Beyond the Basics: Unleashing the Power of Indicator-Driven Stop Loss and Take Profit Strategies

The Dynamic Alternative: A Deeper Dive into Indicator-Level Stop Loss and Take Profit

Stepping away from the rigidity of fixed price targets, the dynamic alternative invites us to adopt a more fluid and responsive methodology. Indicator-level stop loss and take profit strategies are not merely a different way to place orders; they represent a fundamental shift in a trader's mindset and approach to risk management. The core philosophy is simple yet profound: instead of imposing our preconceived notions of where the price should stop or reverse, we let the market's own behavior, as interpreted by technical indicators, dictate our exit points.

This approach transforms your stop loss and take profit from static, arbitrary lines in the sand into intelligent, adaptive boundaries that ebb and flow with the market's rhythm. Imagine navigating a river. A static approach is like dropping anchor at a pre-decided spot, regardless of the current's speed or direction. A dynamic, indicator-driven approach is like using a sophisticated sonar system that constantly scans the riverbed, allowing you to adjust your course and speed in real-time to avoid unseen obstacles and navigate the deepest channels. This is the essence of allowing your risk management to "breathe" with the market. It acknowledges that a 20-pip risk may be appropriate in a slow-moving, placid market, but that same risk level could be suicidal in a volatile, rapidly trending environment.

So, how does this work in practice? Instead of relying on a single, predetermined price, your stop loss and take profit levels are constantly recalculated with each new price candle based on the signals from your chosen indicators. This means your exit points adjust in real-time to reflect changes in volatility, trend strength, and momentum.

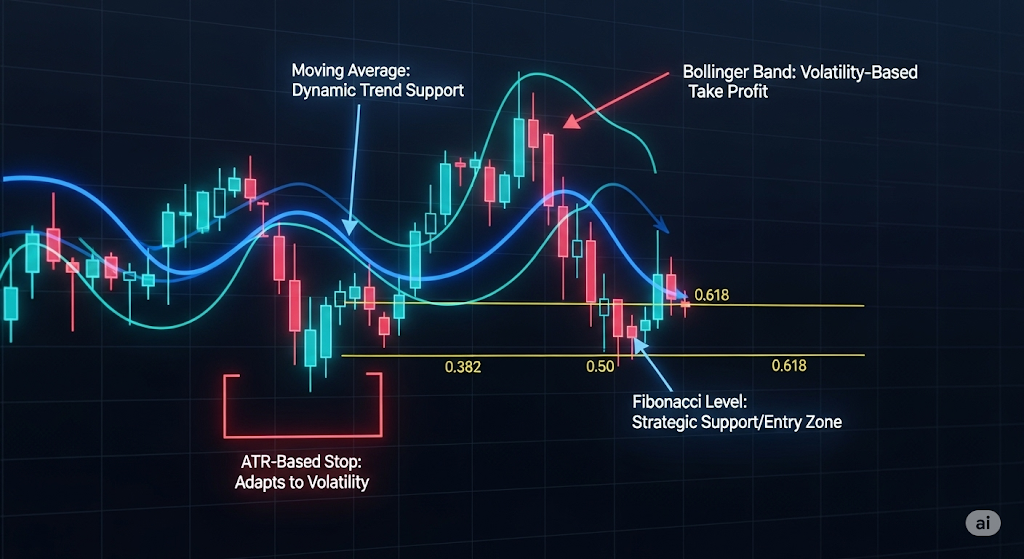

We can categorize these dynamic signals into several key types:

-

Volatility-Based Exits: These are designed to give trades more room to move during choppy periods and tighten up when the market is calm. The Average True Range (ATR) is the classic example here. A stop loss set at a multiple of the ATR will automatically widen when price swings become larger and narrow when they contract. This prevents you from being prematurely "stopped out" by normal market noise during volatile periods.

-

Trend-Following Exits: The goal here is to stay in a profitable trade for as long as the trend remains intact. Moving Averages are a primary tool for this. By placing a "trailing stop" that follows a key moving average, you allow your profits to run, only exiting when the price shows a clear sign of breaking the established trend. This systematically protects your gains while maximizing the potential of a strong market move.

-

Momentum-Based Exits: These strategies use oscillators, such as the Relative Strength Index (RSI) or the Stochastic Oscillator, to gauge the strength of a price move. These indicators can signal when a trend is losing steam or becoming "overbought" or "oversold." A trader might decide to take profit on a long position when the RSI moves into overbought territory and then shows signs of turning down, suggesting that the upward momentum is waning and a reversal could be imminent.

