Review of trades of the Owl Smart Levels strategy for the week from October 2 to 6, 2023

Today I present you an overview of trades made using the Owl strategy - smart levels for the EURUSD, GBPUSD and AUDUSD currency pairs for the week from October 2 to 6, 2023. There were a total of 5 trades opened in all currency pairs. The Owl Smart Levels indicator traded currency pairs both for buying and selling, as the market was moving in different directions, which affected the result. But let's talk about everything in order.

For convenience and timely receipt of signals I use the Owl Smart Levels Indicator. The main trading timeframe is M15, while the H1 and H4 timeframes are used to confirm the trend direction of the higher timeframe.

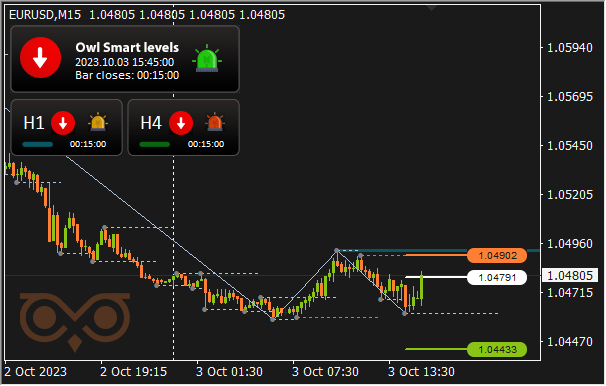

EURUSD review

The market spent Monday in the dead zone. The first signal to open a trade on EURUSD was given by the Owl Smart Levels indicator on Tuesday afternoon.

Fig. 1. EURUSD SELL 0.14, OpenPrice = 1.04791, StopLoss = 1.04902, TakeProfit = 1.04433, Profit = $9.05

The market has changed its direction, and the big arrow of the indicator indicated it by its reversal in time. That's why there was a small profit of 9$.

There were no more trades on the asset.

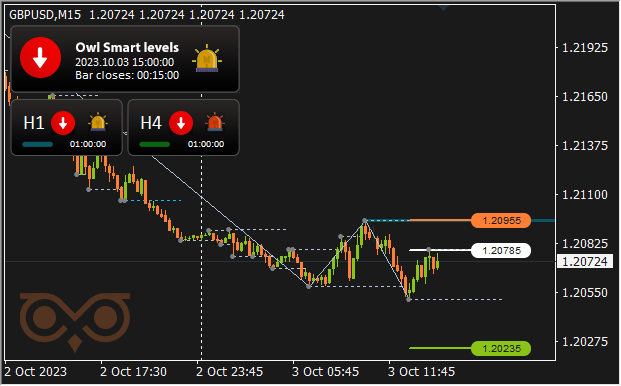

GBPUSD review

GBPUSD also spent Monday in the dead zone, as well as EURUSD.

The Owl Smart Levels indicator suggested opening the first trade on the asset for selling on Tuesday afternoon.

Fig. 2. GBPUSD SELL 0.09, OpenPrice = 1.20785, StopLoss = 1.20955, TakeProfit = 1.20235, Profit = -$12.18

The market direction has changed dynamically, so the indicator gave a signal about it a little later than we would like. The trade was closed with a loss.

The market spent Thursday mostly in the dead zone, but one trade was opened in the middle of the day.

Fig. 3. GBPUSD SELL 0.09, OpenPrice = 1.22344, StopLoss = 1.22487, TakeProfit = 1.21880, Profit = -$15.

Once again, the volatility on GBPUSD did not allow the indicator to signal in advance, and the trade closed with a loss.

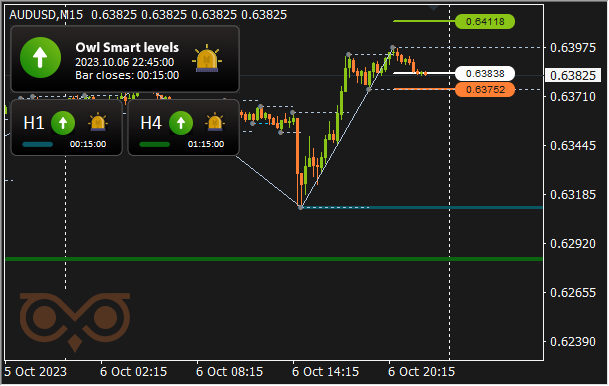

AUDUSD review

Apparently traditional for the last trading week, on Monday there was a dead zone on AUDUSD. The first trade was opened on Thursday morning.

Fig. 4. AUDUSD BUY 0.07, OpenPrice = 0.63422, StopLoss = 0.63217, TakeProfit = 0.64084, Profit = -$3.51.

Here the indicator gave a signal about the change of the market direction in advance, and the loss was minimal.

And the last trade was opened at the very end of the trading session on Friday, literally "on the flag", as chess players say.

Fig. 5. AUDUSD BUY 0.17, OpenPrice = 0.63838, StopLoss = 0.63752, TakeProfit = 0.64118, Profit = $3.84.

The trade had to be closed quickly in order not to carry positions through the weekend according to the rules of trading in the Owl Smart Levels strategy.

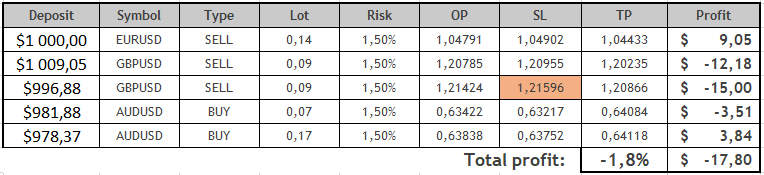

Results:

So, there were 5 trades during the last trading week. Two of them were profitable and three were unprofitable. Unfortunately, the market volatility did not allow to develop the success that we had the week before last, so we had to retreat, and the result in the final table shows a small minus.

We will see how the trading will look like and how the market will behave, as well as what trades will be offered to us to open Owl Smart Levels on Monday, during the upcoming trading week.

See other reviews of the Owl Smart Levels strategy:

I'm Sergei Ermolov, follow me and don't miss more useful tools for profitable trading on the Forex market.