Forex Revolution

- Experts

- VALU VENTURES LTD

- Version: 13.7

- Activations: 10

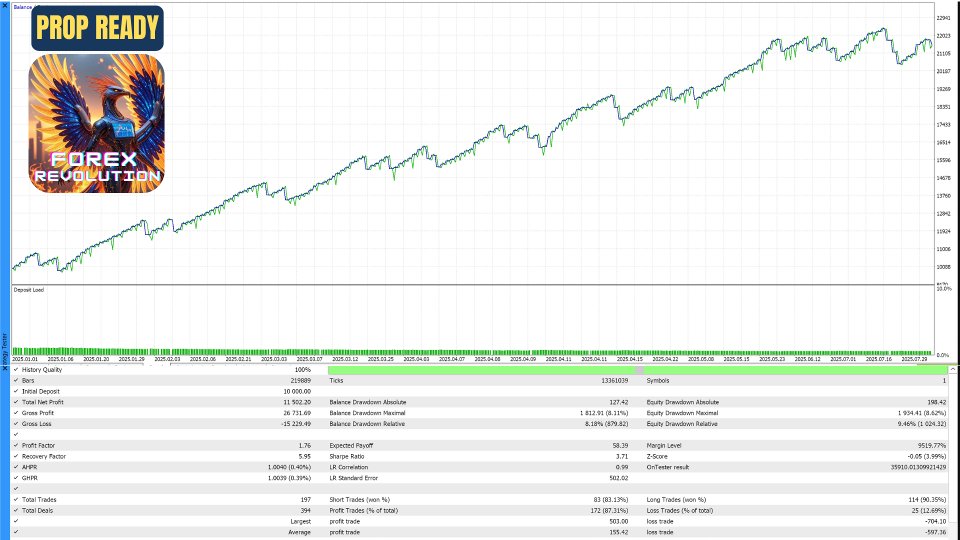

Forex Revolution EA - Advanced Multi-Strategy Trading System - Props firms Ready

Overview

Forex Revolution is a sophisticated MetaTrader 5 Expert Advisor featuring 41 revolutionary trading strategies powered by AI, quantum analysis, and real-time market data integration. Designed for aggressive monthly returns of 20-40% with banking-grade risk management.

Key Features

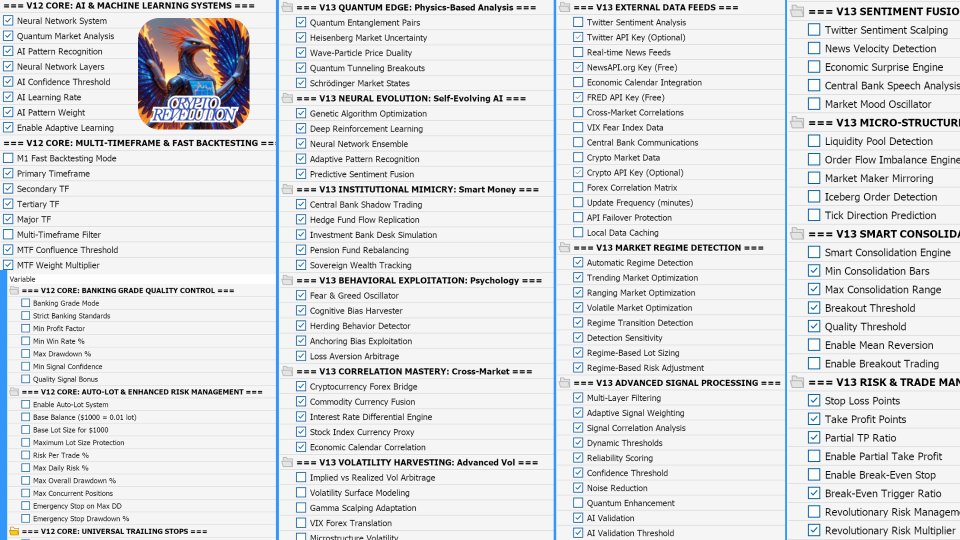

Strategy Categories (41 Total Strategies)

Core Strategy Systems

- Quantum Edge (5): Quantum entanglement pairs, Heisenberg market uncertainty, wave-particle price duality, quantum tunneling breakouts, Schrödinger market states

- Neural Evolution (5): Genetic algorithm optimization, deep reinforcement learning, neural network ensemble, adaptive pattern recognition, predictive sentiment fusion

- Institutional Mimicry (5): Central bank shadow trading, hedge fund flow replication, investment bank desk simulation, pension fund rebalancing, sovereign wealth tracking

- Behavioral Exploitation (5): Fear & greed oscillator, cognitive bias harvester, herding behavior detector, anchoring bias exploitation, loss aversion arbitrage

- Correlation Mastery (5): Cryptocurrency forex bridge, commodity currency fusion, interest rate differential engine, stock index currency proxy, economic calendar correlation

