Perfecting Development Practices for Superior Trading Systems

In the heart of the bustling, often unforgiving, world of financial markets, a simple belief anchors everything I do: your success is my success. This isn't just a catchy phrase; it's the very bedrock of my philosophy as a dedicated system developer. My mission extends far beyond simply coding algorithms. I see myself as a partner to the trading community, a craftsman of robust and reliable tools designed to help you navigate the intricate dance of the markets. I believe that true success is a shared journey, a collaborative effort where my expertise in system development empowers you to achieve your trading goals.

This symbiotic relationship is the driving force behind my relentless pursuit of perfection in my development process. It's a commitment that fuels my desire to continuously refine, innovate, and elevate the quality of my trading systems. I'm not just building tools; I'm forging keys designed to unlock your potential. In this post, I want to pull back the curtain and share with you the core principles that I live by—the very tenets that allow me to create high-quality, yet remarkably affordable, trading systems. It is my firm belief that by sharing this insight, we can foster a more transparent and collaborative trading environment, where every trader has access to the tools they need to succeed.

Maximizing the Quality of Back Tests: The Bedrock of Trust

A back test is far more than just a simple simulation of past performance; it is the bedrock upon which our trust and confidence are built. Think of it as our financial time machine. It allows us to journey into the past and see how a strategy would have navigated the market's most turbulent storms and celebrated its calmest seas. For you, the trader, a back test is your window into a system's soul. For me, as the developer, it is my ultimate report card. An inaccurate or overly optimistic back test doesn't just set unrealistic expectations; it erodes the very foundation of trust. That's why I am fanatically dedicated to a rigorous, transparent, and brutally honest back testing process. My goal isn't to show you a perfect, fairytale equity curve; my goal is to provide a realistic, data-driven forecast of a system's potential, so you can be confident that the performance you see is the performance you get.

Here’s how we achieve that level of confidence together:

-

It Starts with Pristine Data: There's an old saying in data science: "Garbage in, garbage out." This is gospel in system development. A back test is only as reliable as the historical data it's built on. That's why I invest in high-quality, tick-level data that meticulously accounts for every corporate action, every dividend, and every stock split. Using clean, professional-grade data prevents the misleading results that can arise from the free, often error-filled data floating around the web. It's the equivalent of building a skyscraper on solid granite instead of sand.

-

Confronting Real-World Costs: In a perfect world, trading would be free. But here on Earth, every transaction has a cost. I ensure my back tests confront the real-world friction of trading by aggressively accounting for both slippage and commissions. Slippage—the small difference between your expected fill price and the actual price you get—can seem minor on a single trade, but over hundreds or thousands of trades, it can be the difference between a winning and a losing system. The same goes for commissions. By programming these realities directly into the back test, we get a much more sober and accurate picture of true performance.

-

Slaying the Dragon of Curve-Fitting: The single greatest danger in system development is a deceptive beast called "curve-fitting." This happens when a system is tweaked and over-optimized to fit the past data so perfectly that it looks like the "holy grail" in a back test. The problem? This perfectly tailored system has only learned to memorize the past, not adapt to the future. As soon as it encounters new market dynamics, it shatters. I combat this by using robust validation techniques like out-of-sample (OOS) testing. Imagine studying for an exam using a specific set of practice questions (the "in-sample" data). A curve-fit system has just memorized the answers. My systems, however, are then tested on a completely different set of questions they've never seen before (the "out-of-sample" data). When a system performs well on data it wasn't designed for, we can be far more confident that it has learned a genuine, robust market edge and isn't just a product of wishful thinking.

This painstaking, multi-faceted approach to back testing is my commitment to you. It’s how I ensure that when you look at a performance report, you are looking at a grounded, realistic projection, not a financial fantasy. It’s about empowering you with clarity and confidence, so you can make informed decisions for your trading journey.

Democratizing the Tools for Success: Why a Lower Price Doesn't Mean Lower Quality

In the world of trading, there's a pervasive and often intimidating myth: that price is a direct measure of quality. We're conditioned to believe that the most powerful tools must come with the highest price tags, creating a barrier that can make serious system trading feel out of reach for many. I want to challenge that narrative head-on. I believe with absolute conviction that every trader, regardless of their budget, deserves access to high-quality, robust, and reliable trading systems. This belief is the reason I am so committed to keeping my prices fair and accessible. It's a commitment made possible not by cutting corners, but by perfecting my craft.

