grid step for recovery.

-

Lot Multiplier & Increment – fine-tune how lots grow.

-

Risk Percent Mode – automatically calculate lots based on account equity.

-

Lot Rounding – adjust lot size to broker’s precision.

-

Max Martingale Steps – prevents runaway lot growth.

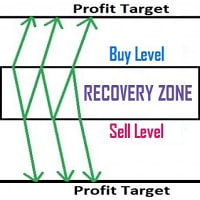

Grid & Entry Logic

-

Configurable Grid Distance – fixed or ATR-based spacing.

-

ATR Mode – adaptive grid spacing that expands/contracts with volatility.

-

Bollinger Bands Filter (Optional) – trades only when price deviates strongly.

-

First Step Size – control the distance before the grid begins.

-

Smart Hedging – balances Buy/Sell positions to reduce directional risk.

Risk & Profit Management

-

Trailing Pending Orders – dynamically adjust grid orders.

-

Equity Protection – safeguards against extreme drawdowns.

-

Aggressive Testing Mode – for stress-testing in the Strategy Tester.

-

Full Debug Logging (optional) – for deep analysis and optimization.

⚙️ Inputs Overview

-

Order Settings: Buy/Sell toggle, Magic Number, Slippage, Max Orders.

-

Lot Sizing: Initial Lot, Martingale, Multiplier, Risk %, Lot Increment, Rounding.

-

Grid Control: Grid Distance, First Step, ATR mode, Bollinger Bands filter.

-

Risk Tools: Max Martingale Steps, Trailing Orders, Debug Mode.

Why Choose Hedging Grid EA?

-

Adaptable: Works on Forex, Metals, and Indices with proper optimization.

-

Flexible: From conservative setups to aggressive growth modes.

-

Protective: Includes strong risk management tools.

-

Proven Logic: Combines grid trading, hedging, and volatility-based filters.

-

Customizable: Every part of the system can be tuned to match your strategy.

Best Use

-

Pairs with steady volatility and liquidity (e.g., EURUSD, GBPUSD, XAUUSD).

-

Timeframes: M15 – H1 recommended for smoother grid behavior.

-

Works with both ECN brokers and standard accounts.

Disclaimer: Grid and Martingale strategies carry inherent risks if misused. Always test in demo and optimize parameters for your broker and instrument before live trading.

This EA is a professional-grade grid + hedging solution that gives you full control over risk, order flow, and strategy behavior.