Understanding Risk to Reward Ratio: what is the best risk to reward ratio in forex

Definition of Risk to Reward Ratio

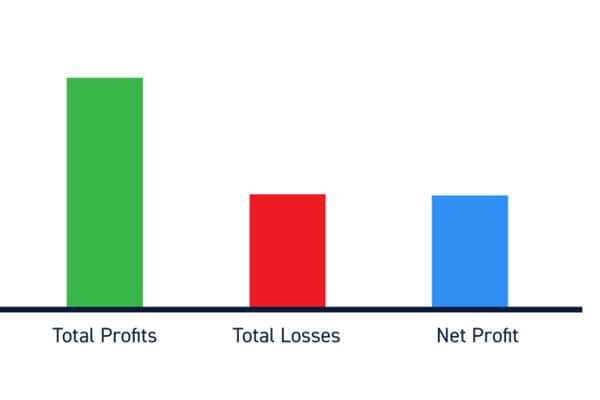

Calculating the Risk to Reward Ratio is straightforward. It involves identifying the amount you are willing to risk on a trade and comparing it to the expected gains. For example, if you risk $50 for a potential profit of $150, the ratio would be 1:3. This calculation allows traders to see if the potential reward justifies the risk involved.

Best Signal Trading for Beginners / Free signal trading in Forex signals Marketing

Importance of Understanding best risk/reward ratio for day trading

The Best Risk to Reward Ratio in Forex

To achieve consistent profits from this trading strategy over the long term, it is essential that your rewards exceed your risks .It's important to consider that there are also trading and non-trading expenses that need to be covered. Ideally, when the success rate is 50%, the risk-to-reward ratio should be at least 1:2 or higher. This means that for every unit of risk you take, you should aim to gain a minimum of two units of reward to achieve sustainable profits in the long run.

what is a good risk to reward ratio forex

The Risk/Reward Ratio is a crucial concept in trading and investing, particularly in the Forex market. To determine a good risk to reward ratio, many traders often look for a benchmark of1:3. This means that for every unit of risk they take on, they anticipate a return of three units. When considering what is a good risk to reward ratio forex, traders aim for scenarios where their potential profit outweighs their potential loss. In fact, understanding what is a good risk to reward ratio forex can significantly influence trading strategies.For instance, if a trader has a setup that suggests they could gain 300 pips while risking only100 pips, they effectively have a risk/reward ratio of1:3. Thus, identifying what is a good risk to reward ratio forex helps traders make informed decisions that can lead to successful outcomes. So, in summary, a good risk to reward ratio Forex analysis often leads to a preference for ratios of at least1:3. This allows traders to maximize their returns relative to the risks taken while continuously evaluating what is a good risk to reward ratio forex for their trading style and strategy.

Using Technical Patterns

Trend Lines and Channels

Conclusion**In the dynamic world of trading, understanding the Reward-to-Risk Ratio is essential for formulating effective strategies and ensuring long-term profitability. By quantifying the risk taken relative to potential gains, traders can make informed decisions that align with their risk tolerance and financial goals.Effective calculation of this ratio allows traders to evaluate the feasibility of their trades, ensuring that potential rewards outweigh the risks involved. A favorable Reward-to-Risk Ratio not only aids in risk management but also positions traders for sustainable success in the marketplace.

Incorporating technical patterns and tools, such as Fibonacci retracement levels and candlestick formations, enhances the ability to anticipate market movements and refine risk assessment. Ultimately, consistently striving for an optimal Reward-to-Risk Ratio empowers traders to navigate the complexities of the market with greater confidence, leading to more successful trading outcomes.Additionally, focusing on the Reward-to-Risk Ratio in Forex trading helps traders to systematically assess each trade's potential profit against its possible losses. By maintaining a disciplined approach to trading based on the Reward-to-Risk Ratio, traders can improve their overall performance and profitability.In summary, the Reward-to-Risk Ratio is a fundamental tool that every trader should master, particularly in the volatile realm of Forex trading. This ratio acts as a guiding principle, offering insights into which trades to pursue and which to avoid, thus enhancing the strategic decision-making process. Therefore, by prioritizing the Reward-to-Risk Ratio in their trading strategy, traders can significantly enhance their ability to achieve long-lasting growth and success in their trading endeavors.

Reward-to-Risk Ratio In Forex Trading

In the dynamic world of trading, understanding the Reward-to-Risk Ratio in forex trading is essential for formulating effective strategies and ensuring long-term profitability. This ratio helps traders quantify the risk taken relative to potential gains, allowing for informed decision-making that aligns with their risk tolerance and financial goals.Effective calculation of the Reward-to-Risk Ratio in forex trading empowers traders to evaluate the feasibility of their trades, ensuring that potential rewards outweigh the risks involved. A favorable Reward-to-Risk Ratio in forex trading aids in risk management and positions traders for sustainable success in the marketplace.By focusing on the Reward-to-Risk Ratio in Forex trading, traders can systematically assess each trade's profit potential against possible losses. Ultimately, prioritizing the Reward-to-Risk Ratio in forex trading strategies enhances the ability to navigate market complexities, leading to more successful trading outcomes.In summary, mastering the Reward-to-Risk Ratio in forex trading is crucial for every trader, particularly within the volatile Forex market. By consistently striving for an optimal Reward-to-Risk Ratio in forex trading, traders can significantly improve their prospects for growth and success in their trading endeavors.