By adopting this indicator-driven framework, you are essentially creating a rules-based system that automates your exit decisions. This not only makes your risk management more intelligent and adaptive but also provides a crucial psychological edge. It removes the guesswork and emotional turmoil from the decision-making process. No longer will you be agonizing over whether to take a small profit now or hold on for more, nor will you be tempted to move your stop loss further away "just in case" a losing trade turns around. The decision is made for you, based on the objective signals of your system, fostering a level of discipline and consistency that is the hallmark of professional trading.

Diving into the Toolkit: A Detailed Guide to Popular Indicators for Dynamic Exits

Choosing the right indicator is crucial, as each offers a unique lens through which to view the market's behavior. A deep understanding of how they work and what they represent is the first step toward effectively integrating them into your exit strategy. Let's dissect some of the most powerful and popular indicators, exploring the nuances of their application for both stop loss and take profit levels.

Average True Range (ATR)

What it is: The ATR is the ultimate volatility gauge. It doesn't provide any directional information, but it masterfully measures the average "true range" of an asset over a given number of periods (typically 14). Think of it as quantifying the market's daily enthusiasm or nervousness. A rising ATR means volatility is increasing (wider price swings), while a falling ATR indicates a period of quiet consolidation.

-

Setting a Dynamic Stop Loss: This is the ATR's primary use case. The standard technique involves multiplying the current ATR value by a chosen factor (the "ATR multiple") and placing your stop that distance away from the entry price.

-

The Multiplier: The choice of multiplier is key. A 1.5x ATR multiple creates a tight stop for aggressive, short-term strategies. The most common multiple is 2x ATR, which provides a good balance, often keeping you in a trade through insignificant noise. A more conservative trader or long-term investor might use a 3x or even 4x ATR to give the trade maximum breathing room.

-

The ATR Trailing Stop: For locking in profits on a winning trade, an ATR trailing stop is unparalleled. Here's how it works for a long position: The stop is initially placed, for example, 2x ATR below the entry price. As the price moves up and makes new highs, the stop loss also moves up, always maintaining that 2x ATR distance from the highest price reached. Critically, if the price pulls back, the stop loss does not move down. It only ratchets higher, protecting your accumulated gains until the pullback is significant enough (more than 2x ATR) to trigger the exit.

-

-

Setting a Volatility-Based Take Profit: While less conventional, using the ATR to set profit targets provides a logical, non-emotional exit plan. If you are risking 2x the ATR on your stop loss, you might set your take profit at 3x or 4x the ATR value from your entry. This ensures a positive risk-to-reward ratio that is directly informed by the asset's recent volatility. For example, if the ATR is $1.50 and your stop is $3.00 away (2x ATR), a take profit at $4.50 (3x ATR) creates a 1:1.5 risk/reward ratio that is adaptive to the market.

-

Best Suited For: All market types, but it truly shines in trending markets where it helps you stay in the trade without getting shaken out by the inevitable pullbacks that occur within a larger trend.

Moving Averages (MAs)

What they are: Moving averages are the cornerstone of trend analysis, smoothing out price data to create a single, flowing line that reveals the underlying trend direction. An Exponential Moving Average (EMA) gives more weight to recent prices and reacts faster, while a Simple Moving Average (SMA) gives equal weight to all prices and is smoother.

-

Setting a Dynamic Stop Loss: MAs act as dynamic support (in an uptrend) and resistance (in a downtrend).

-

Confirmation is Key: A common mistake is to exit the moment the price touches the moving average. A more robust strategy is to wait for a definitive candle close below the MA (for a long trade) or above it (for a short trade). This helps you avoid getting faked out by a quick price "wick" that momentarily pierces the MA but doesn't signify a true change in momentum.

-

Choosing the Right Period: The period of your MA should match your trading horizon. A short-term trader might use a 10-period or 20-period EMA as a trailing stop to stay close to the action. A swing trader will likely find the 50-period MA more suitable, while a long-term investor often uses the 100-period or 200-period SMA as a critical line in the sand. As the price trends higher, the MA will also trend higher, creating a perfect trailing stop that lets your profits run.

-

-

Setting a Trend-Based Take Profit: MAs can also signal when a trend is potentially ending.