- Volatility Harvesting (5): Implied vs realized vol arbitrage, volatility surface modeling, gamma scalping adaptation, VIX forex translation, microstructure volatility

- Sentiment Fusion (5): Twitter sentiment scalping, news velocity detection, economic surprise engine, central bank speech analysis, market mood oscillator

- Micro-Structure Edge (5): Liquidity pool detection, order flow imbalance engine, market maker mirroring, iceberg order detection, tick direction prediction

- Smart Consolidation (1): Intelligent breakout and mean reversion engine with dynamic consolidation detection, breakout probability calculation, false breakout filtering

V12 Core Systems

- Banking Grade Quality Control: Minimum profit factor, win rate monitoring, drawdown limits, quality grade assessment, Sharpe/Sortino/Calmar ratios

- Auto-Lot Sizing: Dynamic position sizing, account balance scaling, revolutionary risk multiplier, regime-based adjustment, maximum lot protection

- Universal Trailing Stops: ATR-based trailing, manual point trailing, break-even stops, minimum profit triggers, freeze level validation

- AI & Machine Learning: Neural network system, quantum analysis, pattern recognition, adaptive learning, self-optimization, validation accuracy

- Multi-Timeframe Analysis: Primary/secondary/tertiary timeframes, confluence detection, MTF filtering, weight multipliers, direction consensus

- Revolutionary Dashboard: Real-time performance display, strategy status, system monitoring, API integration status, regime detection display

Advanced Systems

- Market Regime Detection: Trending/ranging/volatile regime identification, automatic optimization, confidence scoring, transition detection, adaptation factors

- API Integration System: Twitter sentiment, news feeds, economic calendar, VIX data, cryptocurrency data, forex correlations, real-time updates

- Advanced Signal Processing: Multi-layer filtering, adaptive signal weighting, correlation matrix analysis, dynamic thresholds, noise reduction, quantum enhancement

- External Data Feeds: Real-time sentiment analysis, economic surprise detection, central bank communications, cross-market correlations, API failover protection

Risk Management & Performance

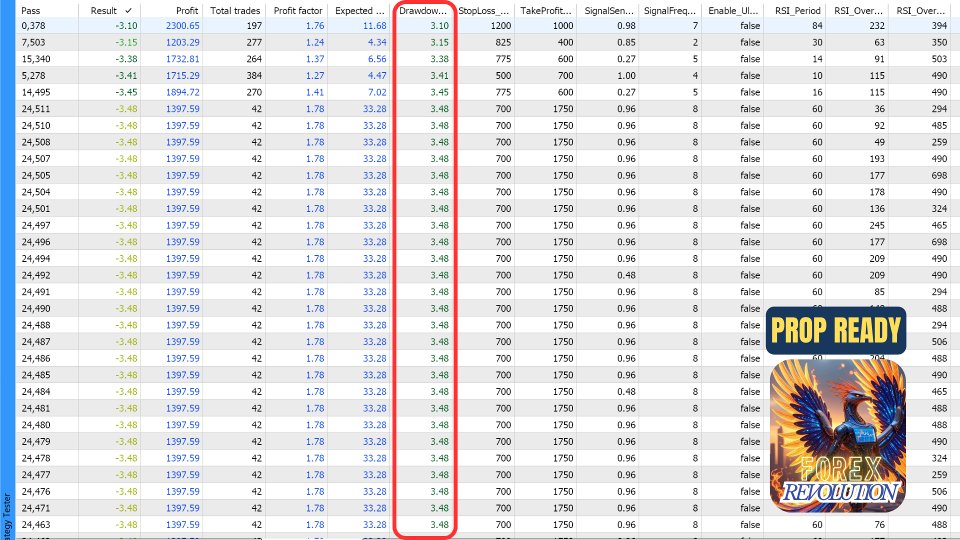

- Revolutionary Performance Targeting: 20-40% monthly return targets, aggression levels, innovation modes, performance scoring, target tracking

- Enhanced Risk Management: Maximum concurrent trades, daily/overall risk limits, emergency stop system, margin requirements, volume validation

- Position Management: Partial take profit, break-even triggers, regime-based position sizing, validated lot calculations, stops level compliance

- Marketplace Validation: Symbol compatibility, freeze level checks, volume limit validation, margin calculations, trading compliance, error handling

Technical Features

- Fast Backtesting: M1 optimized processing, rapid signal generation, historical data analysis, performance optimization, strategy validation

- Signal Processing: Signal stacking bonuses, quantum signal boost, revolutionary mode multipliers, AI validation, reliability scoring

- Data Management: Local data caching, API rate limiting, error handling, retry mechanisms, offline mode support, connection monitoring

Notes

- EA works on any symbol/timeframe but optimized for forex

- Includes marketplace validation and compliance features

- Real-time dashboard shows all system status and performance

- Supports both live trading and backtesting modes

- No external DLL dependencies required

Warning: High-frequency trading system designed for experienced traders. Past performance does not guarantee future results.