You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Scalping

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2014.03.07 09:08

Who Can Trade a Scalping Strategy? (based on dailyfx article)

The term scalping elicits different preconceived connotations to different traders. Despite what you may already think, scalping can be a viable short term trading methodology for anyone. So today we will look at what exactly is scalping, and who can be successful with a scalping based strategy.

What is a Scalper?

So you’re interested in scalping? A Forex scalper is considered anyone that takes one or more positions throughout a trading day. Normally these positions are based around short term market fluctuations as price gathers momentum during a particular trading session. Scalpers look to enter the market, and preferably exit positions prior to the market close.

Normally scalpers employ technical trading strategies utilizing short term support and resistance levels for entries. While normally fundamentals don’t factor into a scalpers trading plan, it is important to keep an eye on the economic calendar to see when news may increase the market’s volatility.

High Frequency Trading

There is a strong misconception that all scalpers are high frequency traders. So how many trades a day does it take to be considered a scalper? Even though high frequency traders ARE scalpers, in order for you to qualify as a scalper you only need to take 1 position a day! That is one of the benefits of scalping. You can trade as much or as little as you like within a giving trading period.

This also falls in line with one of the benefits of the Forex market. Due to the 24Hr trading structure of Forex, you can scalp the market at your convenience. Take advantage of the quiet Asia trading session, or the volatile New York – London overlap. Trade as much or as little as you like. As a scalper the choice is ultimately yours to make!

Risks

There are always risks associated with trading. Whether you are a short term, long term, or any kind of trader in between any time you open a position you should work on managing your risk. This is especially true for scalpers. If the market moves against you suddenly due to news or another factor, you need to have a plan of action for limiting your losses.

There are other misconceptions that scalpers are very aggressive traders prone to large losses. One way to help combat this is to make scalping a mechanical process. This means that all of your decisions regarding entries, exits, trade size, leverage and other factors should be written down and finalized before approaching the charts. Most scalpers look to risk 1% or even less of their account balance on any one position taken!

Who can Scalp?

So this brings us to the final question. Who can be a scalper? The answer is anyone with the dedication to develop a trading strategy and the time to implement that strategy on any given trading day.

=================

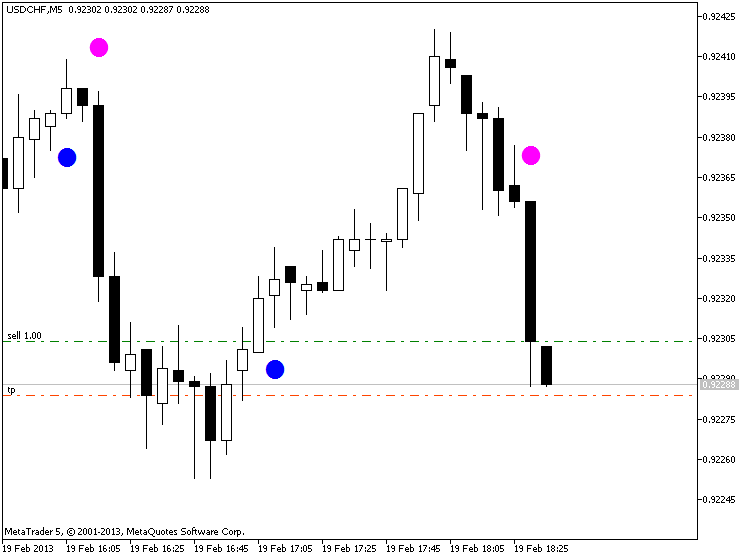

Trading examples

Metaquotes demo

GoMarkets broker, initial deposit is 1,000

Alpari UK broker initial deposit is 1,000

RoboForex broker initial deposit is 1,000

Forum on trading, automated trading systems and testing trading strategies

PriceChannel Parabolic system

Sergey Golubev, 2013.03.22 14:04

PriceChannel Parabolic system

PriceChannel Parabolic system basic edition

Latest version of the system with latest EAs to download

How to trade

The settingas for EAs: optimization and backtesting

Trading examples

Metaquotes demo

GoMarkets broker, initial deposit is 1,000

Alpari UK broker initial deposit is 1,000

RoboForex broker initial deposit is 1,000

Scalping the forex market

All the ins and outs on scalping the Forex market. May Chris dives into the world of Scalping where he explains in great detail how this style of trading can be accomplished in the Forex market. This live webinar not only clarifies how a trader can scalp but also provides every Forex trader with a great guidance and extra tips.

