Velora EA v1.0 – Complete Setup Guide, Strategy Walkthrough, and Set File Download

Advanced Grid Trading System with Smart Trailing and Volatility Breakout Strategy

What is Velora EA ?

Velora is an automated Grid Trading system that:

-

Places multiple trades at different price levels

-

Automatically manages profits and losses using trailing stops

-

Uses volatility breakout signals to enter trades

-

Operates 24/7 without manual intervention

Grid Trading Concept: Instead of placing one large trade, the EA places several smaller trades at different price levels. When the market moves against you, it adds more trades to average down the cost. When the market moves in your favor, it uses trailing stops to lock in profits.

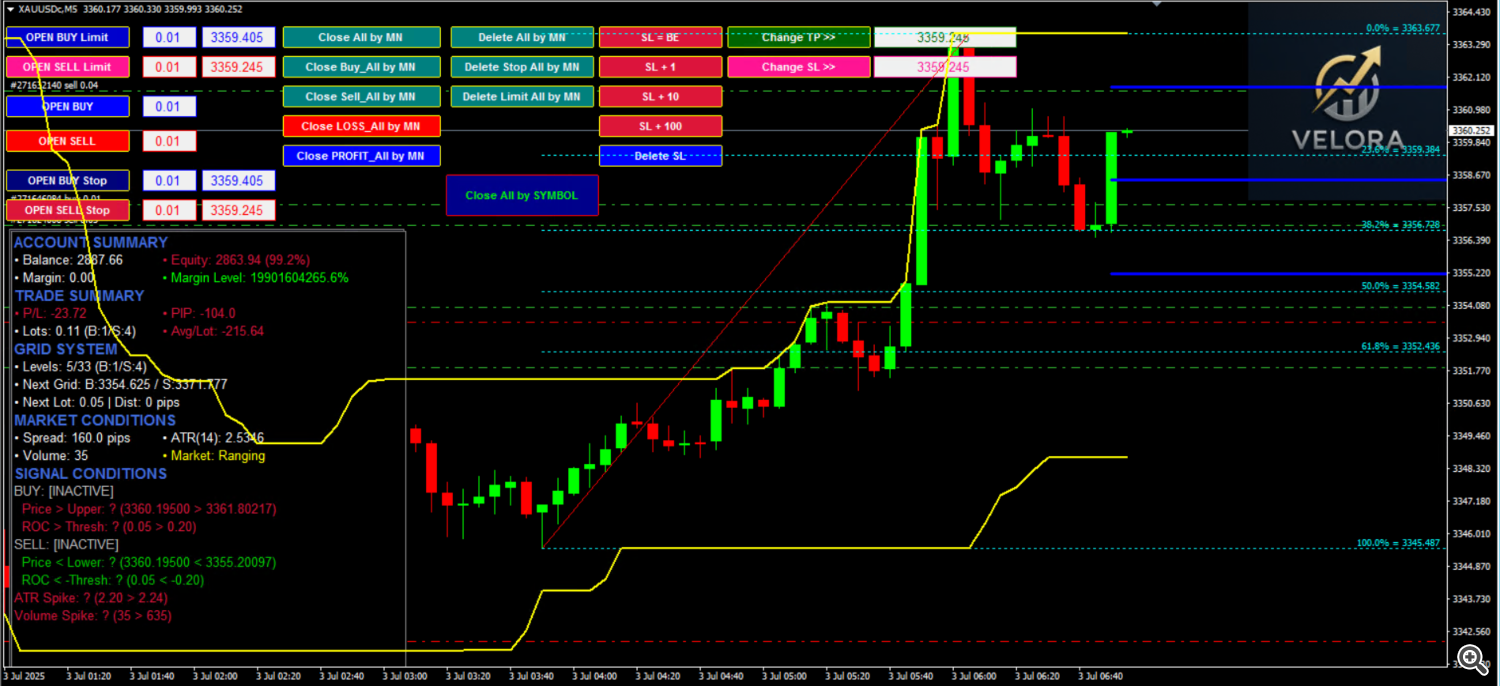

Real-Time Dashboard

Velora EA displays a comprehensive real-time dashboard on your chart showing all important trading information. Key sections include:

-

Account Summary: Balance, Equity, Margin, Margin Level

-

Trade Summary: Profit/Loss, Pips, Lots, Avg/Lot

-

Grid System: Active grid levels, next grid price, next lot size

-

Market Conditions: Spread, ATR, Volume, Market state

-

Signal Conditions: Buy/Sell activation and requirement status

Dashboard colors indicate:

-

Green: Profitable/Good conditions

-

Red: Loss/Bad conditions

-

Yellow: Warning/Moderate conditions

-

White: Neutral information

-

Blue: System information

Visual Indicators

-

Keltner Channel: Blue bands for volatility, with middle EMA

-

Fibonacci Retracement: Red/Aqua lines auto-adjust to structure

-

Donchian Channel: Yellow bands for breakout detection

-

Alert Boxes: Red rectangles highlight breakout zones (optional)

Breakout confirmation requires alignment of:

-

Donchian Channel breakout

-

Keltner volatility breach

-

ATR spike

-

Volume increase

-

ROC threshold passed

Chart Control Panel

Velora includes a set of trading control buttons directly on your chart. Functions include:

-

Trade Closures (all, buy/sell, profitable/loss)

-

Manual Buy/Sell market or pending orders

-

Stop Loss and Take Profit adjustments

-

Visual grouping by button color (Blue = Buy, Red = Sell, etc.)

