Backtesting Real Telegram Signals in MetaTrader: why it matters and how Becktester TG Signals works (MT4/MT5)

That’s why the “test before you trust” approach helps: take the actual message history from a channel, convert it into structured trades, and run it through the Strategy Tester. This makes it easier to separate marketing from statistics.

What the utility does

Becktester TG Signals is a two-part workflow:

- Python app — connects to Telegram, loads message history from a selected channel/chat, parses signals, and exports them to a CSV file.

- MetaTrader EA (MT4/MT5) — reads that CSV and reproduces trades in the Strategy Tester, producing performance metrics and an equity curve on historical data.

Why traders may need this

- Validate signal channels before copying. Check trade frequency, drawdown, losing streaks, and stability across periods.

- Compare multiple sources. Same test environment → easier comparison of Win Rate / Profit Factor / Drawdown.

- Measure sensitivity. Understand how spread/slippage and entry precision affect results.

- Reduce “trust-based” decisions. Numbers help avoid emotional trading based on a channel’s claims.

Key advantages of the approach

- Uses real message history (not curated examples).

- Runs inside MT4/MT5 Strategy Tester: familiar reports, visuals, and period-to-period comparisons.

- Flexible parsing via keyword and symbol-alias configurations.

- Safety filters: skip duplicates, weekend signals, time windows, risk limits.

High-level workflow

- Select a Telegram channel/chat and a date range in the Python app.

- Parse messages and generate signals.csv (commonly into Terminal/Common/Files so the terminal can access it).

- Open the Strategy Tester in MT4 or MT5, attach the EA, and point it to the signals file.

- Review statistics and (optionally) export a results report to a separate CSV file.

CSV structure (what gets exported)

The export keeps the data structured: date/time, command type, symbol, entry/SL/TP, lot size, and service fields (message ID, edit flag, error field for unparsable messages). Multiple take-profit levels can be stored as a list separated by | .

Main EA settings overview (MT4/MT5)

1) File & parser basics

- SignalFile — CSV filename (e.g., signals.csv ).

- DebugLogs, DebugCsvRows — extra logs + print first CSV rows.

- BrokerUTCOffset — broker UTC offset (helps align timestamps).

- SkipDuplicates — skip duplicated signals.

- SkipWeekendSignals — ignore weekend signals if needed.

2) Lot sizing & risk

- LotMode — fixed / risk-based / per-symbol rules / lot-by-TP slots.

- FixedLotValue, RiskPercent, RiskPercentPerSymbol — core sizing controls.

- LotSizePerSymbol, LotSizeSpecificPair — fixed lots per instrument.

- DivideLotByTPCount — split size across multiple TP targets.

3) SL/TP interpretation

- SLMode, TPMode — use values from the signal or custom levels.

- CustomSL, CustomTP — custom targets (depending on units).

- SLUnit, TPUnit — Price / Pips / Points.

- AllTPInOneLine, SLMerged, TPMerged — handle specific formatting styles in messages.

- RejectOrdersWithoutSL, RejectOrdersWithoutTP — optionally ignore signals missing SL/TP.

- TPToCopy — choose which TP levels to include (e.g., only TP1 and TP3).

4) Execution & slippage behavior

- ForceMarketExecution — always enter at market.

- MaxSlippage — maximum allowed price deviation.

- HandleSlippage — ignore the signal or place a pending order when out of range.

- PendingOrderExpiration — pending order expiry (minutes).

- EntryRangeMode, EntriesInZoneOnly — how to interpret “entry zone”.

5) Management (breakeven & trailing)

- ActivateBreakeven, BreakevenAfterPoints — move to breakeven after X points.

- ActivateTrailingStop, SLTrailingMode, TrailingStartPoints, TrailingStepPoints, TrailingDistancePoints — trailing options.

- BreakevenToSignalEntryPrice — use the entry price from the signal for BE when applicable.

6) Risk limits & time filter

- MaxTradesPerDay, MaxLossesPerDay — daily caps.

- MaxDailyLoss, MaxWeeklyLoss, MaxMonthlyLoss — loss limits (percentage or currency).

- LossExceedAction — stop copying or close & stop if limits are exceeded.

- UseTimeFilter, StartTime, EndTime, AllowedTradingDays — trade window & weekdays.

7) Stats & report

- ShowStats — show statistics.

- ExportReport, ReportFile — export results to CSV (e.g., results.csv ).