Trading Forex Trends with Heiken Ashi bars.

In this tutorial, you'll:

Learn the fundamentals of the Heikin-Ashi technique.

Learn how to use Heikin-Ashi bars to eliminate price noise and stay with the trend..

Learn how to properly implement this strategy to become a Consistently Profitable Trader.

Learn the step that MOST traders miss when learning new setups and how you can use this one step to cut your learning curve in HALF.

Using the Fibonacci Fans to determine the nature of a pullback

Fibonacci ratios are a very popular tool among technical traders and are based on a particular series of numbers identified by mathematician Leonardo Fibonacci in the thirteenth century. For some reason, these ratios seem to play an important role in the financial markets, just as they do in nature. The Fibonacci fans are a charting technique consisting of diagonal lines that use Fibonacci ratios to help identify key levels of support and resistance. They can be used to determine critical points that cause price to reverse. One of the most effective ways of using them is to determine the extent of a pullback. Due to its characteristics, one can estimate if a pullback will be a mere retracement, or will it turn into a reversal of the existing trend.

MetaTrader 5 for Android Smartphones and Tablets

Access to the Forex and Exchange markets, a large set of technical indicators and analytical objects, all types of trading orders and execution modes. Market Watch and Depth of Market, financial news and traders' chat. All these features now fit in your hand and are available anywhere in the world from your favorite smartphone.

MetaTrader 5 for iPhone & iPad

You can trade forex and stock exchange instruments anytime and anywhere. Experience the best of trading with 30 technical indicators and 24 analytical objects, all types of trading orders, Market Watch, Depth of Market, financial news, and traders' chat.

Who Really Controls the Forex Market?

As we discussed in our last lesson the forex market is an over the counter market meaning that there is no centralized exchange where all trades are made. Because of this, the price that someone receives when trading forex has traditionally differed depending on the size of the transaction and the sophistication of the person or entity that is making that transaction.

At the center or first level of the market is something known as the Interbank market. While technically any bank is part of the Interbank market, when an FX Trader speaks of the interbank market he or she is really talking about the 10 or so largest banks that make markets in FX. These institutions make up over 75% of the over $3 Trillion dollars in FX Traded on any given day.

There are two primary factors which separate institutions with direct interbank access from everyone else which are:

1. Access to the tightest prices. We will learn more about transaction costs in later lessons however for now simply understand that for every 1 Million in currency traded those who have direct access to the Interbank market save approximately $100 per trade or more over the next level of participants.

2. Access to the best liquidity. As with any other market there is a certain amount of liquidity or amount that can be traded at any one price. If more than what is available atthe current priceis traded, then the price adjusts until additional liquidity enters the market. As the forex market is over the counter, liquidity is spread out among different providers, with the banks comprising the interbank market having access to the greatest amount of liquidity and then declining levels of liquidity available at different levels moving away from the Interbank market.

In contrast to individuals who make a deposit into their account to trade, institutions trading in the interbank market trade via credit lines. In order to get a credit line from a top bank to trade foreign exchange you must be a very large and very financially stable institution, as bankruptcy would mean the firm that gave you the credit line gets stuck with your trades.

The next level of participants are the hedge funds, brokerage firms, and smaller banks who are not quite large enough to have direct access to the Interbank market. As we just discussed the difference here is that the transaction costs for the trade are a bit higher and the liquidity available is a bit lower than at the Interbank level.

The next level of participants has traditionally been corporations and smaller financial institutions who do make foreign exchange trades, but not enough to warrant the better pricing

As you can see here, traditionally as the market participant got smaller and less sophisticated the transaction costs they paid to trade became larger and the liquidity that was available to them got smaller and smaller. In a lot of cases this is still true today, as anyone who has ever exchanged currencies at the airport when traveling knows.

To give you an idea of just how large a difference there is between participants in the Interbank market and an individual trading currencies for travel, Interbank market participants pay approximately $.0001 to exchange Euros for Dollars where Individuals in the airport can pay $.05 or more. This may not seem like much of a difference but think about it this way: On $10,000 that is $1 that the Interbank participant pays and $500 that the individual pays.

The landscape for the individual trader has changed drastically since the internet has gone mainstream however, in many ways leveling the playing field and putting the individual trader along side large financial institutions in terms of access to pricing and liquidity.