-

MA Crossovers: A classic exit signal for a long position is when a short-term MA crosses below a longer-term MA (e.g., the 20-period EMA crossing below the 50-period EMA). This "death cross" pattern suggests that short-term momentum is fading and a trend reversal may be underway.

-

Reversion to the Mean: In some market structures, assets tend to revert to a longer-term moving average. For instance, if you enter a short trade as a stock breaks down, you might set your take profit near a major long-term support level like the 200-day SMA, anticipating that buyers will step in around that well-watched level.

-

-

Best Suited For: Strongly trending markets. In sideways, choppy, or ranging markets, MAs will frequently whip back and forth, generating numerous false exit signals.

Bollinger Bands (BBs)

What they are: Bollinger Bands are a fusion of a moving average (the middle band) and a volatility indicator (the outer bands). The outer bands are typically set at two standard deviations from the middle band, meaning they contain the vast majority of recent price action. The bands expand when volatility increases and contract (a "squeeze") when volatility dries up.

-

Setting a Dynamic Stop Loss: The outer bands provide excellent dynamic boundaries. If you enter a long trade near the lower band (a "reversion to the mean" strategy), a logical place for your stop loss is a decisive candle close below that lower band. A break of the band suggests that the selling pressure is stronger than statistically expected and the downtrend may continue. It's often wise to wait for one or two consecutive closes outside the band to confirm the signal and avoid getting stopped out on a "head fake."

-

Setting a Dynamic Take Profit: The bands provide natural profit targets.

-

Opposite Band Target: The most common take-profit strategy is to exit a long position when the price reaches the upper Bollinger Band. The logic is that the price is now statistically "expensive" or overextended and is likely to pull back.

-

Partial Profits at the Middle Band: A more advanced technique is to take partial profits when the price reaches the middle band (the 20-period SMA). You can then move your stop loss to your entry point (a risk-free trade) and let the remainder of the position run towards the upper band. This strategy allows you to lock in some gains while still participating in further upside potential.

-

-

Best Suited For: Both ranging and trending markets. In ranging markets, they excel at identifying overbought/oversold levels for reversion trades. In trending markets, the price "riding the band" (consistently hitting the upper or lower band) can be a signal to hold the trade rather than take profit immediately.

Fibonacci Retracement & Extensions

What they are: Unlike other indicators that are calculated from simple price and volume data, Fibonacci tools are based on a mathematical sequence discovered centuries ago. They are used to forecast potential areas of support and resistance by drawing key percentage levels (23.6%, 38.2%, 50%, 61.8%) between a major price swing's high and low.

-

Setting a Strategic Stop Loss: Fibonacci levels are zones, not exact lines. Their power lies in identifying potential turning points.

-

Beyond the Level: If you enter a long trade on a bounce from the 61.8% retracement level, placing your stop just pennies below it is risky. A smarter approach is to place the stop loss below the next Fibonacci level (e.g., the 78.6% level) or, even better, below the entire swing low that you used to draw the levels. This anchors your risk to a concrete structural point on the chart, not just a mathematical line.

-

The Concept of Confluence: The most reliable Fibonacci stop loss levels are those that coincide with another technical signal. For example, if the 50% retracement level also lines up with a 200-period moving average, placing a stop below that "confluence zone" creates a much more powerful and defensible support area.

-

-

Setting a Projective Take Profit: While retracements identify pullback levels, Fibonacci Extensions are used to project where the price might go next. By using the initial swing (A to B) and the retracement (B to C), the tool projects levels like 127.2%, 161.8%, and 261.8% as potential profit targets. This is incredibly useful in a strong trend or after a breakout, as it provides logical, calculated price targets far beyond the previous swing high.

-

Best Suited For: Clear, trending markets with well-defined swing highs and lows. Their subjective nature (choosing the correct swing points is a skill) means they are best used by experienced traders and in conjunction with other confirming indicators.

