Alpha vs. Omega: Which Algorithm Dominates in EA Gold Fighter MT5? A Backtest Showdown

Alpha Algo vs Omega Algo: Which Algorithm is Stronger in EA Gold Fighter MT5? Backtest Comparison!

Back testing is an absolutely crucial step before you decide to use any Expert Advisor (EA) on a live trading account. It helps you evaluate the EA's past performance, understand its risks and profit potential, thereby making more informed trading decisions.

In this blog, we will conduct a backtest of the [Gold Fighter MT5 EA], a bot I developed specifically for trading Gold (XAUUSD), and explore its unique features. (Disclosure: I am the developer of this EA.)

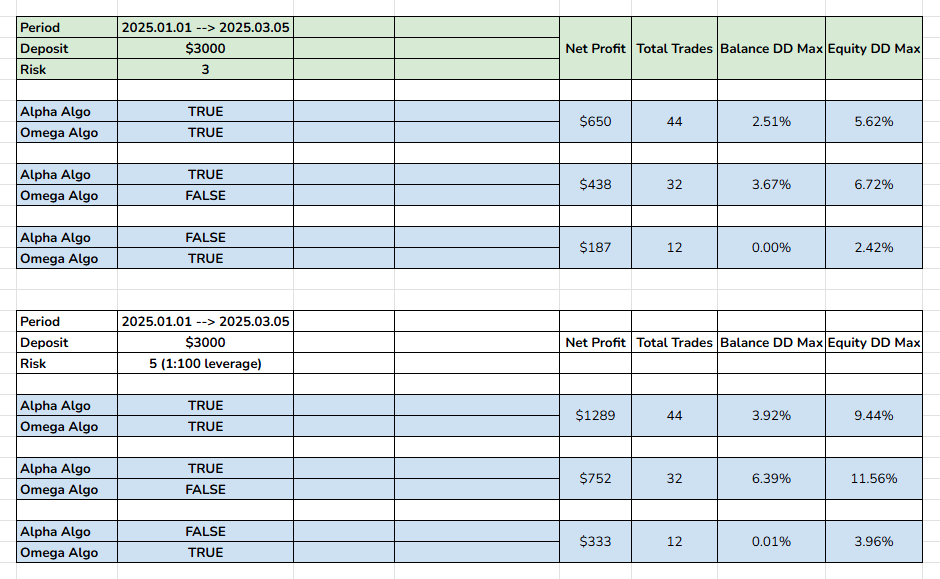

Backtest Period: Here, I will be backtest from the January 1, 2025, to March 1, 2025.

Backtest Parameters:

-

Capital: $3000

-

Leverage: 1:100 (common in the Forex market)

-

Risk: Priority level 3 or 5 (depending on margin). If your leverage is 1:100 or higher, you can use risk level 5.

-

EA:

-

Backtest Algo 1 (Alpha Algo) individually

-

Backtest Algo 2 (Omega Algo) individually

-

Backtest both Algo 1 & 2 simultaneously

-

Core Differences Between Alpha Algo and Omega Algo:

To better understand the Gold Fighter MT5 EA, we need to delve into the core differences between its two main algorithms: Alpha Algo and Omega Algo. This is a key factor affecting how the EA manages risk and generates profits.

-

Stop Loss Difference:

Alpha Algo (Old Algorithm): The unique and perhaps most controversial feature of Alpha Algo is its non-use of a traditional hard stop loss. Instead, this algorithm employs an advanced "montage" trade management system.

Montage Trade Management: Instead of stopping losses based on a specific price level, Alpha Algo uses a series of flexible exit methods, triggered based on internal algorithmic logic and market conditions, independent of price hitting a fixed Stop Loss level.

-

Advantages: Helps avoid "stop hunt" commonly encountered in volatile markets, especially with Gold. At the same time, it can optimize profits by keeping orders open longer when the market shows signs of recovery.

-

Disadvantages: Requires larger capital to withstand strong market fluctuations and requires a clear understanding of the "montage" trade management principle for effective use.

Omega Algo (New Algorithm): Overcoming some of the disadvantages of Alpha Algo, Omega Algo is equipped with a hard Stop Loss.

Hard Stop Loss: Each trade will have a predetermined Stop Loss level, based on new risk calculations integrated into the algorithm.

-

Advantages: Controls risk in a traditional and understandable way, suitable for traders who prefer certainty and want to limit the maximum loss for each trade. Suitable for smaller capital accounts.

-

Disadvantages: Can be more prone to "stop hunt" in highly volatile markets, and may miss some price recovery opportunities if the Stop Loss is set too tight.

-

EA Risk Management:

- Alpha Algo: Manages risk through the "montage trade management" system. Risk is controlled by intelligent exit algorithms, combined with capital allocation and "montage" style order management.

- Omega Algo: Manages risk using a hard Stop Loss and different risk calculation algorithms. Risk is limited by the hard Stop Loss, and order sizes are adjusted based on the set risk level.

From my experience, I strongly recommend that you use both Alpha and Omega algorithms simultaneously in the Gold Fighter MT5 EA.

Reasons:

-

Complementary Strengths and Weaknesses: Alpha Algo with "montage trade management" and Omega Algo with hard Stop Loss complement each other. Alpha Algo can "catch" big waves and optimize profits when the market moves in the right direction, while Omega Algo better protects capital during periods of unpredictable or adverse market fluctuations.

-

Diversification of Strategies: Using both algorithms helps the EA adapt better to various market conditions, increasing the potential for stable profits.

-

Optimize Profit and Risk Control: By combining, you can leverage the profit potential of Alpha Algo and the risk safety of Omega Algo.

Recommended Risk Level: 2-4 (on the risk scale of 1-10 of Gold Fighter MT5 EA). This risk level is considered balanced between profit potential and capital safety.

Below is the backtest parameter table:

As you can see in the backtest result table above, Gold Fighter MT5 EA has shown its profit potential when combining both algorithms to increase performance and smooth drawdown.

If you are interested in exploring the power of Gold Fighter MT5 EA, please perform your own backtests with different parameters and periods to better understand how the EA operates under various market conditions. You can also test the EA on a demo account to experience real trading before deciding to use it on a live account.

Do not hesitate to share your backtest results or any questions you may have in the comment section below.

Let's discuss and optimize trading strategies with Gold Fighter MT5 EA together!