Forum on trading, automated trading systems and testing trading strategies

EURUSD GANN ANGLE

Ahmed Saad Soliman, 2016.11.12 11:38

EURUSD GANN ANGLE

after the decline on EURUSD after the US election price reached 1 x 1536 weekly Gann angle overlapping with 6.66 Gann percentage

this is an indication that EURUSD will move higher

Please watch this video for more information

Forum on trading, automated trading systems and testing trading strategies

Something Interesting in Financial Video October 2013

Sergey Golubev, 2013.10.31 07:48

185. How Futures are Traded Part 2The next lesson in free online video futures trading course which covers how futures are traded.

============

What is Futures Trading?

Futures Trading is a form of investment which involves speculating on the price of a commodity going up or down in the future. What is a commodity? Most commodities you see and use every day of your life:

- the corn in your morning cereal which you have for breakfast,

- the lumber that makes your breakfast-table and chairs

- the gold on your watch and jewellery,

- the cotton that makes your clothes,

- the steel which makes your motor car and the crude oil which runs it and takes you to work,

- the wheat that makes the bread in your lunchtime sandwiches

- the beef and potatoes you eat for lunch,

- the currency you use to buy all these things...

... All these commodities (and dozens more) are traded between hundreds-of-thousands of investors, every day, all over the world. They are all trying to make a profit by buying a commodity at a low price and selling at a higher price.Futures trading is mainly speculative 'paper' investing, i.e. it is rare for the investors to actually hold the physical commodity, just a piece of paper known as a futures contract.What is a Futures Contract?

To the uninitiated, the term contract can be a little off-putting but it is mainly used because, like a contract, a futures investment has an expiration date. You don't have to hold the contract until it expires. You can cancel it anytime you like. In fact, many short-term traders only hold their contracts for a few hours - or even minutes!

The expiration dates vary between commodities, and you have to choose which contract fits your market objective. For example, today is June 30th and you think Gold will rise in price until mid-August. The Gold contracts available are February, April, June, August, October and December. As it is the end of June and this contract has already expired, you would probably choose the August or October Gold contract. The nearer (to expiration) contracts are usually more liquid, i.e. there are more traders trading them. Therefore, prices are more true and less likely to jump from one extreme to the other. But if you thought the price of gold would rise until September, you would choose a further-out contract (October in this case) - a September contract doesn't exist. Neither is their a limit on the number of contracts you can trade (within reason - there must be enough buyers or sellers to trade with you.) Many larger traders/investment companies/banks, etc. may trade thousands of contracts at a time!

A Short History of Futures Trading

Before Futures Trading came about, any producer of a commodity (e.g. a farmer growing wheat or corn) found himself at the mercy of a dealer when it came to selling his product. The system needed to be legalised in order that a specified amount and quality of product could be traded between producers and dealers at a specified date. Contracts were drawn up between the two parties specifying a certain amount and quality of a commodity that would be delivered in a particular month...

...Futures trading had begun!

In 1878, a central dealing facility was opened in Chicago, USA where farmers and dealers could deal in ‘spot’ grain, i.e., immediately deliver their wheat crop for a cash settlement. Futures trading evolved as farmers and dealers committed to buying and selling future exchanges of the commodity. For example, a dealer would agree to buy 5,000 bushels of a specified quality of wheat from the farmer in June the following year, for a specified price. The farmer knew how much he would be paid in advance, and the dealer knew his costs.

Until twenty years ago, futures markets consisted of only a few farm products, but now they have been joined by a huge number of tradable ‘commodities’. As well as metals like gold, silver and platinum; livestock like pork bellies and cattle; energies like crude oil and natural gas; foodstuffs like coffee and orange juice; and industrials like lumber and cotton, modern futures markets include a wide range of interest-rate instruments, currencies, stocks and other indices such as the Dow Jones, Nasdaq and S&P 500.

Who Trades Futures?

It didn't take long for businessmen to realise the lucrative investment opportunities available in these markets. They didn't have to buy or sell the ACTUAL commodity (wheat or corn, etc.), just the paper-contract that held the commodity. As long as they exited the contract before the delivery date, the investment would be purely a paper one. This was the start of futures trading speculation and investment, and today, around 97% of futures trading is done by speculators.

There are two main types of Futures trader: 'hedgers' and 'speculators'.

A hedger is a producer of the commodity (e.g. a farmer, an oil company, a mining company) who trades a futures contract to protect himself from future price changes in his product.

For example, if a farmer thinks the price of wheat is going to fall by harvest time, he can sell a futures contract in wheat. (You can enter a trade by selling a futures contract first, and then exit the trade later by buying it.) That way, if the cash price of wheat does fall by harvest time, costing the farmer money, he will make back the cash-loss by profiting on the short-sale of the futures contract. He ‘sold’ at a high price and exited the contract by ‘buying’ at a lower price a few months later, therefore making a profit on the futures trade.