Beginner tip: Use auto mode and avoid manual buttons unless necessary.

Basic Lot Settings

-

Starting lot size: Recommended 0.01 for beginners

-

Fixed lot increment: Defines lot growth per grid (e.g., 0.005 gradual, 0 aggressive)

Grid Trading Parameters

-

Initial distance (pips): Defines spacing between grid trades. Adjust per instrument.

-

Distance multiplier: Increases spacing dynamically (1.5 = moderate, 2.0 = wide)

-

Maximum grid levels: Total trades allowed (10–40 based on account size)

Hedging Strategy

Velora can run grids in both buy and sell directions.

-

Enable with: Allow buy and sell grids = TRUE

-

Set delay: e.g. 3600 seconds = 1 hour

-

Define max total orders: e.g. 20–30 trades max when hedging

Use hedging only with:

-

Sideways market conditions

-

Large accounts ($2000+)

-

Experience in managing multi-directional exposure

Trailing Stop Management

-

Trailing stop distance: Manual pip-based trailing

-

Use ATR trailing: Enable to adapt stops dynamically

-

ATR multiplier: Set trailing aggressiveness (e.g., 3.0 = loose, 1.5 = tight)

Entry Signal Controls

-

Keltner & ROC filters: Define volatility and momentum criteria

-

Volume spike check: Confirms real market participation

-

Ranging market filter: Avoids trend conditions

-

ADX filter (optional): Detects trend strength

Buy/Sell trades only trigger when all logic is confirmed.

Risk Management Features

-

Max drawdown %: Auto-closes all trades when exceeded

-

Max allowed spread: Prevents entry during high-cost conditions

Quick Setup Guide

-

Assess account size:

-

$500 = Conservative setup

-

$1000+ = Moderate or aggressive

-

-

Choose profile:

-

Conservative: 0.01 lot, wide grid, no hedging

-

Moderate: 0.02 lot, moderate spacing, delayed hedging

-

Aggressive: 0.03+ lot, tighter spacing, hedging enabled

-

-

Choose instrument:

-

Safe: EURUSD, GBPUSD

-

Advanced: GOLD, NASDAQ, BTC

-

Parameter Reference Chart

| Parameter | Conservative | Moderate | Aggressive |

|---|---|---|---|

| Starting Lot | 0.01 | 0.02 | 0.03–0.05 |

| Lot Increment | 0.005 | 0.01 | 0.01–0.02 |

| Grid Levels | 10–15 | 20–25 | 30–40 |

| Trailing ATR Multiplier | 3.0 | 2.5 | 2.0 |

| ROC Threshold | 0.5–0.6 | 0.3–0.4 | 0.2–0.3 |

| Hedging | No | Yes (delay 1–2h) | Yes (delay 30m–1h) |

Set File Downloads & User Manual

You can download pre-configured set files using the following format:

Set File Naming Convention:

BrokerName_Pair_RiskLevel.set Example: PuPrime_EURUSD_Safe.set or Vantage_XAUUSD_Aggressive.set

Available for:

-

PuPrime: EURUSD, GBPUSD, GOLD, SILVER, DAX, BTC, USOIL

-

Vantage: EURUSD, GBPUSD, NAS100, DJ30, BTC, XAGUSD, USOIL

-

DarwinexZero: EURUSD, GBPUSD, NAS100, WS30, BTC, XAGUSD, XTIUSD, GBPJPY, and more

Set File Risk Levels:

-

Safe: Conservative risk profile

-

Aggressive: For experienced traders only

Manual Guide in PDF Format:

You can download the Velora User Guide.zip which contains the complete User Manual in PDF format, along with all relevant set files. This ZIP file is available as an attachment at the bottom of this blog post.

Set File Disclaimer

These set files are not guaranteed optimal settings for all users. They are provided as starting references only.

Every trader has different:

-

Risk preferences

-

Account size

-

Broker conditions (spread, margin, slippage)

-

Trading goals

BEFORE USING ANY SET FILE, YOU MUST:

-

Read the complete User Guide

-

Backtest thoroughly for at least 3–6 months

-

Demo trade 2–4 weeks to observe behavior

-

Adjust parameters based on your conditions

Risks Include:

-

Grid trading may cause high drawdown during trends

-

Hedging increases exposure and complexity

-

No guarantee of profit – losses are possible

Use these set files responsibly and always prioritize risk management.

Product Link

You can purchase or download Velora EA directly from the official MQL5 Market page:

Velora EA on MQL5 Market: https://www.mql5.com/en/market/product/143233

Final Reminders

-

Always demo test before going live

-

Begin with conservative settings

-

Monitor dashboard regularly

-

Adapt based on volatility and market type

-

Use VPS for uninterrupted operation

-

Hedge only if you fully understand the risks

Velora EA v1.0 – Trade with precision, manage with discipline.