OBV for Gold & Forex Traders: Volume Secrets, Trend Detection, and Smart Money Signals

OBV for Gold & Forex Traders:

Volume Secrets, Trend Detection, and Smart Money Signals

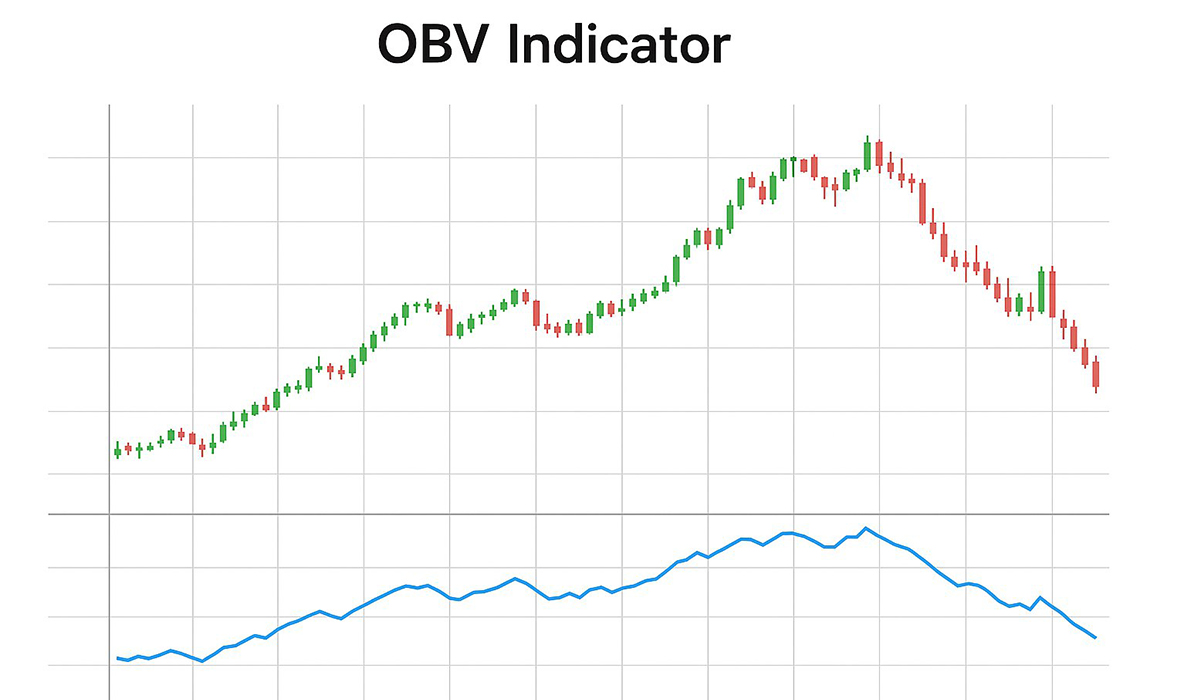

The On-Balance Volume (OBV) indicator is one of the oldest yet most powerful tools in technical analysis. Built on volume and price movement, OBV reveals the true flow of market liquidity and exposes the underlying strength or weakness behind price action.

Professional traders use OBV for trend confirmation, divergence detection, identifying valid breakouts, and developing algorithmic trading systems.

In this comprehensive guide, we explore everything you need to know about OBV and how to use it as a reliable tool—or even as the foundation of Expert Advisors (EAs).

The OBV indicator is a cumulative volume-based metric that tracks whether money is flowing into or out of the market.

It was introduced by Joseph Granville with the principle that:

If volume increases consistently while the price has not yet reacted, OBV will reflect this accumulation early—often before a major move begins.

This makes OBV a frontline tool for forecasting market direction.

OBV Formula

The core formula is extremely straightforward:

-

If today’s Close > yesterday’s Close → OBV adds today’s volume

-

If today’s Close < yesterday’s Close → OBV subtracts today’s volume

-

If today’s Close is equal → OBV remains unchanged

Through this cumulative calculation, OBV creates a dynamic line that reflects real buying or selling pressure—far more accurately than price alone.

1. OBV Is a Leading Indicator

Unlike lagging indicators such as MACD or Moving Averages, OBV is a leading indicator.

It often shifts direction before the actual price trend reverses.

When institutional traders enter the market with large volume, OBV responds immediately—making it ideal for early trend prediction.