The Flip Side: A Detailed Guide to Navigating the Concerns and Drawbacks

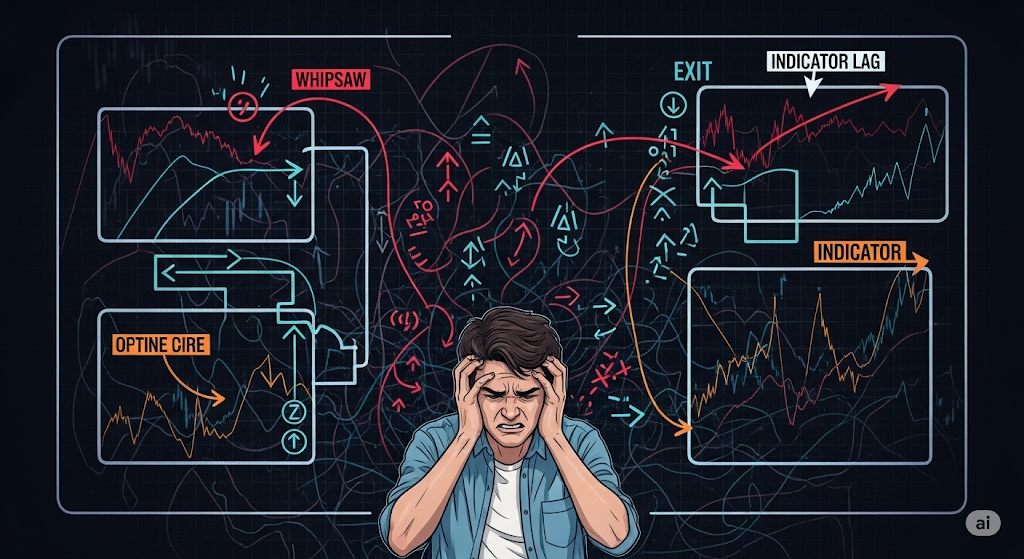

While the allure of a perfectly adaptive, automated exit strategy is strong, it's crucial to approach indicator-driven systems with a healthy dose of realism and a thorough understanding of their inherent flaws. These are not "plug-and-play" solutions but complex tools with significant potential for misuse. Ignoring the following drawbacks is a common and costly mistake for aspiring traders.

Indicator Lag: Winning Yesterday's Battle

The single most critical concept to understand is that technical indicators are, by their very nature, reactive, not predictive. They are mathematical formulas calculated using past price and/or volume data. This means they can only tell you what has already happened, not what is about to happen. This inherent delay is known as "lag."

In a slowly drifting, stable market, a small amount of lag is often inconsequential. However, in a fast-moving market, such as during a major news release or a market panic, lag can be devastating. Consider a classic moving average crossover system. If a stock is in a strong uptrend and suddenly reverses on bad news, the price might plummet 10% before the short-term moving average even begins to flatten, let alone cross below the longer-term average to generate a "sell" signal. By the time the signal appears, the optimal exit point is long gone, and a manageable loss has ballooned into a significant drawdown. This trade-off is unavoidable: the smoother you make an indicator to filter out market "noise" (e.g., by using a longer period), the more lag you introduce, making it slower to react when you need it most.

The Whipsaw Effect: Death by a Thousand Cuts

If lag is the danger in trending markets, the whipsaw is its destructive cousin in sideways, choppy markets. The whipsaw effect occurs when an indicator generates an exit signal, you act on it, and then the price immediately reverses, invalidating the signal and continuing in its original direction. Imagine your indicator tells you to sell your long position, you exit, and then watch in frustration as the price immediately shoots higher without you.

This is particularly common with momentum oscillators like the RSI or Stochastics in range-bound conditions. The indicator might flash "overbought," prompting you to sell, only for the price to drift sideways, dip slightly to flash "oversold," and then move back up. Getting caught in this cycle feels like trying to drive a car by only looking in the rearview mirror while stuck in a parking lot—lots of frantic activity, but you end up going nowhere while burning through fuel. Each whipsaw may result in only a small loss (plus commissions), but a series of them can relentlessly bleed an account dry, all while causing immense psychological frustration that often leads traders to abandon their entire strategy right before a real, profitable trend emerges.

Over-Optimization and Curve Fitting: The Perfect Past, the Flawed Future

With modern back testing software, it's dangerously easy to fall into the trap of over-optimization, also known as "curve fitting." This is the process of tweaking an indicator's settings and a strategy's rules until they perfectly match the historical data you are testing them on. For instance, a trader might see that a 14-period ATR stop caused a loss on a specific trade in 2023. They might then change the setting to a 17-period ATR, which would have kept them in that trade for a profit. They repeat this process across dozens of trades until their back test shows a flawlessly smooth, upward-sloping equity curve.