You might ask, "How can you offer top-tier systems without a top-tier price?" The answer is transparency in action. It all comes back to the development principles we've discussed:

-

Efficiency as a Superpower: By minimizing system validation times, creating robust architecture from the start, and knowing our back tests are rock-solid, we eliminate countless wasted hours. This hyper-efficient workflow isn't just about getting better systems to market faster; it's a direct and massive reduction in development cost—a saving that I can pass directly to you.

-

A Lean and Focused Philosophy: I am not a large corporation with bloated marketing budgets, downtown office rents, or a team of salespeople. I am a developer, a craftsman, dedicated to one thing: building exceptional trading systems. My overhead is intentionally minimal. My growth comes from the quality of my work and the word-of-mouth recommendations from a successful community, not from expensive advertising. You are paying for the engine, not the fancy paint job and leather seats.

This approach allows us to redefine what "value" truly means. It isn't about paying the most; it's about getting the most for your investment. That means a powerful system, built on a foundation of integrity, at a price that empowers you to focus on what truly matters: capitalizing on its signals and growing your trading account.

This brings me to the most important principle of all, the very heart of my work: Your success is my success. This is more than a slogan; it is my entire business model. My long-term viability isn't fueled by one-time sales of systems that fail to perform. It is built on fostering a thriving community of successful traders who trust in the tools I provide. When you succeed, you remain a valued member of our community. You share your positive experience with others. Your journey validates the quality of my work. A system that doesn't work for you is a fundamental failure for me.

I am dedicated to serving the entirety of this incredible community's needs, without making you break a sweat at checkout. Think of me not as a vendor, but as a partner in your corner. Let's build something great together, founded on transparency, mutual trust, and the unshakeable belief that we can all achieve great things in the markets.

The Gauntlet: My Unshakeable Commitment to Real-World Performance

Everything we've discussed—fast innovation, intelligent design, and honest back testing—is built upon one final, non-negotiable process. This process was born from my earliest and most painful days as a developer. It was born from failure.

My time as a new MQL5 creator was built on a cycle of consistent failure in providing value that lasts. I was driven by a burning desire to impress my customers, but this passion became both a hindrance and a blessing. I quickly learned a harsh lesson: a trading system that looks like a masterpiece on one broker can devastate an account on another. I saw strategies that were incredibly profitable on Darwinex get wiped out on IC Markets. I saw systems that looked brilliant on IC Markets look like a complete scam on Eightcap.

This blurred the lines of everything I was trying to accomplish. How can I promise you robust performance if that performance changes dramatically depending on your broker? It was unacceptable. I knew I had to find a remedy, no matter how difficult or time-consuming.

That remedy is what I call "The Gauntlet." It is an intense, multi-layered validation process that every single strategy must survive before it ever gets close to being included in a system I release.

Here is my blueprint for achieving consistency and reliability across the market:

-

The 5-Broker Minimum: Every potential strategy is first tested across a minimum of five different, reputable brokers. This immediately exposes any sensitivities to specific server times, spreads, or execution styles.

-

Randomized Environment Testing: It doesn't stop there. For each of those brokers, we run the tests again, but this time we randomize the environmental variables—simulating a wide range of pings, spreads, and slippage conditions. This is a brutal stress test.

-

The Monte Carlo Simulation: Finally, we layer on Monte Carlo simulations. This bombards the strategy with thousands of variations in trade order and historical data, ensuring its profitability isn't just a lucky coincidence or a quirk of one specific historical path.

A strategy doesn't just have to survive this gauntlet; it has to thrive. It must meet my strict requirements for consistency, profitability, and a high return over drawdown across all brokers and all simulations over a massive 20-year period. If any strategy fails even one of these checks, it is thrown out for good. No second chances.