2. OBV Detects Real Market Pressure

Price alone may not reveal who controls the market, but OBV exposes the underlying strength:

-

A rising OBV indicates strong buying pressure and capital inflow

-

A falling OBV shows distribution and capital outflow

This makes OBV invaluable when evaluating whether a trend is backed by real volume or is weak and unsustainable.

3. OBV Clearly Shows Trend Strength

By analyzing OBV swings:

-

Higher highs and higher lows → strong bullish trend

-

Lower highs and lower lows → confirmed bearish trend

Many traders draw trendlines directly on OBV for fast and reliable trend analysis.

4. OBV Divergence: One of the Most Reliable Market Signals

– Bullish Divergence (Strong Buy Signal)

When price forms a lower low but OBV forms a higher low, hidden accumulation is happening.

This often signals the start of a major bullish reversal.

– Bearish Divergence (Early Sell Warning)

If the price forms a higher high but OBV fails to confirm it, distribution is underway—warning of a potential downtrend.

OBV divergence is widely considered more reliable than many momentum indicators because it is based on real volume.

5. OBV Validates Breakouts More Accurately Than Price Alone

– Confirmed Breakout

A breakout becomes highly credible when both price and OBV move above their previous structure levels.

– Fake Breakout Detection

If price breaks a support or resistance level but OBV does not confirm the move, the breakout is likely false.

This makes OBV a perfect confirmation tool for breakout traders in Forex, Gold (XAUUSD), and Crypto.

1. Detecting Trend Reversals Early

OBV is one of the fastest tools for identifying trend exhaustion and reversals—making it valuable for swing, day, and position traders.

2. OBV + Moving Averages Strategy

A popular and highly effective method is to combine OBV with Moving Averages:

-

Rising OBV + price above MA → strong uptrend confirmation

-

Falling OBV + price below MA → strong downtrend confirmation

This hybrid method improves trend clarity and reduces false signals.

3. OBV for Expert Advisors and Algorithmic Trading

Because of its simple formula and high accuracy, OBV is an excellent indicator for algorithmic systems:

-

EA development

-

Trade filtering

-

Trend confirmation

-

Volume-based signal generation

In MQL4 and MQL5, OBV is lightweight and easy to integrate, making it ideal for advanced automated systems.

4. Perfect for XAUUSD and High-Volume Markets

OBV performs exceptionally well in markets where volume has a strong influence:

-

Gold (XAUUSD)

-

Major Forex pairs (EURUSD, GBPUSD, USDJPY)

-

Cryptocurrency markets such as BTC and ETH

Especially on M30, H1, and H4 timeframes, OBV reveals trend strength more accurately than many built-in indicators.

Advanced Techniques to Maximize OBV Performance

1. Use Higher Timeframes for More Accurate Signals

H4 and Daily timeframes offer much cleaner volume behavior and significantly reduce market noise—making OBV more reliable.

2. Combine OBV With Market Structure and Price Action

For maximum precision, OBV should be used alongside:

-

Supply & Demand zones

-

Trendlines

-

Liquidity levels

-

Break of Structure (BOS)

-

Support/Resistance zones

This combination produces extremely high-quality signals.

3. Bigger Divergence = Bigger Reversal

A wide gap between price and OBV indicates powerful displacement and is often followed by a strong reversal move.

OBV is a simple, powerful, and highly reliable indicator suitable for new and professional traders alike.

It provides accurate insight into:

-

Real buying and selling pressure

-

Trend confirmation

-

Divergences

-

Breakout validation

-

Algorithmic trading filters

Because of its lightweight structure, OBV is not only a trading indicator but also a core component for many Expert Advisors and automated strategies.

Built by Altan Karakaya | Professional Volume-Based Signal Tool

Alongside OBV, we highly recommend testing the TW Volume Signal Pro indicator, created by Altan Karakaya.

This tool is designed using advanced volume analysis principles and aligns perfectly with the logic behind OBV.

It provides clean, actionable, and algorithm-friendly signals.

Why TW Volume Signal Pro Is Worth Adding to Your Strategy

-

Works as a perfect complementary tool for OBV-based systems

-

Generates clear entry and exit signals

-

Excellent for strategy development and backtesting

-

Ideal for building Expert Advisors and algorithmic trading models

-

Highly effective in Forex, Gold, and Crypto markets

-

Suitable for scalping, day trading, and swing trading

This indicator enhances volume confirmation and strengthens decision-making in all market conditions.

Ideal for Traders Seeking Stronger Volume Confirmation

If your trading approach relies on volume, momentum, or market structure,

TW Volume Signal Pro is a powerful and reliable tool worth testing as part of your strategy portfolio.