The problem is that this "perfect" strategy has been meticulously engineered to win a game that's already over. It's like creating a key that perfectly fits one specific, antique lock. The moment you introduce it to a new lock—the live, unpredictable market—it will almost certainly fail. A truly robust strategy is one that performs reasonably well across a variety of settings and market conditions, not one that is perfectly sculpted to the past. The goal of back testing should be to validate a robust methodology, not to create a "perfect" but fragile system destined to break.

Complexity and the Need for Expertise

Implementing a fixed stop loss, like risking 2% of your account on a trade, is simple arithmetic. Implementing a dynamic, indicator-based stop loss is an exercise in applied technical analysis. It requires a much deeper level of knowledge and expertise. You cannot simply add a 50-period moving average to your chart and hope for the best.

You must understand the theory behind the indicator: What is it measuring? How is it calculated? What are its inherent strengths and weaknesses? For example, knowing that Bollinger Bands are based on standard deviation helps you understand why 95% of price action should remain within them. You must also understand how to interpret its signals in different contexts—a moving average crossover means something very different in a strong trend than it does in a sideways market. This complexity is a significant barrier to entry and, if not respected, can lead to traders misapplying these powerful tools with disastrous results.

No One-Size-Fits-All Solution

There is no "best" indicator for setting stops and profits. The optimal tool is entirely dependent on the asset, the timeframe, and the current market "regime." Applying the wrong strategy to a market is like using a screwdriver to hammer a nail.

For example, a trend-following strategy using a 50-period moving average as a trailing stop might work beautifully on a high-momentum stock like NVIDIA during a bull run. However, that same strategy applied to a stable, range-bound utility stock would result in constant whipsaws and frustration. Conversely, a mean-reversion strategy using Bollinger Bands to sell at the top of the range and buy at the bottom might be highly profitable on that utility stock but would lead to catastrophic losses if applied to NVIDIA during its ascent, as you would be constantly selling into one of the strongest trends in the market. A professional trader doesn't have a single "holy grail" indicator; they have a toolbox and the expertise to select the right tool for the specific job at hand after analyzing the current market environment.

Best Practices for a Flawless Implementation

Harnessing the power of indicator-driven exits while skillfully dodging their inherent risks is what separates consistently profitable traders from the pack. This requires more than just adding an indicator to a chart; it demands a disciplined, methodical approach. The following best practices are not just suggestions; they are the pillars upon which a robust and successful indicator-based trading system is built.

1. Go Beyond Back testing: The Gauntlet of Testing

Simply running a strategy on historical data isn't enough. Your testing process must be a rigorous gauntlet designed to reveal every potential flaw before a single dollar of real capital is at risk.

-

Thorough Back testing: A proper back test must cover a large and varied dataset—at least a few years' worth of data that includes bull markets, bear markets, and sideways consolidation. Manually stepping through your charts, candle by candle, is an invaluable way to build an intuitive feel for how your strategy behaves. For automated testing, be brutally realistic. Factor in costs like commissions, spreads, and potential slippage (the difference between your expected fill price and the actual fill price), as these can turn a seemingly profitable strategy into a losing one.

-

Forward-Testing (Paper Trading): This is the bridge between the historical data and the live market. Once a strategy proves itself in a back test, trade it on a demo account for at least one to three months. The goal here is twofold. First, it validates the strategy's effectiveness in current market conditions, which may differ significantly from the past. Second, and more importantly, it tests you. Can you execute the signals without hesitation? Do you get frustrated by whipsaws? Do you have the discipline to follow the rules when the pressure is on? Treat your demo account with the same seriousness as a real one to get a true measure of your readiness.

2. Become a Market Meteorologist: Match the Indicator to the Climate

The most common mistake traders make is using their favorite indicator in all market conditions. This is like wearing a winter coat in the desert. Before you even consider a trade, you must first act as a market meteorologist and diagnose the current climate or "regime."

-

Regime Analysis: Use a higher timeframe (e.g., the daily chart for a 1-hour trading setup) to determine if the market is trending, ranging, or breaking out.

-

Deploy the Right Tool:

-

For Trending Markets: When the market is making clear higher highs and higher lows, deploy trend-following tools. A trailing stop behind a 20 or 50-period Moving Average or a Parabolic SAR will keep you in the trade to capture the lion's share of the move.

-

For Ranging Markets: When the price is bouncing between clear support and resistance levels, switch to mean-reversion tools. Use Bollinger Bands or oscillators like RSI to identify points where the price is "overstretched" and likely to revert to the middle of its range.