Other hedgers of futures contracts include banks, insurance companies and pension fund companies who use futures to hedge against any fluctuations in the cash price of their products at future dates.

Speculators include independent floor traders and private investors. Usually, they don’t have any connection with the cash commodity and simply try to (a) make a profit buying a futures contract they expect to rise in price or (b) sell a futures contract they expect to fall in price.

In other words, they invest in futures in the same way they might invest in stocks and shares - by buying at a low price and selling at a higher price.

The Advantages of Trading Futures

Trading futures contracts have several advantages over other investments:

1. Futures are highly leveraged investments. To ‘own’ a futures contract an investor only has to put up a small fraction of the value of the contract (usually around 10%) as ‘margin’. In other words, the investor can trade a much larger amount of the commodity than if he bought it outright, so if he has predicted the market movement correctly, his profits will be multiplied (ten-fold on a 10% deposit). This is an excellent return compared to buying a physical commodity like gold bars, coins or mining stocks.

The margin required to hold a futures contract is not a down payment but a form of security bond. If the market goes against the trader's position, he may lose some, all, or possibly more than the margin he has put up. But if the market goes with the trader's position, he makes a profit and he gets his margin back.

For example, say you believe gold in undervalued and you think prices will rise. You have $3000 to invest - enough to purchase:

- 10 ounces of gold (at $300/ounce),

- or 100 shares in a mining company (priced at $30 each),

- or enough margin to cover 2

futures contracts. (Each Gold futures contract holds 100

ounces of gold, which is effectively what you 'own' and are

speculating with. One-hundred ounces multiplied by three-hundred dollars

equals a value of $30,000 per contract. You have enough to

cover two contracts and therefore speculate with $60,000 of

gold!)

Two months later, gold has rocketed 20%. Your 10 ounces of gold and your company shares would now be worth $3600 - a $600 profit; 20% of $3000. But your futures contracts are now worth a staggering $72,000 - 20% up on $60,000.Instead of a measly $600 profit, you've made a massive $12,000 profit!

2. Speculating with futures contracts is basically a paper investment. You don’t have to literally store 3 tons of gold in your garden shed, 15,000 litres of orange juice in your driveway, or have 500 live hogs running around your back garden!

The actual commodity being traded in the contract is only exchanged on the rare occasions when delivery of the contract takes place (i.e. between producers and dealers – the 'hedgers' mentioned earlier on). In the case of a speculator (such as yourself), a futures trade is purely a paper transaction and the term 'contract' is only used mainly because of the expiration date being similar to a ‘contract’.

3. An investor can make money more quickly on a futures trade. Firstly, because he is trading with around ten-times as much of the commodity secured with his margin, and secondly, because futures markets tend to move more quickly than cash markets. (Similarly, an investor can lose money more quickly if his judgement is incorrect, although losses can be minimised with Stop-Loss Orders. My trading method specialises in placing stop-loss orders to maximum effect.)

4. Futures trading markets are usually fairer than other markets (like stocks and shares) because it is harder to get ‘inside information’. The open out-cry trading pits -- lots of men in yellow jackets waving their hands in the air shouting "Buy! Buy!" or "Sell! Sell!" -- offers a very public, efficient market place. Also, any official market reports are released at the end of a trading session so everyone has a chance to take them into account before trading begins again the following day.

5. Most futures markets are very liquid, i.e. there are huge amounts of contracts traded every day. This ensures that market orders can be placed very quickly as there are always buyers and sellers of a commodity. For this reason, it is unusual for prices to suddenly jump to a completely different level, especially on the nearer contracts (those which will expire in the next few weeks or months).

6. Commission charges are small compared to other investments and are paid after the position has ended.

Commissions vary widely depending on the level of service given by the broker. Online trading commissions can be as low as $5 per side. Full service brokers who can advise on positions can be around $40-$50 per trade. Managed trading commissions, where a broker controls entering and exiting positions at his discretion, can be up to $200 per trade.

============

Euro Day Trading Strategy

The key elements of this strategy are as follows:1. A strategy designed for intraday trading

2. Rangebound strategy expecting the market to revert to a mean

3. Plot 2 pairs of bollinger bands, each using different standard deviations

4. When the market closes at or above the upper band of the higher standard deviation bollinger band, look to short

5. Confirm that ADX is low

6. Exit based on a fixed risk/reward, lower bollinger bands, and/or a spike in ADX