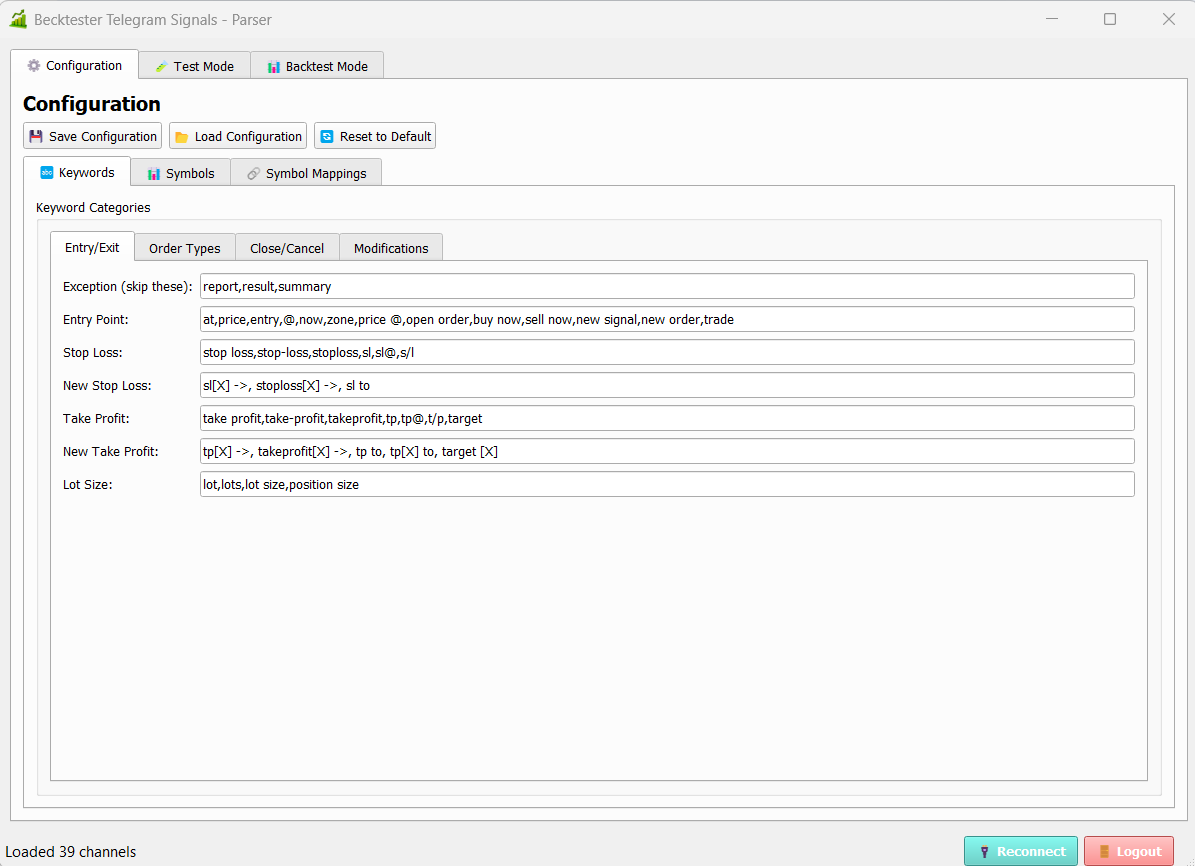

Python-side configuration (keywords & symbols)

The source includes several configuration files that make parsing adaptable:

- app_config.json — Telegram connection settings (api_id/api_hash/session) and output preferences.

- backtest_settings.json — last channel, date range, and output CSV path.

- configs/default.json (and other configs) — keyword sets for BUY/SELL, SL/TP, modifications, closes, etc., plus symbol lists and aliases (e.g., GOLD → XAUUSD).

- config/current_config.json — the active parsing configuration.

This matters because channels format messages differently (TP1/TP2 vs “targets”, GOLD vs XAUUSD, etc.). Configurable keywords and symbol aliases help fit the parser to the channel’s style.

Update: MT5 release

The typical walkthrough is often shown on MT4, but the workflow is the same for MT5: the same CSV concept, the same Strategy Tester approach. A dedicated MetaTrader 5 version of the EA is now available.

Download

To keep this educational, links are placed at the end. Replace placeholders with your actual product pages:

- MT4 version: Becktester TG Signals (MT4)

- MT5 version: Becktester TG Signals (MT5)

Disclaimer: Educational content only. Backtesting is a model and does not guarantee future results. Real trading includes latency, slippage, varying spreads, and execution differences.