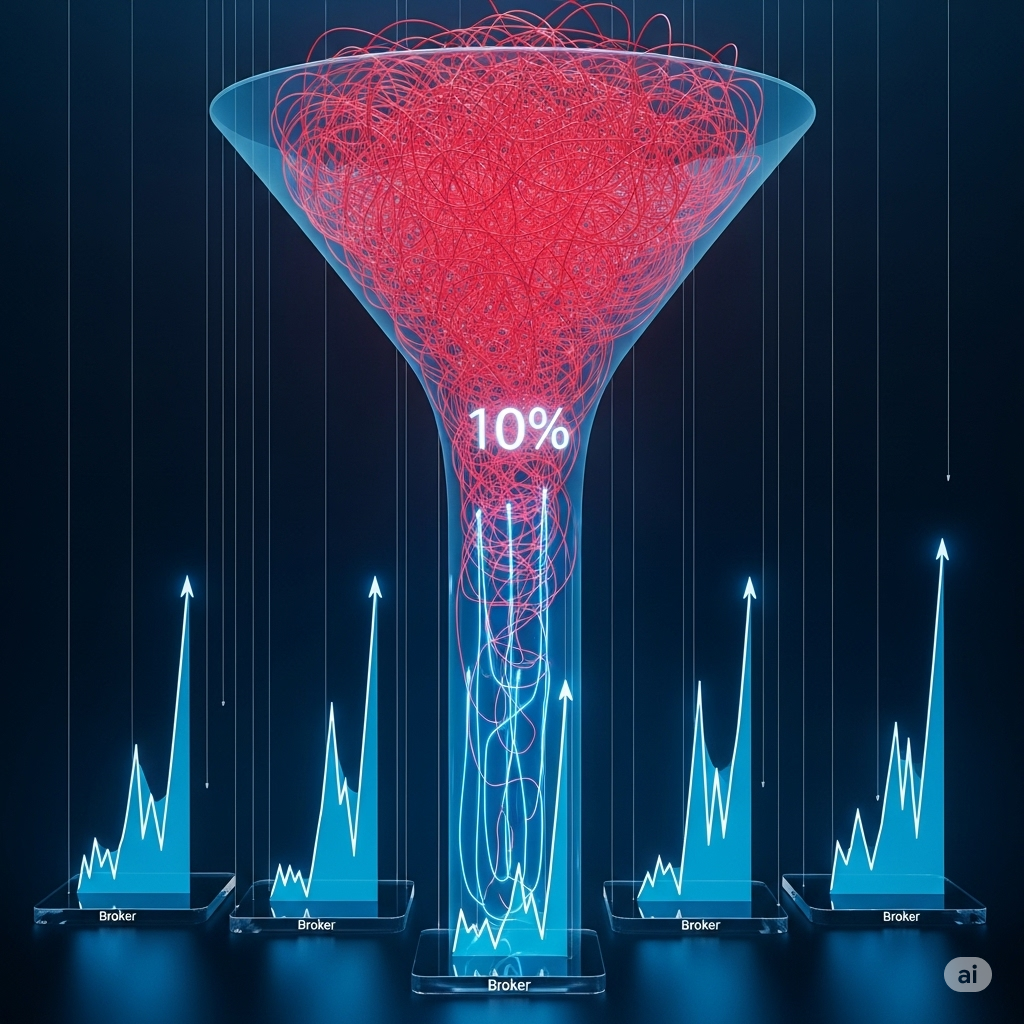

You can see how this becomes incredibly time-consuming, but it is absolutely necessary. The result? A stunningly clear picture of a strategy's true, core performance. Out of every 300 unique strategies I build and select for testing, fewer than 30 may pass my checks for robustness and performance. That's a pass rate of less than 10%.

Those few elite strategies are saved and added to the system, and the entire process begins again. This is how I build an Expert Advisor. It's a relentless process of brainstorming, filtering, testing, and selecting only the most resilient and consistent strategies, giving me the ultimate confidence I need to release these systems to you.

This exhaustive gauntlet is my investment in your success. It skips the drawn-out demo time and uncertainty you would otherwise need to endure. It means you can run my system with the assurance that it has already been stress-tested against a vast array of market conditions and broker environments, allowing you to be happy and confident in the results from day one.