-

For Volatile Markets: When volatility is high and price swings are erratic, a pure volatility-based stop like the Average True Range (ATR) is your best friend. It gives the trade the necessary breathing room to survive the chaos without getting stopped out prematurely.

-

3. Build for Robustness, Not for Perfection: The Art of Avoiding Over-Optimization

Resist the siren song of the "perfect" backtest. A strategy that never loses on historical data is a red flag, not a holy grail, as it has likely been curve-fitted to the point of being useless in the future.

-

Robustness Checking: A truly good strategy is robust, meaning it's not dependent on hyper-specific settings. Once you find parameters that work, test the strategy with slightly different ones. If your strategy uses a 50-period moving average, does it still perform reasonably well with a 45-period or 55-period? If a small change causes the entire system to collapse, your strategy is too fragile for the real world.

-

Out-of-Sample Validation: This is the professional's defense against curve fitting. Divide your historical data into two parts. Build and optimize your strategy on the first part (e.g., data from 2020-2023). Then, without making any further changes, run the finalized strategy on the second, "unseen" part of the data (e.g., 2024 onwards). This is the closest you can get to simulating how your strategy would have performed on a future you didn't know was coming.

4. Seek Confirmation: The Power of Confluence

An indicator signal by itself is merely a suggestion from a robot. A signal that is confirmed by the raw behavior of the price itself is a high-probability event. This alignment of different technical elements is called confluence, and it should be the foundation of your decision-making.

-

The Two-Filter System: Think of it this way: The indicator provides the initial signal, but pure price action analysis must provide the confirmation.

-

Examples in Action: Don't just exit when the price touches your moving average stop. Wait for a strong, bearish candle to close decisively below it. Don't just sell because the RSI is overbought. Wait for the RSI to turn down and for the price to form a bearish reversal pattern, like an evening star or a head-and-shoulders top, at a historical resistance level. When multiple, independent reasons to exit align, the quality of that decision increases exponentially.

5. The Master Blueprint: Your Comprehensive Trading Plan

Your indicator-based exit strategy is just a single clause in a much larger contract you make with yourself—your trading plan. This non-negotiable document should govern every aspect of your trading.

-

Ironclad Risk Management: Define your position sizing model (e.g., never risk more than 1% of your account on any single trade). Define your maximum drawdown rules (e.g., "If my total account equity drops 10% from its peak, I will stop trading for one week to re-evaluate my strategy and mindset").

-

Detailed Trade Management: The plan must dictate how you behave during a trade. Will you take partial profits? At what point will you move your stop loss to breakeven to create a "risk-free" trade? These decisions must be made in a calm, objective state before you enter the trade, not in the heat of the moment.

-

Mandatory Journaling: Your plan must mandate that you keep a detailed journal of every trade. Record the entry, exit, your reasons, the indicator signals, screenshots, and most importantly, your emotional state. This journal is the ultimate tool for self-coaching and continuous improvement.

The Final Word: The Indicator Is the Tool, You Are the Trader

We've journeyed deep into the world of dynamic, indicator-level exits. We've seen their profound promise—the ability to transform risk management from a static, rigid exercise into an adaptive, fluid dance with the market. We've examined the powerful tools in the toolkit, from the volatility-gauging ATR to the trend-defining Moving Average. We've also stared unflinchingly at the perils—the frustrating lag, the account-bleeding whipsaws, and the siren's call of over-optimization.

Ultimately, these strategies are not a "set and forget" path to riches. They are not a holy grail that will magically solve the puzzle of the markets. To think of them as such is to miss the point entirely.

Think of it this way: a trader using a fixed stop loss is like a pianist who can only play a single note, striking it over and over regardless of the song. A trader who skillfully employs indicator-driven exits is like a concert pianist with a full symphony at their fingertips. They can play with thunderous power in a trending market and with soft, delicate precision in a quiet one, adapting their music to the mood of the audience—the market itself.

But the symphony doesn't come from the piano; it comes from the pianist. Success with this approach requires a deep understanding of your chosen tools, the discipline to follow a rigorously tested plan, and the wisdom to know which tool to use in which market condition. The strategies discussed here are powerful, but they are and always will be just that: tools. Their ultimate effectiveness is determined not by their settings, but by the skill, knowledge, and discipline of the trader who wields them. The most important indicator on any chart is your own well-trained, disciplined mind.